Crypto has unlocked a comprehensive index fund, thanks to the launch of Coinbase’s launch of the Coinbase 50 Index ($COIN50).

The index tracks what they consider the top 50 eligible digital assets, all of which are listed on Coinbase directly, weighted and packaged into a single fund. This makes it easy for anybody to get access to all of crypto (outside the US of course). But who knows… maybe soon it will be tokenized and tradable on Base?

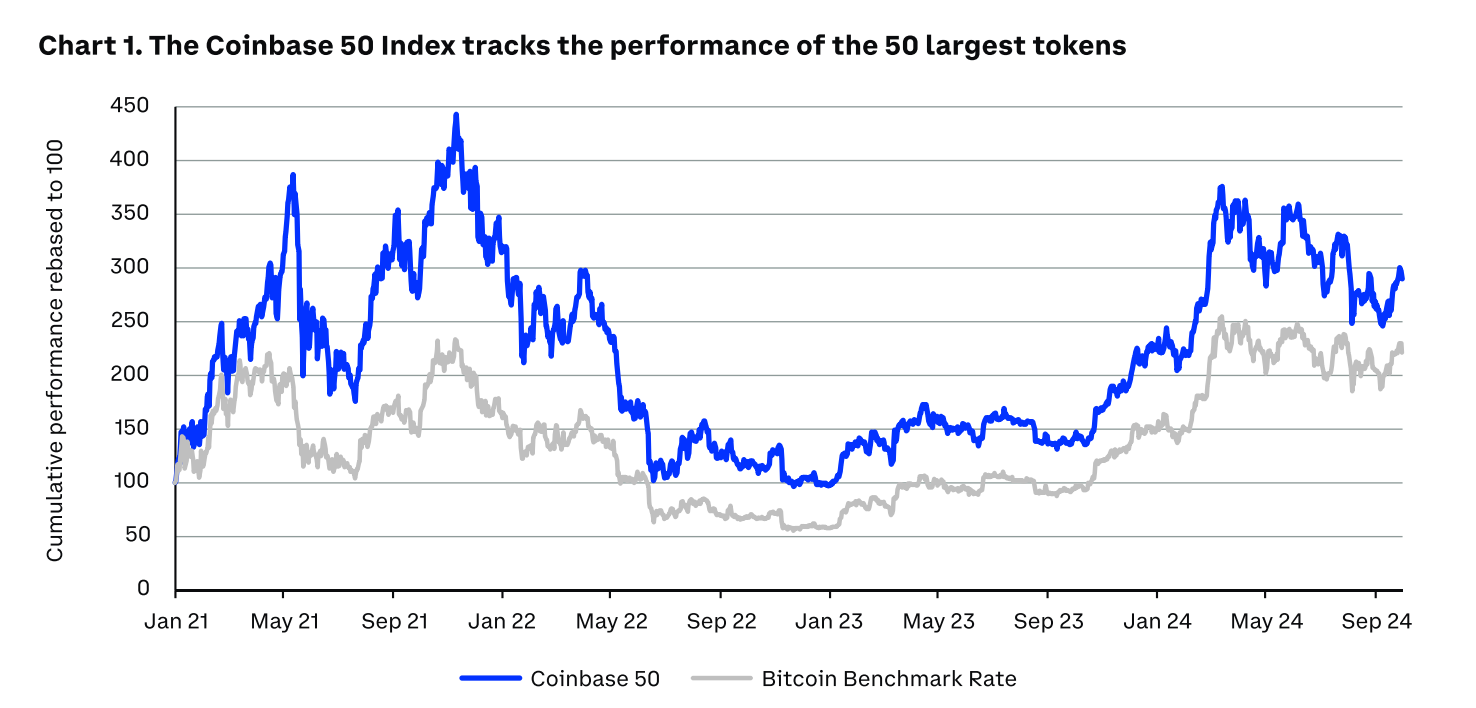

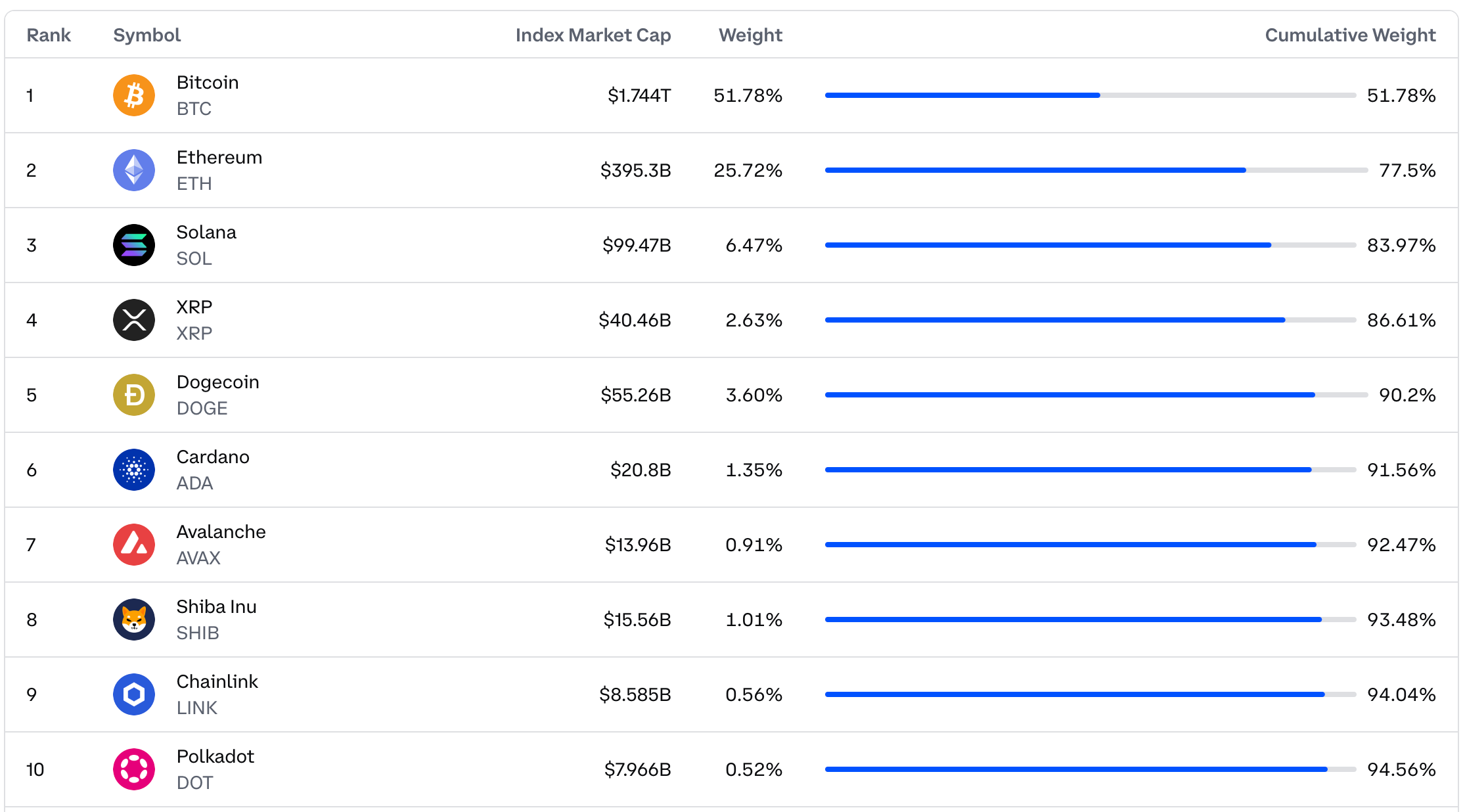

Now, why not just buy Bitcoin? Buying the fund gives you about half exposure to BTC, with another quarter ETH, but then a sampling of all the rest. Their white paper argues that such a weighting could outperform Bitcoin.

With long-term crypto followers knowing how tough it can be to pick winners from losers, and concerned Bitcoin may at some point hit a ceiling, the concept of an index fund that reweights to a top 50 may be a great solution, in the way that index funds offer a superior solution for investors to get access to “stocks” without having to pick and choose.

