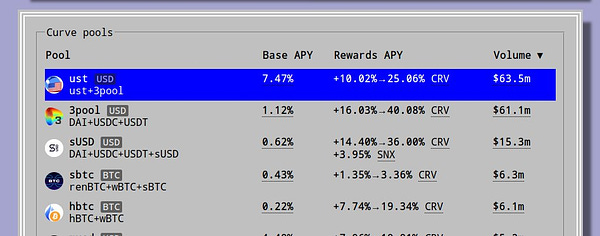

Impressive run by $UST from Terra, which has claimed the prestigious ranking of top stablecoin on Curve.

The $UST coin has been on an absolute bender since we last peeped their progress, now passing $1B in circulation.

The supply of $UST has more than doubled over the past month, putting it firmly in the top 5 dollarcoins and within striking distance of DAI. All this activity despite it only being tradable on 7 exchanges.

Meanwhile the underlying $LUNA token has also soared, hitting 14th place on CoinMarketCap as of publication.

Much of the excitement is presumably a rush to participate in the recent launch of Anchor Protocol, which targets a whopping 20% fixed APR.

You read that right, 20%. Anchor was first articulated in a June 2020 white paper , which proposed a stabilization mechanism by averaging yields from other bAssets within the Terra ecosystem. The Anchor smart contract calculates 12-month moving averages and distributes yields from collateralized bAssets according to the stabilized interest rate, stashing any extra yield for a rainy day if the gains exceed the anchor rate.

For some additional information about Anchor, check out their launch blog post or the following threads.

Like all things DeFi, the launch came with plenty of drama. Nodes suffered DDOS attacks in what amounted to a reverse bank run.

To say people are excited about Anchor would be an understatement.

Fans are even naming their beautiful dogs in honor of the protocol:

Venture capitalists are frothing into a “due diligence be danged” mob mentality not seen since the early days of Zuckerberg.

There is some bad news for the ladies, though — founder and future trillionaire Do Kwon took a break from the flurry of activity to get married last month.

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. Author is a $CRV maximalist, but has no stake anywhere within the LUNA ecosystem.