Two case studies in potential suitors for Curve, both from wildly different worlds.

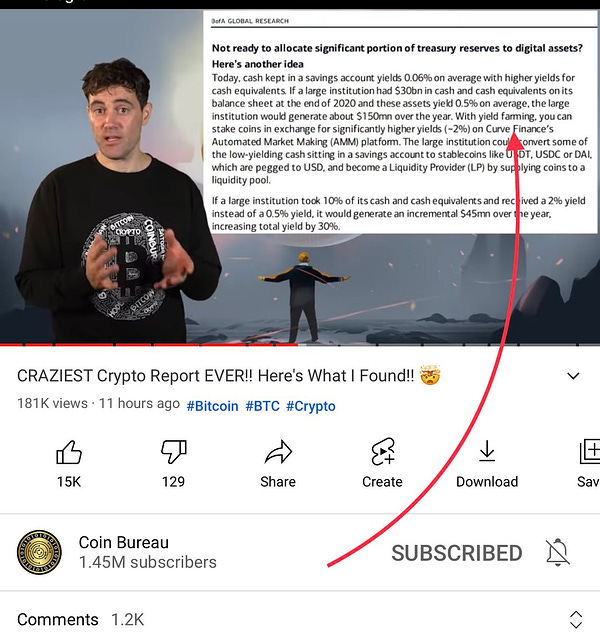

The Veronica: Bank of America

Bank of America, sniffing its own mortality, recommends Curve as an option for earning more than five basis points worth of interest.

Sure, if Bank of America actually chose to ape into Curve, this could bring a ton of liquidity to Curve and also add value to $BAC’s clients.

Spoiler alert: they won’t ape. First, TradFi doesn’t really care about giving their clients good yields, even if Curve could handle it.

The only way Bank of America could design a product that may interest them: $BOA pockets 95%+ worth of the Curve yields, passes the rest on to customers, and christens the lukeworm sandwich a “crypto savings account.” Sad thing is it could still even outperform most offerings on the market.

Unfortunately, it’s tough to imagine things going so smoothly given the embarrassingly primitive level of technical sophistication on display. They’ve only published one article and already look to be falling to the left side of the normal distribution. Judging from the article, it looks like they can’t even figure out how to max their boosts.

Ouch… my sides! The thing is, PilotVietnam being the absolute legend he is, would actually sit there and patiently try to explain why it’s actually impossible for him to recover their missing seed phrase.

You also know Bank of America wouldn’t just ape in quickly, like the billions in liquidity from satisfied Curve users who don’t even bother to join the Telegram. You can already envision them requesting PilotVietnam chat with their Bangalore office at 2 in the morning. They’d insist on discount rates and specialty functions inserted into immutable smart contracts. In the end they’d do something stupid like tiptoe $100K into the LinkUSD pool, and get angry nobody was using the pool, then ultimately demand a refund, a bailout, and regulatory intervention all at once.

All the meanwhile anons would keep seamlessly moving around stacks 20x the size nary a peep. It’s like a fixed law of the universe that the most annoying customers are also the worst paying. Any small business owner is familiar with the “management reserves the right to deny service at its discretion” clause they can deploy against customers who would be awful customers anyway.

Yes, the scenario outlined above is made up — more predictive than descriptive. Yet the thing is, Bank of America is not going to ape. If they wanted to ape, they would have aped already. They don’t want to ape, so they making excuses about why they can’t ape.

The poor team at Aave gets to grapple with this exact phenomenon right now. Their unsatisfiable prospects in TradFi are interested in using Aave, but too elite to dip their toes into the public pools with the hoi polloi. So they’re demanding Aave rebuild it all from scratch just for them.

