Curve has launched on X Layer, marking its fifteenth chain supported in the Curve UI. (NOTE: DefiLlama lists 16, but Harmony has fallen out)

We’ll confess, we didn’t know much about X Layer.

But we researched it so you don’t have to!

Here are X (aka 10 if we have any readers who aren’t ancient Romans) things you need to know to get you up to speed on X Layer.

Ɪ: X LAYER IS NEW

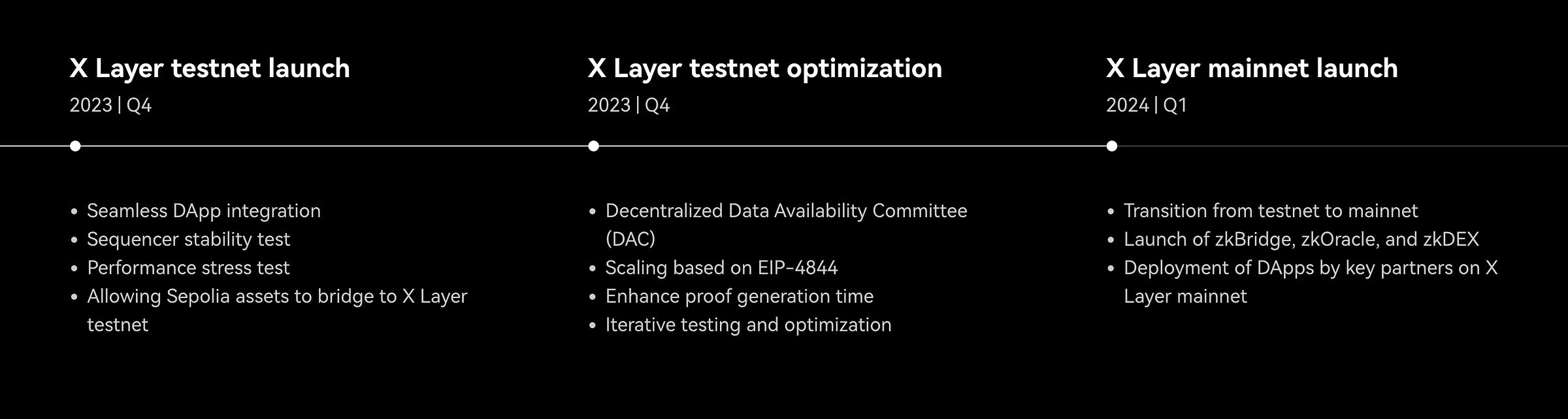

X Layer was scheduled to launch in Q1 2024 according to their website, or as late as April 15 according to 𝕏. It followed a two month testnet period that saw 3MM transactions that drove 26MM in testnet volume.

The live deployment has already notched 2.4MM transactions according to their block explorer, so we may see a flippening soon. Hundreds of dApps participated in the testnet and are planning to launch soon, if they haven’t already.

