Last week witnessed a new broadside against Curve from a once-powerful DeFi relic.

Uniswap, an inefficient Curve knockoff, has taken note of Curve’s success and launched a last-ditch attack on Curve’s trusty 3pool. Their attack comes in the form of cutting trading fees on some pools.

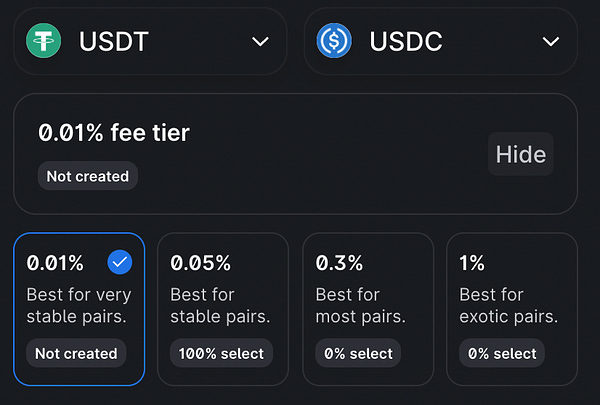

Uniswap v3 concentrated liquidity ranges are difficult to rebalance for volatile assets, especially as assumptions of lower gas prices have failed to materialize. Yet it’s theoretically usable for stable assets not expected to break peg — Curve v1’s bread and butter. Most Uniswap fees had traditionally been a royal 0.3% (30 bps), making the protocol revenue rich.

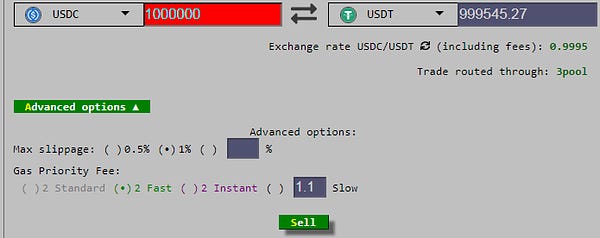

Yet this was always a major premium to Curve’s 0.03% on 3pool, making it difficult for Uniswap to compete on cost. This past week, Uniswap’s “governance” slashed fees to a lowball 0.01%, undermining Curve’s cost advantage.

Notably, this may even be making money for Uniswap LPs.

The unicorn in their new logo may in fact be a clever reference to the rarity of LPs making money on Uniswap. Until now, very few people tangled with Uniswap and came out the better, with the possible exception of the DeFi Education Fund.

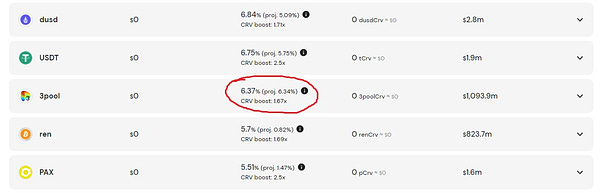

Although it may not be negative like other Uniswap pools, these new pools still carry that “TradFi Saving Account” energy for wannabe stakers.

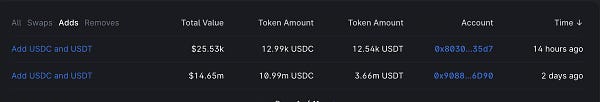

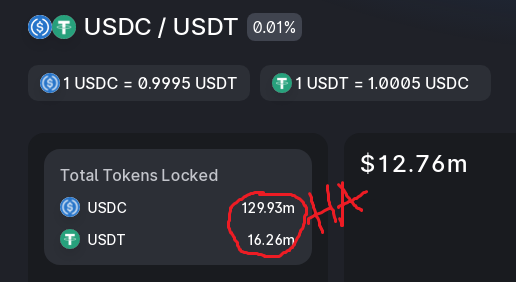

In this particular case it’s just one lucky ducky earning all the rewards. Given the choice between rewarding all of its users or one single whale, you know which one Uniswap will pick every single time.

LPs aside, what about casual users? Will Uniswap finally defeat dethrone Curve by creating a flimsy replica and undercharging for the service? Does this all spell the end for Curve?!?!?!?

In a word… no. The path to unseating Curve won’t be quite so easy for Uniswap. Curve has plenty of levers at their disposal if needed.

