The FUD is strong over the past week. If you’re here looking for FUD-mongering, we recommend you look elsewhere. We view most of this firestorm to be about as credible as the WETH FUD, which had the primary effect of revealing journos as the credulous dupes they are.

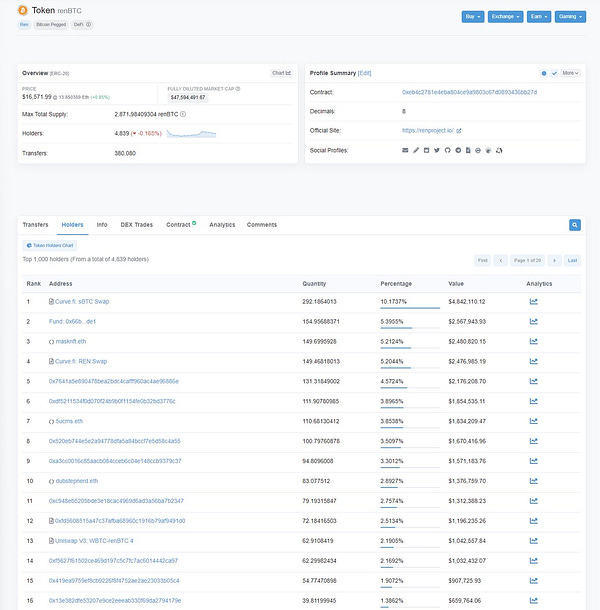

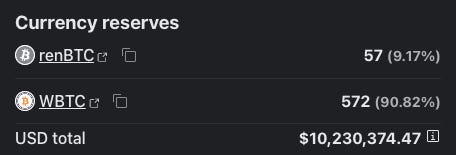

Of course, even fake FUD can have real consequences. For instance, even though WBTC is likely safe (in our opinion), holders have nonetheless been abandoning it for the asset that’s shutting down in less than a month…

Let’s hope all the new renBTC holders successfully exit in time, otherwise they’ll be forced to trade back the other direction. As always, FUD tends to redound to the benefit of Curve trading fees.

AAVE AIP-121

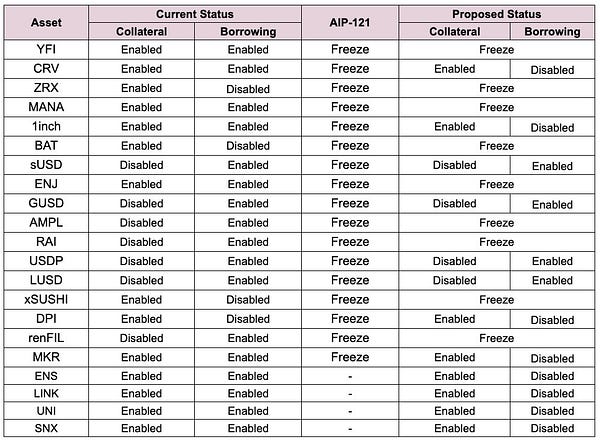

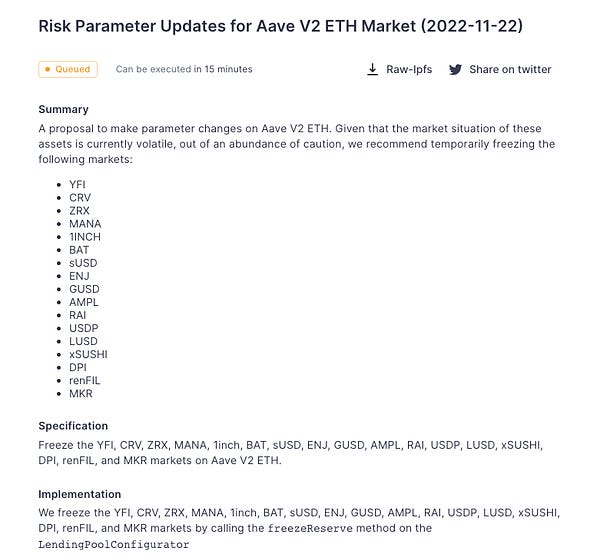

One notable effect of the recent FUD was the swift reaction to last week’s Avi vs. Aave duel. The community quickly passed AIP-121 as a means of fortifying the protocol:

“A proposal to make parameter changes on Aave V2 ETH. Given that the market situation of these assets is currently volatile, out of an abundance of caution, we recommend temporarily freezing the following markets: YFI, CRV, ZRX, MANA, 1inch, BAT, sUSD, ENJ, GUSD, AMPL, RAI, USDP, LUSD, xSUSHI, DPI, renFIL, and MKR”

The proposal is being billed as a temporary measure. Nonetheless, the sudden move sparked heavy controversy.

