All everybody wants for the holidays is v2 pools opened to the masses. You may be wondering what’s the holdup? Stuck in a cargo ship off Long Beach, perhaps?

Curve has a habit of testing extensively to make sure launches proceed without incident, and as a result Curve is uniquely safe relative to the DeFi wild west. Curve also never announces timeframes. So you might need to wait a month, or you may need to wait a decade. Fortunately we’ve got plenty of v2 pools to provide us great coverage while we wait.

Truth be told — no matter how extensively you test in Brownie, the real battle testing comes from releasing it into the world and letting a thousand apes try to rip it to shreds. We’ve seen a handful of pools deemed ready to release into the wild, for the ultimate stress test. The launch of Curve v2 pools to date provides good experimental data from real world usage, to make sure the pools are working as intended.

A good omen for the release of Curve v2 is that these pools have been dropping at an accelerating rate.

May 28: TriCrypto1

July 13: TriCrypto2

Nov. 1: EUR*USD

Nov. 24: CRVETH

Where the first TriCrypto was highly experimental and needed a tweak after a few months, the process has clearly been refined to the point where we’ve seen several pools drop over the past month. The uptick in pool frequency indicates at least some level of satisfaction with v2 pool performance. Better yet, we’re starting to see some data released to the public about these first three pools.

TriCrypto

Of course, crypto markets are crazy volatile, a point your relatives may be angrily texting you about if they took your Thanksgiving advice to buy cryptocurrency. Listen Uncle Horace… I said CVX, not XRP!

Bitcoin and Ethereum have been volatile and highly unpredictable all year. As it turns out though, the TriCrypto pool handled a pool composed of these unpredictable elements with flying colors.

It’s really quite fortunate this “test in prod” strategy worked so well in this instance. The first crypto pool, TriCrypto, could have been a major disaster un-ruggable Curve. Fortunately, the first pool required only a few tweaks in the migration to TriCrypto2. As a result, apes just keep aping.

TriCrypto now has $1B in liquidity, a number most protocols could only reach in their wildest dreams.

EUR*USD

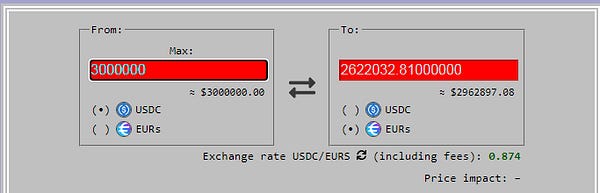

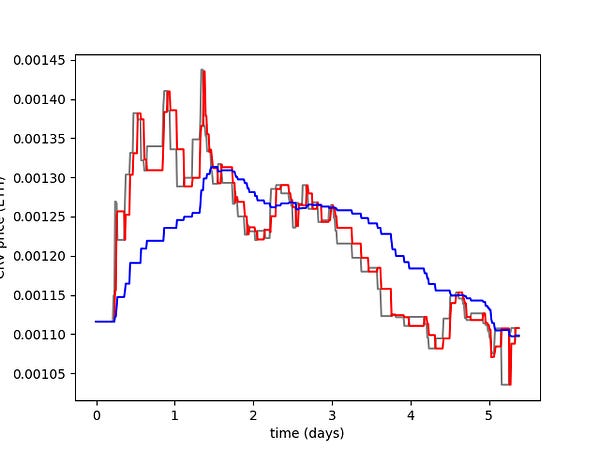

Below we see data from the genesis of the EURTUSD, a Euro pool from Curve’s second v2 release. Initially it was a bit of a struggle to find peg, but after a few dozen ticks you can see the blue line start to catch up with the activity.

This pool is already eating into competitors. You simply cannot beat Curve’s low slippage, low fees, and high liquidity. It conquers all.

CRVETH

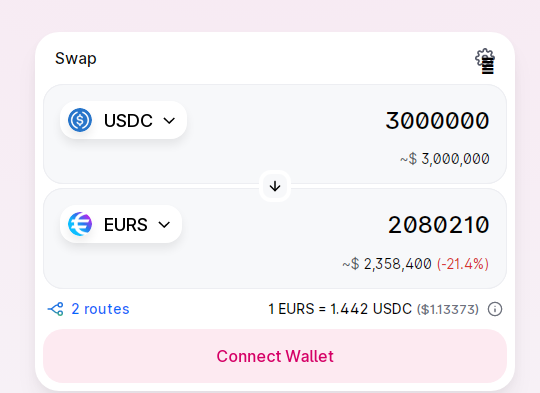

Similarly, the recent launch of the CRV-ETH pool handled extreme fluctuations in the price of CRV with relative ease.

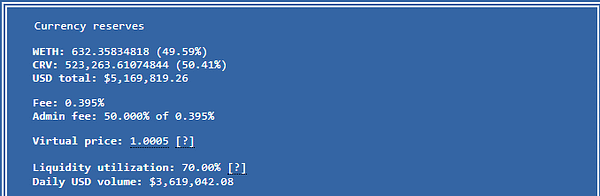

The liquidity utilization in this pool is also through the roof. The screenshot below demonstrates that with just $5MM worth of CRV/ETH deposited to the pool, there’s been over $5MM worth of trading activity.

All this activity despite the fact the pool is just barely getting started — no gauge, no Convex... could be big!

v2 Powers Combined

Every time a new v2 pool drops, the routing options expand.

As of today, with just three pools, most of the main asset types are easily linked together. Low slippage, low fee, high liquidity movement among Curve’s various pools can get you most anywhere you need in crypto: dozens of dollarcoins to euros, Bitcoin, Ethereum, Curve… all made easy.

When anybody can deploy a v2 pool, these routes will explode exponentially. It won’t be possible to maintain this chart. We’ll enjoy Metcalfe’s Law on steroids.

Wen v2 indeed!

Disclaimers! Author has a stake in TriCrypto2