The much awaited StableSwap factory is live! The factory has already seen 22 pools launched through it, mostly people testing it, but a few already live and actively enjoying their oracle.

Rate Hikes

It’s like Powell… but on the blockchain…?

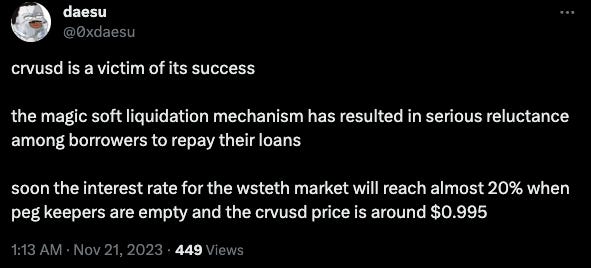

What’s going on here? At the macro level… there’s too many people who want to borrow $crvUSD. Even despite high interest rates, borrow rates across all of DeFi have spiked, and $crvUSD rates have drifted upward in true free market fashion.

For $crvUSD, you have to pay 12.46% to borrow wstETH! Woof!

Yet the stablecoin still finds more willing minters than redeemers. The token’s total supply remains near all-time highs, even despite downward pressure on the price of $crvUSD.

It’s presumably yield farming opportunities make it lucrative. From the premia column on Curve Monitor, you can earn still earn 94.02% (!) after you subtract out this rate, if you do the highest yielding strategy tracked by the Curve Monitor.

In this case, the tooltip reads:

Premia for wstETH is max yield (106.48%) from factory-crvusd-9 farmed on Curve (max boost) minus the borrow rate (12.46%)

Top 5 yields:

Curve (max boost) factory-crvusd-9 106.48%

Convex crvUSD-STBT 41.90%

Curve (max boost) factory-crvusd-22 27.20%

Curve (max boost) factory-crvusd-7 26.30%

Convex crvUSD/GUSD 23.07%

Respectively, this is farming in the $crvUSD pools for $MAI, $STBT, $STBT, $SUSD, and $GUSD. While your risk tolerance may vary, it’s a decent premium to put your funds at risk.

Needless to mention, it can cost a lot of money in terms of gas costs to open a position, and once you have it open you are relatively comfy in terms of liquidation protection, so why not let it ride through the high interest rate times?

The core problem here is caused somewhat by $crvUSD rates being too low relative to the market. Even at 13% interest rate, it’s still worthwhile to print $crvUSD and farm, so the market keeps printing, and $crvUSD floods the market, making it cheaper.

$crvUSD therefore needs a hike in interest rates to slow this vicious cycle.

Unlike Powell and the Fed though, the borrowing rate here has relatively limited human intervention. It’s a simple math formula, with three variables and three constants to help shape these variables.

You can look up the precise monetary policy in the Monetary Policy contracts. The newest proposal also explains the guts of how these rates are calculated quite well. At essence:

rate = rate0 * exp(depeg / sigma) * exp(- pegkeeper_filling / (total_debt * target_f))or prettied up…

At the moment, there are very few human inputs. The three variables are derived from data pulled onchain:

Depeg:How badly is $crvUSD depegged (up or down)Total Debt:How much debt in the systemPegkeeper Filling:How much debt do Peg Keepers hold

Keeping rates calculated automatically via onchain inputs reduces the need to listen to Powell speeches and try to prognosticate where the market is moving based on his mood. It becomes an incontrovertible formula, a nice upgrade from TradFi.

Meanwhile the other variables “rate_0,” “sigma,” and “target_f” can be thought of as scaling factors for the variables and entire system. You’ll note the formula boils down to three numbers multiplied by each other. If the various exponent values are zero (because depeg is zero or peg keepers are empty), then the exponents evaluate to “1” and the formula reduces to just rate_0, making it the easiest constant to plug into your mental math.

These constants can all be set by the DAO, which allows the DAO to operate in the manner of the Fed: pushing and pulling levers to bring the system in line with changing market conditions.

We’re in a situation where we want to adjust the rate_0 parameter, which affects the default market rates in the base case. This had been set at 8.6% and 5.8% for staked and unstaked assets, back when markets operated at lower rates.

These base rates are poised to spike to double digits!

You might complain that we’ve just rebuilt the Fed onchain, by which a cabal of insiders has excess power to arbitrariliy adjust interest rates. You’re partly right, but human intervention is not intended to be the permanent state!

Unlike the Fed, $crvUSD plans to decentralize this power further. Once $crvUSD has been more thoroughly battle-tested, we should expect to see the rate_0 factor governed automatically by a smart contract, which will further reduce dependence on human whimsy.

If you’re looking for to play with these formula, we recommend the tool built by 0xstan, which allow you to jiggle these parameters and see the results.

Like it or not, $crvUSD is going to continue spreading throughout DeFi.