November 20, 2023: Repeg Season

DAOs act to bolster decentralized stablecoins $crvUSD, $GHO, $mkUSD, $fETH

Flash forward to the new year. You wake up groggy from staying up late to party the night before. Head pounding, you look at your up-only credit card bill starting from Black Friday and racking up throughout the holiday season.

Woof! Did you need those subwoofers?

You casually resolve to get your financial health in order for 2024…

It turns out, all the major decentralized stablecoins have been engaging their communities to have some serious conversations about restoring balance to their stablecoin. DAOs are all busy taking action to bolster the decentralized stablecoins, with Curve’s $crvUSD and Aave’s $GHO in particular examining their peg.

$crvUSD

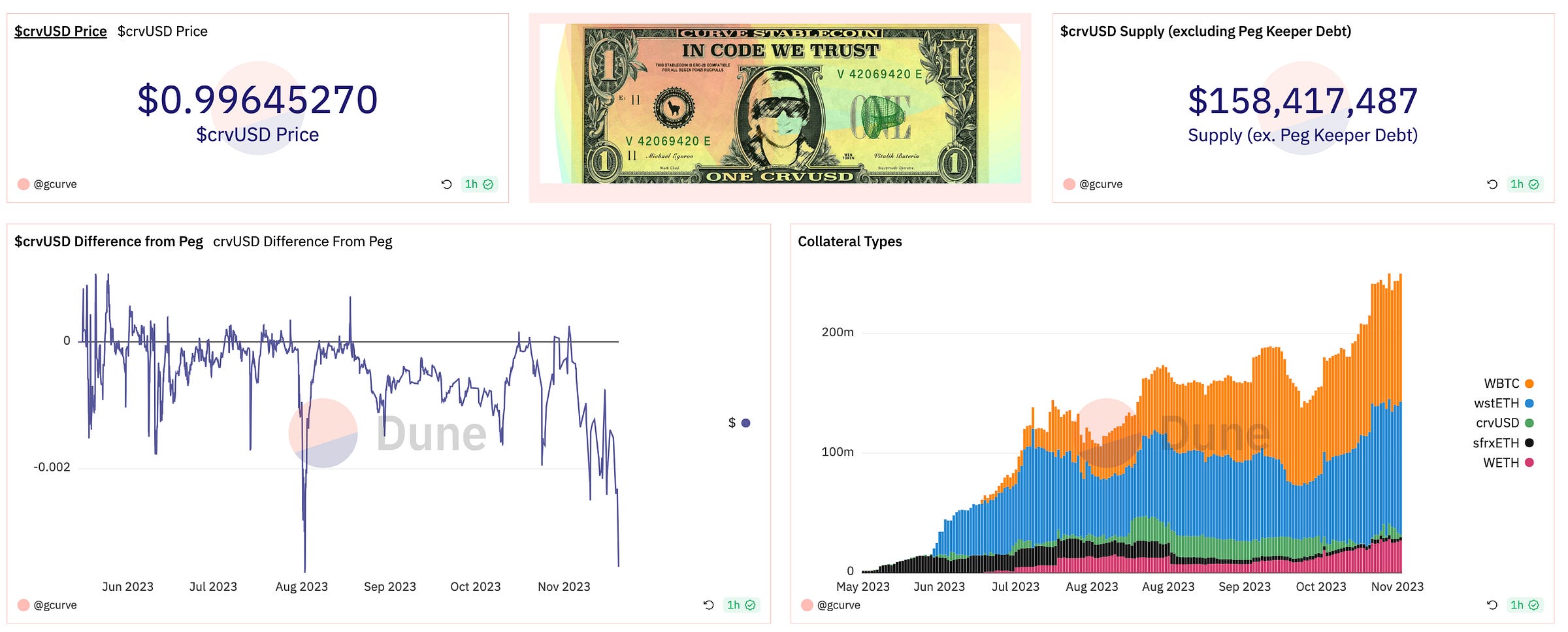

The Curve decentralized stablecoin has been holding peg so strong since its outset that it’s become a reliable warhorse. However, the peg has shown signs of buckling in the past few weeks. A $0.0035 discount approaches the best discount we’ve seen since the coin’s inception.

