Nov. 4, 2021 - CVX Wars: Return of the DeFi 🌌️ 🚀

Institutions Join the Epic Battle to Return Yields to the Galaxy

Episode VI

Return of the DeFiAfter DeFi yields were slain in the Great Chinese Mining Purge

it seemed the degens may never recover. The team at Convex

and their Votium allies regrouped. Now, four rounds in, the

Convex Wars have escalated. Small rebellious protocols are

locked in an epic struggle to return great yields to the galaxy.

Just four rounds of bribes in, and the Convex Wars are continuing to heat up.

Bribes nearly hit $5MM, 2.5x the previous round. The effective yield per $vlCVX, (aka what users earn for vote locking Convex), also jumped about twofold. Growth of $vlCVX notches in just a shade lower than growth total bribes, due to ever more users racing to lock CVX and earn their share.

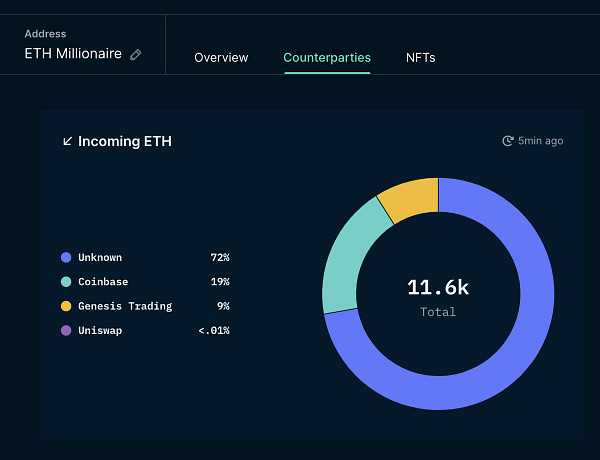

As bribes get insane, these benefits are flowing to lockers of $CVX. Institutional money is rushing in to snap up the dwindling $CVX supply, presumably to get their turn at the trough.

Genesis Trading, a global brokerage, has been revealed to hold a hefty $5MM position.

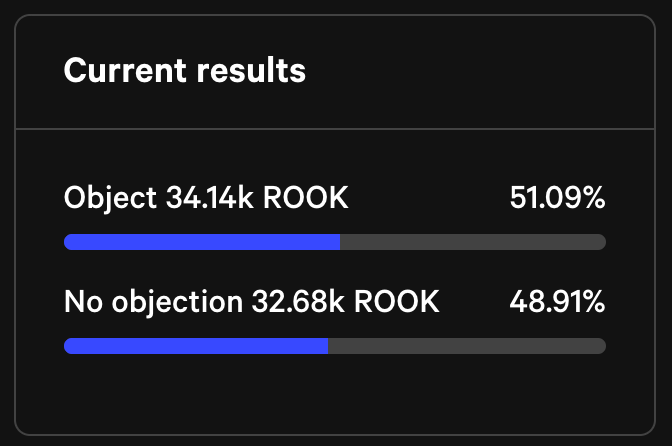

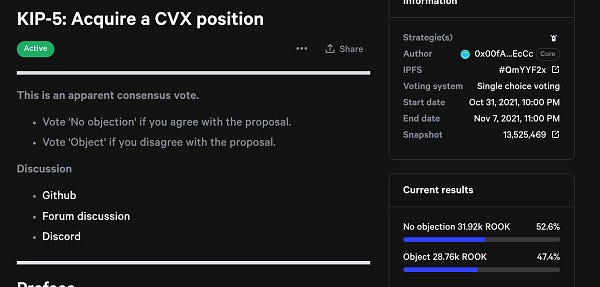

Meanwhile Keeper DAO is heavily weighing buying up to $40MM USD worth of CVX in what is currently a neck-and-neck vote.

It’s currently teetering toward a “no” vote, possibly because the price of $CVX has exploded since the proposal was first floated. It’s still anybody’s guess which way this will fall.

Some even speculate the $OHM-ies may be party to the action, though we’ve not confirmed this on-chain.

How long will the bribes keep increasing? It’s anybody's guess, but $CVX bulls are speculating that the bribes will continue flowing as long as they remain effective. Maybe this is just the tip?

This sparked a great public discussion: ‘tis better to rent or own?

Votium even offered their two cents:

If bribes do continue apace, this makes $CVX that rare token where you feel a bit relieved when the price goes down, so you can scoop it up on the cheap. In this way, $CVX stakers are wired different than run of the mill traders.

While the big money is just now catching on to Convex, it’s the future whales-in-training who have proven the real beneficiaries. How often in life does value ever make its way downstream to the less fortunate?

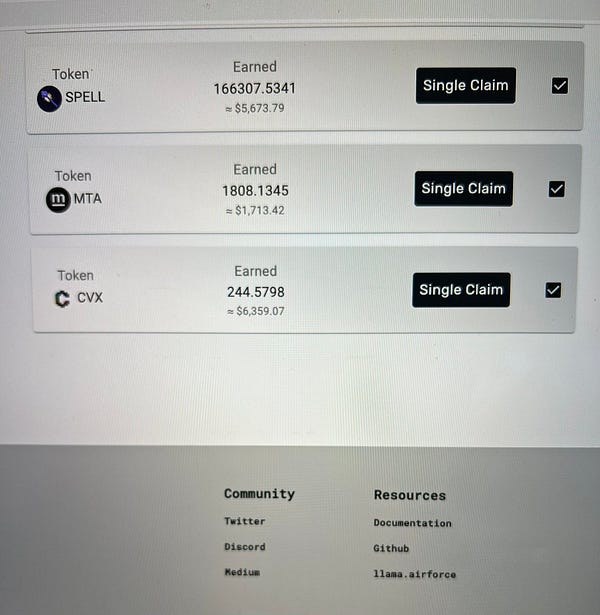

Votium is notably friendlier to peasants thanks to their implementation of gasless voting. This allows users to stake and wait to collect until when (if?) gas prices drop. As a result several users are providing very helpful material online to help.

Despite all the great emerging resources, computing bribes remains a bit opaque. Resources to compare Convex yields that factor in miscellaneous yields in the ecosystem remain elusive.

Whatever your strategy, at the moment it looks tough to design a purely losing strategy. Hence, the exuberance of CT for $CVX reads less as regular shilling, and more as testimonials from seriously satisfied users.

In the fast moving world of DeFi, it turns out this sale may well be over by the Christmas season! Consult with your local Santa about whether you’ve been good enough to earn CVX this Xmas.

Disclaimers! All proceeds from subscriptions support PAC DAO Crypto Activism, which we need more than ever.