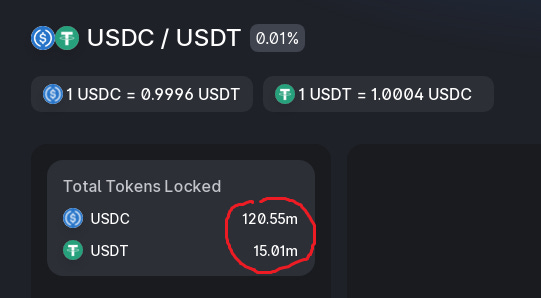

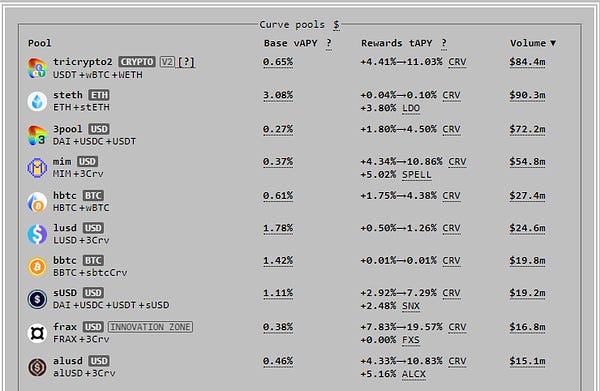

Even without any major changes, Curve’s efficient stableswap invariant and deep liquidity remains the best in industry formula for low slippage at high volumes.

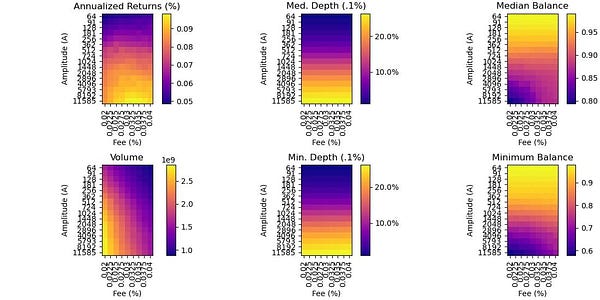

Curve has run the numbers extensively on the optimal parameters for its pools. It retains the option of dropping to .01% fees to match the 1 bps pools. Yet the preferred option looks to be raising the A parameter.

