$TBTC

They don’t miss, frens!

Llama Risk gives an unbelievably thorough review of tBTC, with the most flagrant red flag being the “high proportion of supply in LLAMMA compared to on exchange.” A very thorough and compelling read.

As goes $tBTC, so goes $crvUSD…

$PRISMA

Disclaimer: Author is an investor in $PRISMA

May we all be so lucky as to launch like Prisma. To ring in the historically bullish month, the protocol released their new $PRISMA token.

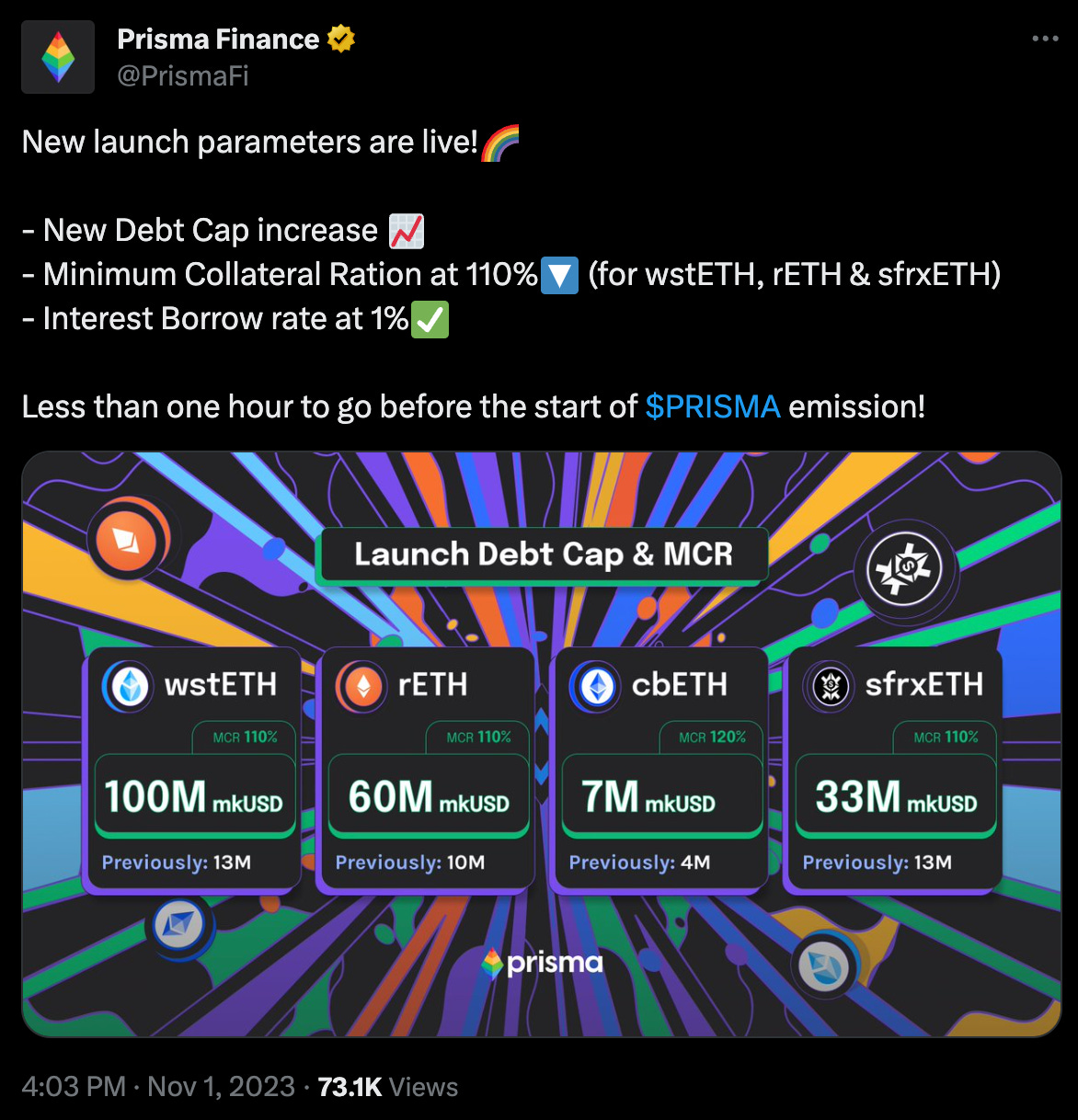

They also raised many of their debt ceilings and otherwise adjusted parameters for a smooth takeoff.

