Frens — make sure to join us tomorrow morning at 10:30 PT for a Live Llama Party… featuring the Wen Llama NFT team.

It’s liquidity migration season!

We know lazy LPs prefer to yield farm and then disappear for months. But DeFi remains highly active when it’s not being radioactive. If you’re playing with on-chain ponzis, you should be prepared to check in frequently and make sudden moves when necessary. Devs doing something™️ can be a form of soft rug.

Fortunately, in most cases, the worst that befalls you is that you may not earn yield for a little bit. This would be the case for potential upcoming migration events for $yCRV and $cvxCRV. First up though, an important warning to anybody in the Stargate $STG pools!

Stargate

If you are in either of Curve’s Stargate pools (STG-USDC or STG-FraxBP), get out immediately!

The team recently learned of security issues with their token. Curve moved quickly to kill emissions and replace them with new pools imminently.

As of the 15th, if you’re stuck in the Curve pools, your stake will become worthless. Get out immediately! About half the LPs have gotten the message, but not everybody has heard yet!

If you are interested in redepositing, the method to maximize your unstaking would be to withdraw all tokens in a balanced fashion and therefore avoid slippage. Withdrawing wrapped would also be a useful option for those in the FraxBP pool who are concerned about gas fees — this would give you a single FraxBP LP token, as opposed to needing to set new approvals for both Frax and USDC.

Whatever you do, move your liquidity immediately!

Yearn $yCRV / Convex $cvxCRV

The other big potential liquidity migration on the horizon — it appears as though Yearn and Convex are preparing to launch new pools for their flagship $CRV wrappers.

‘Member this cryptic vote last month??

The vote would go on to pass with overwhelming support.

Devs proceeded to deploy a new pool implementation on-chain twenty seven days ago. You can recognize it is up to date because it uses Vyper 3.7, the most current version.

The closest match to this code in public Curve repositories is within the new $crvUSD repository. This newest pool type is very similar to previous Curve factory templates for stablecoin pools, but comes with some added logic like calculating price internally based on an exponential moving average.

This is of course relevant to $crvUSD because the LLAMMA heavily uses price oracles — you can witness adapters for three different flavors of price oracle in the repository:

The new price oracle enabled stable pools were added to the factory last month, but otherwise mostly ignored. Unsurprising, as they don’t yet show up in the UI.

Until the great Fiddy noticed something yesterday…

Shortly thereafter…

Hmm… plain pools with an exponential moving price average? Sounds familiar, right?

We can observe that in the past month, exactly two new EMA pools have been launched, presumably through direct contract interaction since it’s not in the UI. The two pools are Yearn $yCRV, and then shortly thereafter, Convex $cvxCRV:

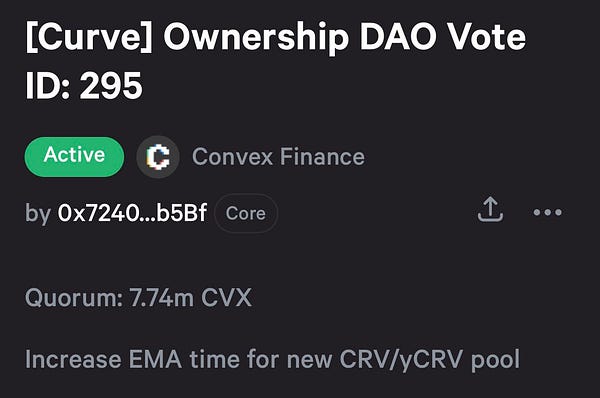

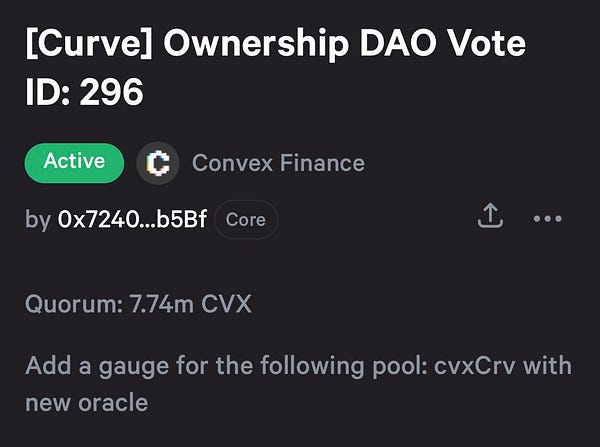

Both Yearn and Convex launched replacements for their prior wrapped Curve pools, and are hammering swift governance votes to prepare these pools for prime time. Convex has been planning the migration for months, first mentioning it in the January newsletter and reiterating the move it in their most recent newsletter. They plan to cut incentives to the old pool, enticing liquidity to migrate to the new pool. We imagine Yearn will do something similar.

Are the two protocols moving now due to any particular time urgency? If it’s a $crvUSD tie-in, they should know the stablecoin is coming SOON™ (ie never). Even if $crvUSD did actually launch, it’s rumored to initially only contain raw ether, so it may be many soons before other tokens get approved for lending.

Anyhow, with both protocols you need not worry too much about the distant future, as they’re both plenty active at present. Yearn is busy preparing its play on LSDs with $yETH.

Convex just launched Polygon support, along with updates on cvxFPIS and cvxFXS.

Exciting times for both, just note that if you participate in either pool you may need to migrate sooner than SOON™ .

Finally, as we complete our tour around governance, it appears that the $eUSD dollarcoin launching out of Reserve Protocol is on its way to passing, so we may expect liquidity inflows here:

The $eUSD pool has about a million worth of liquidity, and Reserve owns about 5% of the DAO owned CVX to help incentivize pools launched through its platform (FraxBP also supports pools built against FraxBP). You may soon observe speculators rush into the pool as soon as they notice rewards about to stream to the pool.

Disclaimers! None of this has been financial advice! Author has exposure to $yCRV and $cvxCRV.