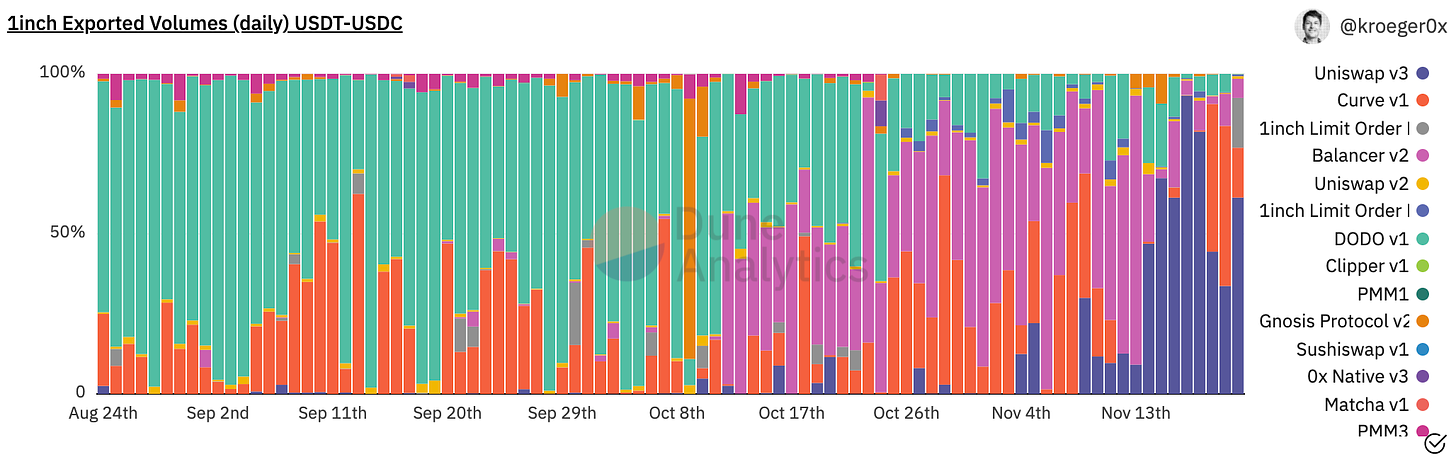

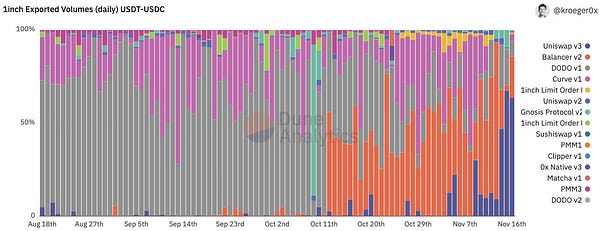

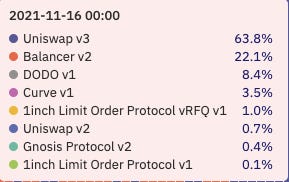

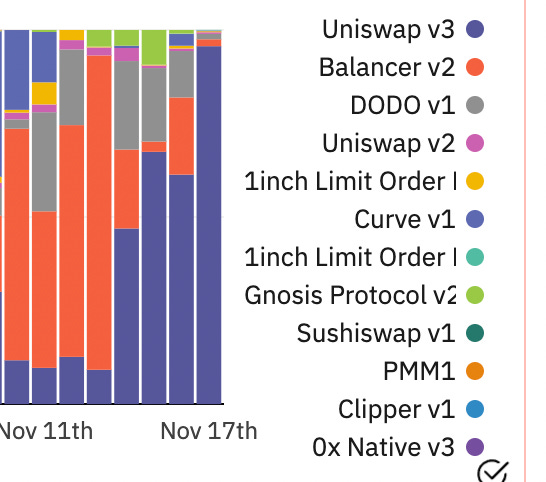

Curve hasn’t even had to make this move yet. With A still at 2000, Curve volume has already picked back up as the Uniswap pool became unbalanced. In the past several days, Curve volume has mostly beaten Uniswap — with far greater profitability.

This would come as little surprise to anybody who followed the research by @nagaking.

We can expect the battle to continue, and perhaps there’s greater chess at play.

Perhaps Uniswap is offering this as a sort of a loss leader to push users toward more profitable pools. Like when you go to the grocery store just for the sale on milk, but you walk out with a cart full of high priced junk food. If you liked $USDC-$USDT, why not pick up a cute doggie token while your transaction’s processing?

Another way to look at it is the classic Silicon Valley gambit. A startup tries to “disrupt” an existing business by giving away its product for free through a sleek app. VCs horny to invest in “growth” subsidize the startup with dump trucks full of funds. Rinse-repeat until the legacy business can’t compete and goes under. With the field cleared, the startup can charge double original prices. Maybe Uniswap’s game plan is to bankrupt Curve and capture the AMM market?

At any rate, it’s remarkable that the third iteration of Uniswap still struggles to compete with the original release of Curve. It’s an ominous indicator for Uniswap. Curve’s v2 pools could bring Curve efficiency to a breadth of assets. Curve’s initial crypto pools are already accounting for big volume and they’ve yet to be unleashed en masse.

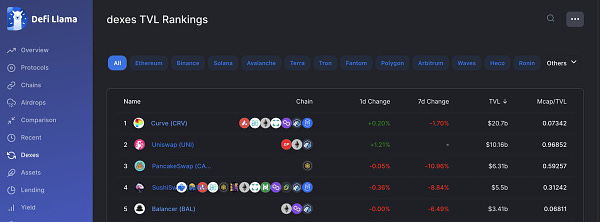

In fact, Curve v1 has proven utterly dominant over Uniswap to date. For most of the past year, Uniswap has utterly flatlined in terms of TVL in ETH terms

Meanwhile Curve has been as perfectly sloped as Chad’s hairline:

Uniswap supporters might point out that their protocol may simply not care about TVL. If your business model is aggressively rugging your users, who needs deep liquidity and low slippage?

If Uniswap wants to escalate the basis point battle, it will be interesting to see precisely how many VC wallets they’re willing to throw at Curve in an attempt to bury it. It’s a sort of DeFi equivalent of the Brannigan gambit.

Should 1 bps proves competitive, maybe they can get VCs to subsidize dropping fees to zero? Negative? How low can you go 👀

Disclaimers! Author is a Curve maximalist, in part by rendering himself so thoroughly unemployable across most of polite society.