March 13, 2023: SVBF 🏦🏃

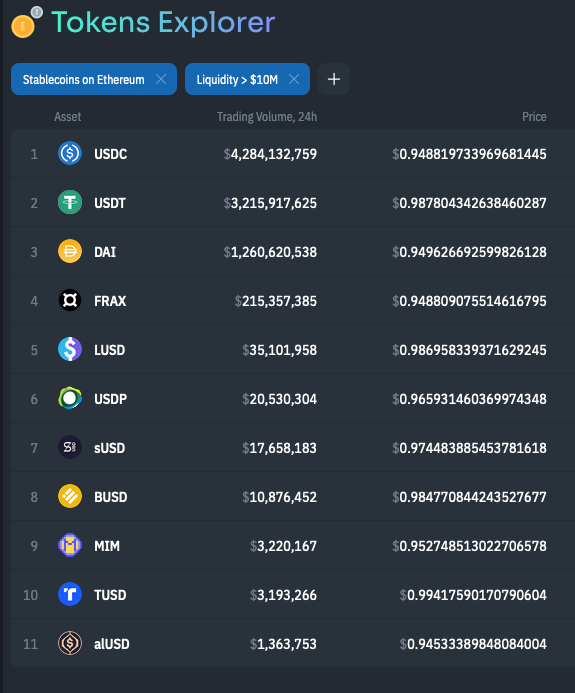

How various tokens reacted to the recent bank run

If you happened to log off for the weekend with Ethereum worth around $1600 and USDC worth $1, you might be logging back in now and thinking everything is about the same… what’s all the hubbub? If this is you, maybe you’ll be happiest if you just stop reading right now. Pretend everything is rosy and nothing happened.

For all else who survived through this past weekend, what a wild ride.

We don’t have enough electrons at our disposal to adequately cover absolutely everything in one newsletter. Today we focus on how various tokens reacted to the past weekend. Commentary on the delicate balance of DeFi vs TardFi and other such politicking gets kicked to another newsletter

1) WHAT

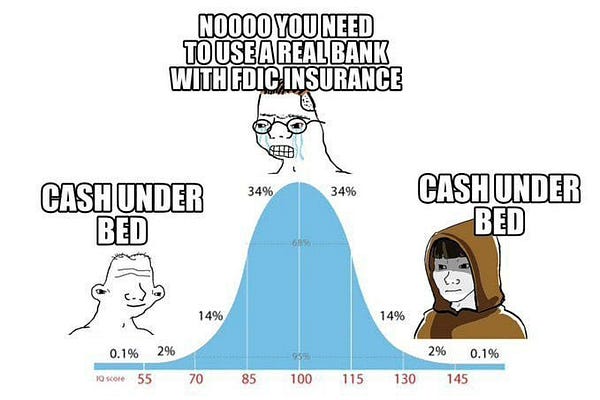

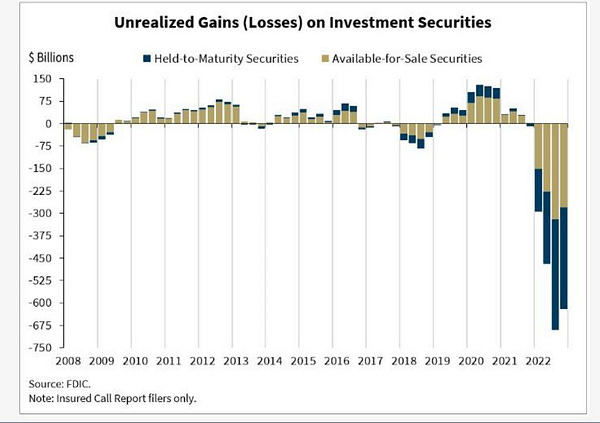

The US banking system, busy buying “safe” US Treasuries into rising interest rates, found their long-term low-yield bills to be effectively worthless. A cascading bank run, cheerled by Senator Warren, bankrupted several banks notably used by crypto companies, including Signature, Silvergate and Silicon Valley Bank.

