November 15, 2022: BitScorn 🌽🌁

Is Bitcoin bridged onto Ethereum teetering?

Bridges are always precarious — you can lose funds while you bridge, your bridged token can depeg, and you find yourself unable to return. The front pages of the Rekt leaderboard are filled with bridge exploits.

Is wrapped Bitcoin teetering?

Specifically, we’re referring to Bitcoin wrapped onto the Ethereum mainnet at the moment — it’s sad, but it’s likely too late for the 16K wrapped Bitcoin on Solana, which are already down about 80%. Yet over ten times as many Bitcoin have found their way to Ethereum in search of yield.

Among wrapped Bitcoin, by far most popular is the 237K Wrapped Bitcoin ($WBTC), which is currently the 21st largest token on CoinGecko, representing about 1% of Bitcoin’s max supply. $WBTC is one leg of Curve’s TriCrypto pool, which natively provides hedged exposure to Bitcoin, Ethereum and Tether.

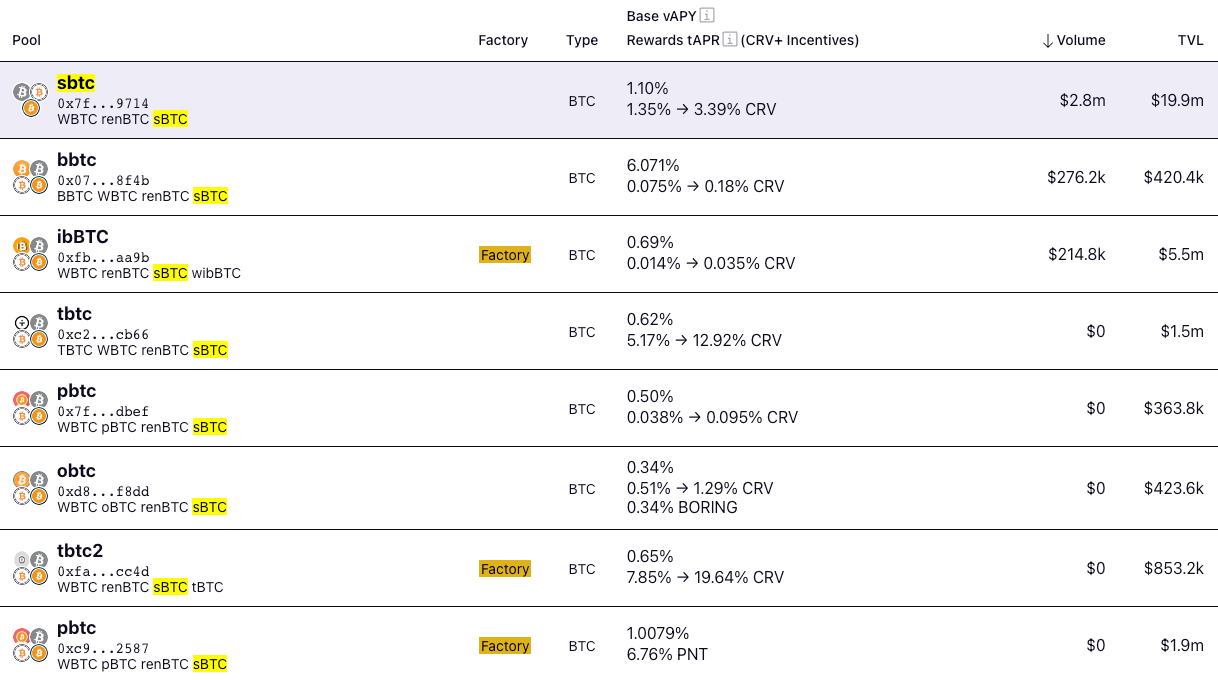

Smaller Bitcoin wrappers include Ren Protocol’s $renBTC (2336) and Synthetix’s $sBTC (557). These three were considered to have reliable enough peg mechanics that Curve created the sBTC pool, what amounts to a 3pool for wrapped Bitcoin. Like 3pool, sBTC could be thought of as a means of derisking and providing fungibility for Bitcoin on Ethereum.

This base pool holds over 1K wrapped BTC (~$20MM USD) — with about two thirds of $sBTC in existence parked in this pool. Though far smaller than 3pool, a half dozen metapools have been built against this base pool. It’s difficult to find yield on $BTC, so Curve’s infrastructure serves as a key platform for Bitcoin on Ethereum.

Wrapped Bitcoin on Ethereum came into the crosshairs after the collapse of the FTX scam (see that NYT… it’s not difficult to call a scam a scam). In particular, we saw a wave of FUD hit $renBTC, then immediately shift to $WBTC, all in the span of a few blocks.

