Whomever you supported in the American election… if anybody… yesterday turned out to be a great day for you… because we can all unite in celebrating the release of the much anticipated f(x) Protocol v2.0 white paper!

Also available in Spanish, Chinese, Japanese…

What are the highlights of v2?

The goal of the v2 is to keep the familiar two token model and enrich it. The stablecoin is decentralized, pegged, and directly redeemable to its backing token.

Meanwhile, the paired token allows up to 10x leverage with neither liquidation risk nor funding fees.

It might sound like a pipe dream, if f(x) Protocol didn’t have such a superlative track record in operating their v1. How do they accomplish such a feat without the system imploding?

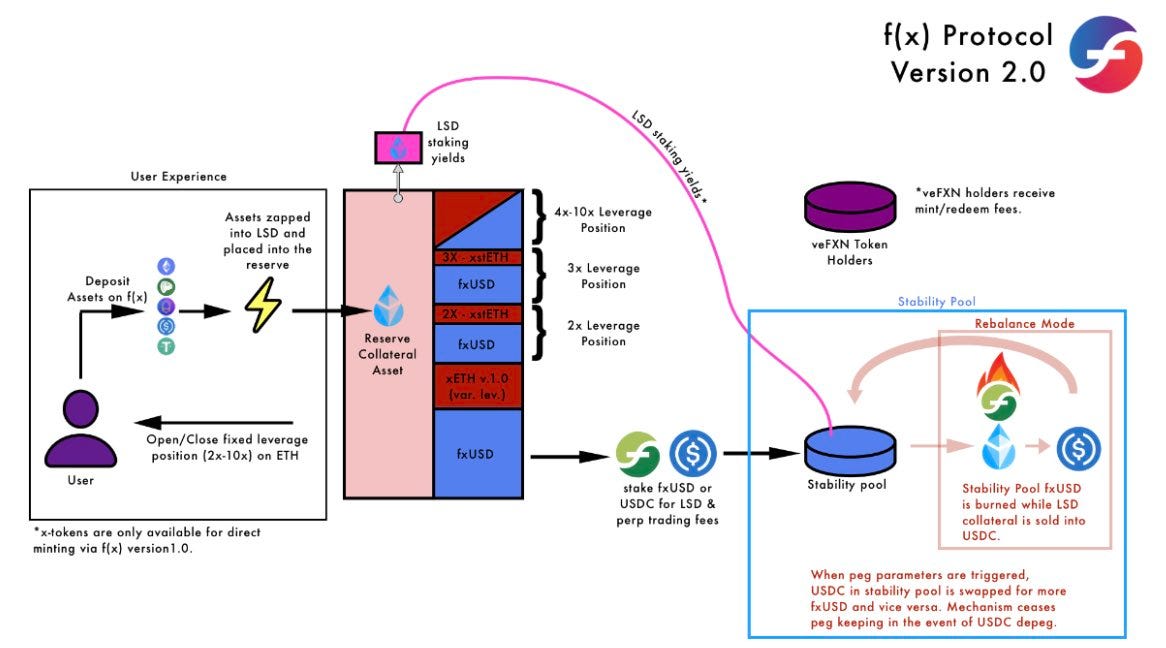

The core of the system is to keep the stablecoin ($fxUSD) and its paired asset ($TOKEN) in balance at all times:

The price of the asset, s, fluctuates, so in order to keep the stablecoin value constant, but the entire system is held to equal the total value of the token reserve.

This means that if you are taking out a leveraged position, the protocol has to mint a corresponding backing worth of fxUSD to keep the system in balance, aided by atomic flashloans. The position must be closed in the same manner.

For instance, let’s assume TOKEN price is $2,000. If a user wishes to open a $200 xPOSITION at a leverage of 10x, the protocol requires that $1,800 worth of fxUSD is also minted simultaneously, such that the total collateralization aligns with the desired leverage.

The closing of an xPOSITION must be done with fxUSD at the real-time fxUSD:xPOSITION ratio at the time of redemption.

The entire ecosystem also makes some additional upgrades to the rest of the ecosystem, like the stability pool and its rebalancing methods, in order to keep the system in good health.

The graphic within the white paper shows off how it works exactly:

We urge you to read through the full paper yourself, as all papers from Aladdin DAO it’s quite comprehensible for all DeFi users.

Is this too good to be true?

If it all seems too good to be true… we believe f(x) Protocol remains among the most underappreciated DeFi protocols. The v1 of the protocol operated flawlessly through the worst recesses of the bear market.