Amidst the panic, with the traditional finance system basically closed for the weekend, degens feared another Terra-style collapse and fled $USDC. Circle had $3.3B stuck in SVB at risk of not being redeemable.

As the weekend rolled on and the FDIC released their plan to ensure depositors remained whole, the panic subsided and the coin gradually repegged.

Traditional markets reopen on Monday, possibly with contagion fears allayed. The banking system remains an utterly broken clown parade, and now the fed is explicitly backstopping future losses by banks. Fun times ahead…

Life on-chain more or less continues as always. No major protocol on-chain blew up (Euler Finance sadly suffered a devastating but unrelated hack). Stablecoins will continue processing redemptions as usual come Monday, although their banking situation has gotten drastically more difficult.

What’s possibly changed is that anybody who lived through the past 72 hours has a dramatically different perception of the assorted tokens on the market, based on how they reacted to the turmoil.

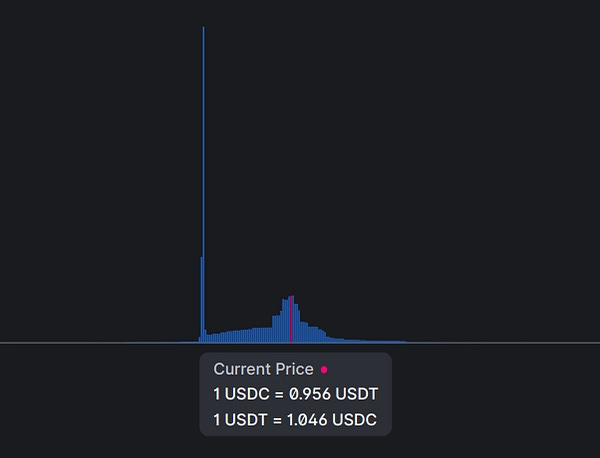

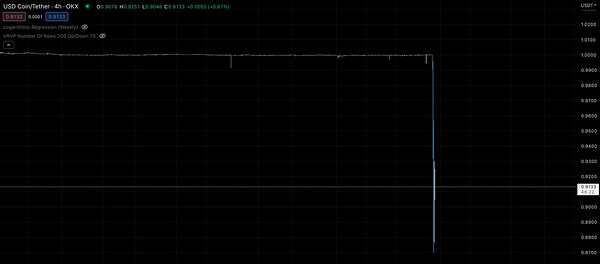

$USDC

Over the weekend, $USDC would be sold off as low as $0.88 — a curious move by panic sellers. A relatively small percentage of $USDC’s backing was stuck in SVB. In the unlikely event the entire amount got erased the theoretical value of $USDC would remain above well above 90-something cents on the dollar. Provided that any portion of the $3.3B ultimately got recovered, then it should trade even higher.

While panic sellers got mocked in hindsight, we don’t particularly think it was a crazy reaction. Arguably, when $USDC got sold off into the 80 cent range, the market was pricing in the risk of further contagion spreading throughout the system, a potential outcome. Sellers taking a ~10% haircut on their stables to guard against a 100% depeg feels little crazier than buying disaster insurance — it’s not necessarily a bad idea to try and lock in 90% of your value when we’ve seen so many people lose absolutely everything over the past year.

At any rate, the insurance proved a losing purchase in this case. Plenty of people (author included) managed to grab cheap $USDC in what appears to be the winning trade.

Another big winner was MEV bots, who essentially pickpocketed the fleeing mob.

The sad thing is that MEV attacks of this nature are relatively simple to mitigate by protocols defaulting to lower slippage tolerance. Curve defaults to a very tight range and suffers fewer issues on this front than other services.

