Yet again, another crazy weekend in crypto.

And as much as we’d enjoy spending Monday’s entire newsletter mocking the sad-sack finance exploits, there’s been even more craziness surrounding Curve:

The Based Pool

Sidechain Boosties

Curve Wars Truce

Magic CRV

The Based Pool

Last month the announcement of 4pool was seen as an explicit attack against MakerDAO’s Dai. This more or less forced MakerDAO to issue a response.

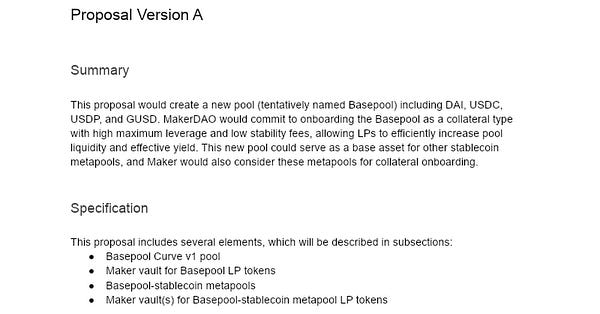

On Friday, the protocol indeed issued an epic reply, in the form of a detailed proposal for a competing “Basepool.”

The trial balloon explicitly A/B tested two possible implementations. The underlying mechanics are similar in both, but plan A involves a lower admin fee and no incentives, while plan B would pursue whitelisting and compete for incentives.

At the core of both implementations would be a 4pool containing relatively low risk stablecoins, including Dai, USDC, Paxos’s USDP, and either Gemini GUSD or Binance BUSD. The pool is tentatively called “basepool,” but we all know what the final name should be if there’s any justice left in this empty universe.

Notably, selecting four low-risk stablecoins compatible with Maker’s protocol would allow users to play on MakerDAO with up to 50x leverage.

Version A of the plan would keep Maker out of the Curve Wars. In this universe, the pool’s admin fees would be cut to 20% to incentivize LPs to provide deep liquidity. The low fees would make it an ultra-efficient pool for trading among like kind assets, while also serving as an attractive base pair for protocols.

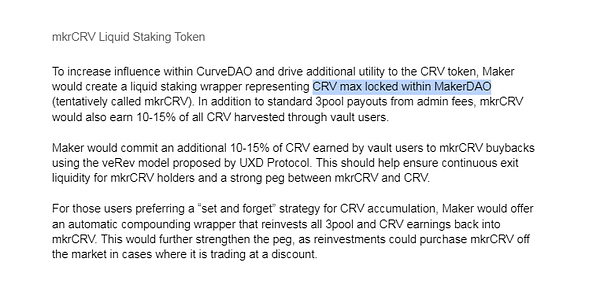

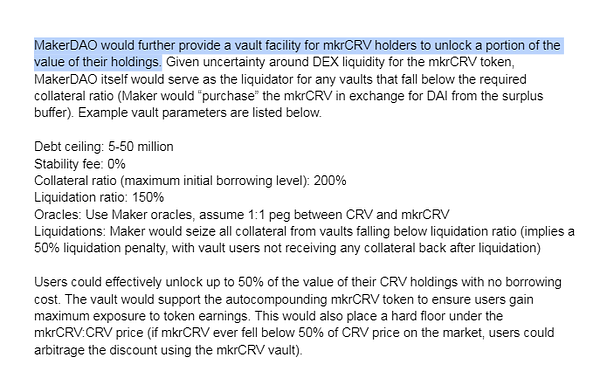

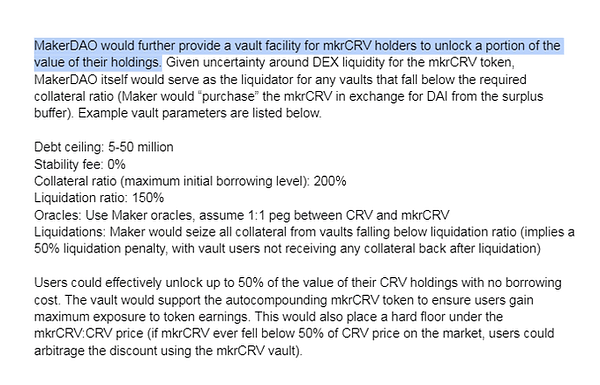

Version B of the plan would push Maker directly into the Curve Wars. They would request whitelist permissions and launch mkrCRV. This would include the whole package of CRV locking, autocompounding vaults, and loads of interesting tokenomics worth digging into.

Ultimately, the direction Maker takes is likely to be at the mercy of Curve governance. The thought of aligning MakerDAO incentives with Curve is turning heads.

The Curve whitelist has been its scarcest asset for some time. Achieving whitelist status has traditionally been difficult even for protocols with long-term participation with Curve.

Compounding the difficulty, existing whitelist holders have a significant stake in governance. Steering a Curve whitelist through the process could hinge on persuading a small number of influencers that MakerDAO could be entrusted with such power.

Unsurprisingly, with Based Pool threatening the FRAX 4pool, rival Sam Kazemian’s initial reply was to draw attention to Maker’s prior harsh words against Curve.

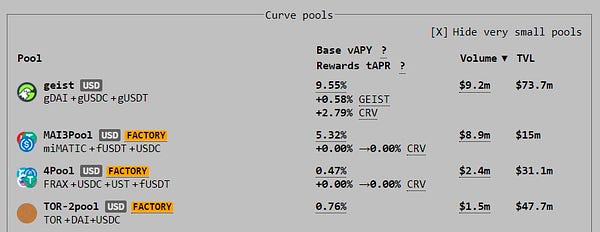

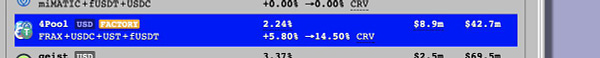

For FRAX’s sake, the groundwork for 4pool is continuing apace. The 4pool is now live on Arbitrum ($51MM TVL) and Fantom ($52MM TVL).

