Happy Birthday to $crvUSD!

Here are a dozen charts that tell the story of the stablecoin’s first year, sourced from a variety of great community dashboards that popped up:

1. Peg

$crvUSD prioritizes its peg above all else, occasionally whipsawing interest rates to bludgeon borrowers into repayment as needed. Here we see the peg has held extremely constant, suffering heaviest (barely half a cent) when BTC leverage demand went most wild during the short lived bull mania of March-April 2024.

2. Peg vs. Competition

The first chart doesn’t really do the peg justice, since it plots $crvUSD only relative to its own historical peg.

Benchmarking against the landscape shows how tight it has truly held relative to the field of stablecoins. To generate this chart, we had to knock out a half dozen stablecoins to narrow the window to +/- 5% and even then $crvUSD only becomes visible if you apply an animation.

3. Rates

The dynamic interest rate is the chief mechanism by which $crvUSD enforces its peg. For the first phase of $crvUSD’s existence, rates were modest, typically below 10%. In more recent months, around the time of Bitcoin ETF approval, demand for leveraged crypto trading went haywire, occasionally pushing rates above 50%

4. Supply

Had conditions been favorable, there was initially hope $crvUSD could hit $1 billion market cap. DeFi conditions being particularly putrid all around, this clearly didn’t happen, but the token market cap held steady around the $100MM range.

The optimist or technical analyst might look at the troughs — each boom/bust cycle appears to keep making higher lows… but not financial advice of course.

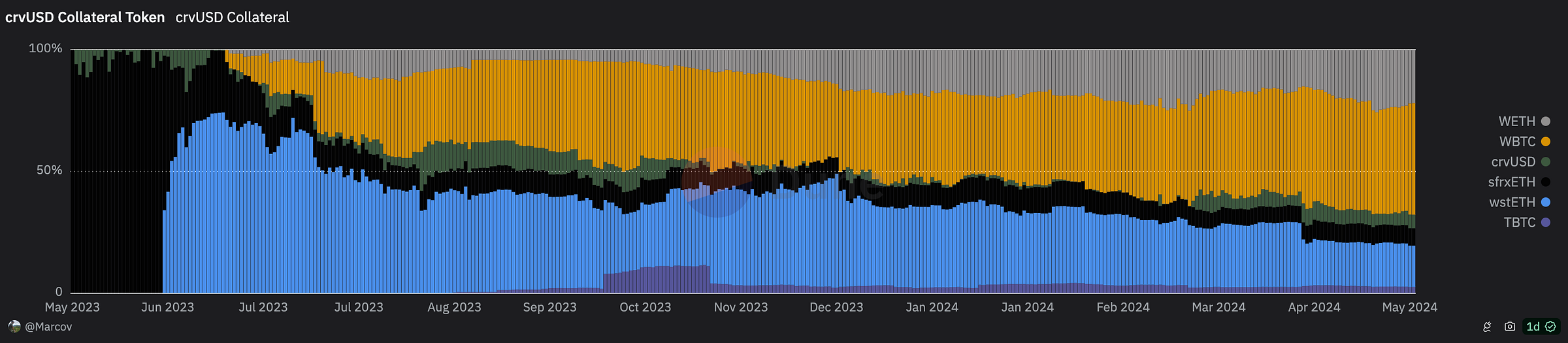

5. Demand

What is the use case for $crvUSD? Bitcoin leverage. The overall collateral backing $crvUSD shows the share of WBTC has grown steadily throughout since inception, currently about 45% of the entire backing.

6.Peg Keepers

One of the most crucial innovations in $crvUSD is the Peg Keepers, the only contracts authorized to mint $crvUSD other than taking out a loan.

When $crvUSD is above peg, the Peg Keepers take on debt, print new $crvUSD and trade it into their affiliated pools. As you can see from the above chart, the Peg Keepers were initially very active, but as $crvUSD got used to trade at max leverage they got relatively quiet until just recently.

7. Sidechains

Why is $crvUSD more stable? Liquidity sinks. Initially, $crvUSD had little use case other than trading it into another stablecoin, which caused the peg to suffer.

Curve had never really seen much utility for supporting sidechains, until they became a potent liquidity sink. Bridged $crvUSD is useful in that there is no minting or redemptions on sidechains, and bridging back to mainnet can be a hurdle.

