As long as there are highly liquid decentralized markets, there will be speculative frenzies, hacks, ponzis, and scams. Fortunately everybody in crypto has a pretty thick skin and knows it could all plummet to zero.

Recently we’ve seen no fewer than four questionable projects, here we review them in order of their impact on Curve users.

FROYO

$FROYO, the Fantom-based unauthorized Curve Fork, appears to have melted.

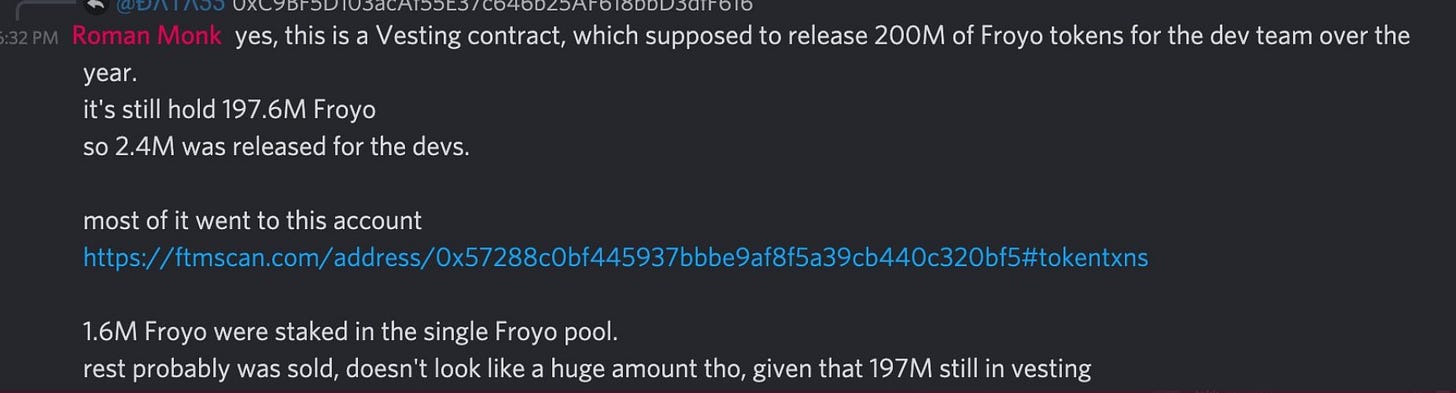

Yesterday the Fantom Community Alerts noted that a dev wallet appears to be siphoning money

Eventually the following response was issued from a developer at @BeefyFinance, which had once touted $FROYO

The $FROYO one-man dev team has gone silent, not issuing a tweet since May 8 and abandoning their Telegram group. While technically it’s possible that the dev just went into the mountains for a few days without wifi, this means the most charitable possible interpretation is that it’s merely an awful project.

However most bets are that this is an outrightscam.

The price of their $FROYO token has meanwhile plummeted.

There were plenty of signs that this project was either unsophisticated or fraudulent. Among other issues, they never even bothered to set up a redirect from http to https, ensuring many new users got an error page.

Arguably it’s also sketchy that the approval for depositing a single dollar defaults to 1e71 dollars, an amount that would make even the US Treasury Department blush.

If it indeed was a rug pull as commonly speculated, it was terribly unsophisticated. All they did was to mimic the successful Ellipsis airdrop, get a little goodwill from the community with claims of a free airdrop, and then sell off the airdrop for what appears to be about $70K worth of Fantom.

Incredibly, the protocol still has about $30MM sitting in it which has not been touched. A more sophisticated hacker might have targeted this money instead of the small money from the $FROYO pump and dump.

People grabbing a speculative airdrop only lost a few pennies thanks to Fantom’s low prices. Anybody who parked cash in these pools may be wise to withdraw and cancel all approvals.

Though it may not have been the world’s sophisticated scam, you still have to acknowledge that this frozen yogurt heist required some cold stones.

SHIBA

Although this is not a purebred scam, the mania caused by the adorable but dogsh— $SHIBA token has bled into Ethereum in the form of absurd gas fees.

The bill for the hype came in at $89MM.

For some time, the best place for some traders to acquire the $SHIBA token was UniSwap. The speculative frenzy drove a lot of WSB types to hammer the Ethereum network trying to grab their discount $DOGE.

In fairness, there may be other factors driving the high gas prices, but it’s still comical the sheer number of rugpulls at play here.

For one, there’s the rugpull of centralized exchanges continually delisting coins with high volumes. Amateur traders constantly return to try and kick the football.

There’s the rugpull risk inherent to $SHIB itself, which has an appalling Gini coefficient.

Finally there’s the rugpull of all the hardcore builders in the space, working diligently to create the future of finance, only to see their net worth eclipsed by assorted breeds of dog coins.

If you expect more hype cycles like this, you may want to just invest in Ethereum. Nobody can honestly say they’re wise enough to know which random dog coin will actually have legs. Yet when the mania clogs the traditional exchanges, Ethereum is the only network that can support the demand.

Yes, it may be obnoxious that in the short term, the free market values dog coins over DeFi. Fortunately Ethereum basically has the surge pricing mechanisms in place to keep the network traffic moving at any level of demand (both before and after 1559). It simply requires you the trader to judge whether or not your ape move is more valuable than scooping up doggie bags at 400 gwei.

RARI

On the more heartwarming side, the kids at RARI fell victim to a more traditional hack but thankfully bounced back.

4K ETH drained in the blink of an eye.

Fortunately, the team was very transparent and upfront, providing a playbook for how to react to such events.

Their solution involved reallocating capital from the team to bail out those affected, and converting the organization into a DAO a bit earlier than expected.

The response mostly earned plaudits along the way:

Hilariously, the hacker cheaped out on gas fees.

For more details on the hack:

Value DeFi

Finally, a quick note on Value DeFi, an organization that leaks money like a Silicon Valley VC. This time they dropped another $11MM, after twice before losing similar sums. This one hardly affects the Curve community, so we won’t go into much depth, except to link a few other resources.

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. Author is a $CRV maximalist, owns a little $ETH and $DOGE, but no $SHIBA.