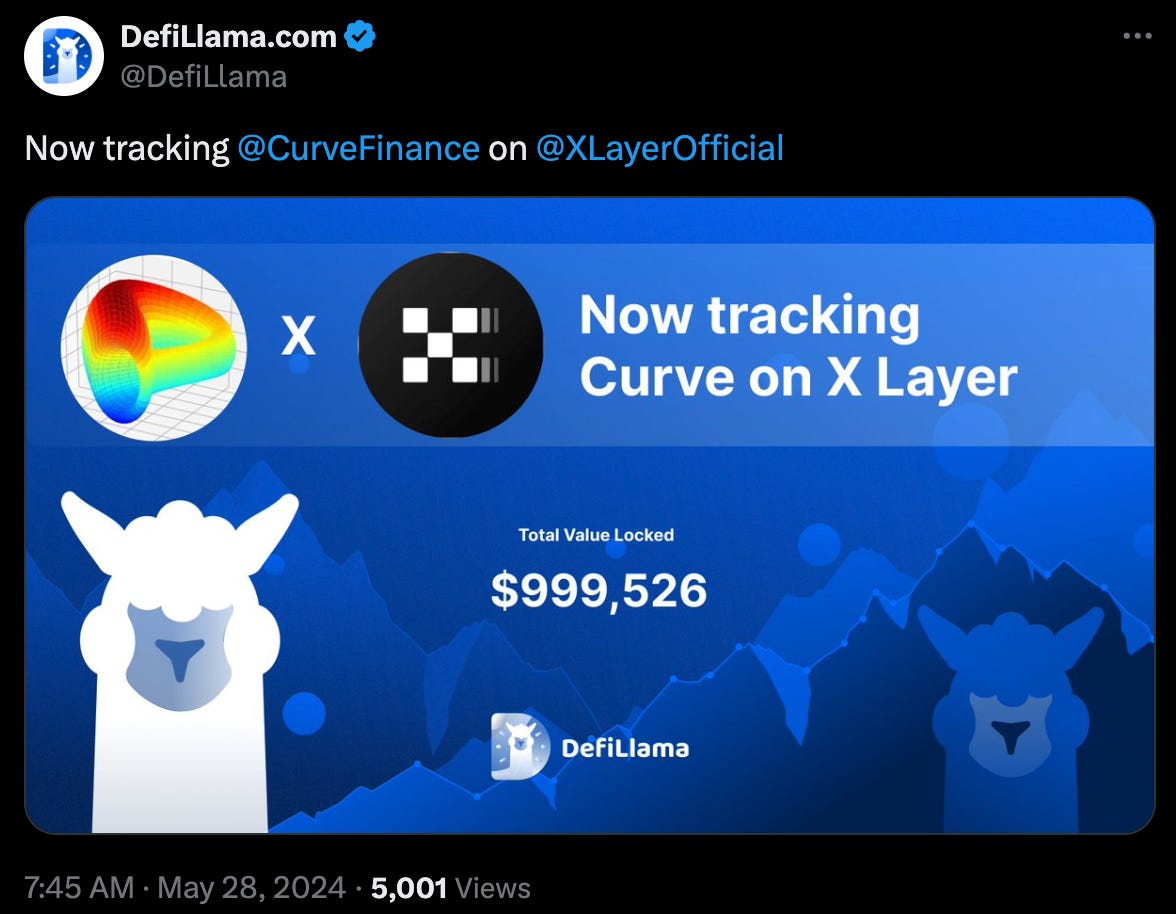

ꞮꞮ: CURVE’S $1MM MAKES IT A RELATIVELY BIG FISH

At first blush, we thought $1MM wasn’t much to blush about…

But contextualized, DefiLlama is currently tracking just $7.54MM on the new chain, making Curve’s deployment relatively large.

ꞮꞮꞮ: CURVE’S X LAYER DEPLOYMENT HAS ALREADY FLIPPENED THE TVL OF THREE OTHER CHAINS

We’ve long noted that Curve’s deployments to so many L2s was almost counterproductive for the DEX, as it never drove a ton of revenue for veCRV holders.

The $1MM TVL Curve has landed so far has already flippened three other chains. Side note… a bit surprising to see Curve has only $3MM TVL on the thriving Base ecosystem.

Ɪ𝐕: MORE DAPPS COMING SOON

Of the 200+ ecosystem partners listed, a variety of heavy hitters appear to be on the way. Forthcoming deployments by Chainlink, as well as ETH staking and restaking protocols, indicate X Layer is attracting major players.