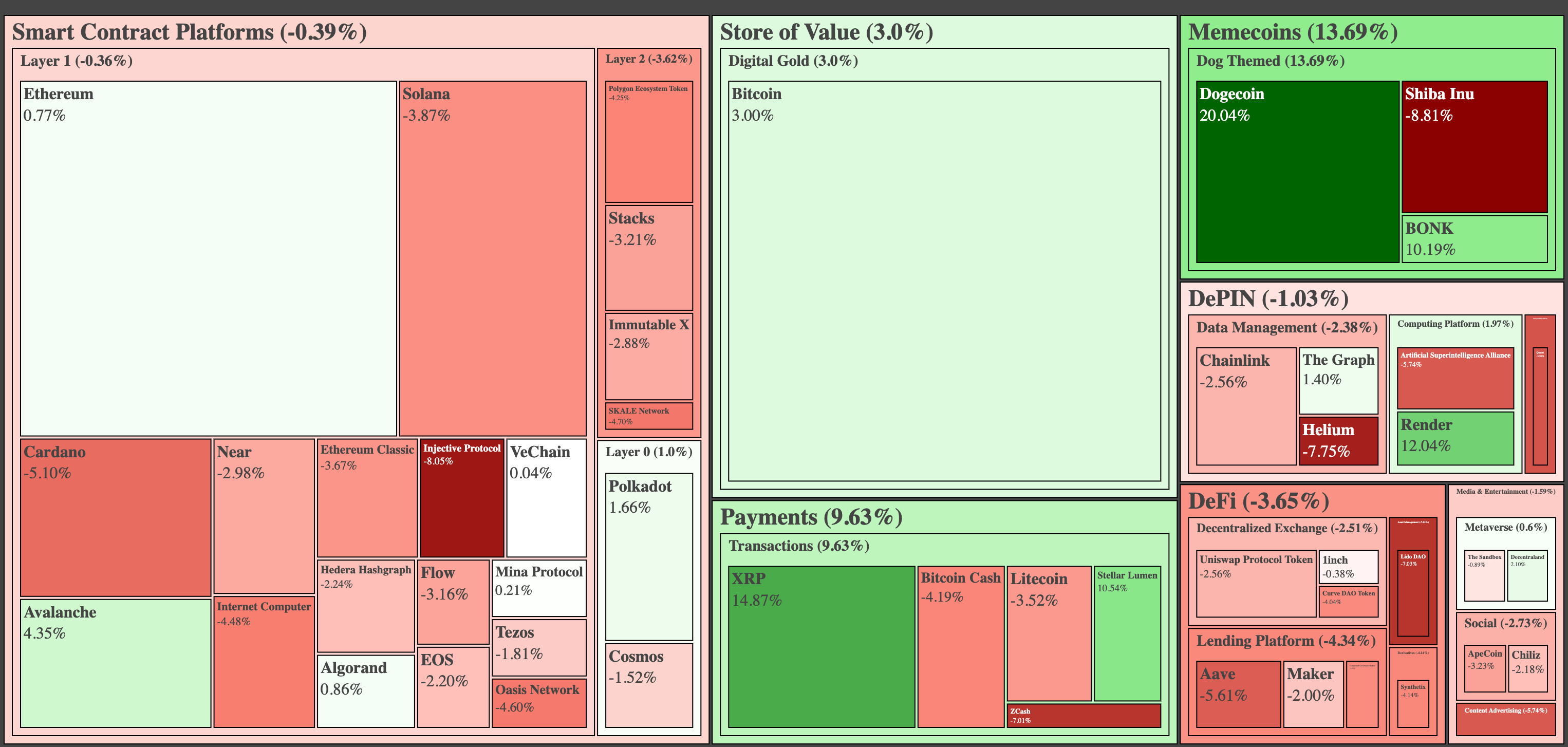

Even for those who may never buy this fund (ie Americans), the existence of a MarketVector dashboard that shows off all the trends in crypto is a nice new data point to add into the crypto toolkit.

And, of course, the sectors are zoomable… so you can drill down further

Eyeballing through the list above, you may wonder what gets included?

Where’s the third largest asset in Tether, amirite?

Some attempts had been made at tracking sectors before, but they were all quite subjective and limited. Coinbase’s attempt is far more holistic, attempting to truly capture the diversity of the crypto market.

Per their white paper, they aim for a weighting by market capitalization, under the constraint that the largest asset is capped at 50%.