The team is actively monitoring the situation per Telegram. It’s possible that the DAO could intervene, but at the moment the team is watching to see if the automated processes do the trick without intervention.

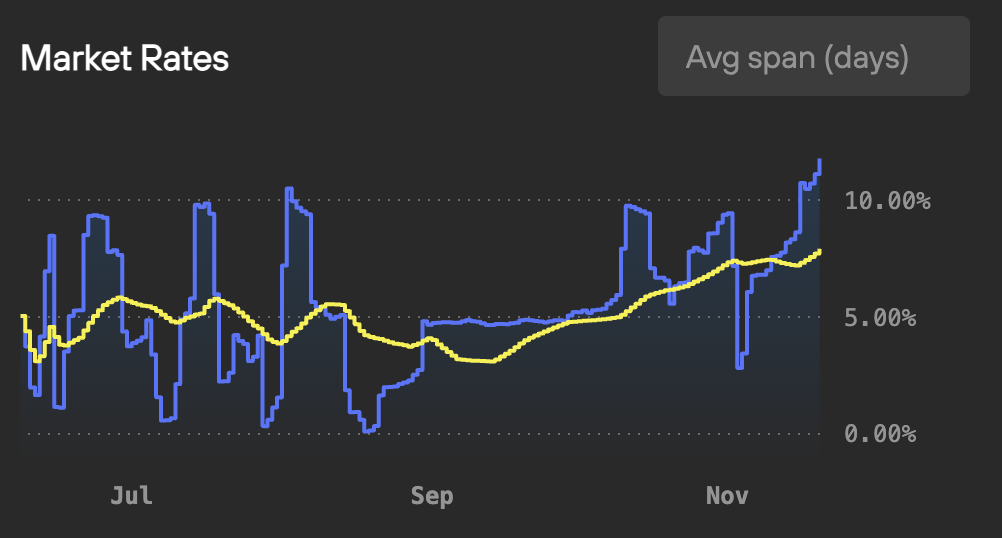

Warning to borrowers, though. Action to correct the peg, whether automatic or manual, means a forthcoming hike in $crvUSD’s already steep borrow rates.

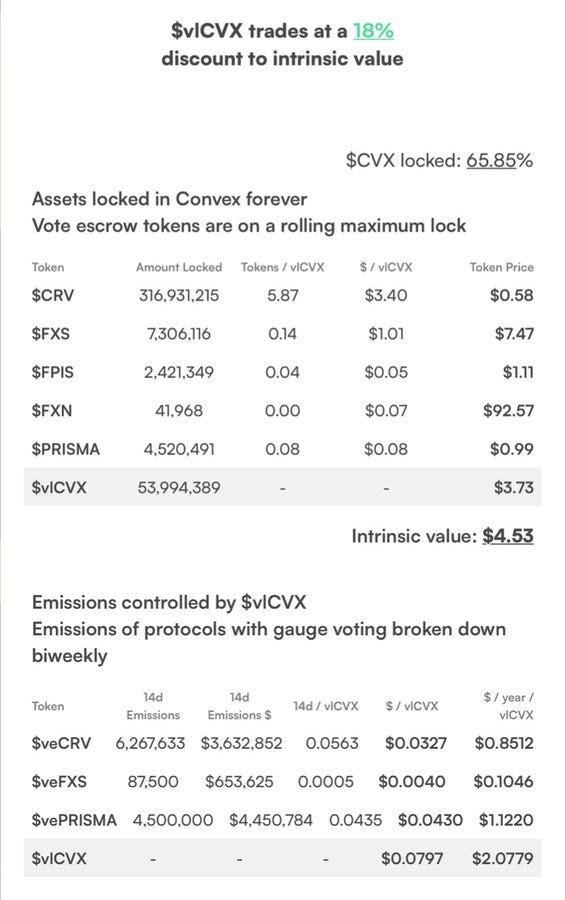

Fortunately the elevated $crvUSD borrow rates are in line with the broader market equilibrium. Despite the escalated rates, we’re not seeing a major crunch in $crvUSD supply, which is still sitting around all time highs north of $150MM

