Welcome to the $frxETH era!

Spotted by crypto intern 16131_, the $frxETH era launched officially when several $frxETH paired pools deployed onto Curve, seeded with ~10-50 ETH worth of liquidity over the past two weeks.

In total, frxETH now contains 12 trading pairs on Curve.

Most new pools came the form of v2 pools, likely inspired by the success of the $cbETH and $rETH pools. Alas, had they held out a touch longer, they may have been among the first to benefit from the gas efficiency of TNG.

Some of the new pairings are indeed noteworthy. The token is now fungible with 8 other varieties of ether, including the top LSDs: $ETH, $stETH, $rETH, $cbETH, $ankrETH, $sETH, $alETH, $pETH. Additionally, we gain volatile trading pairs for $frxETH and flywheel tokens $CRV, $CVX, and $FXS.

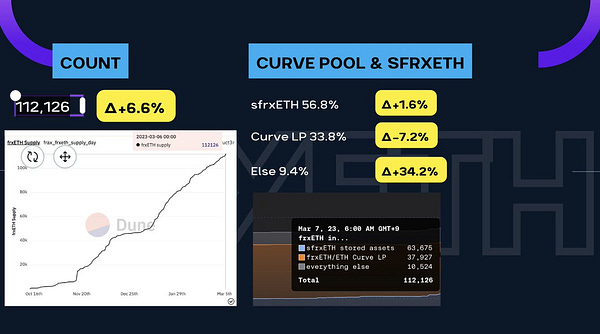

The ascendance of $frxETH has not only intensified the LSD wars, but also been a nice boon for Curve trading activity, as shown by this defimochi dashboard.

A dozen new trading pairs probably won’t hurt Curve none too much neither.

For those unfamiliar with why $frxETH has become so popular, check out the summary by the great wavey last month, reviewing its bespoke $sfrxETH mechanics.

Most $frxETH nowadays gets staked as $sfrxETH, where it yields a whopping 6.3%. Thanks to this healthy tokenomics, it’s grown at a clip, already hitting 1.44% market share in short order after launch. The upcoming Shanghai upgrade will undoubtedly further scatter the field.

Frax is overall delivering a master class in flywheel optimization. Among other places they are splashing cash to attain dominance, they are taking full advantage of the Convex money factory as the top source of birbs.

They’ve also been sighted heavily splashing $FXS through StakeDAO.

Why are they spending so lavishly in a bera? What’s their master plan?

If you find yourself confused by Frax’s strategy, you need only pay the slightest amount of attention, as founder Sam Kazemian is not shy about monologuing his plans for world domination.

This past weekend, he received the celebrity treatment he deserves, playing to a packed crowd in Denver. Flywheel DeFi has the recap:

Kazemian has a talent for identifying, decoding, and describing emerging DeFi concepts succinctly and aptly… almost as if he was an adept philosopher another lifetime ago. For instance, in a previous interview he articulated quite succinctly the vision of the DeFi Trinity, referring to the three killer use cases of cryptocurrency: Bitcoin, Ethereum, and stablecoins.

In Denver, he posits the concept of stablecoin maximalism, the idea that “most crypto protocols will converge to become stablecoin issuers in the long-term.”

Seeing all of DeFi through this lens… every protocol inevitably pushing into becoming a stablecoin issuer or otherwise reliant on stablecoins… the grander strategy of Frax Finance comes into clearer focus. If DeFi is indeed just stablecoins all the way down, how would you position yourself to compete in the realm of stablecoins?

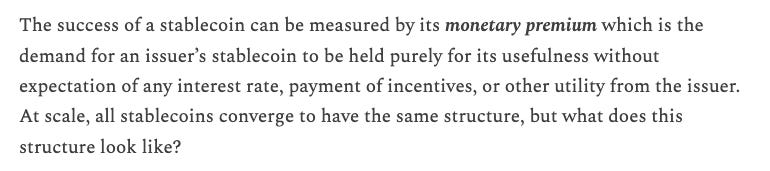

First off, what constitutes winning among stablecoins, when all coins are pegged around a dollar? His talk describes a stablecoin’s success as its monetary premium:

In other words, all stablecoins are worth equally a dollar, yet some can be more valuable due to other properties.

It’s a sensical argument, and we’ll submit to the jury that Kazemian be considered a credible expert on stablecoins. On DeFi Llama’s leaderboard, Frax is one of just six with a market cap above $1 billion.

“So if Frax is so focused on stablecoins, then why the detour into Ethereum LSDs?” screeches the heckler from the rafters.

In Kazemian’s view, Frax Finance is focused on building stablecoins, its LSD being a form of stable ether. Frax currently operates three stablecoins ($FRAX, $FPI, and $frxETH), and its job is to construct the infrastructure around these stablecoins that users expect and demand.

He contends that these services are the necessary suite of services to provide his stablecoins sufficient monetary premium and render them successful. The existence of Fraxlend, Fraxswap and Fraxferry, as well as the ability to attain utility for its stablecoins throughout Curve, positions Frax as being uniquely capable of deploying successful stablecoins.

If you’ve heard Sam’s other talks, you’ll know he’s very explicit about his intent to receive a Fed Master Account. He contends any successful dollarcoin of size will inevitably run into regulatory bodies. In pursuing a Fed Master Account, this allows Frax the ability to integrate this inevitability directly into its tokenomics.

If you think Frax naive on surviving the DC jackal pit, consider that they already know their way around the corridors of power. Elsewhere at ETHDenver, former hilltern DeFi Dave of Flywheel DeFi gave a must-watch talk on stablecoin regulation, comprehensively covering the ins and outs of cryptocurrency policy.

In total, we begin to comprehend Frax’s master plan to conquer the world.

Will it work? You’ll have to stick around to find out.

In our view, the master plan establishes sensible axioms and follows this trail to craft a logical and forward-thinking strategy. Bullish!

Not Financial Advice! Disclaimers! Author has exposure to assets in Fraxland

Great read!