One of the key pegs in the flywheel is the peg between $cvxCRV and $CRV. For the uninitiated, staking a $CRV for veCRV on Curve is great, but a bit complicated. It requires a lengthy four year lock and constant extensions to maximize earnings.

Convex solved this by issuing a $cvxCRV that can be directly 1:1 issued by depositing Curve. $cvxCRV can be staked to earn fees in a far more fungible manner. Staking $cvxCRV into Convex throws off three of the best assets in DeFi: $CRV, $CVX, and $3CRV. In other words, exposure to the entire Curve flywheel. It currently returns 50% yield (NFA, DYOR).

Key to this is the capability of trading $cvxCRV back to $CRV as needed, which gives apes confidence 1 $cvxCRV == 1 $CRV. This is most heavily reinforced heavily by the $CRV-$cvxCRV factory pool. Over the course of its existence, it’s not only mostly stayed on peg, it’s provided healthy returns to liquidity providers in the pool:

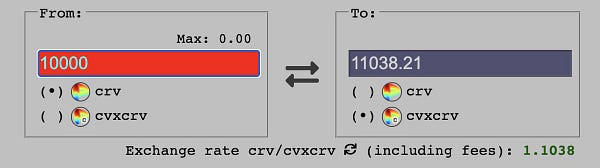

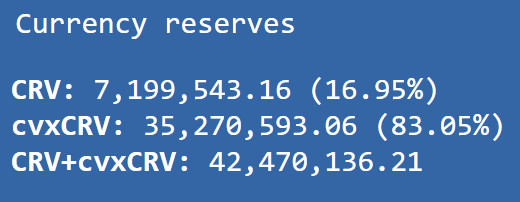

Something unusual has happened over the course of the burger holiday weekend though. As the price of $CRV has gone haywire over the past week, the pool has become heavily imbalanced. The peak I caught was over 85%-15% imbalanced, and discounts got as high as 15%.

What in the fresh Hades is going on?

From the looks of it, somebody with the handle GoldenBull.eth pulled out just over $42.0 million $CRV from the pool in one fell swoop:

Since then, the pool has been off peg for perhaps its longest duration ever (longest? fact checkers weigh in here…)

So what exactly does this mean for the casual ape? It depends on what you expect going forward. A good summary of what’s happening is provided here:

If you expect the peg will be permanently broken, you might guess $cvxCRV has utterly failed in its mission. If you take the maximalist position that $cvxCRV is therefore worth zero, you might just grab whatever $CRV you can from the pool at whatever discount and thank your lucky stars you didn’t lose it all.

One has at least some precedent to consider with the case of Yearn. Yearn previously had a similar concept to wrap CRV as yveCRV and offer extra rewards. Unfortunately the peg did not hold. The apocalyptic scenario has not panned out though — the token is currently off peg by about 60%, not the cataclysmic 0% one might fear. Yearn may also have some ambitions of reclaiming the peg, per a discussion last month in the governance forum:

What about the other side of the bet? If you are bullish $cvxCRV you would assume that over time new users will take advantage of this discount and the pool will correct. If this is the case, then this period amounts to something of a Black Friday / Cyber Monday sale.

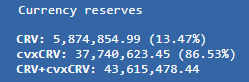

At peak you could have gotten an 14% bonus for trading your $CRV for $cvxCRV. The pool has tightened somewhat to a still-lopsided 21%-79%, which still provides a 5% bonus. Should the pool successfully repeg, you essentially got a nice little bonus.

Supporting this bull thesis would be the Votium bribe activity on the cvxCRV pool. 25,000 CVX (worth about $650K) has been staked to juke the pool’s incentives, a bit of an uptick from the $558K last round.

Another bullish signal is the fact the activity has trended towards restoring the peg in the intervening days. The community has widely been treating this as a buying opportunity.

Note that a one-way bridge of $CRV to $cvxCRV always exists via Convex’s depositor contract. The Curve cvxCRV pool serves as the reverse bridge, and essentially the oracle price as well.

Once you have have your $cvxCRV in hand, you can stake it in Convex and enjoy the flywheel. Or maybe pick up a bit extra for your friends and family and consider your holiday shopping taken care of early!

Disclaimers! Note: Author did in fact sell CRV for cvxCRV at peak imbalance.