An Angry User requested thoughts on what could be done to 10x the market cap, to get $crvUSD past a billy before 2024. The answer lies not so much in the borrowing side, where most markets have not hit their generous debt ceilings. The answer is more adoption of $crvUSD across the DeFi ecosystem.

At the outset of $crvUSD, the liquidity sink for $crvUSD was Conic, but since the hack Conic has been back to the drawing board, with relaunch not expected until 2024.

Picking up their slack has been Silo Finance. Silo’s been heavily incentivizing the Silo ecosystem with attempts to become the replacement liquidity sink. With $300MM in TVL, the team is focused on how to convert this TVL into borrows.

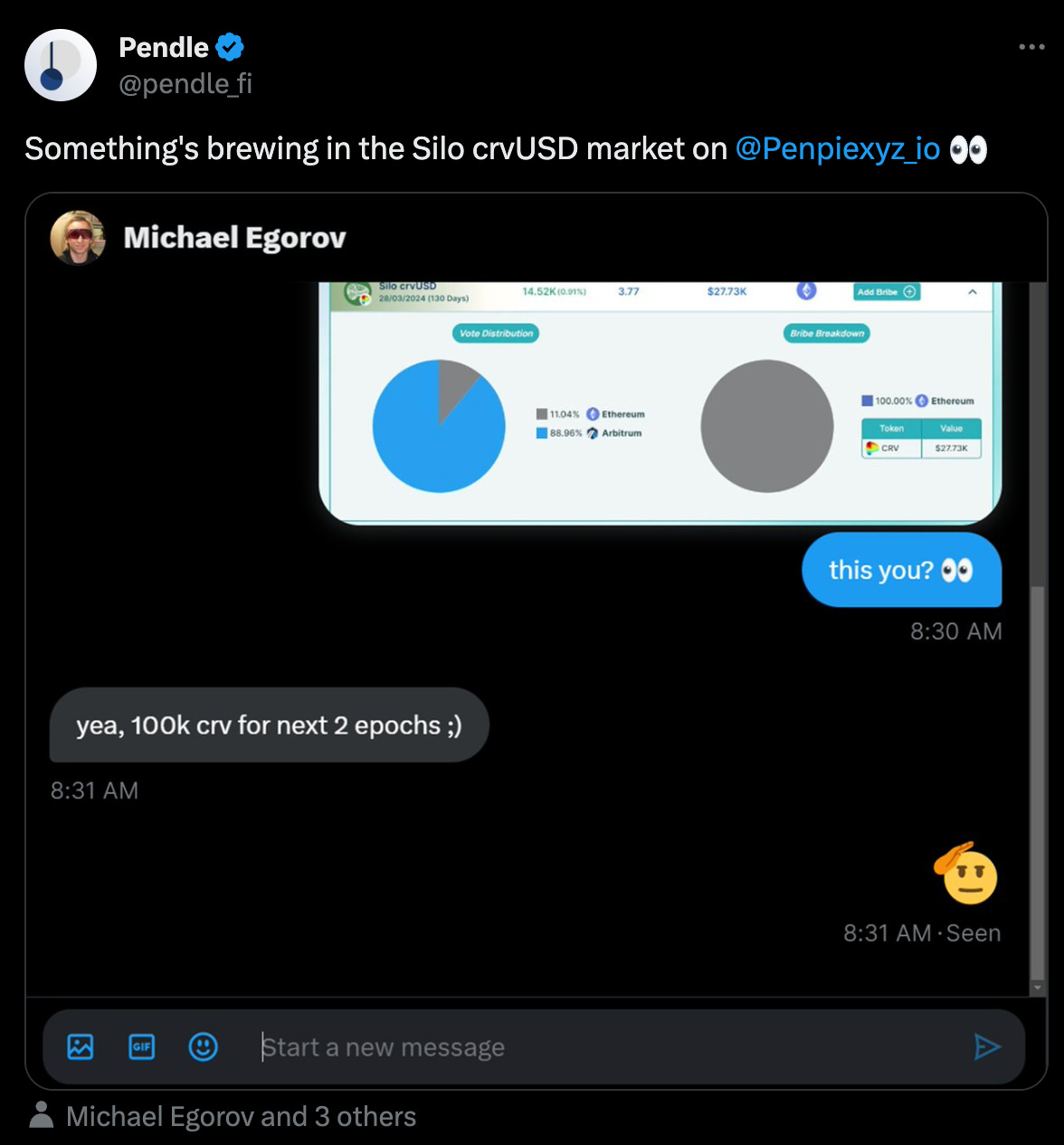

Silo’s been working with yield trading platform Pendle to allow users to trade on potential yield fluctuations on $crvUSD rewards. At the moment, the Silo $crvUSD is superlative among stablecoins:

Follow the money, anons (NFA)

See also…

At any rate, $crvUSD maintaining high TVL amidst high borrow rates is hardly the worst problem for the DAO. Trading volumes are fueling a bonanza in protocol fees.

For more on $crvUSD, check this great thread:

$GHO

Elsewhere in the world of decentralized stablecoins, Aave’s $GHO is fighting to push the peg back to $1.

Aave’s stablecoin launched without any attempt at instituting a peg stability module, instead aiming for growth. Now, the team is focused on restoring peg.

The team has actions to back up their words. After debate, the team unanimously approved an increase to the borrow rates.

They’re also discussing some upgrades to the safety module which could help benefit the $GHO peg.

Incidentally, the governance is also taking a temperature check on onboarding $crvUSD onto v3. The more DeFi protocols work together, the more assured we are about the space.

