March 24, 2022: The Flaredrop 🛩🪂

Will LendFlare Airdrop Lead to More Giveaways to veCRV/vlCVX Holders?

Convex spent all this time building out a beautiful airdrops section. Then, the airdrops dried up...

Since the Ellipsis announcement, I’m not aware of any other airdrops to veCRV holders over the past year. Goblin town…

When DeFi summer was raging, the thought of splashing a little bit extra to veCRV holders was a no-brainer. Holders of veCRV are a community with the following desirable properties:

plugged in enough to understand Curve tokenomics

willing to lock their tokens for >3.5 years on average

often have other forms of liquidity they were hoping to boost

Getting your new token into the hands of smart, patient, whales is sort of a no-brainer. Curve users are cut from a different cloth…

Still, DeFi summer faded. Airdrops dried up. ERC-20 tokens gave way to JPEGS.

Hence the excitement generated by LendFlare’s announcement of a forthcoming airdrop to veCRV / vlCVX holders. Could the drought be ending?

LendFlare first popped onto our radar back in December. LendFlare offers not just borrowing against your LP position, but promises no liquidation risk:

They’ve had a busy several months. They launched earlier this month with a sample of Curve pools and quickly attracted $3MM from early users eager to test the concept.

The protection against liquidation risk in particular has the often risk-averse Curve community willing to give it shot.

LendFlare development is ramping up as they prepare to support more metapools in their v1.5 release.

Their airdrop is also right around the corner, giving back 1% of the $LFT token to holders of veCRV and vlCVX. The $LFT token is used for governance, as well as sharing of loan interest.

Holders of veCRV and vlCVX have already been snapshotted, with the vlCVX airdrop list posted to the Convex Discord. If you are interested in juicing your airdrop, it appears you have a few days left to to supply liquidity, though we don’t know if these terms remain active:

LendFlare will surely get attention thanks to the free giveaway, but they’re not the only borrowing game in town. They’re facing still competition from established protocols like Rari Capital…

…as well as the fast building Curvance…

Curve LP positions may become a foundational building block in the next generation of DeFi offering, and we’re here for it!

Devs Do Something

BTW, want to splash Curve users with something nice? It’s easy!

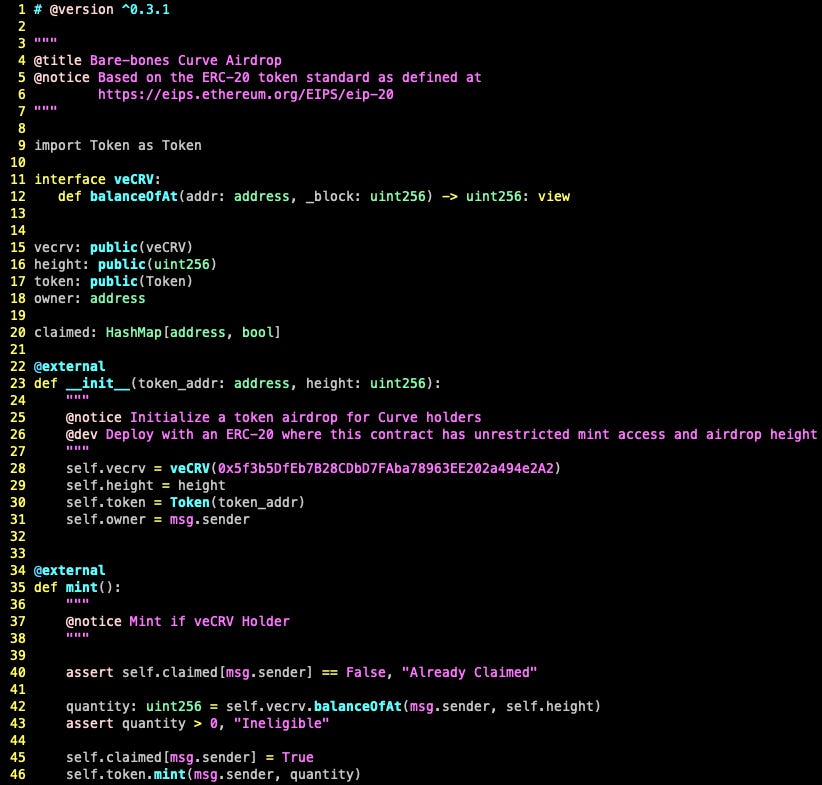

Just pick a block height, since veCRV depreciates linearly over time. In your minting contract, ping the veCRV contract’s helpful function to calculate a wallet’s address at a particular point in time:

vecrv.balanceOfAt(address addr, uint256 _block)

You can use just a few lines of code assert the user was above whatever threshold you set. Here’s a functional airdrop contract knocked together this AM (written in Vyper to honor receiving the team receiving the inaugural veFunder emissions.)

It seems Convex has a similar vlcvx.balanceAtEpochOf() function that could also be used, although epochs are less precise than block heights so you might ask around their #airdrops channel if you’re actually planning an airdrop of your own. If you’re planning to give away free money, you’re likely to be greeted warmly.

Disclaimers! Author is eligible for the LendFlare airdrop