“But Mommy and Daddy… what happens when they run out of letters?”

—A precocious child somewhere raised on the Curve Wars, probably

Prepare yourself for the two newest derivatives of a blue chip DeFi token with seemingly more wrappers than buyers.

Editor’s Note: If we’re going to be allowing three letter wrappers, which seems to be becoming normalized, prepare yourself for at least 26 ** 3 == 17,576 different permutations of $CRV wrappers. This presumes we just keep it at English glyphs. If that’s not enough, there’s a ton of miscellaneous Unicode characters we can tap into.

We for one can’t await next week’s impending launch of $弯ק🍆CRV

$vsdCRV

OK… you know how most degens just care about maximizing yield…

This is the premise behind a lot of the $CRV wrappers to date. Yield maxxing previously spawned a partnership to autocompound Stake DAO’s $sdCRV wrapper in Aladdin DAO’s Concentrator vaults to provide an autoyielding form of $CRV.

So… can we stop torturing the alphabet and move back to more wholesome pursuits, like particle physics and going back to med school, right?

Except, as it turns out, some of us aren’t here for the yields, but the governance power.

We’re gonna need a whole lot more letters…

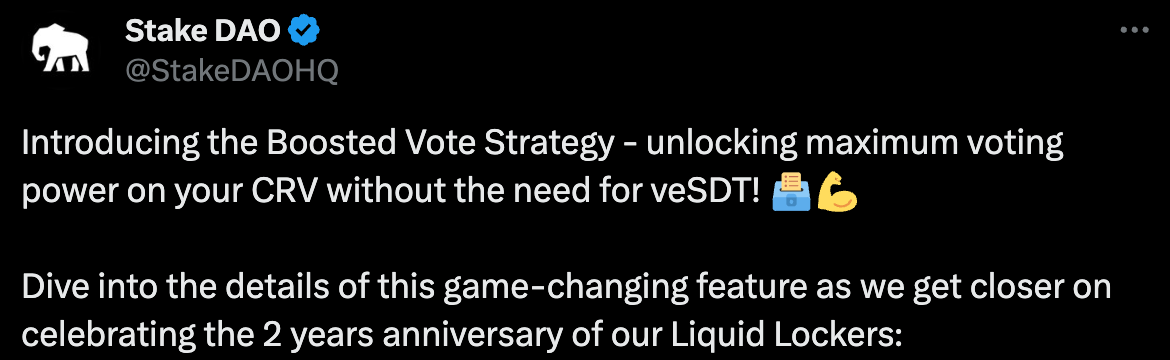

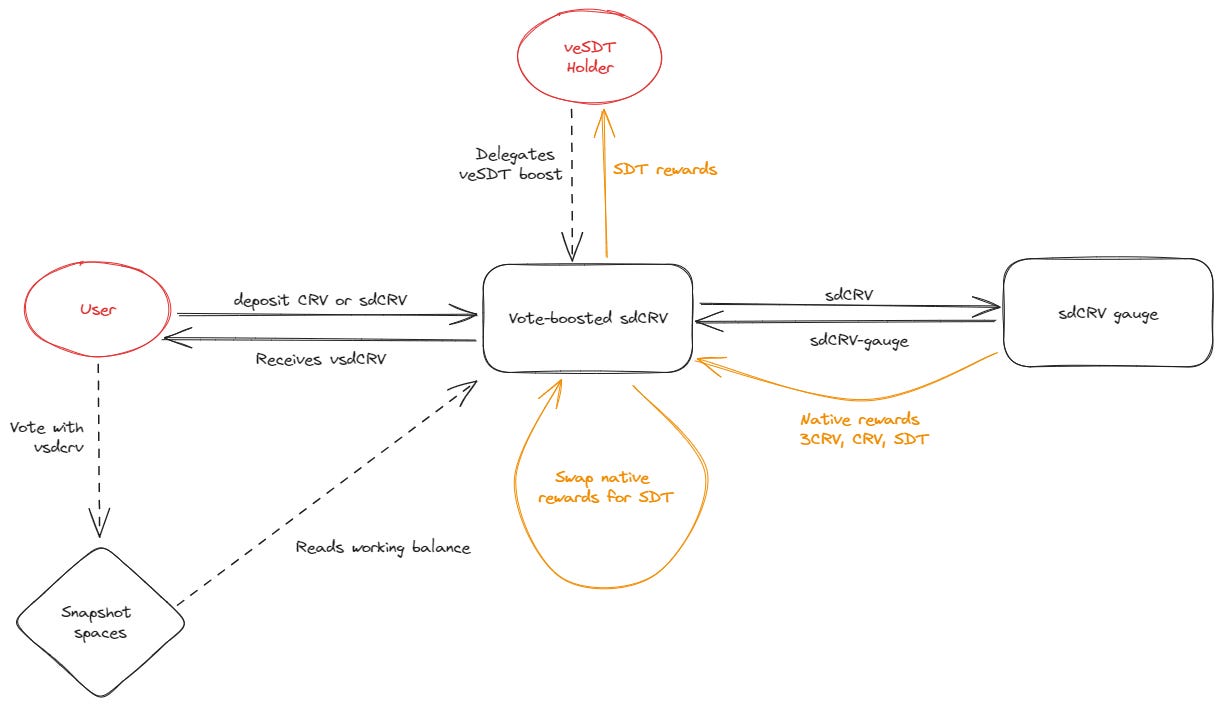

Last week Stake DAO introduced Boosted Vote Strategy and $vsdCRV, for users seeking to boost voting power on $CRV.

You give up your yields, and in exchange you get to maximize your boost. No need for staking SDT as veSDT.

