Even though we know better, we stubbornly hold out hope that most of you are socially functional, well-adjusted human beings who spend your weekends with family and friends.

If so, you may have completely missed the bulk of the attack on $UST.

Money Fight

Over the weekend, the UST-3Pool abruptly suffered several waves of attack.

Pulling the peg to $0.99 may hardly sound dramatic. The spectacle came from the raw volume of capital deployed to fight this war of inches. This penny off sale would come at the cost of billions of dollars on an otherwise sleepy weekend.

Some people may prefer the TardFi paradigm where money is illiquid on weekends. Today, DeFi permits multi-billion dollar skirmishes while banks are closed.

For a period, this would stress available supply.

The first wave hit as much of East Asia was asleep. The Terra community quickly sprang to action.

Jump Crypto team moved quickly to initially restore the peg.

However the onslaught would prove it was not just a quick blip, but a sustained siege. The entire weekend, and even up to publication time, this back-and-forth has continued.

Even as we hit publish, the dance continues. The peg erodes, the peg restores. Rinse. Repeat. In all, the peg held above $0.99 almost entirely throughout, but at a cost of billions of dollarcoins.

The peg holding is thanks heavily to the mechanics of Curve’s Stableswap Invariant. This bespoke formula is able to keep the peg even though the pool itself has grown imbalanced, ranging between 60% to 70% UST since the chaos erupted.

Tokenomics

The sudden skirmish revives debate on $UST’s tokenomics.

Famously, Terra has been buying up BTC to help defend the peg.

The choice of notoriously volatile Bitcoin as a backing has prompted some debate. Bitcoin has been relatively stable compared with other assets amidst the broader bloodbath in the markets, but still fallen steadily for weeks. When the entire market is in freefall, there’s almost nowhere safe to turn (although the dollar has been curiously strong throughout the mess).

Terra’s cache of Bitcoin initially appeared to skate through the events intact.

A day later, the LFG Council would subsequently vote to lend $750MM worth of BTC, with another $750MM $UST earmarked to rebuy BTC.

For his part, Do would have a field day with 💩-posting throughout the theatrics.

Occasionally taking a short break to reflect on the nature of parenting.

Do’s army of $LUNA-tics stayed loyal and fought hard to hold the peg.

Indeed, it’s not even the worst depeg threat in $UST history. $UST occasionally goes through massive trials, but to date has always held its peg.

Yet several other dollarcoins don’t ever suffer such frequent incidents. If you like your stablecoins stable, you may consider other alternatives with less yield and correspondingly fewer headaches.

Spillover

The entire event had spillover effects across DeFi, most notably on $MIM is historically intertwined with $UST.

At the onset of the skirmish, the Curve UST/MIM pool would almost instantly flip its imbalance, from 80-20 MIM/UST to the opposite.

Throughout the incident, rates for $UST also went crazy on AAVE, though it has since settled down to low double digits.

Even MakerDAO has taken notice of the effect of weekend turbulence on DAI.

Whodunit

Even as the war rages, the identities of the assailant remains unclear (drop a note in comments if you’ve seen otherwise). Most commenters seem to agree the attack appears to be coordinated, not an organic panic.

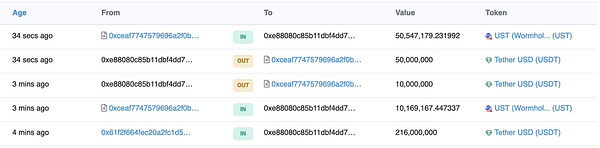

Courtesy the nature of blockchains, all the addresses involved are traceable.

In some cases, the trail led right back to the source.

Alameda for their part have denied involvement.

At least one participant in the skirmish eagerly doxxed himself.

Given that a million dollar $UST buy is a drop in the bucket in the billion dollar battle, His Excellency must have one heckuva “secret plan.”

Another known actor capitalizing on the chaos appeared to be moving to keep his funds safu.

Where to Follow

As of publication, the activity looks to be continuing. If you want to follow along in realtime, there’s a handful of sources we’d recommend.

We posted a few charts throughout this article. These were generated manually using a combination of Brownie, Alchemy, and Jupyter Labs at a resolution of 10 blocks. An upcoming Brownie tutorial will teach you how to run these yourselves if you are curious.

If you are impatient, or for some reason reluctant to code in a new financial system that greatly rewards this skill, then we’ll point you to a few great web resources.

The wonderful Llama Airforce has added a tab to follow Curve pool peg history:

Additionally, a Dune Analytics dashboard has been set up to keep an eye on the events:

How to Profit

Not financial advice as always, but how can you (as a shrimp) profit from this?

If you suspect $UST will repeg, you can use the Curve pools to buy up cheap UST whenever the peg drops, and then sell it off for market value when the pool repegs. This tx, for instance, could earn a cool million for the low upfront price of $50MM.

In truth, betting one direction or the other as a shrimp can be tough. Depegs by just a penny can require a boatload of capital to offset gas fees. Life is always better for whales.

Arguably, the easiest way for shrimp to benefit is simply holding $CRV (or related flywheel assets). Throughout the misadventures, Curve enjoyed a $2.7 billion dollar day in trading, the fees from which get distributed to all holders of veCRV.

Curve pools are proving instrumental to bootstrapping liquidity at the scale that big players require. Flywheelers can profit not just off of trading fees, but via the bribes spent to keep these pools liquid.

It’s perhaps for this reason that the $CRV token has held up relatively strongly amidst a sea of red ink.

Disclaimers! Friday’s interview with Curve Core Dev Charlie is now unlocked for all.