March 7, 2022: I Will Rug No More Forever ☠️⚰️

How Andre Cronje's DeFi Empire Gets Reapportioned

The Godfather has exited the chat. Press F…

Legendary developer Andre Cronje has retired, possibly forever. It’s possible he’ll be back in three months, or return as an anon. We’re assuming it’s for real.

He was indisputably a giant in the space, as clearly evidenced by the stunning number of projects suddenly orphaned. This newsletter would be too long if we collected all the heartfelt goodbyes, and even longer if we included the “don’t let the door hit you” type sniping that may have contributed to his departure in the first place. So we won’t.

We don’t spend time dwelling on his legacy because the past does not exist. The future is all that matters. DeFi has always been a chaotic battlefield to determine who controls the future of FinTech. Cronje’s departure pushes it further into flux.

People always ask how to make a fortune in crypto. In fact, it happened this past weekend against an unexpected backdrop. Bear market. Prices tanking. Sentiment hopeless. Money drying up. On top of everything, a major DeFi developer suddenly throws in the towel. Not exactly where you’d expect generational wealth to be made.

What I saw was a land grab as Andre’s empire got carved up in realtime. Builders still toiling through the lean times happened to be positioned to get their piece of Andre’s empire. The paper hands panic sold. The builders picked up the keys to the kingdom.

That’s how fortunes get made. An unexpected wealth transfer in the trenches. Let’s check in on the new DeFi oligarchs getting minted before our very eyes.

BRIBE.CRV.FINANCE

Most relevant to readers is the fate of bribe.crv.finance, which played an interesting role in the Curve Wars. Before Votium launched, Cronje front-ran the greedy horde with his own frontend to bribe Curve holders directly, popularizing the contentious “bribe” term in the first place. Even though Votium existed for the explicit purpose of managing this process, Cronje's bribe site persisted and continued to play a role in the Curve Wars.

With the free market pricing of crypto tokens often irrational, in some cases it was more efficient for protocols to directly bribe through Cronje’s site. This offered something of a check and balance to the flywheel, and thus became one of the most contentious land grabs that occurred over the weekend.

At least one farmer recognized the obvious opportunity and put out some feelers…

This was too slow though, as the stalwart Llama Airforce had already executed a precision strike.

Meanwhile, the veToken team went even further, announcing a mirror and subsequent development to come.

It will be interesting to see who controls this battlefiled of the Curve Wars.

While midwits like to quip about the Augean state of DeFi, the Curve Wars are in fact more interesting than ever. Bullish for autistic newsletter writers!

YEARN

The hand-wringing about the state of Yearn finance is even crazier. True, Yearn was founded by Andre, but he hasn’t been an active contributor for years.

While it may not matter to a jittery market, the greater recent threat to Yearn was not Cronje’s departure, but the saga of Yearn sage @bantg. Yearn’s beloved waifu-poster was apparently displaced by geopolitical instability and recounted a harrowing tale of escape. We’re relieved to hear of a safe resolution.

It’s a good time for you to research Yearn fundamentals, a veritable Rorschach test in which some see panic yet other see opportunity.

FIXED FOREX

One interesting application Cronje authored which could become more relevant in an increasingly unstable world is Fixed Forex. The project is apparently being absorbed by the DeFi Wonderland team.

Notably, Fixed Forex was an innovative application authored on the backbone of Curve’s v1 pool factory. Nowadays earning yield on currencies may be less popular than stuffing bills under your mattress. For the daring yield farmers, the existence of Fixed Forex has produced good yields for its affiliated Curve pools.

In this manner, Cronje’s disappearance indirectly affects Curve in that we can only speculate what brilliant future applications he may have built off Curve’s burgeoning v2 pool ecosystem. This opportunity is survived by all of you builders out there…

KEEP3R

Like Fixed Forex, The Keep3r network is being taken over by DeFi Wonderland.

CHAINLIST

Developers all inevitably found their way to Chainlist, a wonderful site for managing connections to the dozens of chains in existence. While an incredible utility, the site itself it not a critical base layer and has already been forked by multiple parties, most notably finding a natural fit at DeFi Llama.

MULTICHAIN.XYZ

Multichain also remain relatively unscathed. The multichain.xyz frontend was mostly just a frontend built on multichain.org (previously Anyswap), so it’s basically business as usual for this project.

FANTOM

The Fantom chain had served as the de facto playground for Cronje to release the brainchildren of his innovation. Cronje stepping down as advisor has left an outsized wake and heavily affected all projects on the chain.

However, like Yearn, Fantom has a large team. The departure of Cronje appears to be more of a symbolic hit than anything else.

In fact, it may prove good for Fantom. Teach a dev to rug, they may rug for a lifetime.

SOLIDLY

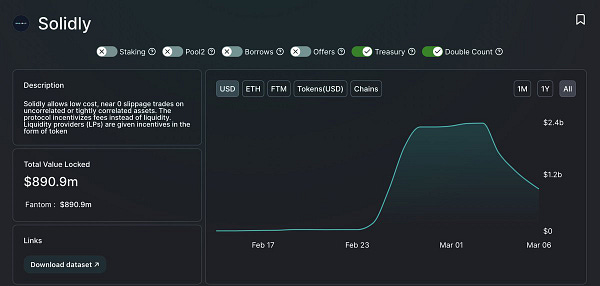

While it’s taboo to speak ill of the recently departed, we hope that fighting your way to the end of the article means enough time has passed to quip about Solidly. People liked to joke about Andre’s projects being rugpulls. If so, Solidly was an epic finale.

Just last week we assigned an overly charitably 5-10% chance Solidly could outgrow Curve long term. We hope any project advocates still clinging to hopium learn to take the L. It’s tough news for a lot of people, but best to live in reality.

As always, DeFi is likely to face some short term pain. When times get tough, keep an eye out for all the teams and protocols that are growing more resilient.

Disclaimers! Author is a Curve flywheel maxi, has zero or only indirect exposure to any other coins mentioned throughout.