For those still trying to make sense of it…

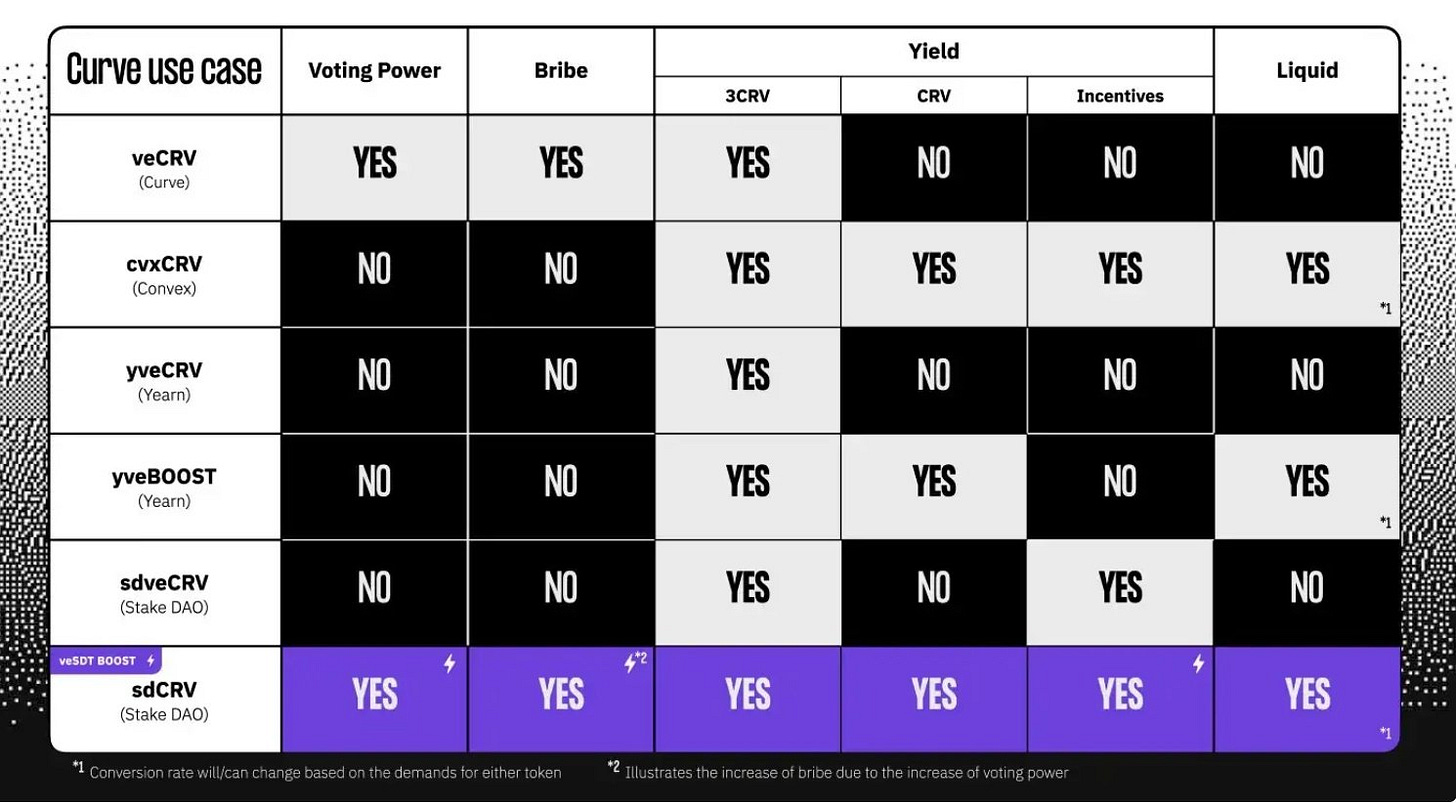

For the other tokens outside of Stake DAO, here’s how they handicap the playing field.

You might be asking yourself… “so if $sdCRV already offers voting power, then what’s the point of vsdCRV?” See… maximizing the voting power of $sdCRV requires locking Stake DAO’s SDT as veSDT to get the full boost, or renting boost from elsewhere. The $vsdCRV token is designed for users who want to max out voting power without needing staked veSDT, and are willing to sacrifice yields to do so.

We imagine most degens are here for the yields, so vsdCRV is likely of interest to major whales who can afford to have sufficient influence on governance that they seek to stretch their voting power. So arguably the new token is less interesting to retail, but a great read all the same.

Confused about everything happening around Stake DAO? This very lengthy thread is a great read covering the history of Stake DAO’s many products

Contents:

OnlyBoost (currently under audit)

Boosted Vote Strategy (soon)

If you’re looking for undervalued tokens which may be worth keeping an eye on during a hypothetical bull market, SDT may be worth keeping your eyes on… (NFA!).