Arbitrum in particular became a nice home for $crvUSD, becoming near permanent home for a good chunk of the total $crvUSD supply, particularly due to...

8. Llama Lend

The newest liquidity sink for $crvUSD is Llama Lend, the killer app for $crvUSD that may prove the ultimate liquidity sink.

Where $crvUSD needs to be backed only by pristine collateral, Llama Lend’s isolated risk silos can theoretically support nearly any collateral. We’ve seen exotic markets already launched using tokens like $UwU, $FXN and $pufETH. More to come?

9. Health

Users have shown themselves to be less likely to play with fire over time. Initially users were a lot more willing to put their health in danger, but more recently users have adopted safer position. The result has been that the $crvUSD has become slightly more collateralized over time.

10. Liquidations

The Chaos Labs dashboard tracks liquidations over time, although these have become far less frequent as users have shown more responsibility at managing their positions.

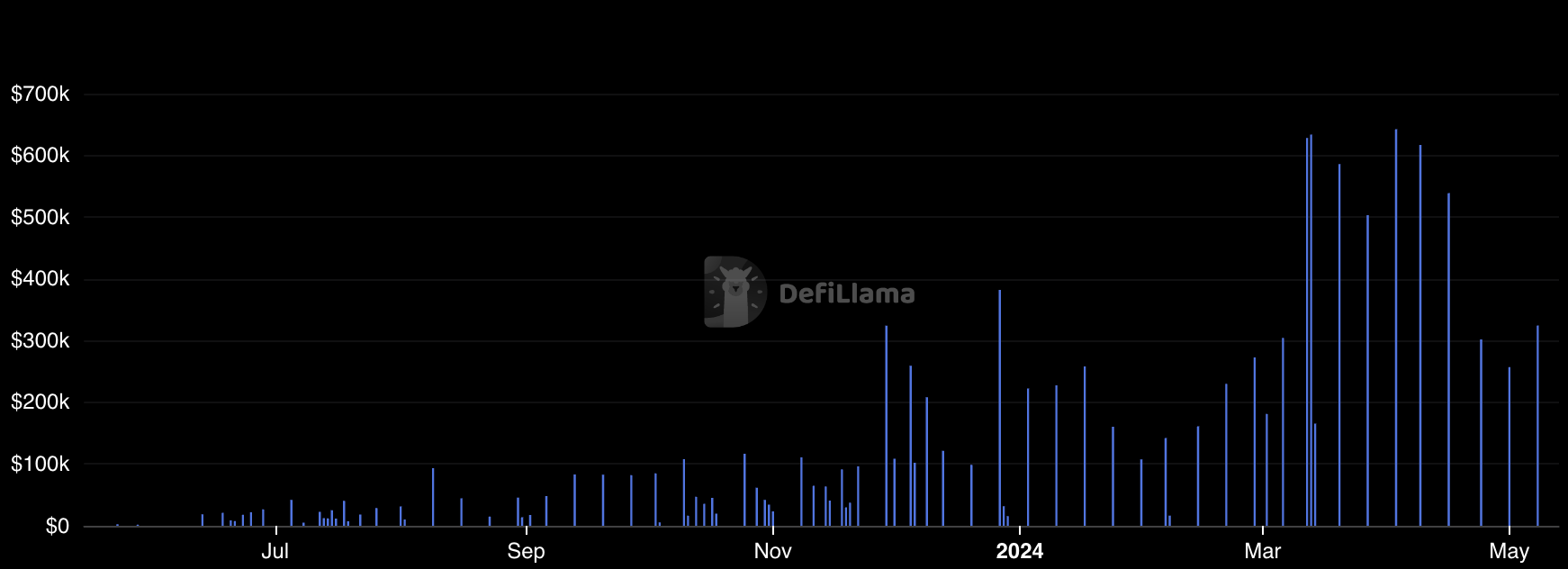

11. Fees

The stablecoin has only become better and better at printing money for Curve. Notable that $crvUSD not only held ~$150MM TVL at the peak of the speculative frenzy, but that it did so with users paying as high as 50% interest rates, leading to several weeks of lofty fees. Even as the frenzy has subsided, $crvUSD remains a cash cow.

12. Share of Revenue

In under a year, $crvUSD revenue (the dark blue bar) has flippened Curve’s traditional revenue from its classic DEX. In other words, $crvUSD has more than doubled Curve revenue. It’s hard to imagine a bigger success story for the DAO.