November 26, 2024: Votemarket v2 🗳️🐘

Stake DAO's Votemarket v2 improves incentives for voters and managers

Last week Stake DAO launched Votemarket v2 directly into the path of an oncoming bull run.

With the bullish euphoria finally subsiding, it’s high time for whomever’s left in this space to appreciate the new launch.

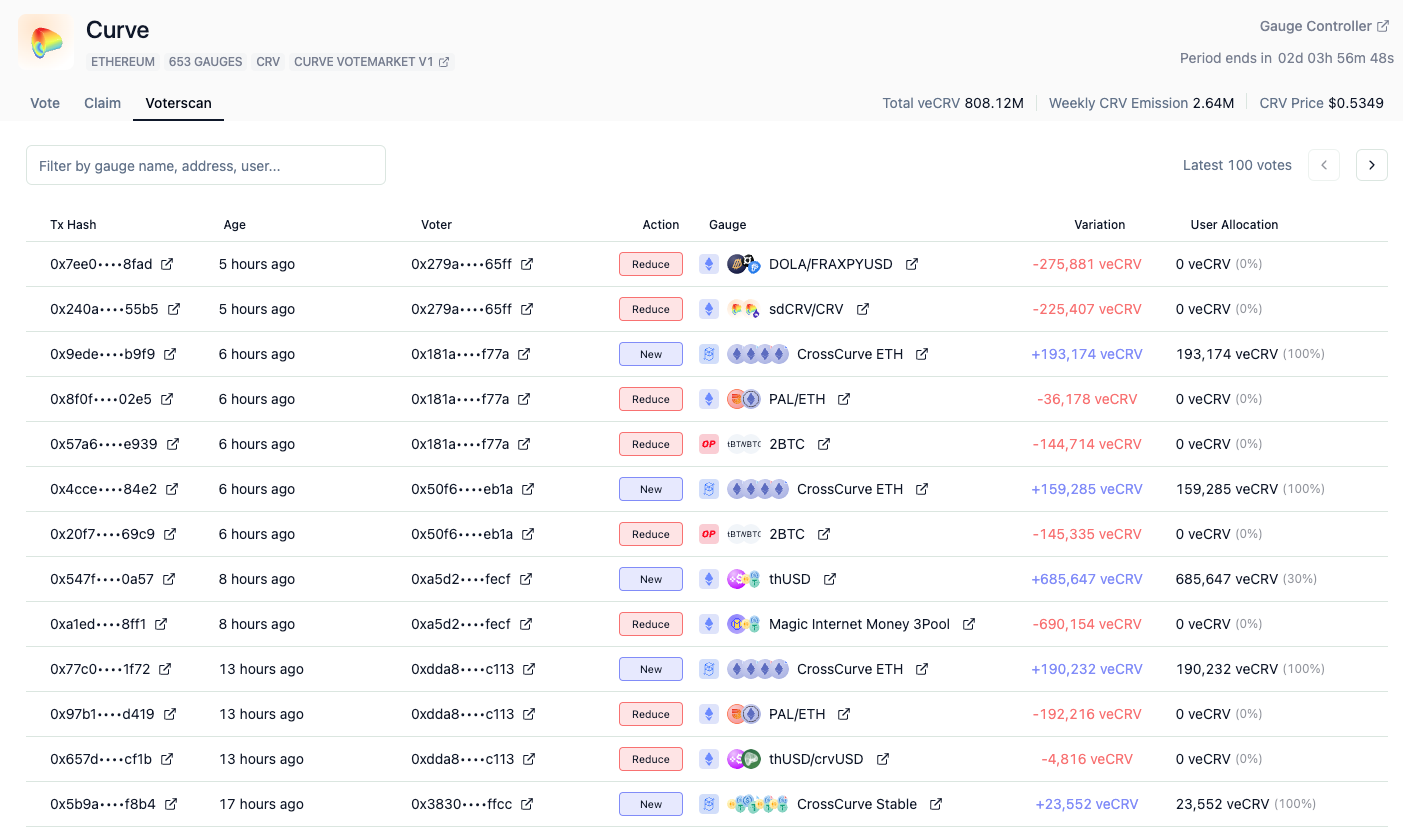

Votemarket v2 includes a revamped and beautiful new UI. Shown here is Voterscan, providing a live feed of all votes…

To really appreciate the new system though, it’s worthwhile to take a look under the hood. The white paper is a quick and friendly read, starting with a good background of the history of vote incentive markets before describing the features of Votemarket v2 that represent a major innovation.

