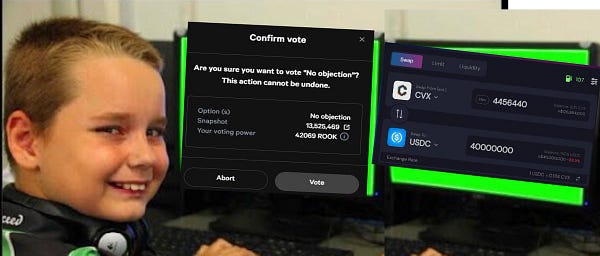

The KeeperDAO ($ROOK) proposal to buy $40MM USD worth of $CVX was an absolute nail-biter. In the waning hours, it appeared it would go down as a narrow loss. The Convex crew already began airdropping $COPE to their followers.

Instead, in the 11th hour, some backroom wheeling and dealing appears to have turned the tide. We may never know what akshually happened. Perhaps it was just youthful hijinks.

Or possibly they detected some unusual patterns in whale migratory patterns that caused them to reconsider. We’ll return to this riddle in a few paragraphs.

Whatever the cause, the vote would flip at the last minute. Could be something!

The result surprised nearly everybody, although at least one user foresaw the gambit.

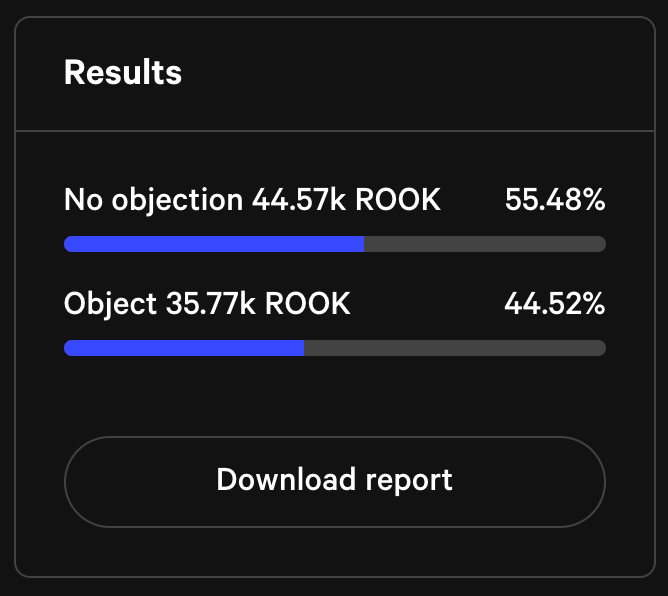

The final tally ended at 55% in favor, 45% opposed. This photo finish appears to have caused some sudden turbulence in the markets.

If you squint, the above chart almost demonstrates a rare TA pattern: the “love glove”. Perhaps it’s an appropriate time to bring in an expert to decipher what exactly was the alpha leak cited just a few paragraphs back: “a black hole of money, a bull symbol, and an unannounced project by a clown frog…” time to put on your thinking caps, so to speak.

While the entire KeeperDAO saga unfolded, $OHM was also announcing major moves to gain exposure to the Curve ecosystem. One announcement dealt with a Curve LP Cohort.

$OHM may now have a higher market cap than $CRV, but all the money in the world can’t buy a controlling interest worth of veCRV. One would need to manipulate Convex for such power.

Days later, a possibly unrelated proposal to add Convex Bonds to OlympusDAO would also drop.

“An acquisition of Convex would help OlympusDAO gain significant exposure and governance power over the Curve ecosystem. Convex has built a moat with Curve by commoditizing Curve Boost and acquiring considerable control over the protocol versus auto-compounding by selling CRV… Curve Finance is the largest DeFi protocol by Total Value Locked and has proven itself as one of the most critical primitives by offering low-slippage stable asset trading through an Automated Market Maker (AMM) market setup.”

While the KeeperDAO community was split, the OHM community was nearly universally supportive of this initiative effort.

Among the comments on the proposal, only one person penned a substantial counter-argument.

With both KeeperDAO and OHM battling over the Curve/Convex flywheel, one question we may never disentangle: which protocol’s influence was ultimately responsible for moving the markets.

Disclaimers! All proceeds from subscriptions support PAC DAO Crypto Activism, which we need more than ever.