War weariness has dampened morale against the backdrop of a bloody market. Fortunately the good wars, the Curve/Convex Wars, march onwards with the close of another Votium round, the addition of $SILO, and a forced mass relockening.

Votium

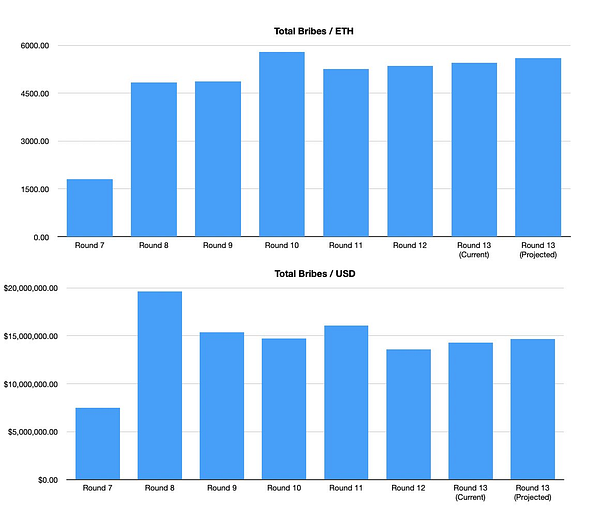

Once again, bribes remain strong in absolute terms, though ticking slightly downwards in terms of $/vlCVX. Given the 🐻💩 market driving all other numbers downwards, it’s a good result, especially as it translates to a 60%+-ish APR.

For a detailed breakdown of the numbers, @wagmiAlexander has been following the details closely and offers thoughtful and must-read breakdown.

Amidst the threads he raises the good point that bribes / ETH provides a better snapshot than bribes / $. Much of the numbers we’re seeing go down in dollar terms are more reflective of the price of ETH dropping than anything else.

Likewise, threads by threadoooor-in-chief Adam Cochran always spin a fine yarn.

One question to keep an eye on is whether the biggest bribers stick around.

We continue to see $FRAX and $UST bribing well into 7 figures as the deepest pocketed donors. $stETH doubling their bribe puts it close to a second comma. Witnessing $cvxCRV and $CVXETH dropping in $ terms is not a major concern as both protocols are committed to keeping their pools incentivized. We like seeing big money splashed at the top, and this week the top five protocols are all above the psychologically important $690K for the first time since week 9.

$SILO

In addition to keeping an eye on past bribers coming back to the trough, another key health metric is whether new protocols are entering the Curve Wars.

A bear market can make it difficult for new DeFi primitives to launch, so innovation drying up is more concerning than most other metrics. Despite all the crazy activity, TVL has been essentially flat since early November almost half a year back.

Ergo we were delighted to see Silo Finance pouncing on the dip to position themselves directly into the Convex Wars.

Rather than tiptoe-ing in, they’re making a comprehensive move. They literally bought the dip, tapping their dev fund rather than waiting for governance approval.

Proving prophylactics can be useful for both family and financial planning, in this case everybody’s favorite safety expert authored the proposal to bring Silo into the war.

The purchase by Silo is strategic to help incentivize their new $SILO/$FRAX v2 pool, a rare pool denominating in $FRAX instead of $ETH.

The $FRAX denomination and architecture of their platform is fueling speculation that they may eventually launch their own stablecoin.

Late last week they published a detailed missive outlining their strategy which is a good read.

For those unfamiliar with Silo Finance, they launched in late 2021 as the winners of the ETH global hackathon. The team is creating a non-custodial lending protocol to borrow any crypto asset using any other bridge asset. They’re attempting to fix the problem faced by other lending protocols, which are at risk of the entire protocol going under when the price of the collateral token moves wildly. The team are building their protocol to isolate the risk into walled off money markets, hence the eponymous $SILO.

More details are available on their docs. $SILO becomes the 20th protocol to accumulate $CVX, snapping up about 2.5% of the total market.

This chart should get you boolish because you can’t easily point to the bear market on the above chart. Protocols have not sold, but are instead holding and acquiring as new protocols enter the battle.

Notably, every dollar in bribes currently yields $1.22 in emissions, so we may expect more protocols may rationally choose to enter as bribery proves so effective.

Relockening

Finally, in what already feels like ancient history, late last week we saw an unusual bug that turned out to be something like a feature.

How is a bug bullish? CVX has an 8+ week locking window, which is an eternity in DeFi. A lot of players had locked their CVX before prices nuked. Lots of FUD got bandied about concerning whether people would choose to relock at expiry.

When the bug was announced, the solution forced a massive unlock and migration to a new locking contract. This amounted to an unexpected opportunity for paper hands to jump ship. In the immediate aftermath of the announcement, the $CVX price plummeted, raising concerns a massive number of people would jump ship.

Much of the concern was around $MOCHI, who had their rewards previously nerfed and could understandably be salty. Impressively, $MOCHI relocked, as did most.

It seems $MOCHI’s time in the penalty box is at an end.

We’ve not yet seen a full post-mortem about the bug that was identified. In the blog post, Convex announced:

“User’s [sic] who vote-lock CVX earn 5%+1% rewards in the form of cvxCRV. This bug made it possible for expired locks to relock directly to a new address, which, in turn, enabled them to claim more cvxCRV rewards than they had earned.”

We presume these are the offending lines, which were rewritten to prevent users from making such adjustments.

According to the source code, the following adjustments have been added to the Convex Vote Locker v2, most of which we presume are premeditated feature enhancements unrelated to this bug.

change locking mechanism to lock to a future epoch instead of current

pending lock getter

relocking allocates weight to the current epoch instead of future, thus allows keeping voting weight in the same epoch a lock expires by relocking before a vote begins

balanceAtEpoch and supplyAtEpoch return proper values for future epochs

do not allow relocking directly to a new address

Here the final bullet point appears to address the reported bug. Our bags thank the Popcorn Network for responsibly disclosing this vulnerability. The do-gooders deserve a follow and a hearty thank you for their work!

Silo is launching a stablecoin as announced here: https://www.silo.finance/post/proposal-silo-stablecoin