Fantom also saw plenty of its own drama this past weekend, but the chain remains alive and kicking. It’s a great time to launch 4pool on sidechains, given that sidechains just levelled up in importance around the Curve ecosystem.

Cross Chain Boosties

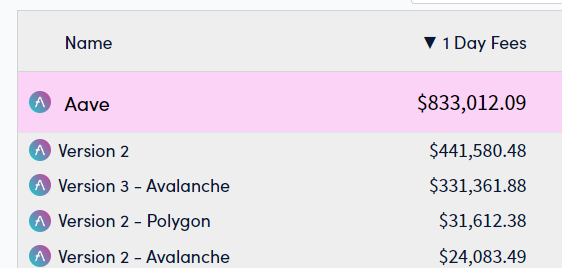

Overall DeFi activity is approaching 50% of volume on chains outside Ethereum mainnet.

Arguably, Curve is underrepresented on sidechains even though it has taken pains to launch on ten chains to date. Of Curve’s $18.9B TVL, the vast majority is on Ethereum: $16.5B (87.7%). Curve with such a small footprint on sidechains means opportunity for growth here. Other protocols have proven sidechain activity can be significant.

The launch of cross-chain boosties is therefore a big deal.

Procedurally, this affects 16 pools on sidechains as outlined in the announcement thread. By the 12th of May these gauges will start to go live.

Curve Wars Truce

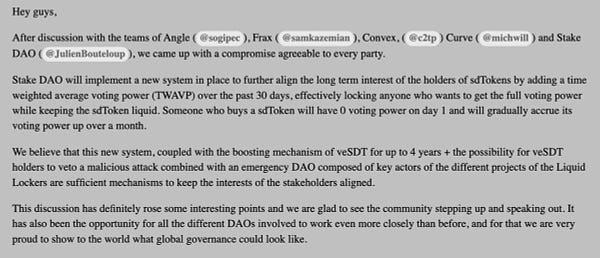

With so much bloodshed in the Curve Wars, we’re pleased to report on an outbreak of peace. Following last week’s heated discussions on a Stake DAO liquid CRV token, five protocols have arrived at a compromise.

The answer, as with all things Curve, is applied mathematics. Rather than being able to purchase instant voting power (which raised concerns about governance attacks), sdCRV will have voting power averaged over the prior month.

With so many stakeholders in favor of the plan, it appears more likely to pass governance. Great work from the collaborative Curve community.

Although if this is a truce of sorts, it may be quiet on only one front of the Curve Wars. Curve Wars remain intense on other fronts.

Magic CRV

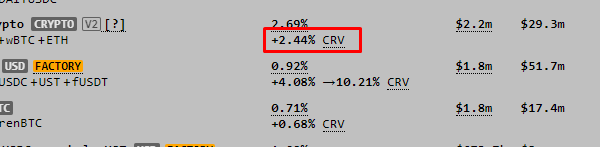

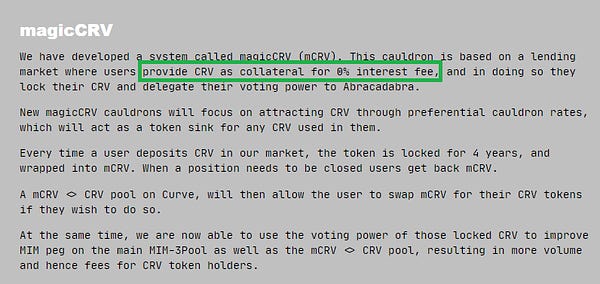

To top off the madcap activity, we also saw Abracadabra also fishing for a whitelist.

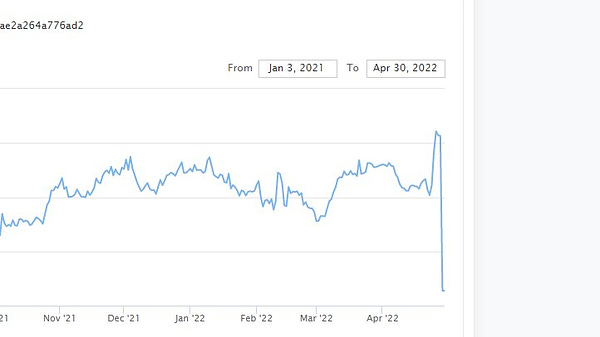

Abracadabra has had a rough few months, with its $SPELL token plummeting against Ethereum.

Despite its troubles, the protocol is still around and fighting hard. The Curve $MIM pool remains a key piece of its empire. The pool contains nearly $1B in TVL, making it a top 5 Curve pool on mainnet. It’s also about 86% imbalanced, so keeping the pool incentivized and healthy is key to Abracadabra’s survival. Hence the launch announcement of magicCRV focuses extensively on the strategic value of maintaining the $MIM peg.

Their magicCRV is a substantial proposal. In fact, to subsidize the launch of magicCRV, Abracadabra bought a significant amount of Curve off the market.

We know whitelist votes are often contentious though, so we wouldn’t dare speculate this early as to the ultimate resolution.

However, between MakerDAO and Abracadabra, the thought of two new whitelisted sources of $CRV has plenty of observers salivating at the potential effect of increased locks.

Also, at the potential impact on overall supply.