Indeed, shorting $CRV and other low liquidity tokens is currently illegal on AAVE. Why aren’t fans rejoicing?

By way of background, AIP-125 is an AAVE improvement protocol that would migrate several of these pools to AAVE v3. The upgraded version of AAVE has a number of improvements over v2, including more resiliency against the Avi attack that saddled the protocol with bad debt.

FWIW, Curve has endorsed this migration.

So where’s the controversy? Willy, who got so much right during the Avi shenanigans, cast the spotlight onto AAVE governance following a mass unstake of AAVE by the team amidst the Avi fallout, which led to much back and forth.

The composition of AAVE governance is an interesting subject, and we’d eagerly read a deeper analysis of the effects of key stakeholders on its decisions.

For instance, we know AIP-121 was authored by Gauntlet, whose role in recommending the questionable parameters in the first place also came under vicious scrutiny.

Some observers raised questions about why specific tokens were singled out, drawing a line between these decisions and AAVE governance.

Although these concerns are certainly interesting to read about, we still don’t count ourselves among the AAVE bears. We find ourselves to be mostly impressed by AAVE’s resiliency, responsiveness and transparency throughout the entire process. Our belief is that the migration to AAVE v3 will only make the protocol stronger.

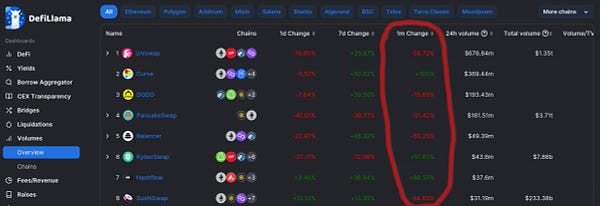

The most notable effect we foresee is that any delay in passing AIP-125 could open a window of opportunity for competing lending protocols to snag some market share. If (when) markets prove volatile in the near future, we don’t expect shorters will rely exclusively on TradFi products to short. Will competitors seize the moment to take advantage?

To reiterate, our editorial stance remains perma-bullish, most particularly on Curve but also broadly on the myriad innovations in all of decentralized finance. This includes AAVE and other innovators on the lending formula.

We’re still here because we believe DeFi is the future. Long term, we expect several of these protocols to grow massively as they flippen their staid TradFi counterparts.

Note that, as a $CRV maxi, we should logically be taking the opposite position. You may have noticed that FUD leads to Curve printing fees, so FUD is mostly good for Curve. You might therefore expect we have a fiduciary responsibility to use this ragsheet to shovel FUD commensurate with the public’s insatiable appetite for it.

Instead, we hope our strong anti-FUD stance earns us some credibility among readers.

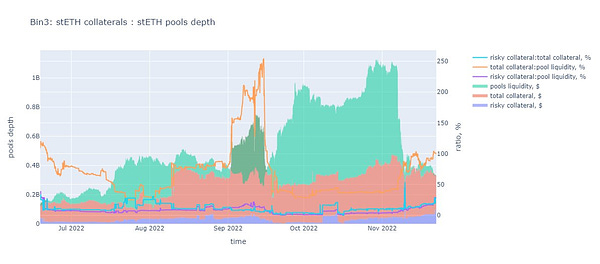

A few final notes related to the situation… worth keeping an eye on the stETH situation as it develops.

We doubt this manifests, but worth keeping an eye on things.

Lest you think this is all merely a weakness of DeFi, it’s by no means limited to the future of finance. It just so happens that DeFi is the more active testbed, but the stakes in DeFi are far smaller. What happens if global geopolitical players realize they can play this game at the international level…

We may live in interesting times?

Disclaimers

What an amazing article ser

Right on

thanks

good article

👍