The first of the three bullets is important for regular crypto users to note, as it may be the first opportunity for users who are not whales to serve as voters. Meanwhile the second two bullet points are of interest to protocols who may serve as incentive managers in this system.

For Voters

As users of Votemarket v1, the service was great, however in practical terms was only effective for whales. Votemarket v1 offered competitive yields, but the gas costs required to claim incentives weekly cut so significantly into smaller positions as to make it impractical for anybody but the largest wallets.

As an uneducated cryptopleb, I wondered why not just allow incentives to roll over? Doesn’t sound so tough… I mean, this creep could describe the feature in just a few words…

Once you dive into the problem though, you realize why it’s such a significant hurdle. The white paper describes the challenges:

The main hurdle to an on-chain platform which would allow voters to claim whenever they want is that, to avoid being reliant on specific architectures of underlying protocols, it needs to adapt to gauge controller contracts which do not store historical data. For this, the platform would need to either store such data or rebuild it, but both options would be even more gas-expensive than claiming every week, which makes it unrealistic for mainnet platforms.

The team put their heads together and devised a practical solution for multi-week reward distribution: in which reward incentives are mirrored onto L2s and verified using receipt tokens and a LaPoste bridge built using Chainlink’s CCIP.

The flow looks as follows, where Bob is offering incentives and Alice is claiming:

As an end user who just wants to get paid, you don’t necessarily need to know any of the technical details. The important part is that smaller accounts to begin profiting!

New users should note that gas costs are still involved in claiming each different type of token. If gas is truly a limiting factor, you may want to focus on particular tokens you expect will frequently run campaigns, so you can reduce the overall number of claims you’ll have to perform over your lifetime.

Fortunately, as seen in the above screenshot, a variety of protocols are already taking advantage of Votemarket v2 and all its nuances.

For Managers

The new system in place for Votemarket v2 provides far more flexibility for managers (ie, protocols who are interested in running incentive campaigns.)

The prior screenshot of the UI shows in the upper left corner a slider to move between veCRV and vlCVX — the new architecture is in fact designed to support both rewards that are computed onchain (ie veCRV) and offchain (ie vlCVX)

A single campaign can therefore have full vote supply coverage. This flexible architecture also allows unspent rewards to be redirected to other strategies in future periods. This means it could even be possible for onchain incentives using points before actual tokens are launched, thanks to the Votemarket v2 receipt system.

Votemarket v2 accomplishes this flexibility with the concept of “blacklisting,” which is not so much to censor users, but more to avoid directing emissions to the Convex address so a separate campaign can instead be targeted toward this address.

From what we’ve seen, protocols who are quite familiar with incentive markets have already joyfully adopted Votemarket v2.

Inverse

As seen in the screenshot above, INV rewards are currently the top of the list by APR, as the protocol was quick to launch an incentives campaign well timed to the $CRV bull run.

If the rewards for veCRV looked tempting, it’s even better on the vlCVX side

Seamlessly delivering campaigns to both markets thanks to Votemarket v2!

Note that one of the pools targeted for incentives are flowing to the $sDOLA pool. Curve recently highlighted this pool’s pairing with $scrvUSD for providing outstanding yields natively.

Stake DAO also happens to simply the maximization of this pool’s farming via their OnlyBoost product — we also see this synergy play out in...

