Nearly every major religion has warning or prohibitions against usury, or excessive interest rates. The severity and definition of the transgression is a matter of debate among religious scholars, but condemnation of the practice is universally etched into the tenets of nearly every religious doctrine.

In Islam, al-riba (الربٰوة) is sufficiently forbidden as to give rise to a $2 trillion dollar halal banking industry. Dante transliterated usurers into the seventh circle of hell. Jesus himself famously grabbed a whip and cast the moneylenders out of the temple.

So humans can’t agree on much, except there’s widespread agreement that excessive interest is to be avoided.

Except onchain, where computer code cares nothing for moral outrage…

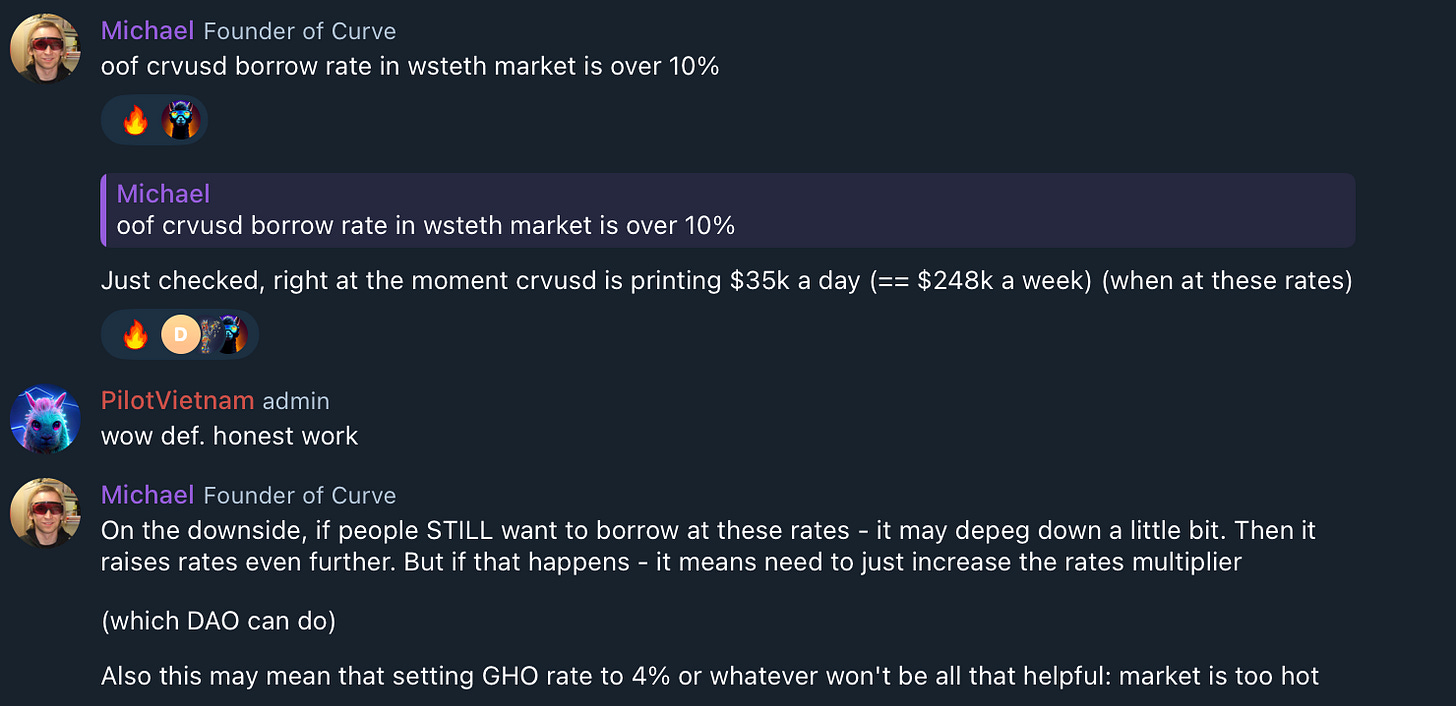

Over the past week, the rate to borrow $crvUSD against $wstETH has peaked above 10%, approaching the highest ever, a rate that many may classify as “excessive.”