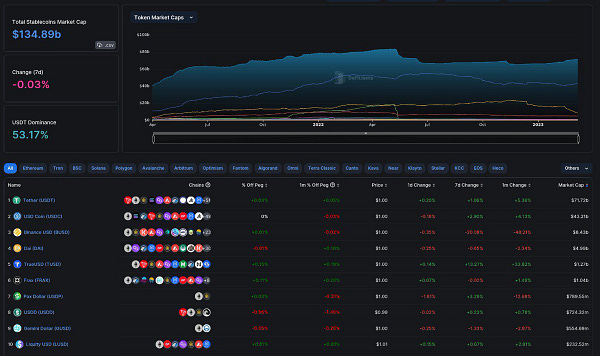

Anyhoo, $USDC remains. The question moving forward is whether or not the second place stablecoin will regain users trust moving forward. Even before this incident we’d already seen massive liquidity outflows from stablecoins generally. Time will tell whether this trend is a permanent climb to zero or if it reverses.

$CRV

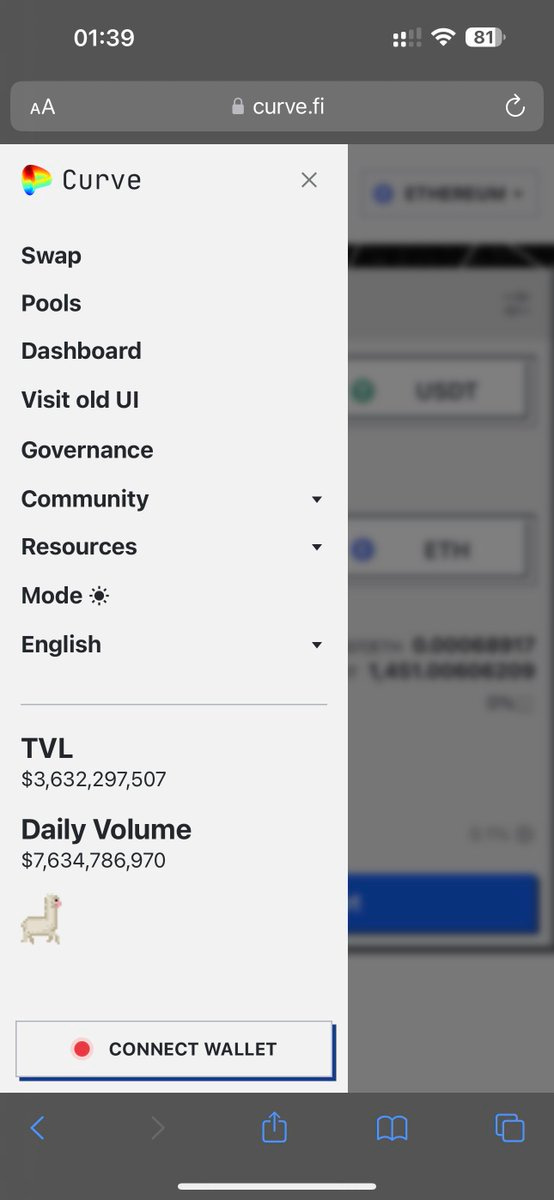

Another major winner was, as usual, Curve Finance. If Bitcoin is “stored energy”, $CRV is “stored FUD.” Wherever there are stablecoin fears, Curve stands ready to take its cut. The protocol shattered its previous daily record of ~$4 billion daily volume by touching $8B, quite a feat considering the parched state of liquidity around DeFi.

It goes without saying that fees will be extra juicy for everybody who already has exposure to veCRV.

If you’re new to crypto, and you expect more black swan style existential crises to beset crypto on a regular basis going forward, getting some exposure to vCRV may not be the worst idea in the world (NFA, ask your registered financial advisor).

If you are too poor to play in DeFi, you can still have fun by simply following the Curve Finance Twitter account. Every time the entire ecosystem feels like it might collapse, the Curve Finance Twitter account is prepared to giggle and toss gasoline on the fire. Some may complain it’s ill-timed, but we find it reassuring and hilarious.

An interesting effect was watching Curve’s performance relative to Uniswap, a rival AMM. Curve pools appear to have a natural facility for handling periods of turbulence due to the fact v2 pools automatically rebalance. On Uniswap the liquidity must be moved manually, which had the effect of inspiring a potential future product from Curve.

