Oct. 17, 2022: The AMM-azing $crvUSD🚰💦

Leaked chat reveals alpha on LLAMMA automated liquidation/deliquidation

The latest $crvUSD alpha drop is here.

As one might expect from the topsy-turvy world of crypto, the leak came from a Commodore 64 themed account created this month with just two followers as of this morning. We’ve verified the conversation is authentic, and it has revealed a lot.

Much to unpack here. Here’s the high level summaries:

Liquidations

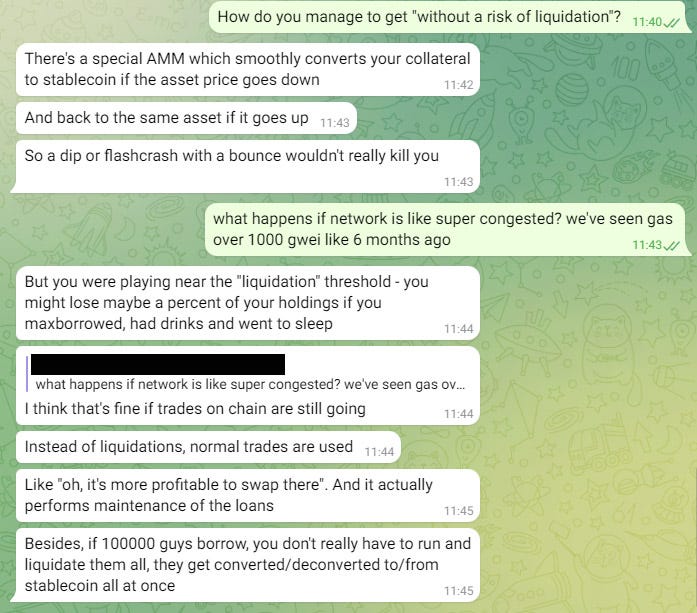

The big drop here is the “AMM”, or Automated Market Maker, being integrated into LLAMMA. We’ve discussed in the past the difficulties lending protocols face in dealing with liquidations. It’s an arbitrarily awful user experience for lenders to have to monitor crypto prices 24/7 to avoid liquidation risk.

For the $crvUSD, the issue is attacked thus:

There’s a special AMM which smoothly converts your collateral to stablecoin if the asset price goes down and back to the asset if it goes up so a dip or a flashcrash with a bounce wouldn’t really kill you.

Most of the crypto world may be used to dumb AMMs, but the under-appreciated and scarcely-understood Curve v2 demonstrated AMMs could operate far more intelligently, automatically rebalancing positions in response to price swings through the power of pure mathematics.

While the technical mechanics of how $crvUSD lending pools will accomplish this feat haven’t been released, we can imagine it borrows heavily from the lessons of v2 pools. For roughly a year, this code has been available to the public, ready for any coder to build such functionality into their own DeFi protocol. Since nobody else is grabbing the low hanging fruit, Mich is grabbing this and creating a novel twist on a stablecoin.

As described in the chat, this AMM will specifically be responsible for automatically liquidating a user’s collateral into a stablecoin as prices approach a liquidation threshold. As the price goes back up, it automatically unliquidates.

This is interesting — as one colleague who asked to remain anonymous described it:

“An AMM that sells your collateral when you get liquidated. Normally in AMMs it’s the other way around, when the price of the collateral falls, the balance goes up. This is the opposite.”

Most notably, this is described as happening passively — quite unlike the current experience. Nowadays whenever prices dip suddenly, we often see gas fees shoot up as users rush to trade in their collateral and avoid liquidation. Is there any real functional point to this when it could be handled automatically? As described in the chat:

“Besides, if 100,000 guys borrow, you don’t really have to run and liquidate them all, they get converted/deconverted to/from stablecoin all at once.”

In the chat here, Mich hints at the UX for $crvUSD during such periods, saying that instead of liquidations, normal trades are used: “Like ‘oh, it’s more profitable to swap there.’ And it actually performs maintenance of the loans.”

This quote unveils a bit more of the mysterious “swap” functionality described previously without adding too much in the way of details.

Throughout the chat, it appears as though the concept of “liquidations” still exists — citing the effects of “playing near the liquidation threshold.” Indeed, the frontend includes functions for liquidation, so we would expect that the AMM can reduce the likelihood of liquidations but perhaps not eliminate them completely in extreme circumstances.

