March 13, 2024: Regov Recap ⚖️🏛️

Results from Reserve Protocol’s deep dive into DeFi governance topics

Congrats to Reserve Protocol, which just saw the market cap for their RTokens sail past the $50MM mark…

During our time in ETHDenver, we’d singled out Reserve Protocol as standouts.

March 5, 2024: Rocky Mountain All-Time High?

We enjoyed hearing yesterday’s takes from big brains at the event (and the article has been stealth edited to add a few late submissions…) Since we’ve given you the broad view, we wanted to add a few of our own specific reflections on takeaways from ETHDenver. Our perspective was not from the main event, which we scarcely attended, but the DeFi side events and several on-on-one meetings with many of the people in the community.

The team featured prominently at the Llama Party IRL and unStable Summit, but it was the ReGov event in particular that drew notable acclaim from attendees.

Since the event, we connected with the team to get a copy of the dataset so we can disseminate their findings to a wider audience. Haters of this Substack may prefer reading Reserve’s own, admittedly superior, debrief of the event.

Enjoy!

Regov Recap

ETHDenver featured so many great side events, we feared an event focused on discussing the nitty-gritty topics related to cryptocurrency governance might suffer for attendance. How many protocols struggle to get meaningful participation for their onchain votes? “DeFi governance is nothing but a meme!”

The ReGov event proved the opposite. The event was wildly attended. Here’s the crowd as the packed event transitioned into an afterparty:

The ReGov event featured a curated discussion on topics in DeFi governance. The inspiration for the conversation is that Reserve is doing research on various aspects of effective DAO operations, as it looks to build out governance systems for the RToken ecosystem.

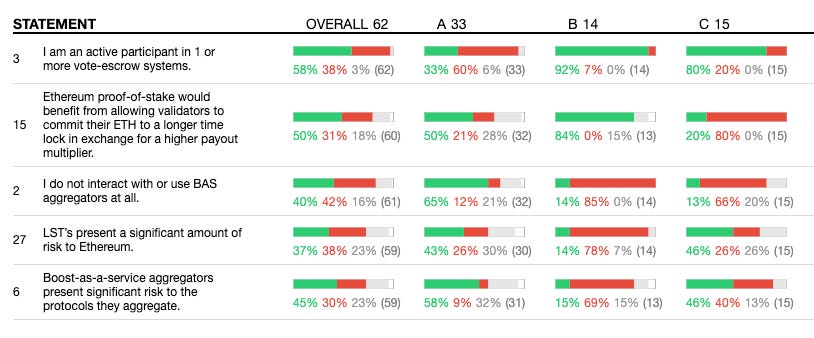

To curate the discussion, the team used pol.is (no relation to the Colorado governor), a realtime survey system. Participation was strong as the team surveyed respondents on several questions pertaining to governance.

The platform then clustered similar voters into three segments based on their responses. The event organizers could then draw out the differences and similarities among these groups to stimulate a more lively discussion.

Group A, which we’ll refer to as “Spectators” constituted the majority of attendees. This group was most notable as users who did not participate heavily in online governance, though the discussion revealed they were still well-informed on issues. The survey questions that best differentiated this cluster from others:

The other two clusters were active participants in governance. The key difference between groups B and C were their time preferences.

We’ll dub group B as the “Low Time Preference” cluster. They generally preferred longer lockups and were generally less skeptical of the risks in LSTs or Boost-as-a-Service aggregators.

This contrasts with group C, the “High Time Preference” cluster. This group wildly preferred shorter lock times, and preferred LP-ing directly to trusting Boost-as-a-Service aggregators.

It might seem as if the differing time preferences of these two clusters would make it difficult to find common ground. You can’t simultaneously shorten and lengthen the lock time. However, the event proved that assigning users into differing clusters made it possible to facilitate a meaningful conversation on relevant topics.

The pol.is dashboard showed there was overall broad consensus on most issues, with only a handful of issues proving divisive.

Where did the groups agree?