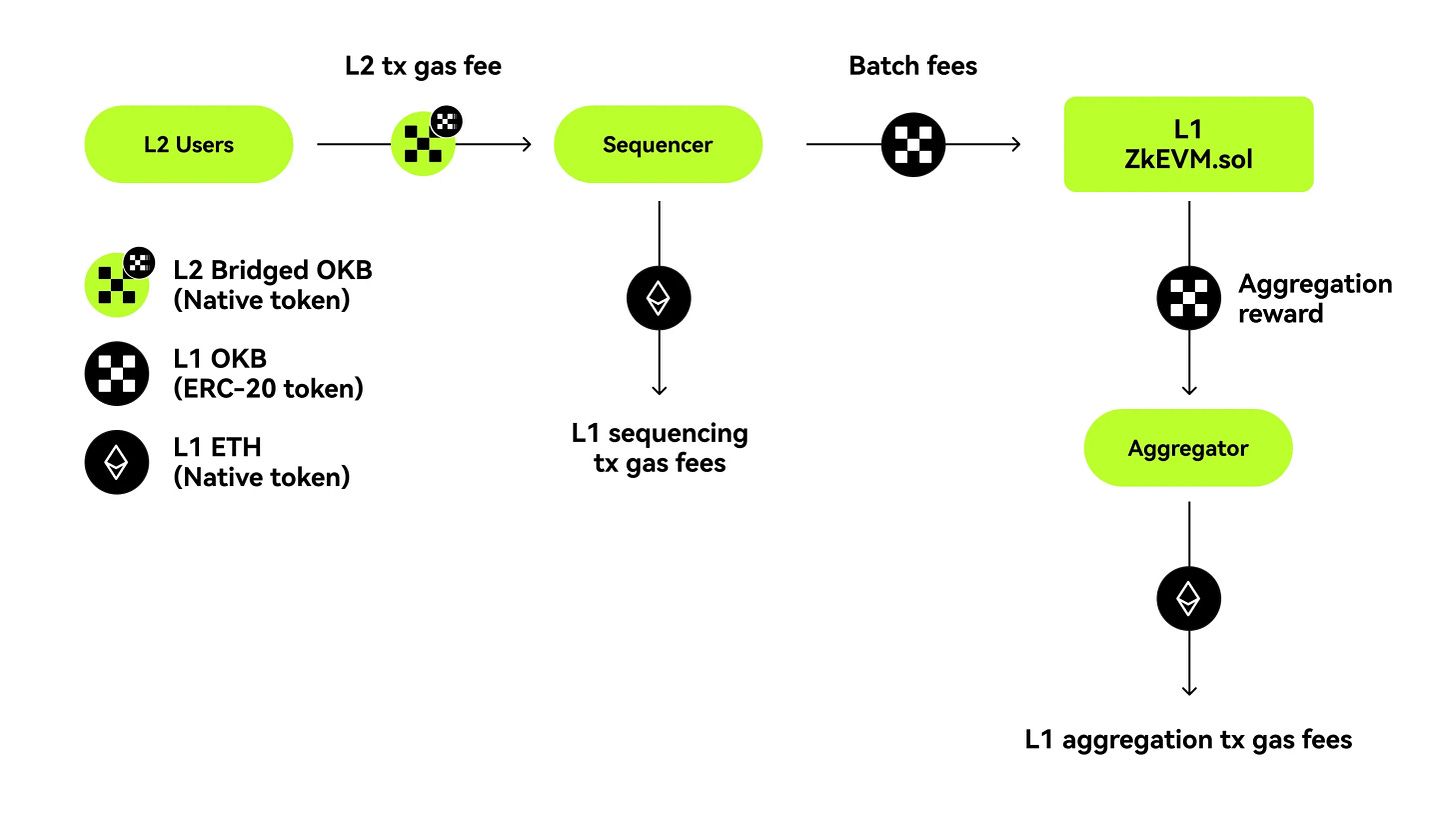

𝐕: POWERED BY $OKB

The chain is powered by the OKB token, which already has a variety of utility for users of the OKX Centralized Exchange.

The token is 48th largest on CoinGecko, and is a deflationary token as the CEX uses trading fees to burn the token.