Convex also went live with their wrapper within an hour.

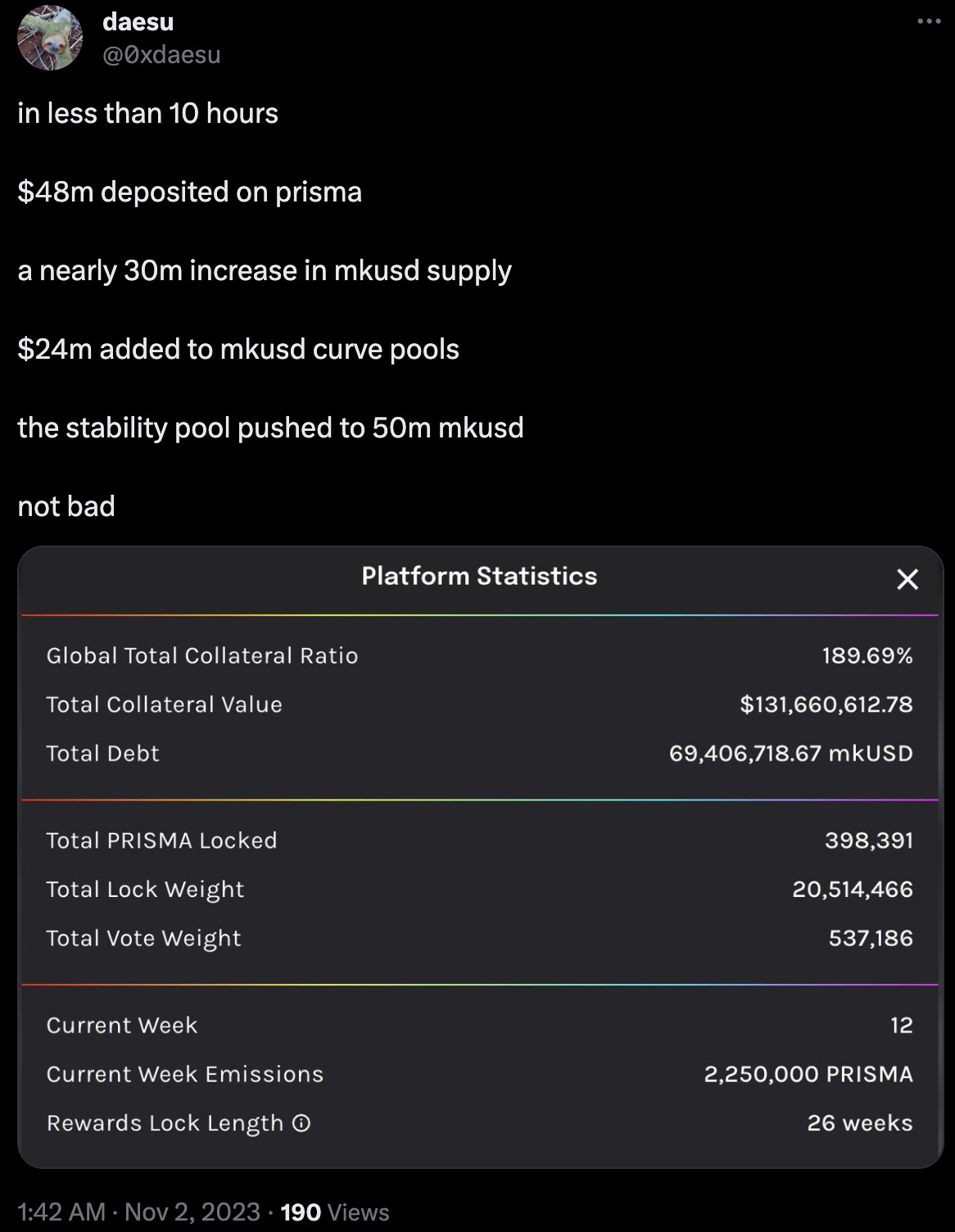

The rest, as they say, is history. The protocol’s TVL would quickly smash through a whopping $250MM.

Additionally, we saw a rush of activity as speculators mobbed to cash in on the frenzy.

Even the $mkUSD stablecoin pumped amidst the rush.

What should you make of it?

