March 19, 2021: Wen EIP-3074? 🔜🇬🇧❓

Ethereum considers allowing smart contracts to control dumb EOAs

EIP-3074 may become a reality in the London release as soon as today. This proposal is important enough that Curve lobbied in support of inclusion:

EIP-3074 would allow major upgrades to the Ethereum experience, improving life for smart contract developers and users alike.

One example use case… what if you have access to an account that owns tokens you care about — maybe reward tokens from a project or baby pictures stored as NFTs — but you don’t own any Ethereum. How do you get your tokens out? Are you willing to sell some of your baby pictures just to pay for the gas to get them out? Who would even buy them? And how do you even manage to sell off these tokens without any gas in the first place?

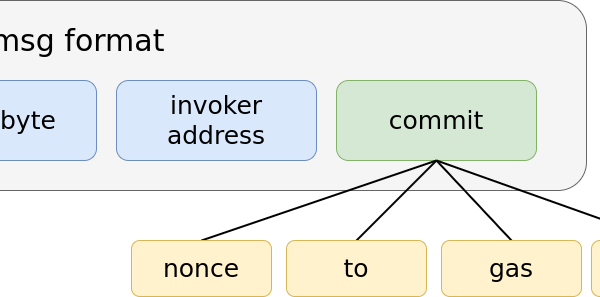

EIP-3074 solves this and more. It creates the capability to delegate control of your standard externally owned address (EOA) to a smart contract. The proposal describes this as “sponsored transactions” — the EOA gives the smart contract permission to make transactions on its behalf

This detailed thread by @lightclients provides a lot of background:

Once the smart contract can control your address, this offers your dumb wallet a broader range of functionality. In an EIP-3074 world, dumb EOAs can act as smart contracts.

You can imagine DeFi offerings that cover your gas fees to ape in, maybe locking your balance until the APY recovers this fee.

Or what if you want to create a transaction with an expiration date:

The multisignature capabilities open up a lot of exciting possibilities.

Batching Transactions

Within Ethereum, smart contracts have functionality EOAs do not. But smart contracts have limited control over EOA addresses. For example, batching transactions is impossible for regular users, only for smart contracts, which has real impact.

Consider wallets with small amounts of dust leftover from a purchase on Ethereum versus Bitcoin — maybe you have a few gwei or satoshis as remainder from buying a pizza. Absent EIP-3074, the satoshis are a lot easier to move than the gwei.

Bitcoin tracks this purchase by carving up your transaction into a UTXO. Remainders from a transaction are stored in the wallet as a chunk of usable UTXO, sort of like breaking a dollar to make your purchase and getting back a physical penny. Ethereum’s simpler account based model is more like a bank account balance — it doesn’t take the time to mint a penny, the network just notes you have a $0.01 credit.

Bitcoin’s UTXO model is a bit bulkier and makes it tougher to support smart contract capabilities. However, Bitcoin more easily supports batching transactions — gathering up several UTXOs and sending it as a single transaction. It’s like dumping your change into a Coinstar machine.

Ethereum’s account-based model does not permit batching transactions natively. This provides a number of advantages over the UTXO model in building out a smart contract platform. But it means that transactions can only be batched by deploying a smart contract, which makes dumb addresses a bit less functional.

Hence why a single satoshi is a bit easier to move around than a single gwei in our current world. It’s not immediately clear to me if EIP-3074 would actually make gwei recovery cost effective, but transaction batching can no doubt provide some efficiency for multiparty transactions.

Drawbacks

The primary drawback is the increased attack surface. To combat this, the proposal is suggesting using the 0x3 prefix for any EIP-3074 signature.

Anybody who accepts the mark of a 0x3 transaction is opting into this wild west system. If you stay out of 0x3 territory, you get to continue transacting entirely in the domain of Ethereum you’re comfortable with.

To be sure, it’s very likely will be exploits in the new system. We saw this with the recent Furucombo approvals exploit — when people give permissions to a smart contract, if the smart contract gets compromised then the hacker gets access to all wallets that trusted them.

People in DeFi generally seem to understand and accept these risks. Many patriots have shed blood so survivors can enjoy great APYs. The community is generally quite excited about EIP-3074.

Well, he wrote it so that doesn’t count. But his friends like it too…

And we’ll just pretend Sachin hates Sam, so we can claim both friends and enemies have united around this proposal

If you’re interested in learning more, you can check out a prototype implementation. This article also provides a good summary:

Or if you’re the type of person with the patience to watch a video, here’s you go:

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. Author is a Curve maximalist and has some Ethereum and unrecoverable gwei.