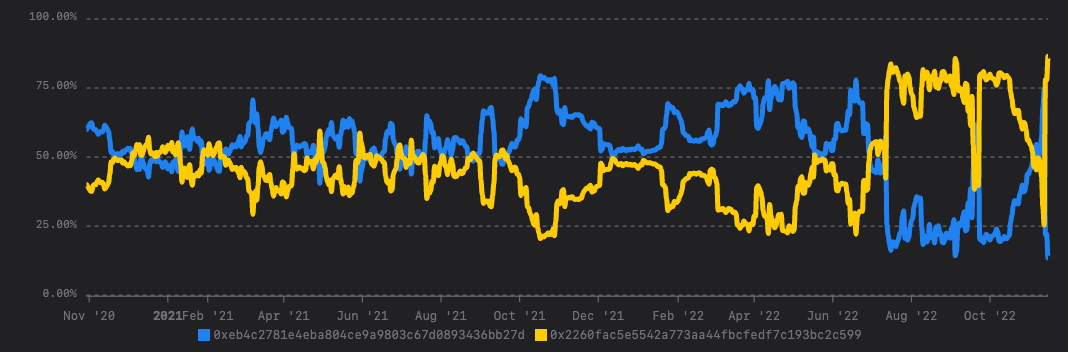

For context, here’s the history of the ren pool, an ordinarily sleepy pool which holds both $renBTC and $WBTC.

The pool has bounced back and forth through its history. It was mostly balanced until October 2021, when it became disproportionately $renBTC (blue). By August of 2022, it would flip back toward $WBTC (yellow). Right before the FTX collapse, it had drifted closer to peg.

It’s worth noting both tokens have historically seen redemptions function normally. $renBTC bridges through the Ren Protocol, and $WBTC is primarily managed through BitGo. Ren Protocol had some concerns about possible blacklisting a few weeks ago, which they attributed to an error in the API setting and resolved.

The sBTC pool has a pretty good A parameter, so these shifts never really affected the exchange rate too badly. At 85% imbalance, the exchange rate is about 1.000 to 1.005

A high A parameter is used when the peg mechanic is pretty good. In this case, a heavier depeg just means a whale can easily claim an arbitrage opportunity on a large enough trade, which quickly brings it back towards peg.

Let’s zoom into the past month, where we saw $renBTC/$WBTC had returned to parity. In the past few days, in the wake of the FTX collapse, we again see volume spike about 10x.

Accordingly, its utilization also jumped (read: heavier fees for Curve):

The specific depeg was quite interesting in that it ran in both directions. Initially we saw some Alameda FUD around $renBTC hit, causing the pool to quickly start drifting towards too much $renBTC. Then word started spreading that FTX could mint $WBTC, and it quickly reversed, imbalancing in the opposite direction.

Regarding the first movement, is Ren safe? Alameda bought Ren in 2021, which caused some concern that Alameda held the keys.

Anon sources knowledgeable about the deal were unable to divulge specifics, but informed that Alameda received no special access to the team or the bridge. Ren Protocol issued a statement:

Whether or not the questions about $renBTC were credible, it would at least take a backseat as concerns about $WBTC began to spread.

BitGo would also issue a statement.

We’re not qualified to judge whether these tokens are safe or not, but wish to review this just to bring awareness to all of you who may have exposure.

Keeping your Bitcoin as anything but Bitcoin always carries risks. Bitcoin hacks are a sticking point for the “don’t sell a single Satoshi, they’re just trying to get your bitcoin” crowd. Yield implies risk, so even modest yields for wrapped BTC carry some risk.

By now we hope everybody has learned the perils of keeping Bitcoin on exchanges. CEXes are undergoing a lot of scrutiny at the moment. They may be playing games of hot potato with their reserves. Who knows which will be the next to disappear.

So too should you be wary of Bitcoin products offered by exchanges. If an exchange goes under, will their wrapped Bitcoin hold peg? In the list below, we see BBTC (Binance) and HBTC (Huobi) — both of which have been targets of concern.

Given the resilience of DeFi, we do tend to feel safer with true on-chain offerings, so be on the lookout for such services.

Also, one final interesting note on the subject of Bitcoin. FTX had heavy liabilities regarding fake BTC they sold, but 0 in assets (owned no actual BTC). This means that for some period of time, the amount of Bitcoin available for sale on the market was greater than the cap would imply.

Given that the amount of Bitcoin being traded is reduced, is this good for Bitcoin? You decide as always frens. Stay safu!

Disclaimers! Author has exposure to TriCrypto and sBTC pools, and therefore also any underlying assets.