There’s a fairly steep learning curve around Prisma Finance. We imagine some crypto denizens, given the choice of educating themselves and yeeting in their entire net worth, will choose the latter every time. For the more cautious types, let’s try to explain the various questions we’ve seen here.

Leverage

One highly compelling value prop of $mkUSD for degens is the ability to lever up… keep your ETH, then use your dollars to buy a lot more ETH.

You may also be able to do this with its progenitor, Liquity’s $LUSD, but Prisma only accepting LSDs to mint means that your collateral has a tendency to increase in value while you wait… always an exciting proposition.

Of course, many other lending protocols use LSDs, so plenty of other leverage options exist. In this newsletter we naturally talk a lot about Curve’s $crvUSD and Protocol f(x)’s $XETH, and there’s surely dozens more outside the flywheel. Where does Prisma fit in?

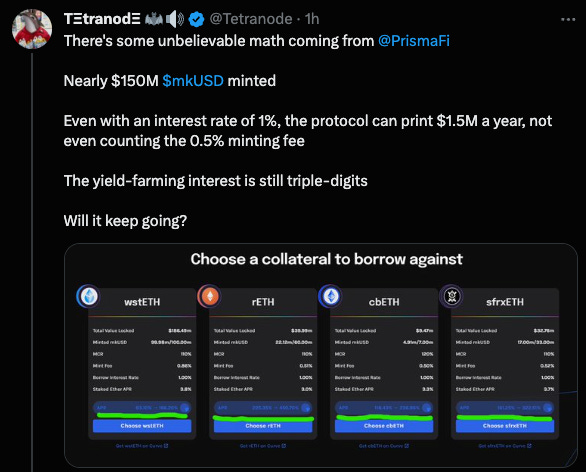

For starters, the introductory rate for Prisma is extremely friendly.

Note of course that staked ETH tends to earn around 3.5%, so the “literally free borrow” analogy is apt. Enjoy the below market average rates while they last.

Against the broader market, it’s well below the still elevated variable borrow rate of $crvUSD. Where $crvUSD’s borrow rate whipsaws to protect the token peg, $mkUSD’s is set by the DAO.

We expect this fee is a loss leader to get the protocol off the ground, and that it will eventually be moved towards the market rate. Yet this offer is compelling, because DAOs are highly public and deliberative, so you can imagine such rate increases will be foreshadowed well in advance.

The other notable fees are a minting and redemption fee. In other words, for users, you will not want to open and close positions willy-nilly, but will be best off if you plan to park your funds at let it ride.

Far more about fees in their docs: https://docs.prismafinance.com/protocol-concepts/fees

Liquity

There’s an irony to Prisma ascending while its forerunner Liquity is continuing its turn at the bottom of the barrel.

September 25, 2023: When it Rains 🌧️☔

Last week we looked into some interesting activity on a few pools, like $LUSD, $cvxCRV, $crvUSD, TriCRV, Base Rewards, Silo and much more. One weekend later, and each of these stories has some big updates. Liquity Last weekend, we surmised the $LUSD activity was due to users panicking about the BSC $LUSD implosion and accidentally selling $LUSD.

As per the above article, one of the issues facing Liquity at the moment is redemptions. Ordinarily in DeFi lending protocols, the challenge is in managing your collateral ratio. If you keep your position above 100% + whatever buffer, you’re usually safe.

However, at Liquity, users have been redeeming with such ferocity that even well-collateralized tranches are under attack. Users with over 200% collateralization have nonetheless found themselves next in queue to see their position redeemed, causing users to jump ship for friendlier pastures.

Token Brice, who is simultaneously hard at work saving another stablecoin $GHO, offered an argument for why this is not the end of Liquity.

I’d asked Prisma, if they’re “just a Liquity fork” as haters scoff, then are they also at risk of a similar issue with redemptions?

The team replied that they are working on some novel modules, currently under audit, which they believe will improve the experience for both users and LPs in the stability pool. We haven’t seen these innovations ourselves, so we’re eagerly waiting to see.