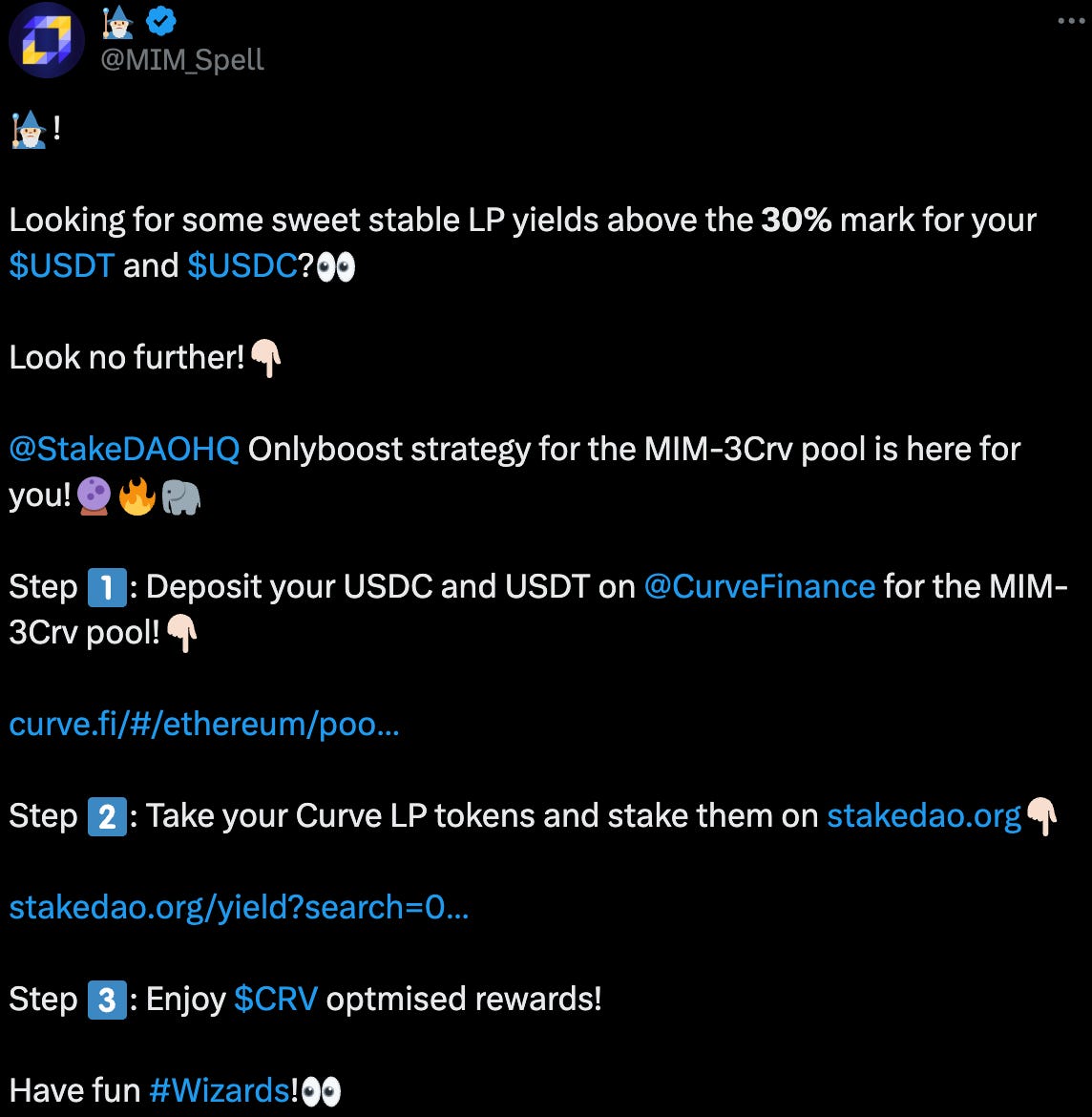

Spell

Throughout the Votemarket v1 era, $MIM by the team at Spell was a stalwart of incentive markets. In this case, we see Spell leaning into both Votemarket and Stake DAO’s Onlyboost to provide a great experience for yield farmers.

Although it seems Romy may have sadly suffered a stroke based on his last scrawlings in the above chat, whomever is managing team’s account wrote out some helpful instructions for new users interacting with Stake DAO:

