May 14, 2021: Lido and Think of London 🇬🇧💦

Lido's Liquid Staking $stETH Leads the ETH2 transition.

With just a few months before Ethereum’s London hard fork integrates EIP-1559, Lido Finance is becoming a critical player in the multi-step transition to ETH2. The liquid staking protocol is currently the 3rd largest ETH depositor address.

The liquid staking mechanism provides a great “have your stake and skeet it too” opportunity for apes who want exposure to the ETH 2.0 transition but don’t want to miss out on the trendiest new DeFi offerings in the interim. Lido’s $stETH token is extremely liquid and accepted across the DeFi ecosystem.

As a result Lido’s enjoyed a meteoric rise from nothing to over $2 billion over the course of six months, with major growth coming from both the Ethereum and the Terra universes.

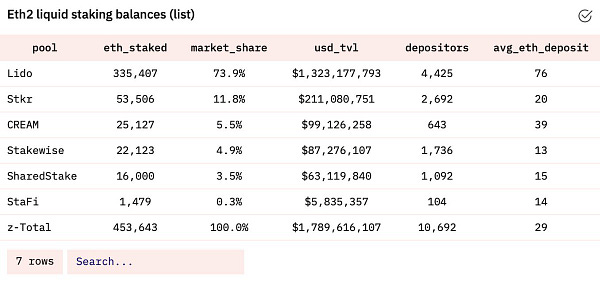

Yet these growth charts don’t tell the full story of how central $stETH and $LDO have become to ETH’s transition story. Many users cannot afford to stake the 32 ETH minimum, meaning they need to turn to staking pools. These staking pools combined serve over 10K depositors and account for about 10% of the total amount staked. Among this market, Lido is by far the most popular choice.

Of course, much of this growth ties directly to their partnership with Curve. 283K stETH in total sit in Curve’s stETH pool, worth nearly $1B. Remember that in total Lido has $2B locked.

Curve has three ETH denominated pools, and among them $stETH is by far the largest, with over $2.2B in volume locked. Part of this is surely the $LDO rewards, so fortunately for the Curve community the Lido team just refilled the rewards gauge for another month with an additional 3.75M $LDO.

A careful analysis of the Curve $stETH dynamics is not as straightforward as one might hope though. A thoughtful thread by @MonetSupply examines how $stETH is holding its peg against incentives and concludes Curve users may be taking up to a 50% haircut on this pool as opposed to holding stETH outright.

At any rate, and exposure to $LDO has been great for recipients. $LDO has been screaming this past month, up almost 5x.

This price movement is surely due to several complex factors. The primary utility of the $LDO token is governance, so it’s entirely possible users are simply hoarding $LDO in anticipation of a contentious vote on an important rebrand.

Another factor may be excitement from a recent funding round they raised at a price equivalent of about 25K ETH. Then again, that’s sort of just a rounding error for the multibillion dollar protocol.

At any rate, the Curve $stETH pool is seeing good action lately. It’s the largest ETH-denominated Curve pool, with over twice the volume locked of the popular $sETH pool. The Curve community recently approved an adjustment to the stETH pool’s ramp to further increase efficiency.

Additionally, the team at Enzyme Finance added the $stETH pool to their protocol, opening up interesting opportunities for the savvy.

ETH-heads are beyond eager for the transition to the next generation of the protocol. Thanks to the foresight and hard work of the team at Lido, the transition is shaping up to be liquid pleasure.

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. Author is a $CRV maximalist, and staked in both $stETH and $sETH pools.