$USDT

Another big winner was Tether. $USDT’s strong performance was tinged with irony, as the top stablecoin has been long derided for being more opaque than its rival.

Few people expected Tether would become the coin of refuge during the antics, but Tether has remained relatively stronk throughout its existence.

So, is Tether the undisputed heavyweight champion among stablecoins?

Tether certainly wins this round, but remember that regulators are on a warpath against stablecoins. If you have any significant amount of your net worth in crypto and may need it bridged to fiat at any point in the next few years, it’s probably worth doing it early.

At any rate, Tether remains perfectly fine against a backdrop of nonstop FUD. Then again, the perennially incorrect FUDsters need only be right once.

$DAI

Throughout the fireworks, the market treated $DAI as little more than wrapped $USDC, and its price depegged accordingly. In Curve’s 3pool, $DAI and $USDC traded essentially in tandem.

DAI would ultimately repeg, but now the remonstrations and soul-searching about its utility begin.

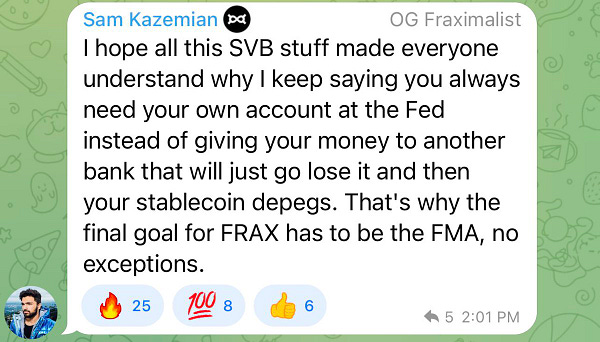

$FRAX

The market also treated $FRAX as little more than wrapped $USDC throughout the events.

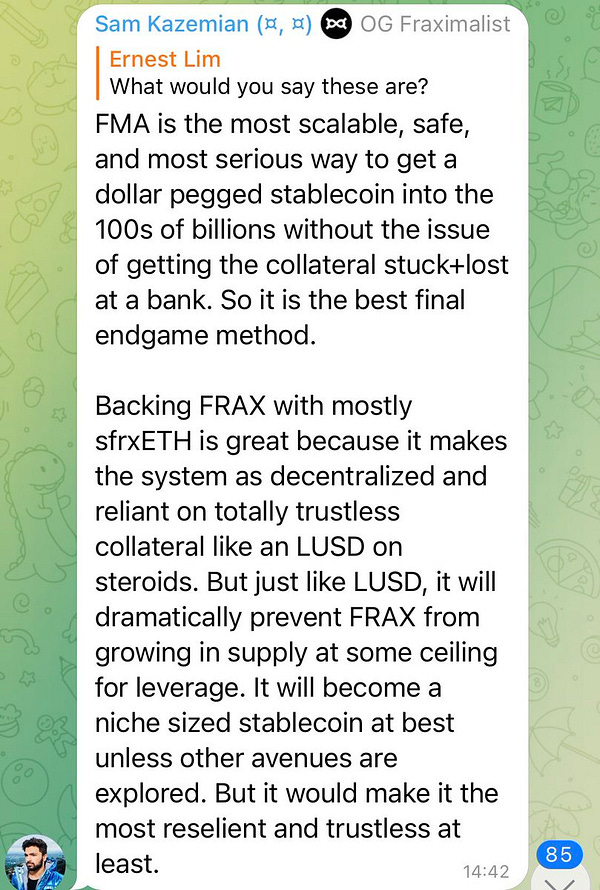

Frax is taking action to move its backing towards $sfrxETH, which is more resilient and stands to benefit from FUD via MEV.

Frax also took this as an occasion to point out the necessity of a Fed master account, as holding significant sums of money in American banks is a big risk in AD 2023.

$MIM

Abracadabra’s $MIM peg also suffered during the festivities, even though it is not heavily backed by USDC.