Gauntlet

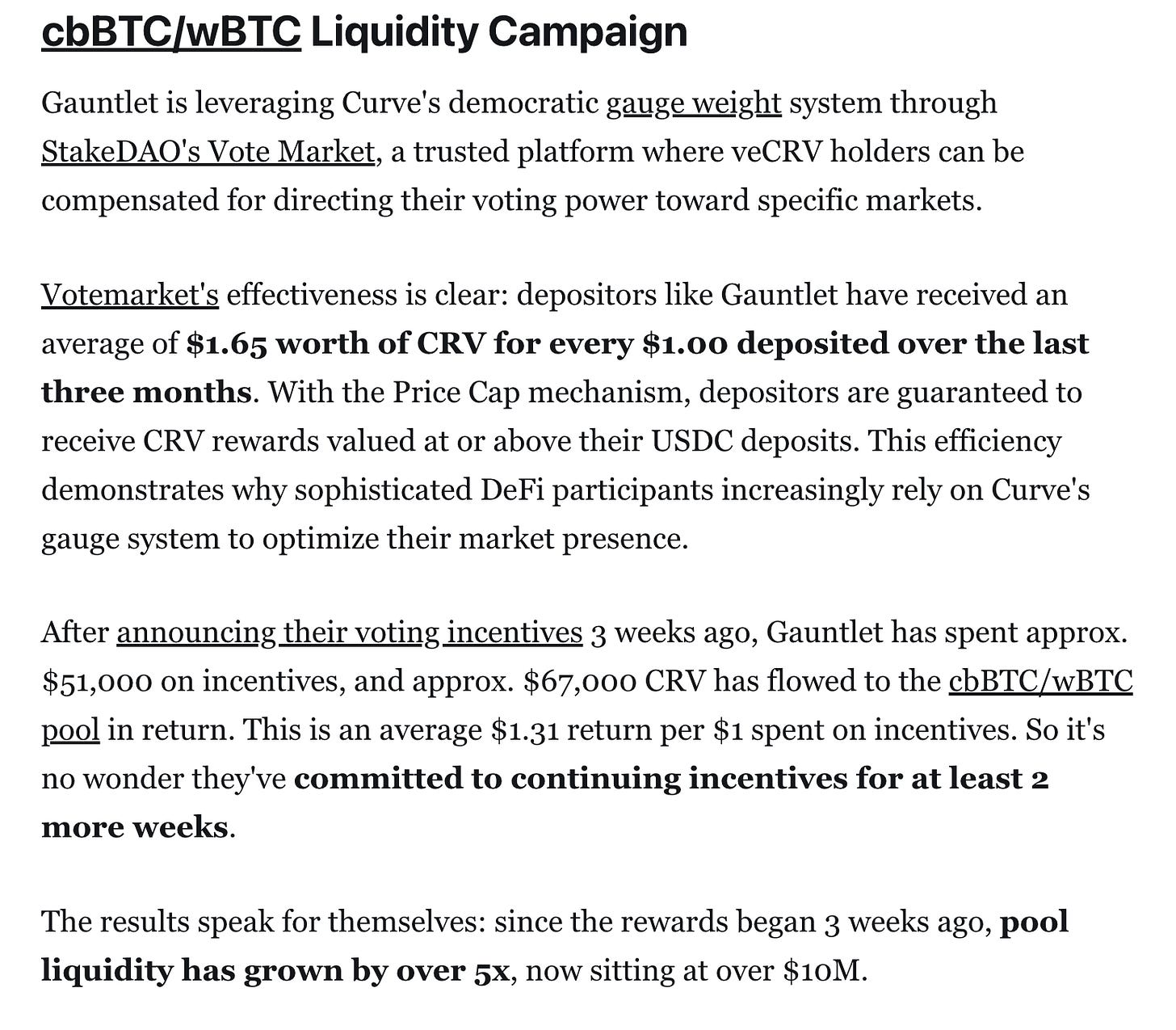

Gauntlet, heavyweights in the liquidity provisioning space, have been successfully using Stake DAO to incentivize the cbBTC / wBTC pool.

The results of the campaign were recently written up in Curve’s revamped news site.

A great return and great results, worth a study.

EYWA

On yesterday’s Llama Party we chatted with EYWA, who provide a great case study in how uses Votemarket to incentivize even though their token had not yet been issued.

Good news for pretty much everybody, except perhaps Lizzie Warren’s deeply held grudge against crypto…

The full Llama Party is available here:

November 25, 2024: VIP Llama Party 🦙🎉

A party on a Monday? In the US, this is a holiday week, so we’re getting the festivities started early with one for the record books!

Stader Labs

Stader Labs is running a campaign on their ETHx pool:

Zooming into the gorgeous new UI, you can see this is delivering a 10.23% APR on an ETH pool… not too shabby!

CLever

Would anything happen to Votemarket, which can optimize campaigns directed at Convex, without Aladdin DAO’s CLever finding a way to benefit?

Some back of the envelope math suggests some incredible results…

In truth, one of the underdiscussed stories of whatever phase of the DeFi market we’re enjoying is the sheer amount of free money lying on the table in the form of incentives efficiency. Just… be careful to run your own numbers and not blindly trust those sneaky UI devs…

Further Reading

Lest you think the Curve Wars ended, check out OurNetwork profiling both Convex and Stake DAO.

Plus our prior coverage on OnlyBoost.

August 24, 2023: The Blind LPs and the Elephant 👨🦯🐘

Once upon a time on mainnet, there were six blind yield farmers, each highly skilled in their own farming techniques but unfamiliar with the full scope of optimization strategies.

Disclaimers! Author is long $CRV, $CVX, $SDT

Pendle ?