Curve’s veCRV, which started veTokenomics, occupied most of the discussion. The Curve tokenomics was released almost four years ago in a completely different era in DeFi. Given the massive changes in crypto since this time, it’s unsuprising that there was unanimous agreement that veCRV is imperfect and could be evolved.

There was also widespread agreement that carefully considering governance is critical, lest a DAO inadvertently destroy itself.

Any attempt to reimagine governance will have to reckon with the fact that DAOs are not necessarily interested in the long-term health of the protocol.

Once you start delving into the specifics of how to evolve veTokenomics, opinions began to diverge more noticeably.

Vote Incentive Markets

A challenge in designing onchain governance is the knowledge that any chain has to accommodate the presence of malicious actors. How to align the interests of everybody, including hackers and haters?

The topic of “vote-incentive” markets loomed large. It’s not controversial to expect that you need to pay to incentivize liquidity. Yet it feels icky to many people when voting power gets colloquially branded as “birbs.”

Whatever the name, there’s general agreement that vote-incentive markets are here to stay, although the High-Time Preference cluster saw more dissent on this topic,

Selling votes may be inevitable. This doesn’t necessarily have to be a problem though.

When asked if vote-incentive markets presented a “significant risk” to the underlying protocols, there was an interesting split:

The majority of both clusters who were more active in onchain governance felt that vote-incentive markets did not pose a significant risk to the underlying protocol.

However, the larger cluster of Spectators felt such markets presented a risk. In most cases, the Spectators’ opinions mirrored one of the other clusters, but this was one of the few questions where the opinion of Spectators diverged notably from active governance participants. Perhaps the perception of such risks is what sidelining these users?

Lock Length

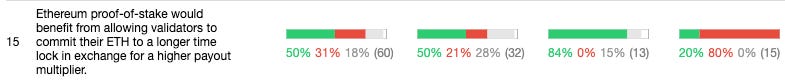

Even more divisive was the topic of lock length. Consider the following questions about the length of locks:

We see the High Time Preference cluster on the right generally disagreeing with longer lockups, with several even outright opposing any locks. Meanwhile the Low Time Preference crowd largely agreed with locks and erred in favor of longer lock lengths, with some even favoring extending lock times to 20 years.

An impassable divide? The actual discussion at the event around these topics was not so contentious as the poll results might suggest. The discussion turned to the linear nature of the 4 year veCRV model. One respondent thought it might be interesting to adjust the shape of this curve, and posited an exponential dropoff instead of a linear.

One of the biggest bellyaches about veCRV is the non-transferability of the four year lock.

There was somewhat more agreement that allowing transferability would reduce the commitment of the stakers, but opinions were more split as to whether or not this affected the overall level of decentralization of the system.

Breaking down along predictable lines, there was marked disagreement about the idea of introducing longer lockups to Ethereum validators to receive greater payouts:

Miscellaneous

In total, attendees voted on 44 statements on a variety of topics, and we highly encourage you to read through the data and draw your own conclusions.

It’s quite interesting that overall, participants sort of organically broke into two large factions roughly united by ideological contours, with a majority of non-participants. That’s basically the American political system in a nutshell.

Where the two factions roughly make sense, one thread worth tugging on is the skepticism the High Time Preference cluster showed towards aggregators.

Is this necessarily downstream from a greater distrust of lockups? Or is it a deeper concern about decentralization driving skepticism?

The High Time Preference cluster generally also had more divergent opinions on the role of Convex.

The event also featured a thoughtful discussion on the proper role of Emergency DAOs.

Plus some disagreements, and an interesting discussion, on the OTC $CRV sales

Here we also see a bit more difference between active governance participants and Spectators, with the spectators being more skeptical of such entities. Again… is this a casual reason they opt to stay sidelined? Or do they lack the wisdom of practical experience?

As the first event of this nature, we’re certain that more such events could get into greater nuances. Governance is a fascinating and critical topic, and this event was clearly successful at starting healthy conversations and unlocking real insights. This is something everybody can agree on…

For more on this topic, check out a Reserve team member’s debrief and the raw dataset.