Do, the humanity! The wild weekend turned out a mere preamble. Yesterday the main 💩-storm blew through. Horrible news for anybody who flew too close to the moon…

For anybody who kept their distance from the Terra $LUNA ecosystem, it was nonstop entertainment, for the price of a modest market nuke.

So let’s get the laughs out of the way. The inspiration for today’s article title was just about the best thing I ever read…

…yet this topped it.

Let’s dig through the rubble.

TERRA

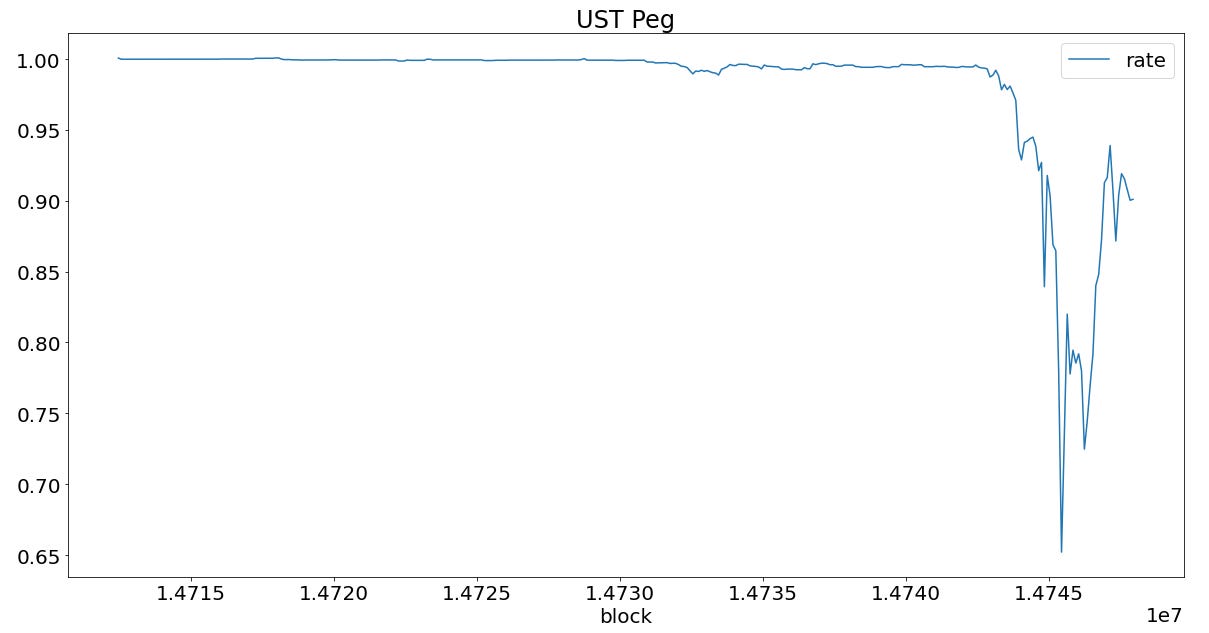

As much as I’d want to say the LUNA-tics have been humbled and learned their lesson, something tells me this will end up a minor bruise. Although the peg dipped as low as $0.65, it would end up recovering to $0.90 overnight.

Getting literally decimated is tough to recover from, but it’s not impossible. In this poll of followers (initiated before $UST dropped below $0.90) suggests people are expecting a quick repeg by a 2:1 margin.

If $UST does fully recover, anybody who waited out the action in the pool (Terra included) would actually end up with a healthy bonus.

For his part, Do Kwon would go quiet after firing up the algorithm, while the main Terra account would retweet a few positive messages from the community.

As a coin, $LUNA would drop out of the top ten on CoinGecko, but still sits in the top 20, giving it disproportionate heft within the broader cryptocurrency markets.

Notably, Terra got flippened by its own $UST. At present $UST (10th on CoinGecko with a $16.3B market cap) is several spots ahead of $LUNA (14th @ $10.7B)

We still haven’t positively identified the culprit behind the attack, but the rumor mill is fingering Citadel.

4pool

This was the week that 4pool had planned to turn on rewards begin its coinquest.

Instead, 4pool itself got raided for any liquidity as desperate $UST holders looked for any offramp.

The other half of 4pool’s decentralized pairing, FRAX, is of course weathering the storm just fine.

Founder Sam Kazemian took to various channels to pontificate on FRAX’s architecture.

Meanwhile fans of the centralized half of 4pool took a victory lap.

Bripto

The broader crypto markets took a beating, albeit relatively mild compared with other crashes. At this point, the real “black swan event” would be closing a quarter without a massive Ponzi crash causing broad market nukes.

One interesting coin to keep an eye on in the fracas is $MIM. Magic Internet Money had regained its peg, if not its balance, in its corresponding Curve pool. Meanwhile the MIM-UST pool would also get raided, moving from 80% $MIM before to 96% UST at the end of the show.

Also, a big congrats to 0xSifu, who made almost a million dollars on the mix. Clearly a financial genius, it’s a wonder nobody has hired him as CFO.

Unfortunately, the other big winner is Elizabeth Warren. In between her quixotic battles against literally everything else on the planet, she may have reserved enough capacity for yet another breathless tirade against stablecoins.

Tin-foilers pointed out the coincidence of timing in the targeted attack on $UST occurring on the same day the Fed released a report lambasting stablecoins. Although I don’t generally believe in coincidences, this does not smell coordinated to me. In this case the stablecoin section read as some boilerplate language buried some 50 pages into an annual report. When the Fed is already fudding stablecoins on a near-daily basis, the odds are pretty good a Ponzi will collapse on the exact same day. I’d expect a coordinated effort to look more like a one-page press release focused on stablecoins to guarantee news impact, but who knows these days.

Curve

Yet again, Curve enjoyed a wild multi-billion dollar trading day.

Looking over the history pages, it may be one for the record books.

Specifically, the ~$3.6B final total falls short of a daily record. We hit over $4B just four months ago, long enough ago we’d completely forgotten. However, multiple days of multi-billion dollar volume might well set a weekly record? A project for aspiring fact-checkers.

One interesting angle is to compare/contrast Curve’s performance versus rival AMMs.

Although Uniswap is quite adept at driving up everyday volume by handing away trading wins to MEV bots, their weaknesses in handling stablecoins in a crisis were on full display. While Curve remained as resilient as always, Uniswap gave up the ghost well before Binance.

Just as “you don’t need decentralization until you do,” the concept of a pool that only is functional under perfect market conditions is basically worthless in crypto.

Reminder to all that Curve v2 pools bring this same level of resilience to volatile pairs. If market nukes continue to occur on a quarterly basis, protocols may have little choice but to rely on Curve to provide 24/7/365 liquidity.