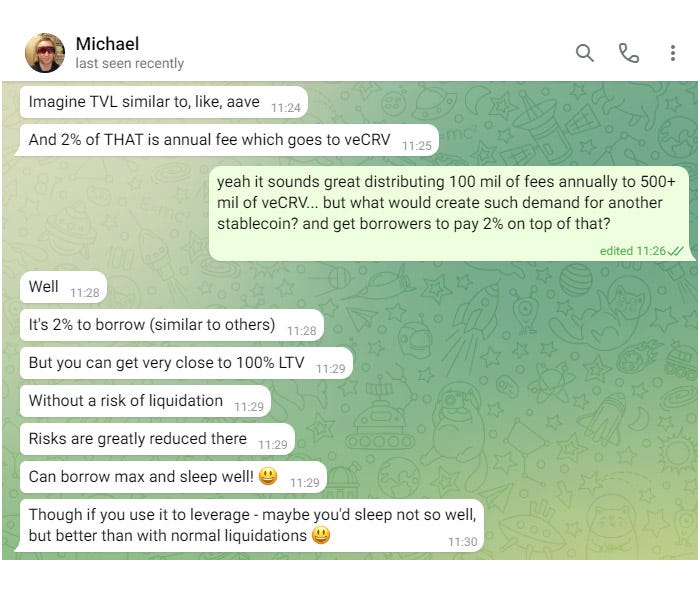

Along these lines, Mich describes the effects of leveraging your position (!) and being able to approach max LTV with lower risks of liquidation. In this manner, major profit potential exists in using next level math to extract opportunity from the spread passive lending-based stablecoins have to hold.

Which brings us to LP effects…

veCRV Effect

…or rather, veCRV effects.

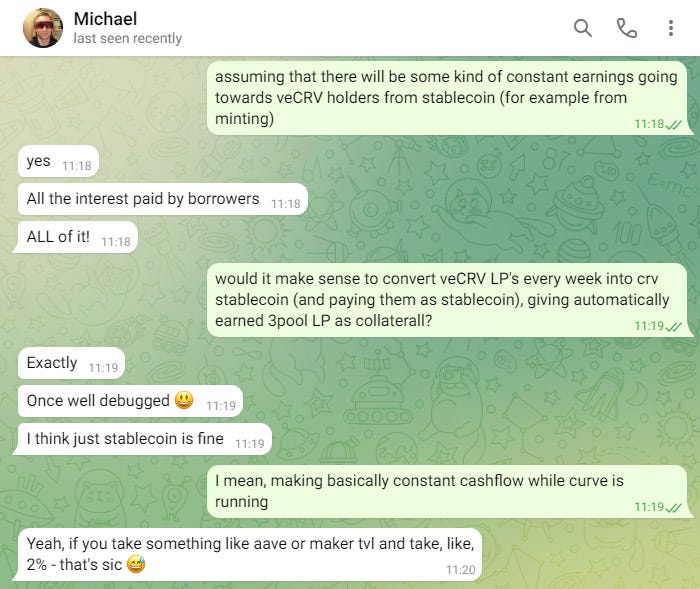

In this case, Mich describes that all of the interest is paid by borrowers, tossing out “2%” — unclear if this is hypothetical, suggested, or actual rate (or whether it is variable or fixed). Treasury rates are about double this.

Any and all these fees are described as going to veCRV holders. For his case study, he posits Maker and AAVE TVL to suggest the scope, which are currently $7.8B and $5.2B. These numbers would suggest $100MM to $150MM in annual fees from interest alone (presumably swap or interest fees would push this up slightly).

Of course, it being a bear market, it’s unclear whether Curve would get to such TVL so quickly. We don’t know how much time it might take to realize this potential, but it appears Mich has his eyes set on a multi-billion dollar market cap, and given his track record we would not recommend fading him (not financial advice).

From the publicly available info, Alunara details how this would flow through to cvxCRV holders.

One major remaining question mark is the collateral. The prior frontend release only references $ETH, though there is intense speculation about whether other tokens could serve as collateral.

It’s worth noting that if Mich is considering getting to Maker and AAVE sized TVL, then he may well be eyeing Curve’s current TVL ($5.9B)

We don’t know at the moment. We look forward to seeing the final release when we’ll be able to get the full look at what Mich has been cooking up.

Disclaimers! Thanks to GPT-3 for the punny headline.

it is very impressive that crvUSD can do liquidation/de liqudation within its amm. I dont get the part how it can do all position at once as mich mentioned in the chat.

Minting at high LTV with low liquidation risk is a nice catch too. Cant stop degens from degening Mich is sure math genius hahaha.

What do you think how crvUSD will keep its peg to a dollar? Would it require other stablecoins to pair with like fraxbp or 3crv?