November 9, 2022: The CZ Way Out 📉💥

Situation Normal: All FTX-ed Up

The Battle of the Billionaires has reached a decisive conclusion: SBF has lost at least one comma from his net worth.

We presume much more fallout is likely to hit the markets as this shakes out. Tomorrow we’ll go into more depth on some of the on-chain effects of how things played out on-chain via Curve.

Today though, a few of the macro takeaways from the collapse of FTX.

CZ Reigns

The amount of influence CZ now has over the smoldering heap of ashes we once called crypto is absurd.

He’s been a good overlord so far, but beware the curse of being the main character in cryptocurrency.

Binance has conquered FTX. Its ultimate fate is a 👍 or 👎 vote by CZ and CZ alone.

However the saga resolves, it will have massive spillover effects on the market.

More Contagion

We’re very likely to see more contagion as the house of cards that was VC-Fi continues to collapse. These firms tend to collapse a bit slower than things play out on-chain, where collapses are nearly instantaneous. Keep an eye on your faves…

So as tempted as you may be to smash the buy button, prudence is advised.

We may well witness a fourth horseman before the year is done.

DeFi >> CeFi

Outside of the most hardcore degens, it’s unlikely anybody will internalize this lesson. It still bears repeating… DeFi >> CeFi.

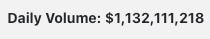

DeFi proved resilient. Curve again proved immaculate and enjoyed a billion dollar day as a reward:

Users may soon have to default to DeFi by default, if no CeFi exchange survives.

It’s not clear how many times VC-Fi needs to collapse for users to get the message, but DeFi solutions have a phenomenal track record by comparison.

Yet they’ll still keep playing with fire, because there remains the spectre of…

Unfavorable Regulation

SBF had been pushing atrocious regulation.

Now his bill is dead, but quite likely to be replaced by something far worse.

Chef’s Kiss. It’s so often the accuser who deserves to be the accused.

Stay SAFU frens…