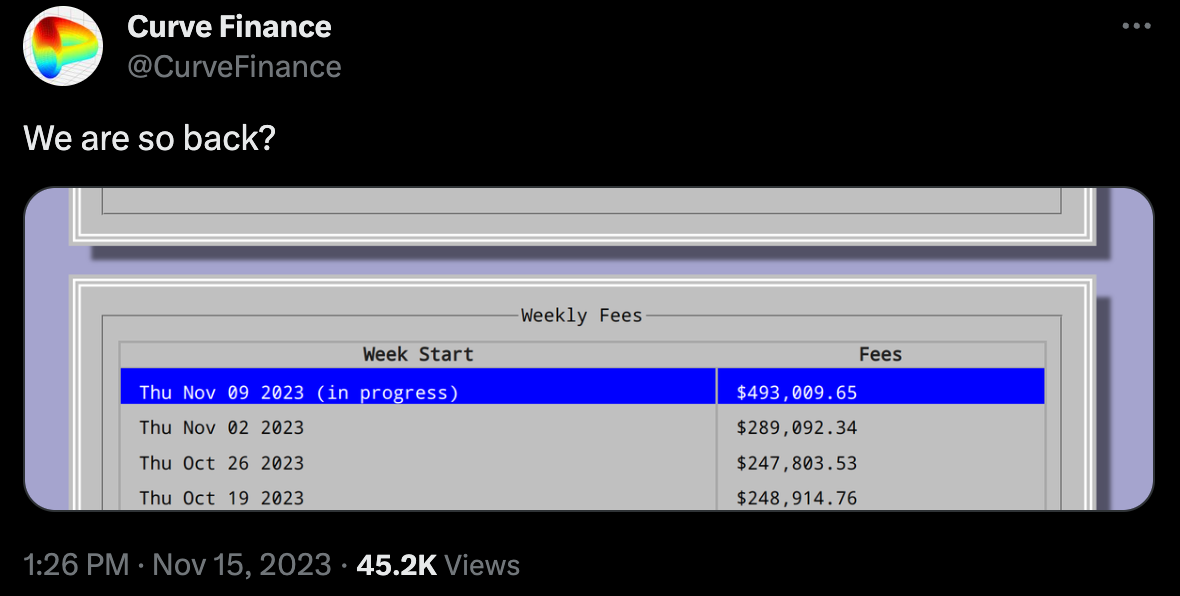

For however long rates stay elevated, it amounts to hefty fees for the Curve DAO. Yet the poors, desperately in need of money, remain apparently willing to accept the terms of loan sharks. Despite the elevated interest rates, borrowing continues.

Perhaps, to the benefit of the devs everlasting souls, religious scholars may not agree the $crvUSD interest rates are necessarily “usurious.” They happen to fall in line with market rates, so it couldn’t necessarily be classified as predatory.

The manic craze is currently threatening the peg of the stablecoin.

OK, we’ll grant you, $crvUSD has held peg so excessively well that the chart is somewhat misleading. A $.003 deviation would hardly be considered a depeg for most stablecoins, but FUDsters gotta FUD.

Is anybody in the community decrying the wicked moneylending practices? In fact, we’re giddily celebrating the unrivalled greed.

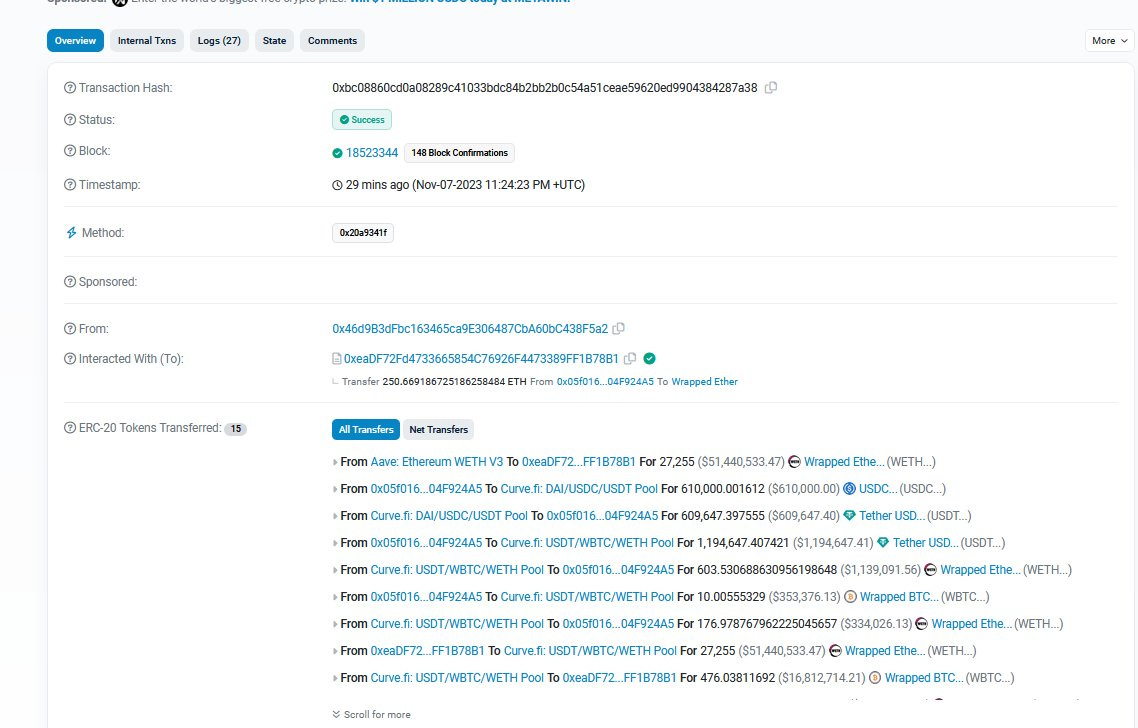

Granted, the sizable bounty this week may not be entirely attributable to $crvUSD.

Nonetheless, $crvUSD constitutes the plurality, or possibly majority, chunk of the fees. Lending platforms are going bananas as the market pivots from bear to bull.

In the last bull market, the avarice within the crypto community knew no limits. Most of us received our karmic retribution in the form of massive portfolio losses. Others are now in prison.

Should the bull market actually resume in force, we encourage everybody to recall the spiritual mistakes of the previous cycle and to practice humility. If you do happen to get rich in crypto, there’s a decent chance you’ll be brutally tortured and murdered anyway. Since you can’t take your private keys with you, we’d encourage you to take some time to prepare your eternal soul as you lock in your gains.