$faCRV/$fcvxCRV

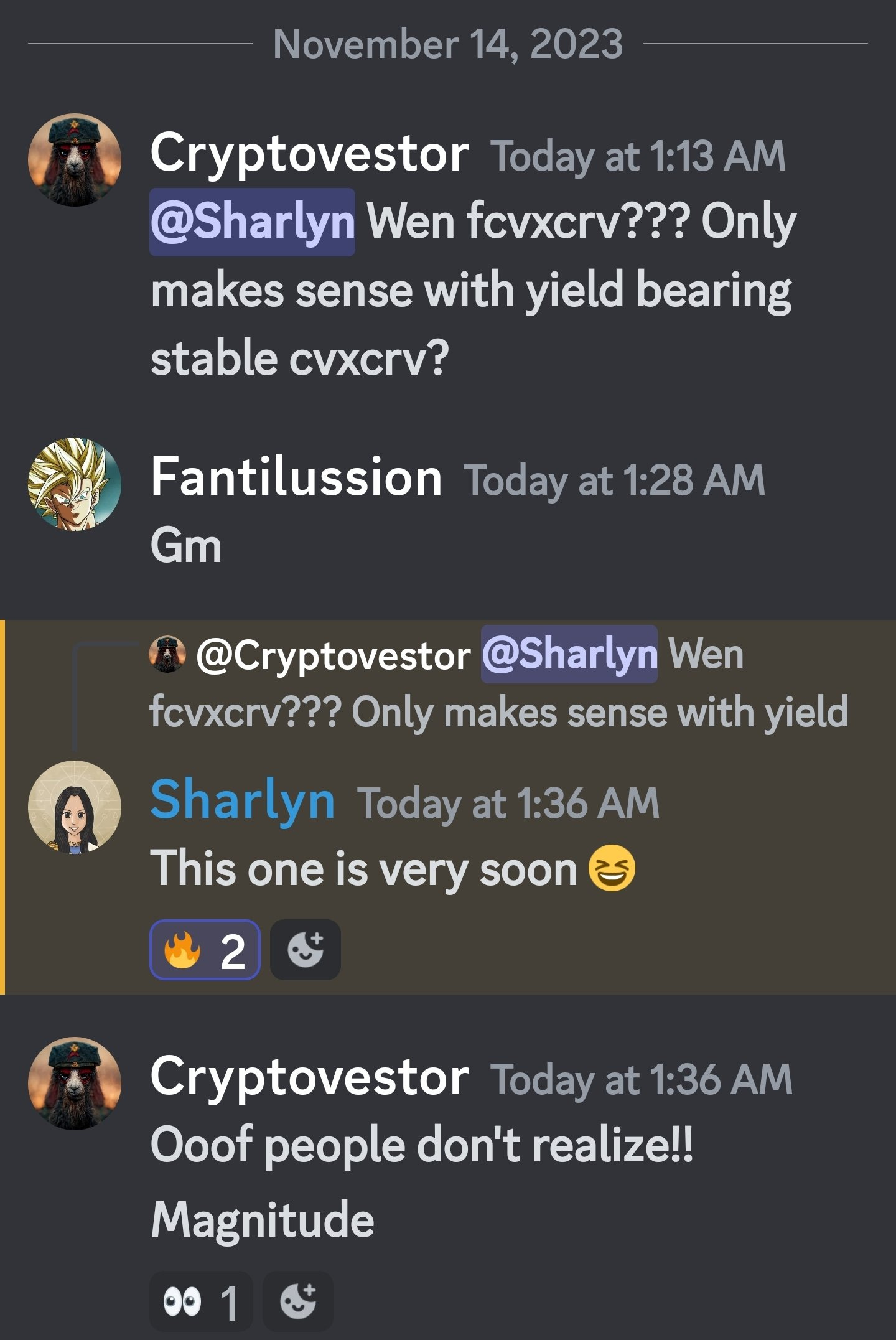

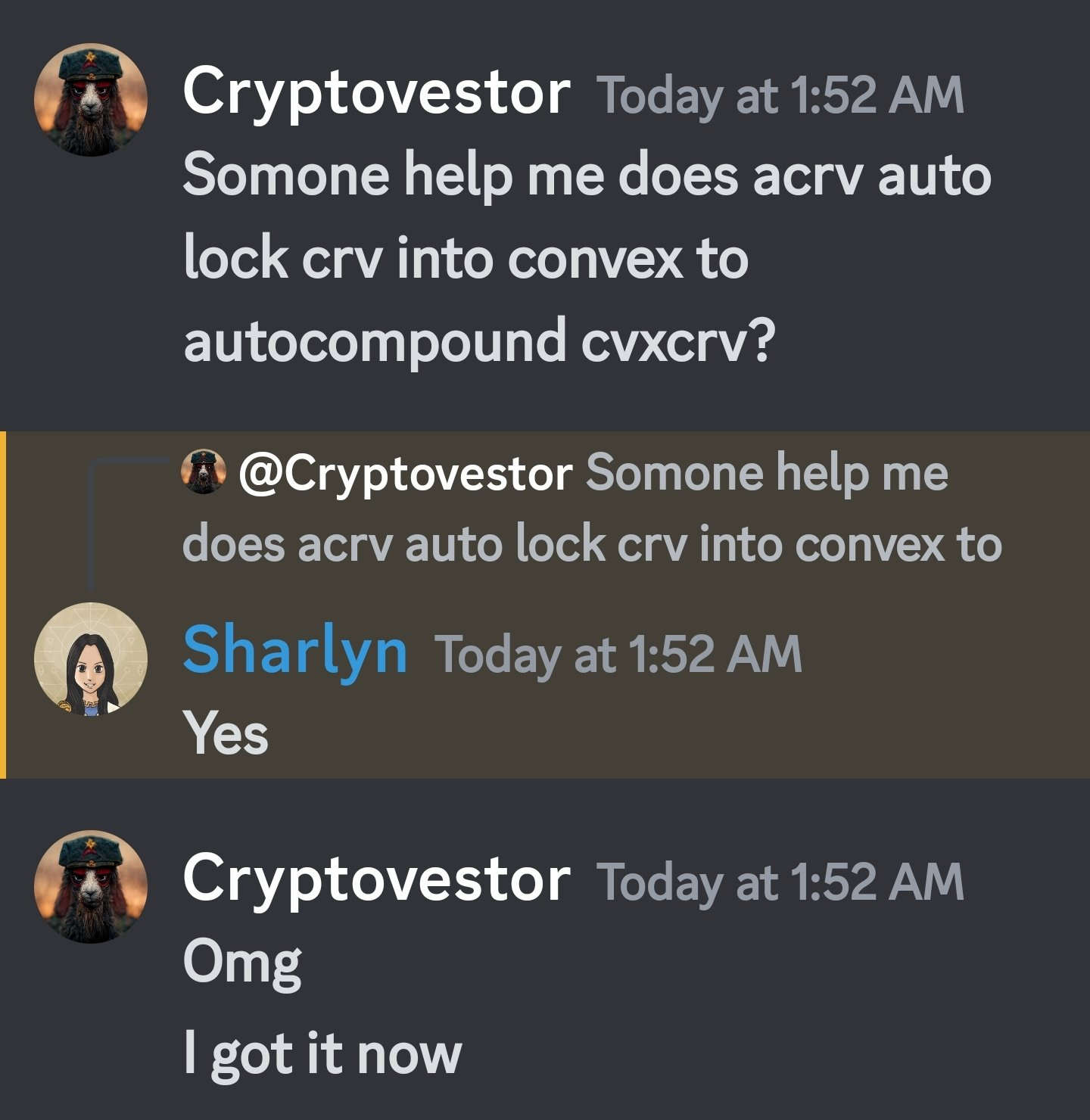

OK… one last forthcoming alphabet wrapper that’s been teased around the Aladdin ecosystem.

They describe the use case during a recent 𝕏 space.

Partway through, the A Team describes some of the issues with these yields in DeFi. If you earn 20% yield, but your token goes down 80%, you’re down bad, right? Most veterans of the Curve Wars are probably intimately familiar with this issue.

