May 19, 2021: Nuclear Winter ☢️🌨️

Breaking down DeFi's performance amidst its first major crypto breakdown

Crypto markets are undergoing what could only be described as a casual nuclear shellacking. While crypto has undergone massive dumps in the past and will also undergo massive dumps in the future, this selloff ranks as one of the most memorable crashes in crypto history.

Among other notable effects, this is the first real stress-testing of DeFi that we’ve ever seen. The most comparable recent crash would be early 2020, at which point DeFi was scarcely a glimmer in Egorov’s eye.

The increasing availability of decentralized leverage in crypto markets surely played a role in the rise of prices. This has been our first experience seeing how DeFi would fare as the bottom fell out.

In prior selloffs, the primary available options were exchanges like Coinbase and Binance. Everybody knows all too well that they collapse in any amount of volume.

As such, these dips are largely artificial unless you have a meaningful way to buy. Even Coinmarketcap and Coingecko were unreachable at the absolute nadir.

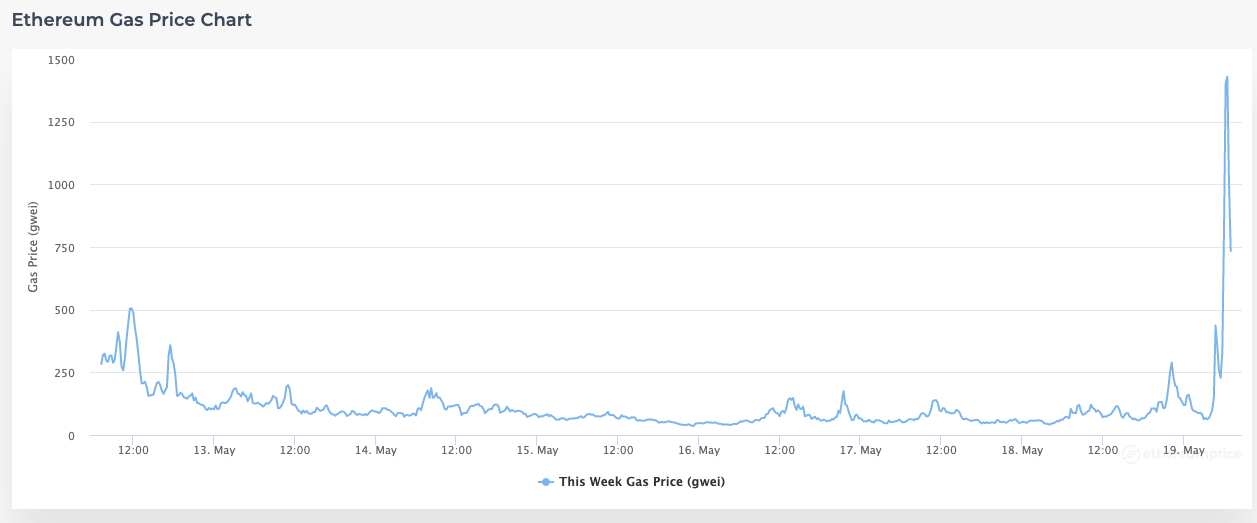

Unlike centralized services, DeFi was technically usable throughout the frenzy. However, gas quickly surged to such high prices as to render it practically unusable in most cases.

This meant that buying the dip remained difficult or functionally impossible, just as it was before DeFi.

Many traders weren’t even trying to sell off, but merely wanted to escape over-leveraged positions. During a slower market drawdown presumably traders would casually exit as their liquidation prices drew near. In this case, the market plummeted to months-long lows in a matter of hours, triggering massive liquidations with no opportunity to escape.

For one example, consider Unit Protocol. During the runup it became very popular as users lent out various assets to acquire USDP. This USDP could be used across DeFi, such as staking into Curve to earn heavy rewards.

USDP’s value prop presumes prices don’t fall by, say, 20% at a time. A sudden 50% drawdown from all time high caught users offguard. With gas prices out of control, users couldn’t cover their positions even if they had the funds available to do so. Per DefiLlama’s stats, TVL reduced from $600MM to $400MM in hours.

This meant buying opportunities, in what may well have been the largest amount of collateral up for liquidation in the history of the protocol. At peak their liquidations page was filled as far as you could scroll.

The deals were insane. Curve at $1.34 is practically an arbitrage play, locking it could earn that back in relatively short order. It got snapped up pretty quickly.

The buying opportunities were mostly short lived. The liquidation mechanics of Unit Protocol are to decrease the price by ~.1% per block, so the above bargains only lasted a few minutes before they got vultured up, anecdotally seeming to survive about ~300 blocks at the worst of it.

These may seem like bargains, but buying amidst the maelstrom was pricey. You would need to make a series of on-chain transactions at a time when gas was spiking above 2000 gwei. These buyouts look to have cost between 0.05 to 0.15 ETH in fees, padding the cost of any potential discounts by several hundred dollars. Presuming you also needed to withdraw your USDP from a vault first, this could well mean you spent $500 in gas to buy up any of these opportunities.

Presumably, the only viable way most people could cover margin calls was to pull money out of DeFi. The total volume locked across all protocols contracted nearly 25% over the past 24 hours, on par with the max drawdown in BTC and ETH prices.

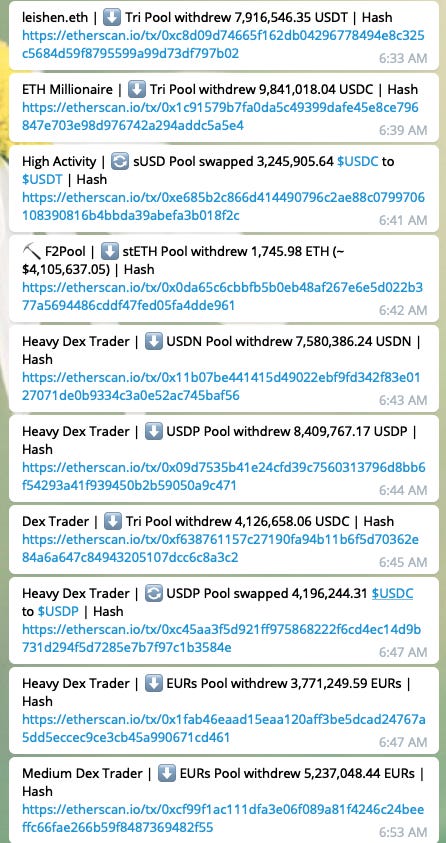

Even throughout this selloff though, Curve pools kept earning money. Despite brief fluctuations, stablecoins held their pegs. Curve proved to be among the few protocols one could harness to move around funds during the selloff. Sure enough, we observed massive withdrawals during the incident.

Heavy movements on Curve redound to the benefit of anybody who was stuck in the pool. Curve is a great place to park your money and collect fees as the rest of the world panics. Should crypto prices entered into a several year bear market, one would assume a move to dollar tokens with Curve yield is a popular place to ride it out. One may expect to see DeFi summer amidst a crypto winter.

We’re already looking at $500MM daily volume from the drop, and possibly even more activity will trickle through if gas prices ever calm down to reasonable rates.

Whatever the future may hodl, we at least now know how DeFi will react to major market crashes. If it’s anything like this case, DeFi offered crypto traders a few more options for liquidity than traditional exchanges. Yet in this case it resembled the crash of the Titanic, where only the richest and best connected could actually access the lifeboats.

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. Author is a $CRV maximalist though his net worth is about half of what it used to be.