March 3, 2021: Namespace Collisions 📛💥

Who's next, after $CRV got confused with PayPal's Curv acquisition.

The name of the game in 2021 is playing name games with tickers.

Yesterday, interest in Curve Finance hit a fever pitch. PayPal announced it was buying a difference Israeli storage firm named Curv. Traders couldn’t be bothered to make a distinction. Jokes abounded:

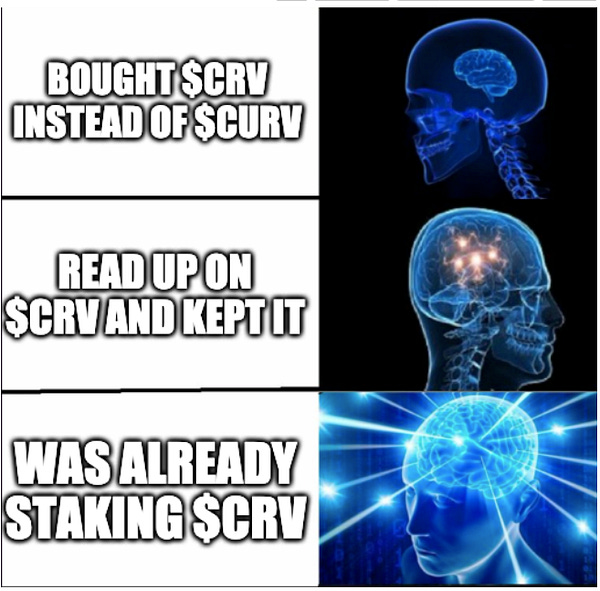

Some traders missed the punchline, instead showing off their lightning hands ⚡🙌

Some traders quickly exited after realizing their mistake

Yet the market didn’t collapse fully. Perhaps the smarter traders took some time to get educated about Curve and realize it’s awesome and worth keeping.

Some took it as a bullish indicator in the space. This deal as estimated to be about $500M, whereas Curve’s fully diluted market cap is currently $7.5 billion. In order for Curve to flippen PayPal, it only needs to run up fortyfold to $305 billion.

This rush to acquire similarly spelled companies is a big trend lately. Already in the past year we’ve seen:

If you’re looking to capitalize on traders’ illiteracy, we’re providing our helpful guide to crypto-equity namespace collisions. It’s not financial advice, but it still fits nicely in your wallet!

No screenshot of Curve stats today as we clean up a few bugs causing stale data to display.

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. Author holds $CRV but no CURV.