More importantly, it’s remarkable how many seemingly impossible features for both stablecoins (decentralized, pegged, redeemable) and leveraged tokens (high leverage, no user liquidations, no funding rate) are solved so completely through f(x) Protocol’s elegant method of cleaving assets. The result is a user-friendly leverage token that can be held passively and a perfect stablecoin. What brilliance.

No surprise that advocates of f(x) Protocol have been so enthused about the release of this white paper, it certainly lives up to the hype.

The crazy part about DeFi in Q4 2024 is that the brilliant work of f(x) Protocol appears to be simply flying under the radar. Perhaps it’s a function of how dead the space has been, or some other malign forces at work, but we’re always perplexed at how little attention the protocol’s FXN token seems to get relative to the innovation. A sleeper hit for sure.

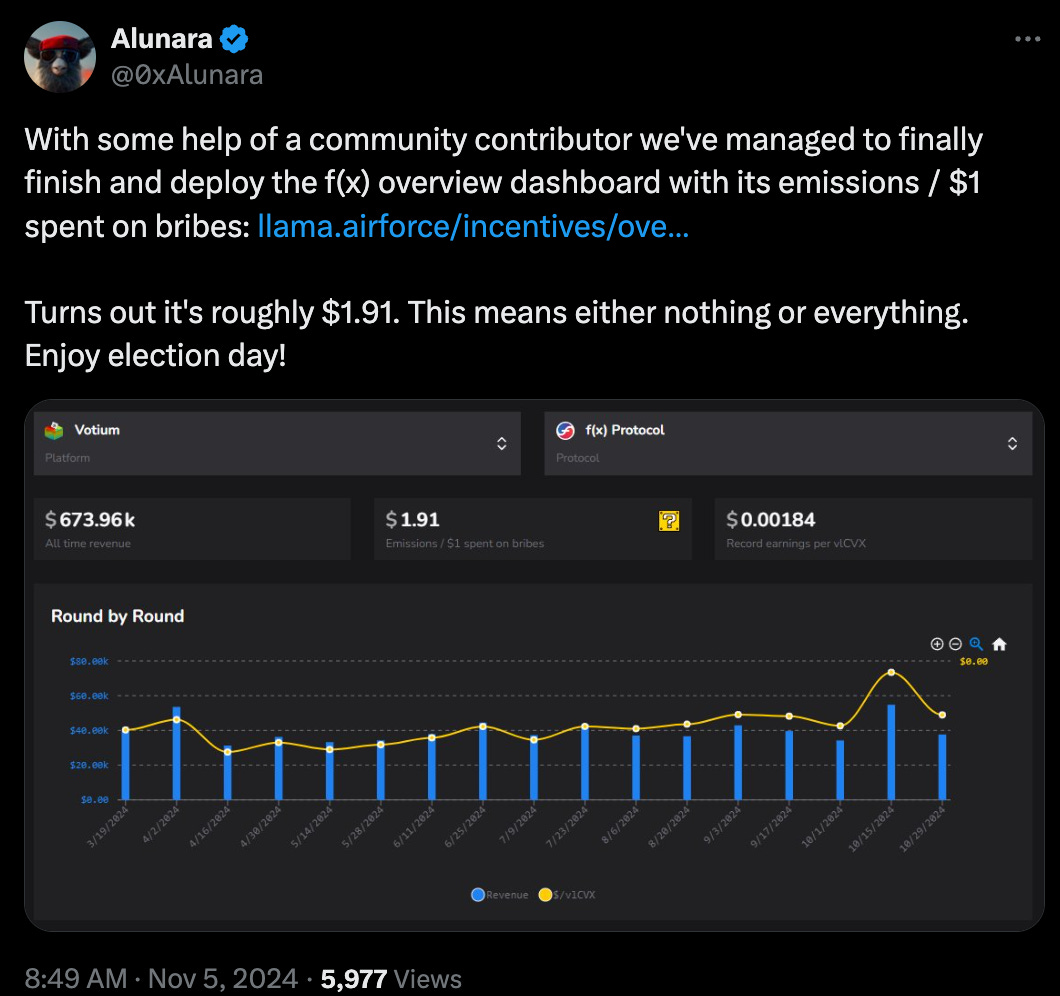

It’s one of so many confounding aspects of DeFi. Just look at its incentives efficiency…

Or, depending on your perspective… those are rookie numbers…

At any rate, in case they are in fact about to make DeFi great again, worth checking out their community call today!

Disclaimers! Author has exposure to FXN via the boosters program.