$MIM made some adjustments nonetheless.

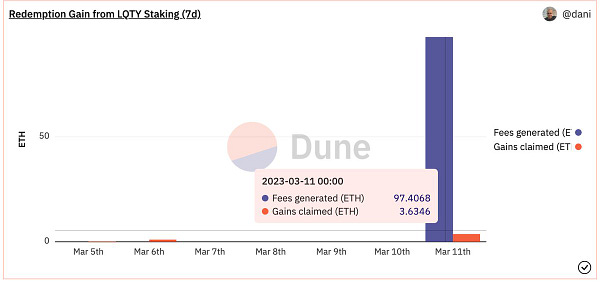

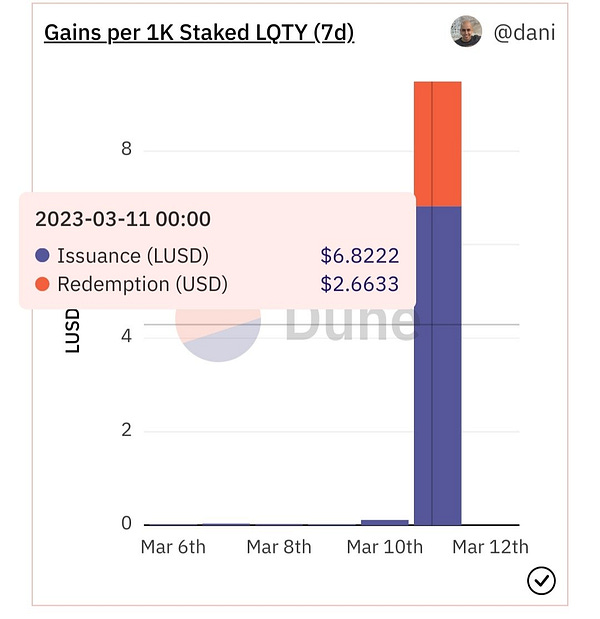

$LUSD

Many other commenters took the opportunity to point recommend $LUSD, widely considered among the most (if not the most) decentralized stablecoin.

Message seemingly received, as $LUSD jumped into the top ten.

Some users noted that usually in market downturns $LUSD tends to float above peg, but not this time. $LUSD explains the reason for dropping below peg:

Whatever may have happened to the actual peg, the protocol itself printed during the chaos. Find yourself a nice FUD-to-$$$ conversion engine and then 💩-post to profits.

Others

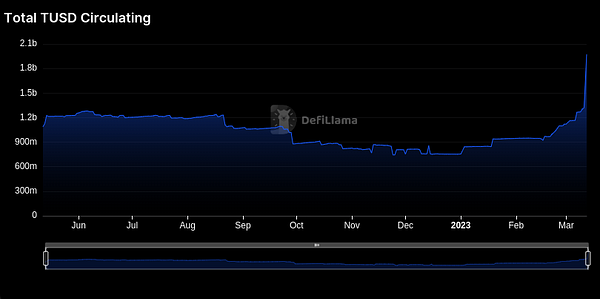

One of the biggest winners in general of late has been TUSD, which has seen its market cap double over the past month.

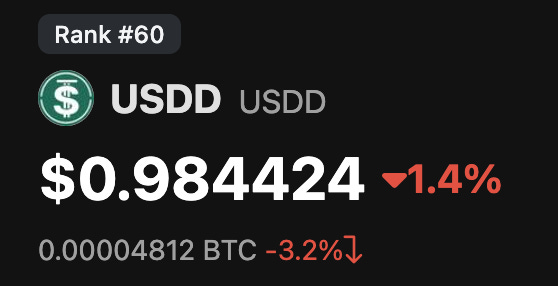

Also running hot were stablecoins backed by Justin Sun.

The market generally agrees on the need for more decentralized stablecoins, but they have yet to see massive adoption.

So what should you have done in this situation, or what should you do in future situations, now that chilling in stables looks less attractive than usual?