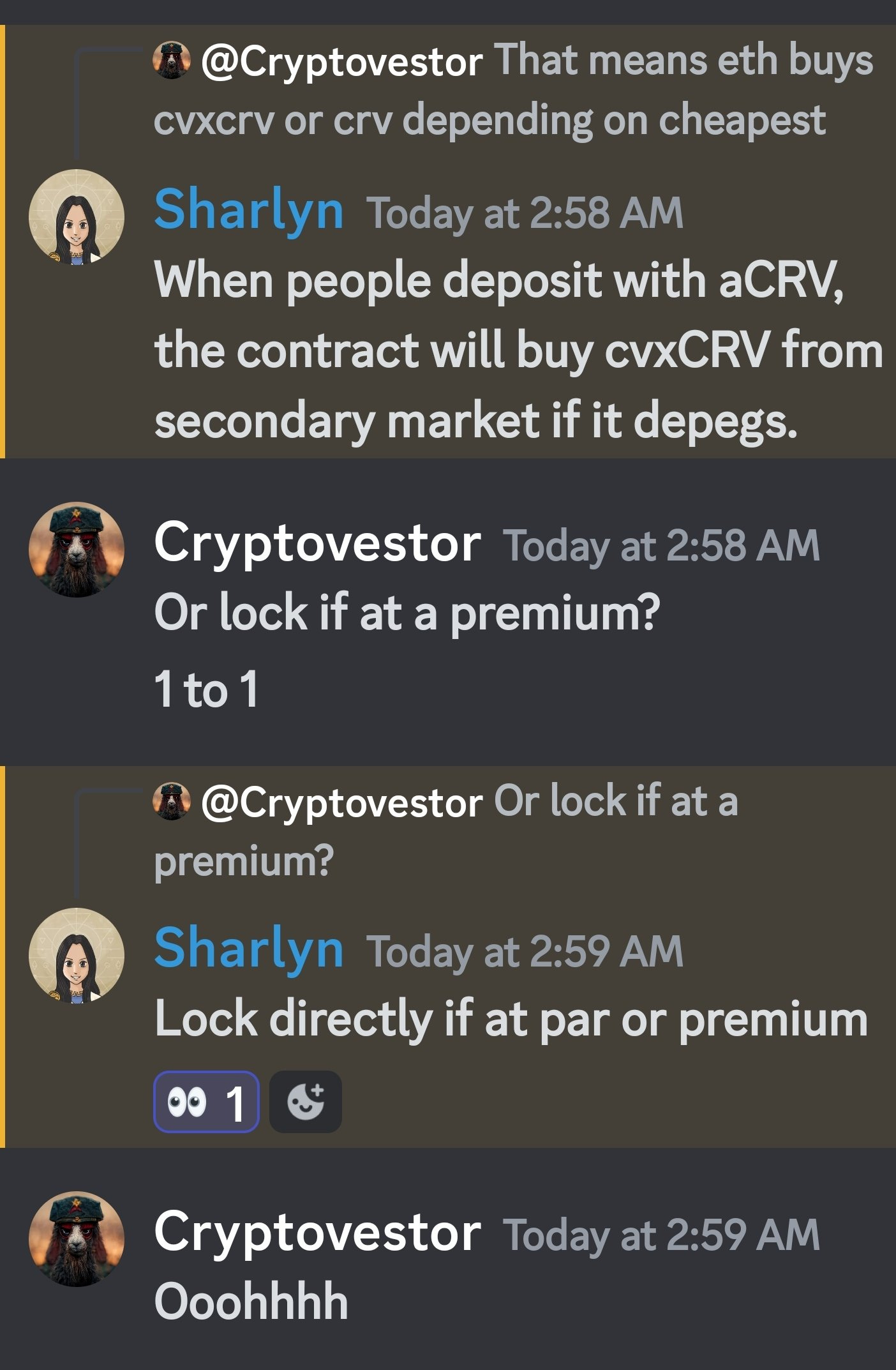

Protocol f(x), which first cleaved ETH into a leveraged version and what amounts to a stablecoin, has a solution. If you split a yield bearing token in this manner, you can still earn the yield on the stablecoin version.

In this manner, any number of tokens can be sliced and diced in interesting ways, and in particular they have their sights set on a Protocol f(x) version of $CRV.

The aforementioned 𝕏 space also discusses the importance of cross-chain strategies to allow for non-whales to participate.

As you can see, Aladdin DAO has lots of loose, irresponsible ideas about how to fit a Protocol f(x) token into the flywheel that makes sense, balance out the disparate Aladdin DAO offerings, and provide value. They also have a nice history of actually executing on their ambitions in elegant and sensible product designs.

Remember, of course, until anything is actually deployed onchain, it’s just idle speculation. We don’t even know what combo of letters it will adopt as a symbol.

We never read too much into crypto price movements, but worth noting that somebody likes something going on around the ecosystem. We’ll just drop this here…

Maybe has something to do with this?

Hmm… maybe time to start cleaving FXN into its stable and unstable components… and letting Stake DAO maximize its governance… and…

Disclaimers! Author has no stake in $弯ק🍆CRV, but otherwise has exposure to $cvxCRV, $sdCRV, $asdCRV, SDT, and maybe others, who can tell anymore…