This yields a top ten that, for example, gained exposure to the recent $DOGE run

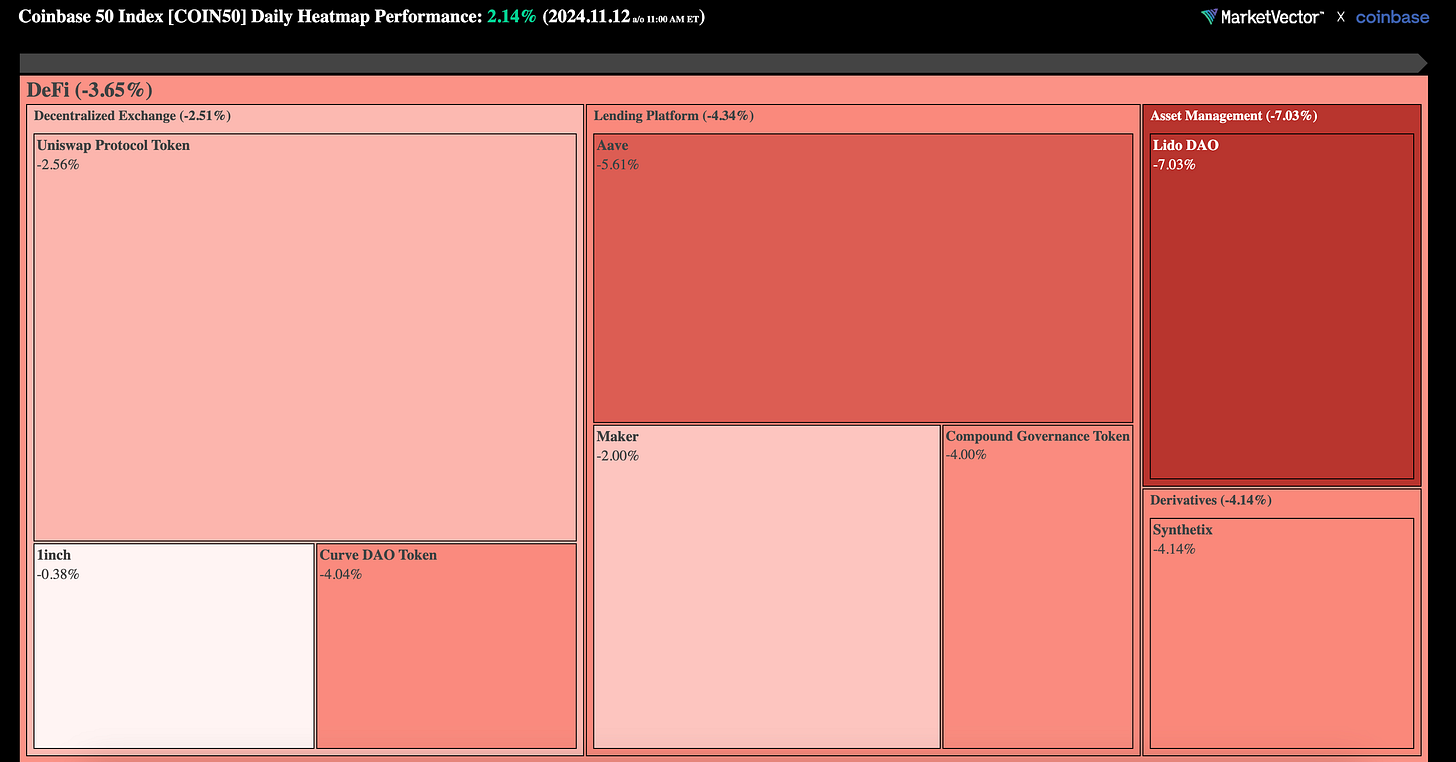

Look way down at the bottom, we were surprised, and pleased, to see our oft-battered $CRV token made the cut right towards the end.

Now, it’s in such a small weight that it’s not liable to be a bonanza for CRV bagholders. For every $1MM of COIN50, the frontpage of DeFi will enjoy about $200 of buy pressure.

NFA, but the saying goes Bitcoin pumps first, then ETH, then the rest of the market… if you truly expect this will play out and believe you are capable of timing the market, you may have a vehicle to do so. Good luck, traders…

Disclaimers! Author does not own COIN50 or COIN, but BTC, ETH, CRV, and smatterings of individual components of the COIN50.