𝐕Ɪ: PARTNERED WITH POLYGON

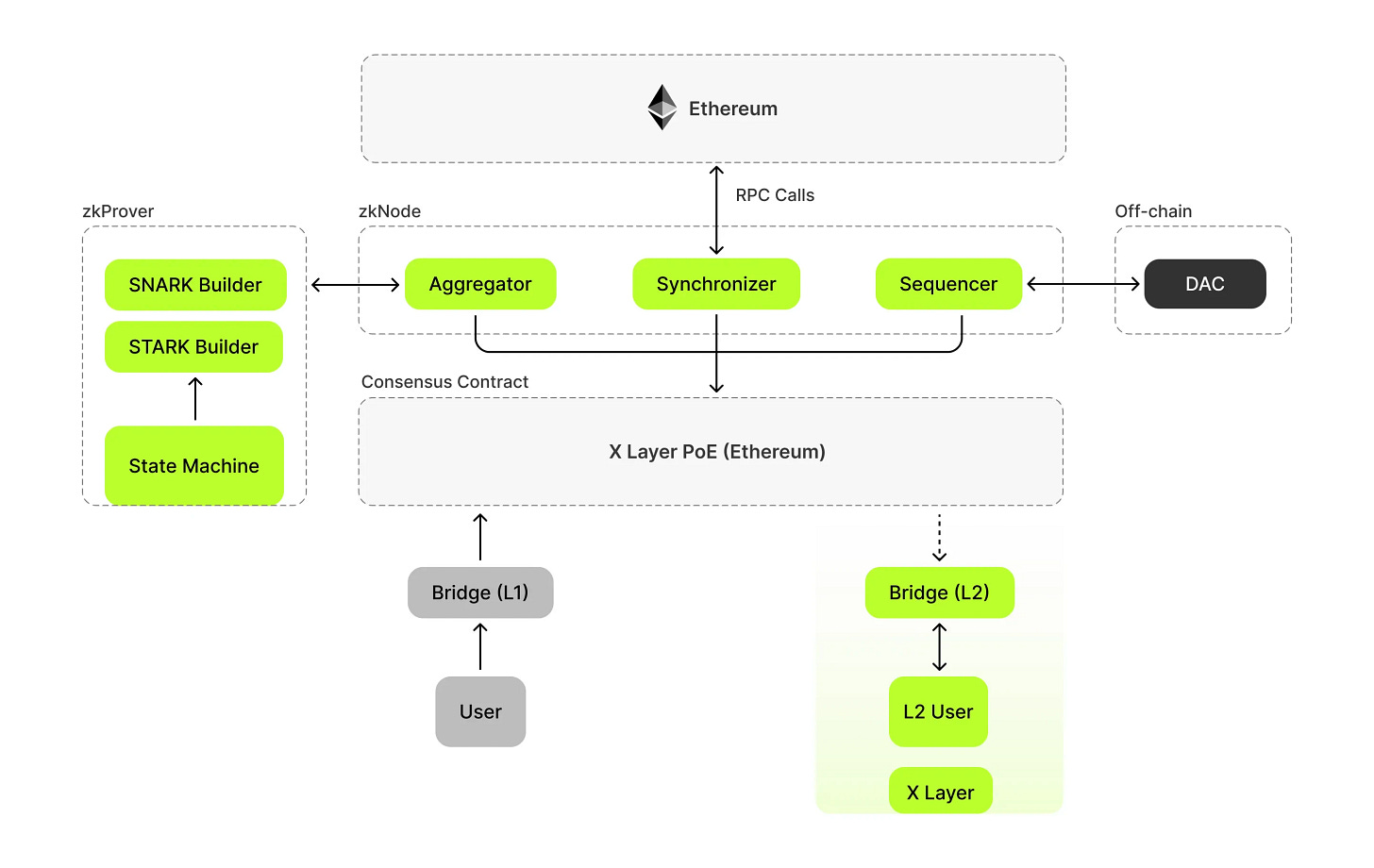

Being built in conjunction with Polygon’s AggLayer means that X Layer will play nicely not just with Ethereum mainnet, but also Polygon and any L2s built with Polygon’s CDK.

𝐕ꞮꞮ: X LAYER IS A ZKEVM

The zkEVM narrative was very big in 2023, though it’s seemed to cool off of late. Here is our article from March of last year on the several Zero Knowledge L2s rushing to market:

March 28, 2023: It's Okay to ZK ⛓️🚀

Admit it, how many of you saw this and had flashbacks to “🤜 Monday 🤛”

