If you’re around today, worth checking out this Paladin event starting in a few hours. They’ve been teasing PAL v2 for a bit, maybe this could be some alfa?

DeFi Money

Over the past week, defi.money has been making some noise. Their launch thread…

Disclaimer: If you catch the fine print, you might note author is among the seed investors here.

Don’t FOMO though, all the projects he invests in do well until they get hacked.

Except this time, as an authorized LLAMMA fork, defi.money will be using some Vyper, so maybe they’ve got some demonstrable coding bona fides? Who’s building the Vyper index fund to invest in projects built using Vyper, and where can we throw money at it??

But we digress…

Defi Money is a licensed refactor of $crvUSD, but plans to support more collateral and be more natively cross-chain.

So let’s start with the critics. Why not build it in-house? Opponents of Curve bemoan the fact that too many players build atop Curve, and the resultant “flywheel” is too complex and value extractive at each step.

Curve sees it differently though…

One investor raised the analogy of $MIM with Bento/Degen Box…

The longer tail of memecoins will surely find their way into gatekept lending markets eventually, and LLAMMA may be the secret to unlocking these markets.

Mich does explicitly see soft liquidations as a feature users are willing to pay for.

LLAMMA has been in the market for a year, and users like it. As an open source protocol, it could have been copied by ambitious protocols, time’s up for them to reverse engineer it and grab this free lunch for themselves.

Yes, $crvUSD is of course a shade more complex than the run of the mill protocol. Far quicker to copy, and let the proceeds flow towards veCRV holders.

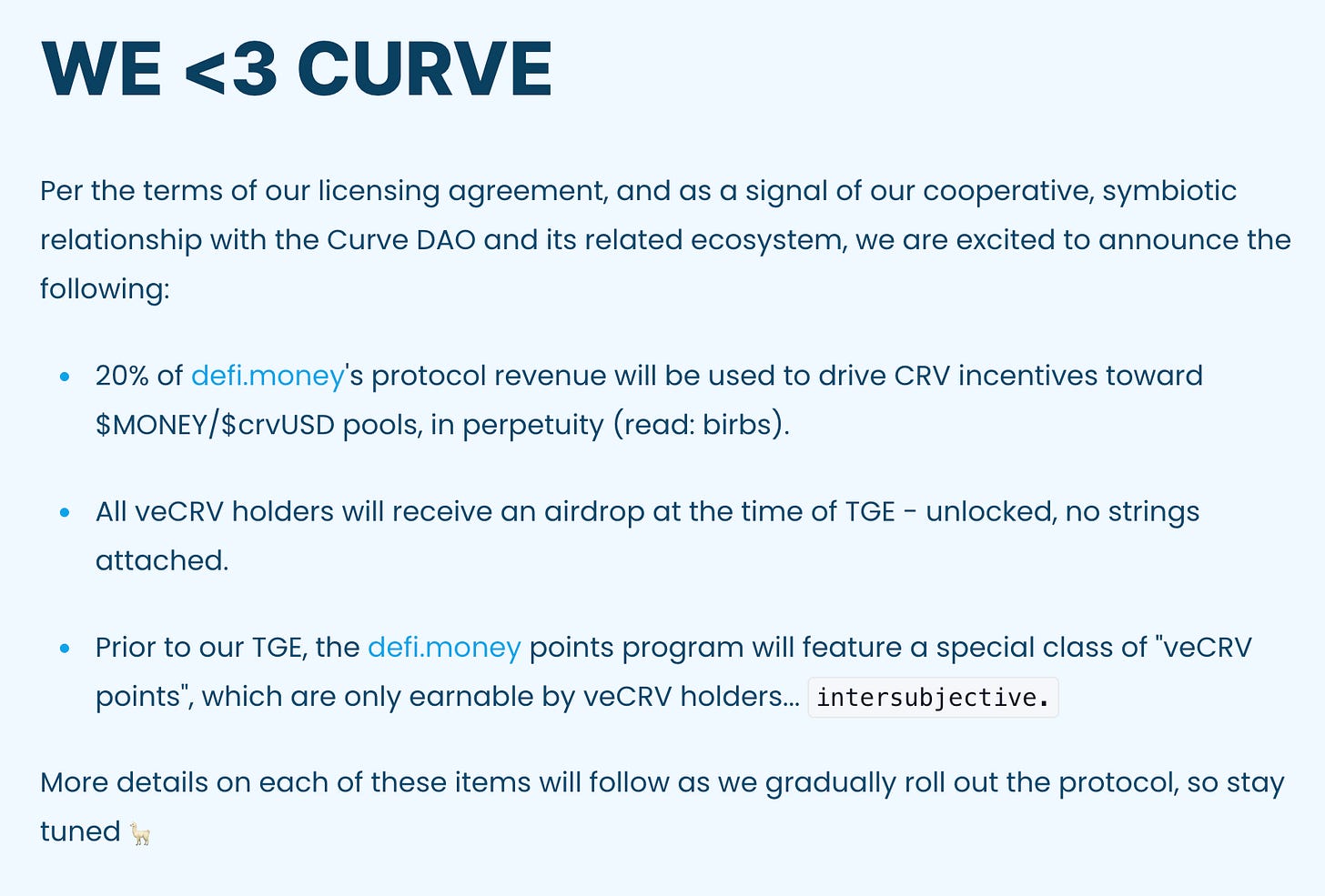

So the more recent announcement on particulars of how DeFi Money would be engaging with the Curve ecosystem drew a lot of attention.

Specifically…

How I Learned to Stop Worrying and <3 veCRV

The value of all of this is yet to be determined, but there is undeniably fringe benefits in being a veCRV holder — or by extension $CRV wrappers in the event they pass this on.

May 2, 2024: Wrapper's Paradise 🎁📄

We’re doing everything we can to promote this good writeup by the legendary Pilot Vietnam, comparing Curve wrappers: They all earn rewards in a bit diff ways and have tradeoffs. For example, locking veCRV directly on Curve you know you'll exit 1:1 but of course you're not liquid. You can also earn around 35% right now, including bribes. those bribes have…

It got us ruminating on veCRV while contributing to a short blurb on $CRV for yesterday’s Leviathan newsletter

After years preferring $CRV wrappers, are we coming around to veCRV maximalism?