For more on the use case, check this thread by the Big Chungus himself:

Tokenomics

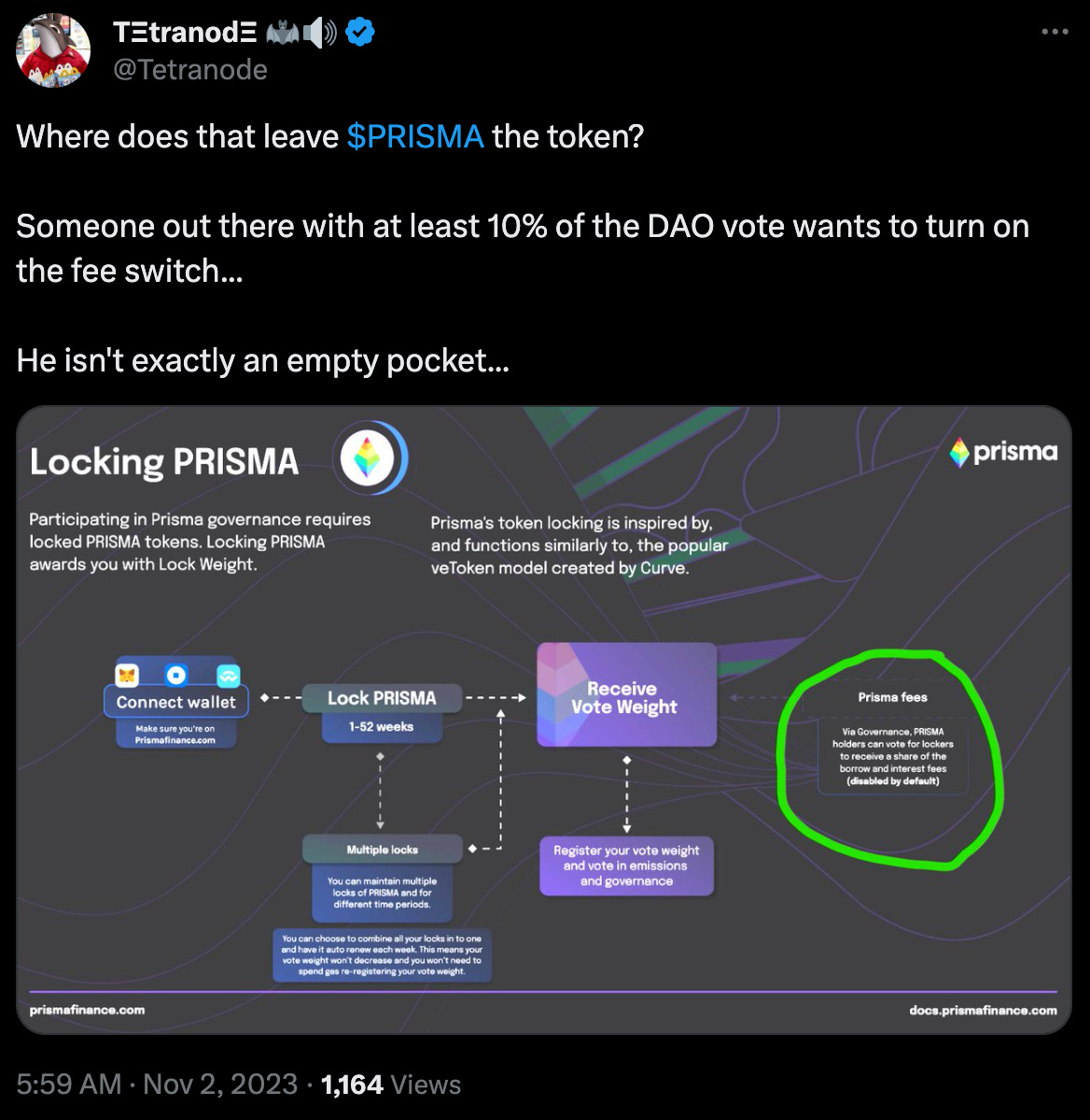

One of the major differentiators between Liquity and Prisma is the veTokenomics layer the team has embedded atop the protocol. Much of the tokenomics had been shrouded in mystery until more details got dropped recently.

However, even in the absence of details, the “who’s who” roster of early investors and outstanding work building hype for their airdrop offered hints that the team was taking tokenomics quite seriously.

From the article, we see the early release schedule will be primarily aimed at emissions (62%), with 2,250,000 tokens being released each week for the first month.