𝐕ꞮꞮꞮ: X LAYER OPTS FOR VALIDIUM

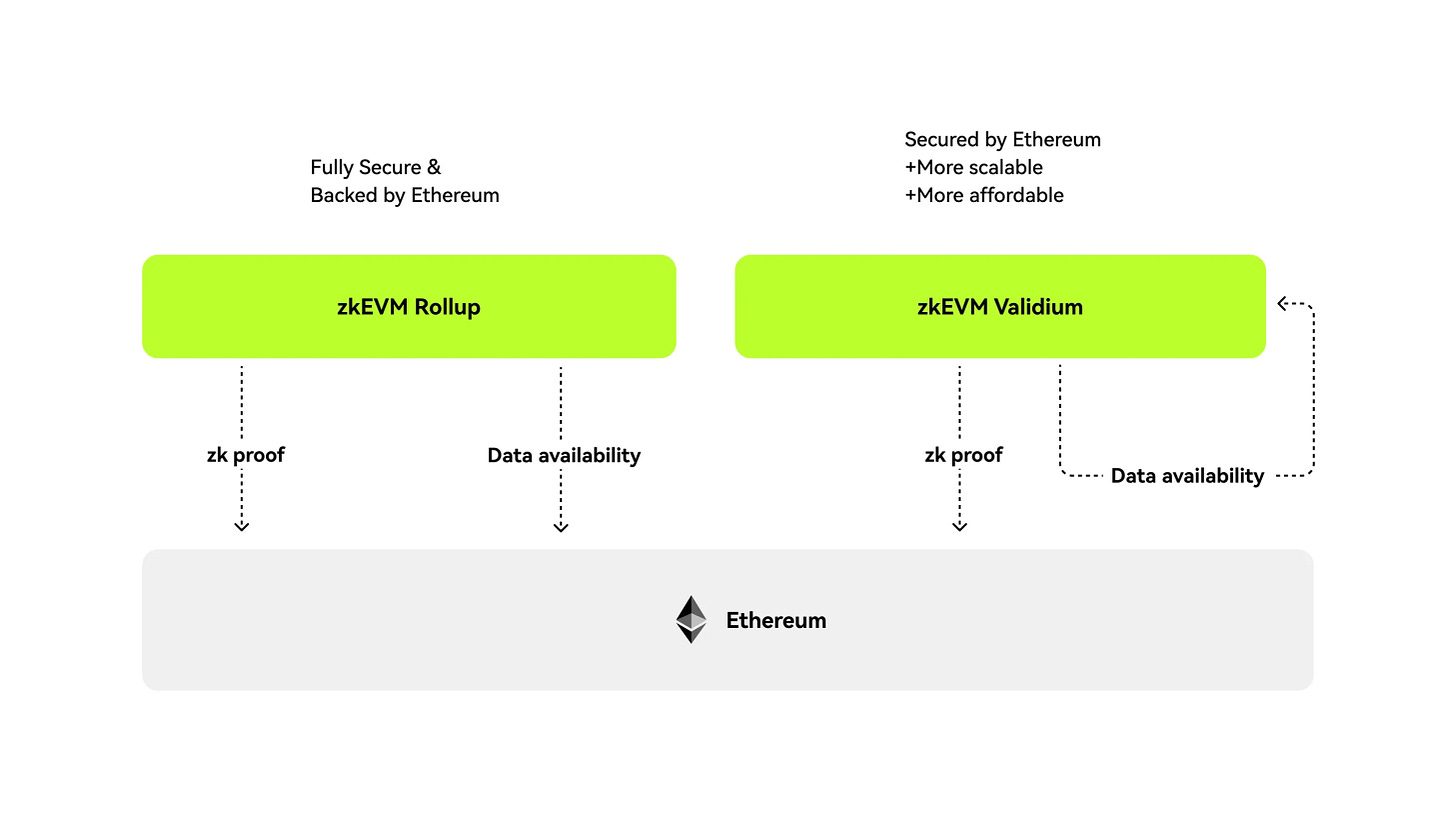

In their architecture, X Layer opted to use Validium instead of Rollups.

Rollups would write the full transaction data to mainnet, providing full data availability to mainnet. Validium only writes the proof that the transaction is valid, sacrificing full data availability but potentially allowing for lower transaction fees as the chain scales.

𝐈𝐗: SEQUENCER INCENTIVES

There’s a lot of money in L2s. If you want to run software to secure the network and profit from potential growth, sequencers are required to lock a specific number of OKB tokens in the layer 1 ZkEVM.sol contract. The number of tokens locked per batch is determined by the variable batchFee.

More details in their documentation, or since it’s the same as Polygon zkEVM’s mechanisms you can consult their resources.

𝐗: COULD BE BIG

From our vantage point, the most bullish part of the new L2 is the tie-ins with the OKX exchange. The CEX is fourth largest in the world, behind Binance, UpBit and ByBit.

We’ve seen in the past that chains launched by Centralized Exchanges can become quite big, being able to tap into their native users. Binance’s BSC and Coinbase’s Base are both top ten by TVL. OKX has 50MM users with billions of assets

Disclaimers! Author has no stake in X Layer and has never used OKX