March 29, 2021: Visa, It's Everywhere $USDC 💳🤑

Multitrillion dollar payment network integrates stablecoins

Game over. Crypto wins.

Jeremy Allaire, central to launching USDC, announced the news and explained the significance:

“For Visa, this means they get the money as fast as a blockchain moves funds, without reversal risk, without the time delays and costs of SWIFT, ACH, etc. Huge!”

Although crypto markets broadly pumped, this is undeniably great news specifically for Ethereum

This morning’s announcement by Visa is arguably bigger than even Tesla’s prior purchase of Bitcoin. For one, think what a trillion dollar settlement layer can do for Ethereum’s scaling questions.

The context is also absolutely incredible. Crypto is moving from the “THEN THEY FIGHT YOU” stage to “THEN YOU WIN” territory gradually but now suddenly.

Somebody who deserves way more credit than he is getting is former OCC chair Brian Brooks. His January memo literally provided a straight line path between authorizing payment providers to make settlements using stablecoins to this announcement just three months later. Please join our #BrianBrooksNobelPrize campaign.

As we argued last week, the existence of a robust stablecoin infrastructure creates the rails to allow for quicker adoption. We’re seeing this play out in realtime with this Visa announcement. A crypto-dominant future is visible on the short-term horizon.

There still are some kinks to be worked out of course…

Of course this is not being used for small purchases. This announcement applies to partners:

The pilot would reportedly allow Crypto.com to send USDC to Visa’s Ethereum address to settle some of transactions under the crypto exchange’s Visa card program by linking Visa’s treasury with digital asset platform Anchorage.

Visa, founded in 1958, may become the first sexagenarian to pick the right digital currency bandwagon to jump onto.

The news would seem to be good for $USDC, although its price plunged .18% on the news.

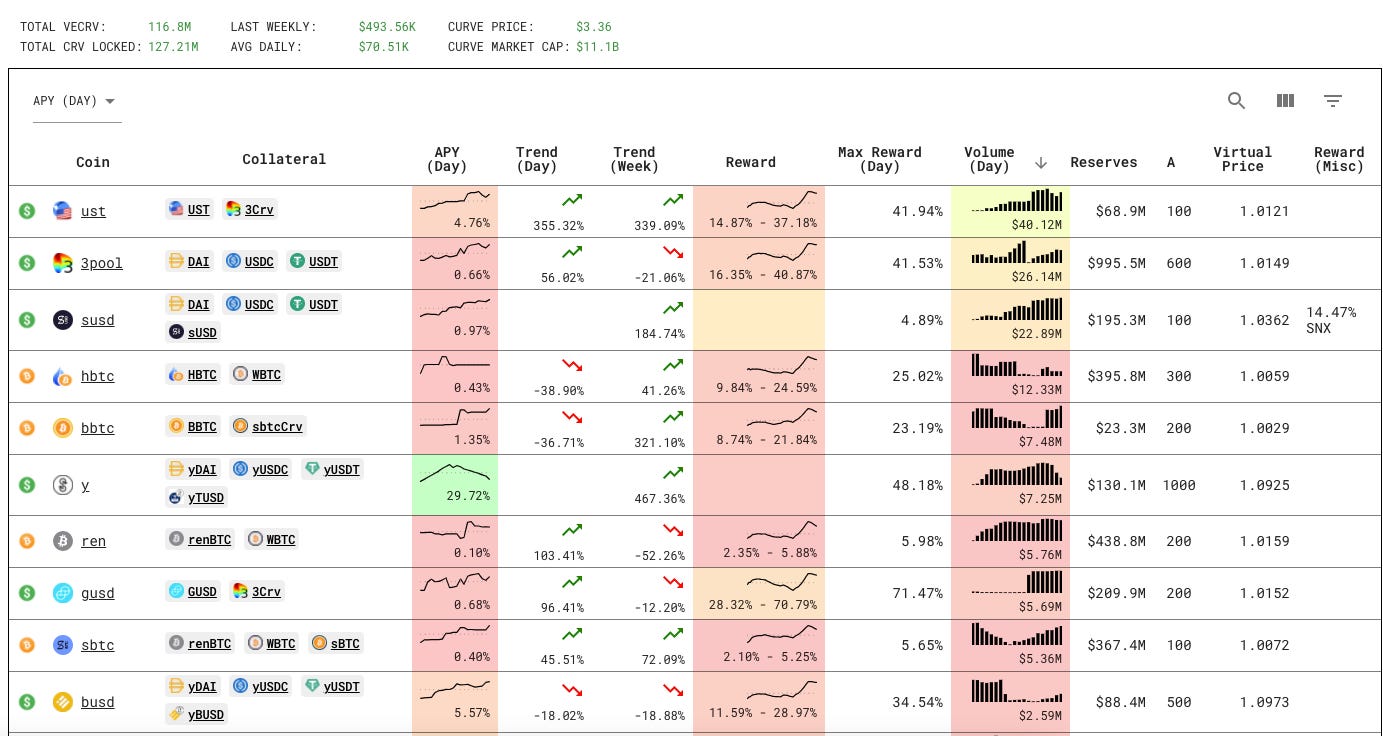

USDC is of course rapidly ascendant in the stablecoin world, second only to USDT with $11 billion in circulation. In total, USDC has transferred over $555 billion in payments in its entire history. Visa transfers this month roughly every month.

It’s certainly great news for Ethereum, although some Eth-heads critiqued the media’s poor reporting.

One person managed to sneak in an $MSFT comparison anyway

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. Author is a Curve maximalist and owns a little USDC.