Maybe it’s just the sudden exodus of capital from DeFi talking, but some of the stablecoin farm yields are starting to look awfully tempting!

A dollar is a dollar is a dollar? Not quite. Some of these you should run away from, while some might be worth at least keeping on your radar.

With hostile regulators lurking around the corner, we reiterate our recommendation from yesterday: everybody stay away from stables until we see what the damage looks like.

Yet we know many of you are degens who can’t resist the siren call of yield. With that in mind, today we offer paying subscribers our notes on which stablecoins they should definitely run away from, and which might be worth more research.

Subscriptions also benefit PAC DAO crypto activism, which is about to become vital as regulators pounce. Non-subscribers are advised to stay out completely.

STEER CLEAR

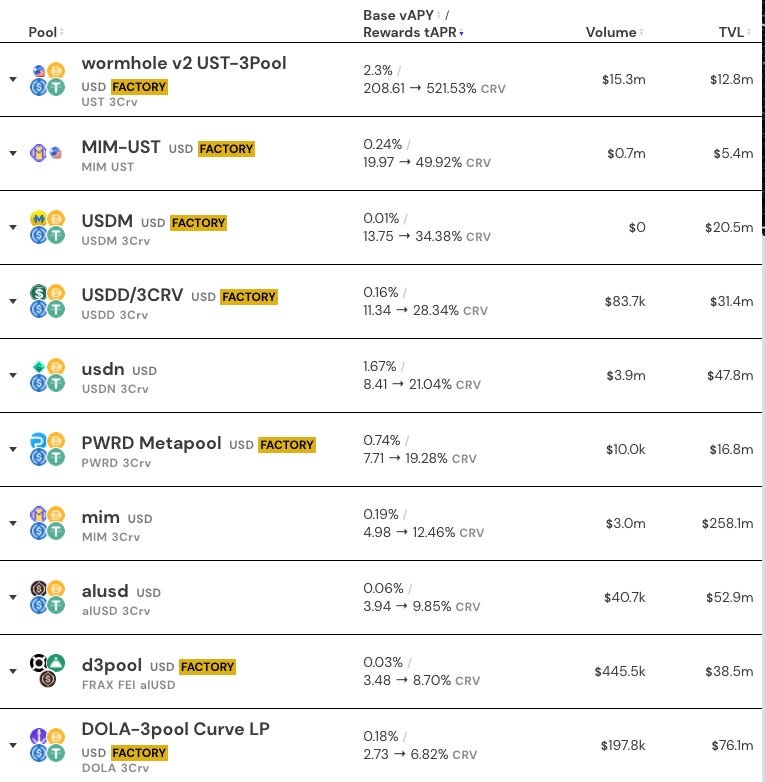

The screenshot above shows some tempting yields. Yet the following pools, presented in descending order of risk (worst to mildest), should nonetheless be avoided.

UST 521.53%

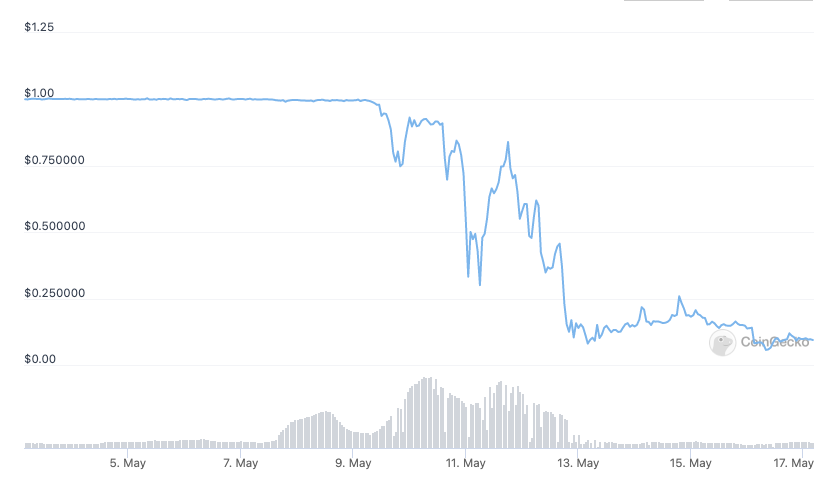

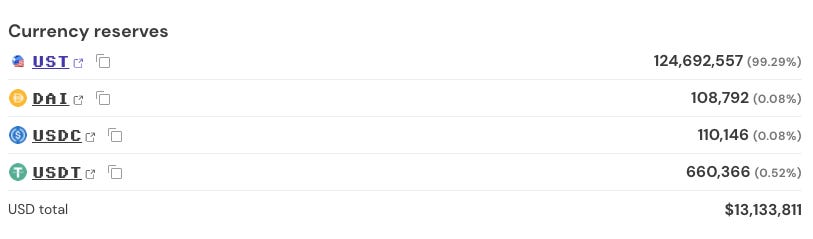

That tAPR is juicy, right? Don’t you dare chase it. For starters, the pool is a whopping 99.3% imbalanced, which provides you just $.10 on the dollar.

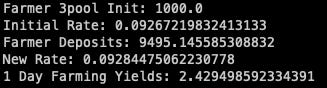

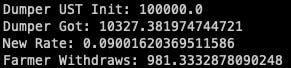

What happens if you put in $1,000 to try to farm these rewards? Nothing ventured, nothing gained, right? We put together a Brownie script you can use to simulate the yield.

Unboosted, our farmer deposits $1K and earns about 2.4 CRV per day. Not bad! Leave it there and soak up that sweet, sweet CRV.

First thing to note — this pool was receiving heavy Votium bribes to maintain its rewards. In the most recent round, Terra was notably absent. We can absolutely expect these bribes will disappear.

So you might pocket about $10 to $20 before your rewards simply disappear. So much for your get rich quick scheme.

One more thing to note is that this pool is also crazy imbalanced. There’s nearly 130MM UST tokens eager to drain less than 1MM in good liquidity.

Simply by depositing about $1K worth of 3pool LP tokens is enough to shift the pool balance. Due to the exchange rate of 1:10, you get 10K worth of LP tokens. Yet this small deposit is enough to shift the price of $UST by $.002 cents.

So it’s not a lot, but there’s hundreds of millions of tragically rekt UST bagholders stuck in the pool. They want nothing more than exit liquidity.

Let’s consider the effect if somebody decides to cut their losses after you jump in. We posit a user with $100K UST, now worth just about $10K. Imagine they decide to time their withdrawal to just after you hop into the pool.

They dump their $100K worth of UST and reclaim $10K. This shifts the price down to $0.09. Suddenly when you go to withdraw, you’re only getting back $981. You gained a few bucks worth of $CRV, but lost as much from price fluctuations. Not worth it!

Gamblers may be hoping their luck works the other way. Maybe for some reason a bunch of people flood into a pool that is shutting off rewards? That’s called the “Greater Fool” theory, and we don’t recommend it no matter how unfathomably bottomless human stupidity appears to be. Whenever you see unreasonably high tAPRs, don’t chase it.