It’s Election Night in America! As a single issue voter (cryptocurrency), there was not much worth paying attention to though. The only candidate who made cryptocurrency an issue won, making our community a perfect one for one!

May be tough to square it with the state’s purposely onerous BitLicense, but nonetheless a W is a W.

The most important policy action was not on the ballot though. The federal government’s working group released its report on stablecoins.

Due to the expectations game, the reaction basically amounted to a shrug. Most everything was already telegraphed over the past few months. Therefore, even if the report was bad, it was bad in line with expectations. Indeed, the fact that it wasn’t even worse than telegraphed gave some people optimism.

The biggest bull signal amounted to product placement (or perhaps more?) for some of the TradFi entities who presumably lobbied hard to get their brand names listed in the report.

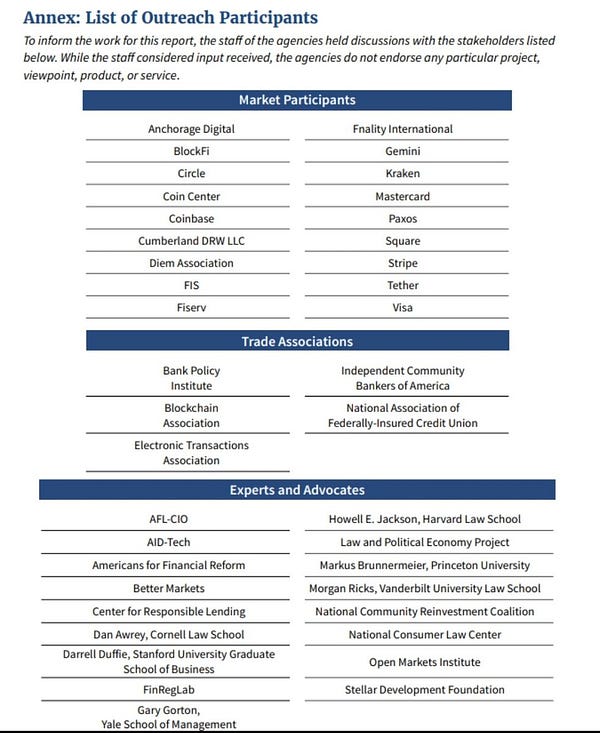

The sources were indeed eyebrow-raising. If I made a list of ten organizations who I would willingly pay to hear them speak about cryptocurrency, would my list have any overlap with their list of sources? If this was a crypto event’s speaker list, your first thought is “I’ll skip the $5000 ticket and just hang around the after-parties.”

Most of the report reeks of manifest destiny. It’s an overly presumptive land grab for the government to assert stablecoins fall under its domain. The line of thinking is: a stash of money exists, therefore it belongs to the jurisdiction of assorted government agencies, the only question is how to divide the spoils.

Historically, however, the precedent surrounding stablecoins appears to already be quite clear… at least from the perspective of somebody unqualified to offer legal advice. For the past few hundred years, something like stablecoins have existed frequently and within the law as various forms of scrip. Think of arcade tokens, subway credits, Starbucks points… maybe even postage stamps and frequent flier miles. Provided you’re supplementing and not competing with the Fed’s printing monopoly, it’s been widely considered legal.

To my read, stablecoins more closely resemble scrip than a competing currency. If you buy an Amazon gift card, it acts very much like a stablecoin. Each Amazon dollar holds a value of $1. It can only be spent in a narrow ecosystem of Amazon shops, and therefore has inferior utility to the US dollar. Similarly, a stablecoin allows one to transact a fixed stash of value within the Web3 ecosystem. Stablecoins even provide more off-ramps than Amazon dollars, albeit it comes at a small penalty.

For the history of the USA, small entities that have offered scrip have never been regulated, provided they were taxed appropriately. Locally printed currencies made a comeback as recently as 2020 when forcible lockdowns devastated local economies. The small town of Tenino, WA released wooden coins redeemable at local businesses. This was considered clearly legal because there’s tons of precedent. The entire gambit was a throwback to a gambit the town used to save itself during the Great Depression. They even used the same archaic newspaper printer from the 1890s to mint the coins.

The only difference in this instance seems to be that the pot of money has grown sufficiently large enough that regulators could line their pockets. Like mafia bosses meeting to carve up territories, the paper begins delineating the boundaries for which agency can walk around which neighborhood and peddle their “protection.”

Sure enough, Circle, the wannabe bank we presume is jonesing to flip its USDC into a CBDC, was awfully quick on the trigger to announce its support of this land grab.

The paper justifies this overreach by whipping up a variety of boogeyman in the form of “risks.” Of course, the stale FUD couldn’t frighten Smokey the Bear at this point, but regulators only need the thinnest veneer of fear to justify heavy-handed action. The risks cited include:

Risks of stablecoin runs

Payment system risk

Systemic risk and concentration of economic power

The thought that a few hundred billions worth of stablecoins present any risk to the US financial system is of course downright laughable. Yet it works as convenient sleight-of-hand to distract from what is not just the risk of harm but the certainty of harm being delivered to holders of bona fide US dollars, in the form of irresponsible monetary policy and runaway inflation. In this context, the “risks” of stablecoins are better described as “opportunities,” in that stablecoins may allow holders better access to lifeboats to escape the Titanic.

At any rate, the working group behind the paper appears to be cognizant that they lack proper authority. The conclusion of the paper is that they need Congress to act. On this point surely everybody would agree: the OS of the US is badly out of date.

The argument now is what to do with this operating system. Replace it, amend it, or planned obsolescence. Given the debacle of the infrastructure bill, nobody expects swift action would be likely.

The paper even outlines what such legislation might look like, which attracted plenty of commentary on how such legislation may affect the landscape.

The big fear with pushing this to the legislative branch is that the broken DC process often backfires. Do we trust new legislation would get it right as bank lobbying money taints the process?

It may be a ways away, but most people anticipate some form of regulation will come. In fact, absent such clarity, you can’t expect TradFi to start making massive movements into the space. Therefore some in the community are looking forward to thoughtful legislation.

For this reason, we need massive grassroots support for PAC DAO to make sure Congress doesn’t mess it up.

Most likely, the future of stablecoins will entrap the USDCs of the world into the banking system, while the more decentralized coins eluding capture. “Level of Decentralization” will inevitably be one of the axes of a quadranted matrix in a future McKinsey slide deck. The second axis… that will cost you six figures for an 8 week engagement.

At one extrema will be the super-regulated and highly neutered version of dollarcoins. Regular people will wonder why everybody’s raising such a big stink about cryptocurrency. They’ll grumble as their FedUSD wallet programmatically taxes itself out of existence at a rate of -33% per year and can only interact with bank-sponsored smart contracts that only seem to lose them money.

At the opposite end, degens will push their activity toward fully decentralized coins with anonymous teams and cartoon frogs in their Discord. These coins will zap their way at light speed through an innovative ecosystem of DeFi products and services, most of which will geofence to block US residents. The most talented American coders and mathematicians will flee the country. The remaining midwits left in charge will desperately pump ammo into their own feet in a misguided effort to stop the bleeding.

Disclaimers! All proceeds from subscriptions support PAC DAO Crypto Activism, which we need more than ever.

Unfortunately I don't think stablecoins are like an Amazon gift card. The Liberty Reserve guys were extradited and went to prison, because they started a centralized stablecoin in 2006.