The Efficient Market Hypothesis is almost more of a paradox than hypothesis.

If markets are inefficient, it implies there’s free money just lying around — not usually the case, right?

If markets are efficient though, then how did they become efficient? Somebody had to make a trade to bring it to equilibrium, and therefore they existed in an inefficient state.

Perhaps markets are inefficient because nobody is using Ethereum anymore. Gas is down to 3 gwei, so it feels like a ghost town.

Yet that may not be true… it may be that there’s more users on mainnet than ever…

Is Ethereum dead and this is cope? Or is it bustling?

Tough to tell in the fog of war…

…aka information asymmetry…

…but information asymmetry in markets usually just means free money?

As you browse DeFi, you may find yourself noticing many such discrepancies.

In some cases, it’s the wisdom of the crowds efficiently sorting risk/reward factors.

In other cases it’s pure oversight.

You can amass great fortunes if you have the wisdom to distinguish between the two!

Curve Llama Lend is “testing in prod.” There’s clearly very little information on the table. In hindsight it will become apparent where we fall in this blurry superposition of two potential outcomes:

Horrible hack of a complex protocol! All the funds got drained and everybody lost everything! Anybody dumb enough to grab for 20%+ yields got caught with their hand in the cookie jar!

Smart contracts were solid! All the early pioneers who plunged into the dangerous waters made out like bandits! Oh man, it was like DeFi Summer 2.0, we may never see an opportunity like it again!

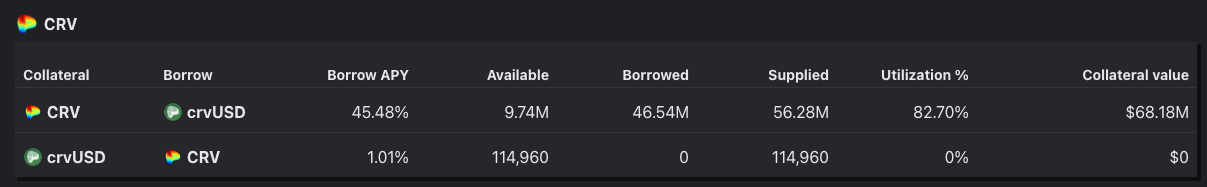

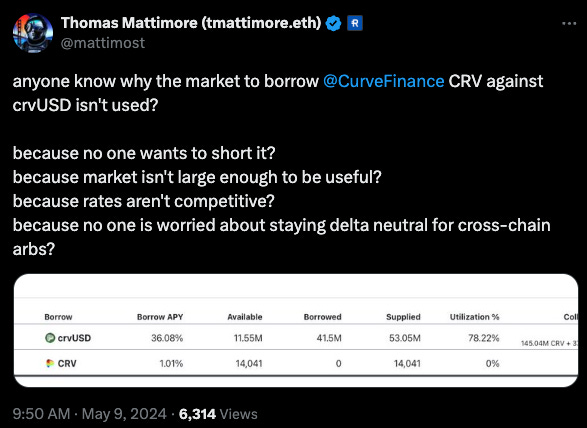

Many such cases, innit? Take the untapped $CRV short market…

The countless death spiral clout-masters should theoretically be falling over themselves to gobble up this free money.

Alas, crickets…

Could the noisy $CRV death spiral thread00rs be <gasp> disingenuous? Perhaps they simply value social media clout more than cold hard cash?

Initial responses suggested the markets were simply too small, but perhaps due to increased attention, the market swelled and yet no nibbles.

Of course, there can be myriad reasons why the death spiral crowd would refuse short $CRV on Llama Lend even if their belief that Curve was on the precipice of disaster was indeed genuine. They may well believe that $crvUSD is itself likely to be a casualty of the implosion, and thus they may not want to risk touching Curve infrastructure. Yet if they truly believed this, shouldn’t they invest in finding this bug and claiming a bug bounty…

There’s still other non-short strategies people could take advantage of?

There seems to be so many such opportunities for free money in DeFi. We know there’s fairly marked discrepancy between economic actors with a short-term time preference and a long-term time preference.

Few people can afford to wait for yields to mature, you have to already be rich to be willing to wait for strategies that require a bit of time to yield. Strategies like lending rate arbitrage.

Or buying depegs of assets that tend to repeg over time…

If you need money tomorrow to feed your family, you need to make it all back in one trade. Hence, memecoins, airdrop farming, leveraged trading. Why you sometimes hear that markets are a transfer of wealth from the impatient to the patient.

Or sometimes… a transfer of wealth from the less intelligent to the more intelligent…

We’ll posit an answer to these inconsistencies…