Who knows… maybe something that’s always played out the exact same way every time before will somehow be different this time for Aave, because of reasons or something. We’ll just wait and see what happens. 🍿🍿🍿

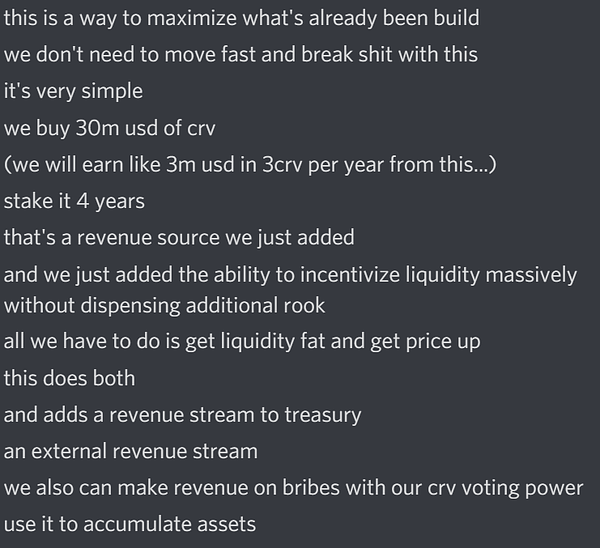

The Betty: $ROOK

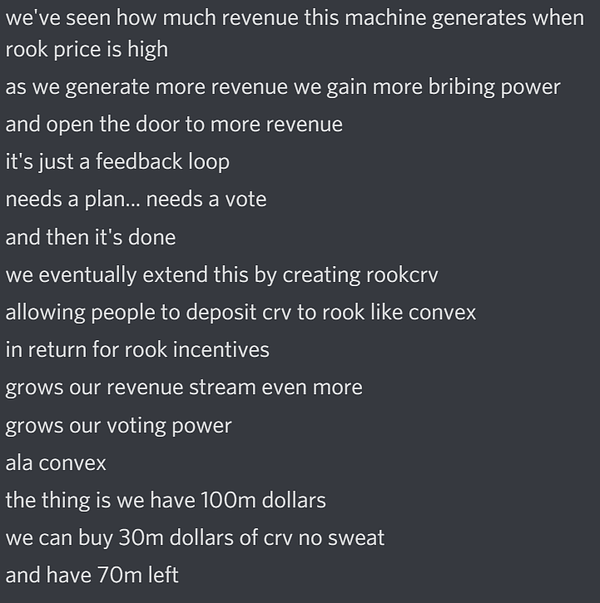

It’s not a household name, but another suitor is gaming out plans for Curve. The chessmasters at KeeperDAO are considering using their war chest to make a tactical entry into the Curve Wars.

The community is running the numbers and recognizing that they have an opportunity to rival Convex’s stake, an opportunity that may not last forever if they don’t pounce swiftly.

If you’re not familiar, KeeperDAO has been around the space for quite some time, built to execute such gambits.

Now this isn’t actually a love triangle, there’s plenty of Curve to go around, but f you had to pick just one of these two suitors for the long-term strategic benefit of Curve, it’s obviously $ROOK. Bank of America has an alluring brand but empty suits. $ROOK has already crafted a tactically sound strategy that could make an instant difference. Check and mate.

If $ROOK decides to act, they could move in an instant. Bank of America might write another statement in an analyst report 3 months from now. Just completely different universes.

I’ve seen people from the old financial order hand-wringing for over a year now trying to figure out how to build the bridges between TradFi and DeFi. If it worked, it would be a boatload of money. By today’s indicatoins, it’s never going to work. Crypto will render TradFi obsolescent and nobody will particularly notice who showed up late to the party.

Legacy TradFi has expressed its revealed preference, which is to sit on the sidelines and NGMI. Some VCs were faced with the same choice and they chose to ape, so they might make it. Companies like Visa and Mastercard are tiptoeing in by starting to build on Ethereum, but they waited until Ethereum was bigger than they were. At this point, a company like Visa needs Ethereum to stay relevant more than Ethereum needs Visa.

Crypto doesn’t actually need TradFi involvement to grow. The DeFi sites trying to build a bridge to banks will only find they serve more as an anchor.

Read Disclaimers. Author is a $CRV maxi, and while this is wonderful fan fiction it in no way represents the actual views of Curve