Before the weekend the team announced they were creating a parent entity Avara, and the various Aave projects and acquisitions will exist under this umbrella.

Prisma

The newest stablecoin in the decentralized stablecoin field, Prisma’s $mkUSD, is itself keeping busy with early tuning.

As a fork of Liquity’s $LUSD, the team has been very conscious of the issues facing the highly decentralized stablecoin. Fortunately for Liquity, the coin’s intentionally looser peg has not suffered peg issues, keeping adequately in the ballpark of a dollar for the duration.

But what has it cost Liquity to achieve its soft peg? Everything… or at least, requiring borrowers over-collateralize their troves in excess of 200%.

Prisma’s $mkUSD is aware of the issues facing Liquity and have been working on what they describe as “innovative” modules under audit to help avoid the need for such stark over-collateralization. Their early peg has also been within a decent range.

At the moment, Prisma’s new DAO is voting on some new governance proposals which could shape the early evolution of the protocol.

While Prismaposting, the famed rabbit-whale took a victory lap, contrasting the natural intelligence of Prisma investors with the less natural intelligence on display at OpenAI.

For more updates on the Prisma ecosystem, reference the recent interview with Richard on Leviathan.

$fETH

A final quick note, as we hope to do a more in-depth piece on it soon, but if you want a stablecoin with seemingly unstoppable peg mechanics, you could do a lot worse than Protocol f(x) pegging a “stablecoin” to the “volatility” of Ethereum. The relatively boring market has proved to be a godsend to the stability of the stablish token.

We’re not offering financial advice here, but if you’re shopping some Black Friday discounts, it might pay to educate yourself on why a certain corner of crypto is so giddy over Protocol f(x)’s FXN token and its wild run.

Plus the ripple effects…

Stay safe frens!