Bilingual bonus for those who read the foreign language Curve Telegram channels! It turns out one channel dropped some alfa about $crvUSD that’s been public for some time, but hasn’t been commonly spread outside a few private groups.

We’ll keep this info paywalled for 72 hours, so beg or birb your fave chad subscribers to share the alfa if you can’t wait.

All subscribers feel free to share this article at your discretion…

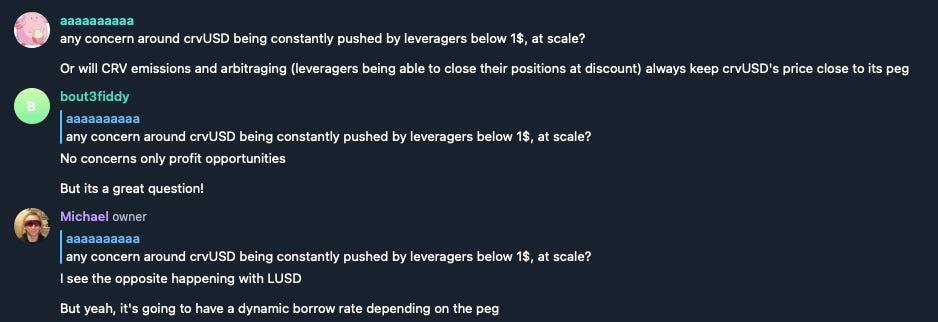

One of the open questions around the design of $crvUSD had been the peg mechanics and how this impacted borrowing. A recent chat in the main Telegram confirmed this would be dynamic, but was sparse on the details.

Little did English speakers know, some alfa on this topic had actually been on full display for over a month in one of Curve’s public Telegram channels. Problem is it never made the jump to English, so it was only known to the most cunning linguists.

Big hat tip to the anon tipster who happened to be in the know…

Translation via Google Translate:

Vladimir Lukiyanov, [Sep 12, 2022 at 2:19:50 AM]:

hmm. Mikhail, how will crvUSD be integrated into veCRV?

that is, where will the profitability for veCRV come from?

Michael, [Sep 12, 2022 at 2:20:20 AM]:

Well, at least so that the entire % of crvUSD loans will go to veCRV

Vladimir Lukiyanov, [Sep 12, 2022 at 2:21:14 AM]:

Not those who provide liquidity?

Michael, [Sep 12, 2022 at 2:21:48 AM]:

What kind of liquidity?

Vladimir Lukiyanov, [Sep 12, 2022 at 2:22:02 AM]:

well, yes. there will be minting and not borrowing.

Michael, [Sep 12, 2022 at 2:22:08 AM]:

Yes

Actually that's why I think aave decided to release gho

We calculated and decided that they would earn more in this way, and the liquidation mechanism was tested

Alexey, [Sep 12, 2022 at 3:03:57 AM]:

in the form of what?

Michael, [Sep 12, 2022 at 3:04:52 AM]:

In the form of crvUSD, of course (but then it will be converted).

Another thing is that when everything works well, you can switch the distribution of commissions to crvusd

Alexey, [Sep 12, 2022 at 3:07:27 AM]:

will individual lockers have any advantages over collective farmers?

Vladimir Lukiyanov, [Sep 12, 2022 at 3:09:03 AM]:

there will be only smaller commissions)

because for collective farmers it will be divided, including for those who are not locked up (in the sense that the share of non-steaked ones will go stabbed)

Michael, [Sep 12, 2022 at 3:10:26 AM]:

Mm. It seems to me that at the protocol level the same thing should be - well, how are the commissions distributed now, exactly the same

Vladimir Lukiyanov, [Sep 12, 2022 at 3:10:58 AM]:

and % of loans will be set by DAO?

Michael, [Sep 12, 2022 at 3:11:06 AM]:

Not really

It will be dynamic depending on the peg

But (for now) % which is obtained when "on peg" is set to dao

However, in the future it will be possible to make a thing that dynamically counts it as well (you should not screw up too much at once). Then it will be completely autonomous

Alexei, [Sep 12, 2022 at 3:12:29 AM]:

this is coma. What about borrowing? will there be a loan bonus if the person is a locker?

Vladimir Lukiyanov, [Sep 12, 2022 at 3:12:58 AM (Sep 12, 2022 at 3:13:03 AM)]:

so there is no job as I understand it. there is a minting of new crvUSD

Michael, [Sep 12, 2022 at 3:13:06 AM]:

When borrowing, I think it will not work to screw discounts on%,% should be the same

Well

Mints when borrowing

Like dai, lusdTL/DR:

All $crvUSD fees will go to veCRV

“When everything works well, you can switch the distribution of commissions to crvUSD”

Percentage of loans

Initially set by DAO, so less to screw up at launch

Eventually automated as dynamic system depending on the peg

This chat fleshes out some missing pieces, such as the role of $crvUSD on $CRV tokenomics, and some of the loan/peg mechanics. At this point, the broad contours of the major $crvUSD mechanics are now mostly public.

This drop here contains less info than the last drop we pointed to, which described the momentous functionality of LLAMMA, which serves to continuously liquidate/deliquidate a borrower’s collateral to reduce risks in a passive fashion.

Plus our dissection of the frontend repo:

Some of the details which have not been made public as of yet:

Technical details / Github repo

Whitepaper

Collateral types (likely ETH, possible for more?)

Detail on the “swaps” as described in the frontend repo

Other questions you have? Maybe it’s already been leaked. Drop it in comments!