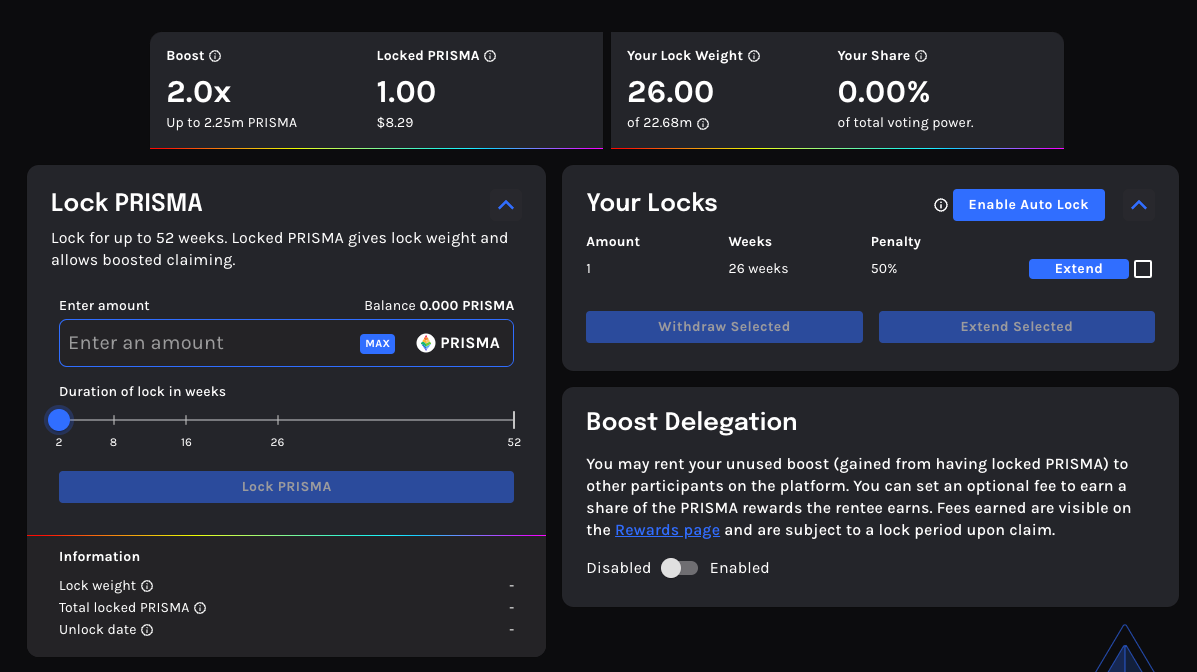

Locking $PRISMA gives users the ability to direct PRISMA emissions and vote on DAO proposals.

Notably, most early recipients have their PRISMA locked and gradually released, which add some hurdles to dumping.

With the UI live, we can already see some innovations atop the typical veTokenomics experience.

For one, they include a “freeze” function to autolock your $PRISMA, so you don’t see the depreciation in voting power each week like veCRV. Additionally, they include an early exit mechanism with a steep penalty.

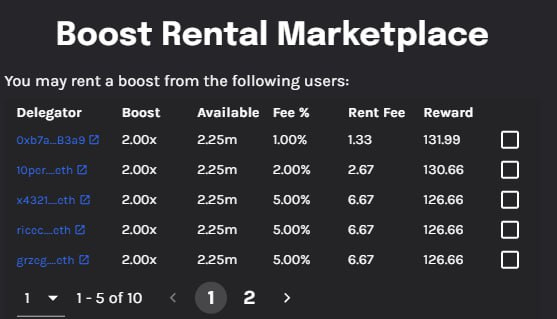

Another interesting facet is the Boost Delegation enabled out of the gate.

This gives lockers an easy reward for locking as opposed to dumping. Early lockers. are peddling boosts for ~3%

Finally, the early yield farming opportunities for $PRISMA are bespoke, keeping degens as net buyers of $PRISMA to access the various high yields.

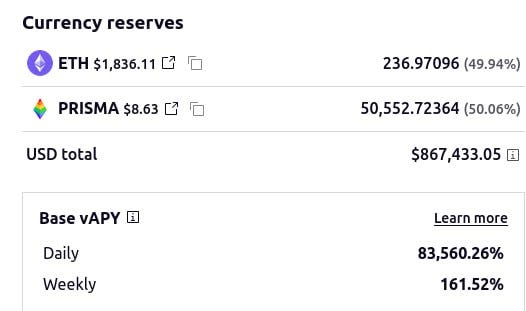

Of course, early yields tend to drop, but these are holding up pretty good so far.

The Curve pool doing numbers too.

How should you play this? No financial advice to follow (nor precede)...