Q: Why did the chicken cross the road?

A: To earn an amplified, auto-compounded yield!

It’s easy to see why people are so excited about Chicken Bonds.

We all know the sky high yields are unlikely to last. Yet Chicken Bonds remain awfully cluckin’ interesting.

Contextualizing Chicken Bonds

Chicken Bonds is the latest from Liquity — meaning you know it will be incredibly big-brained, profitable, and very decentralized. Indeed, other than a shutdown function reserved to the Yearn DAO, Chicken Bonds has no other governance.

Chicken Bonds are an innovation on protocol liquidity acquisition strategies like Olympus DAO or Tokemak. Liquity needed such a service themselves, so they built a clever solution designed to be low cost and offer strong user protection.

Chicken Bonds released a version built on their $LUSD token, but the generic concept can be utilized by any protocol. Given its early success, we might expect to see many other protocols adopt Chicken Bond mechanisms in the way that Olympus forks were previously en vogue.

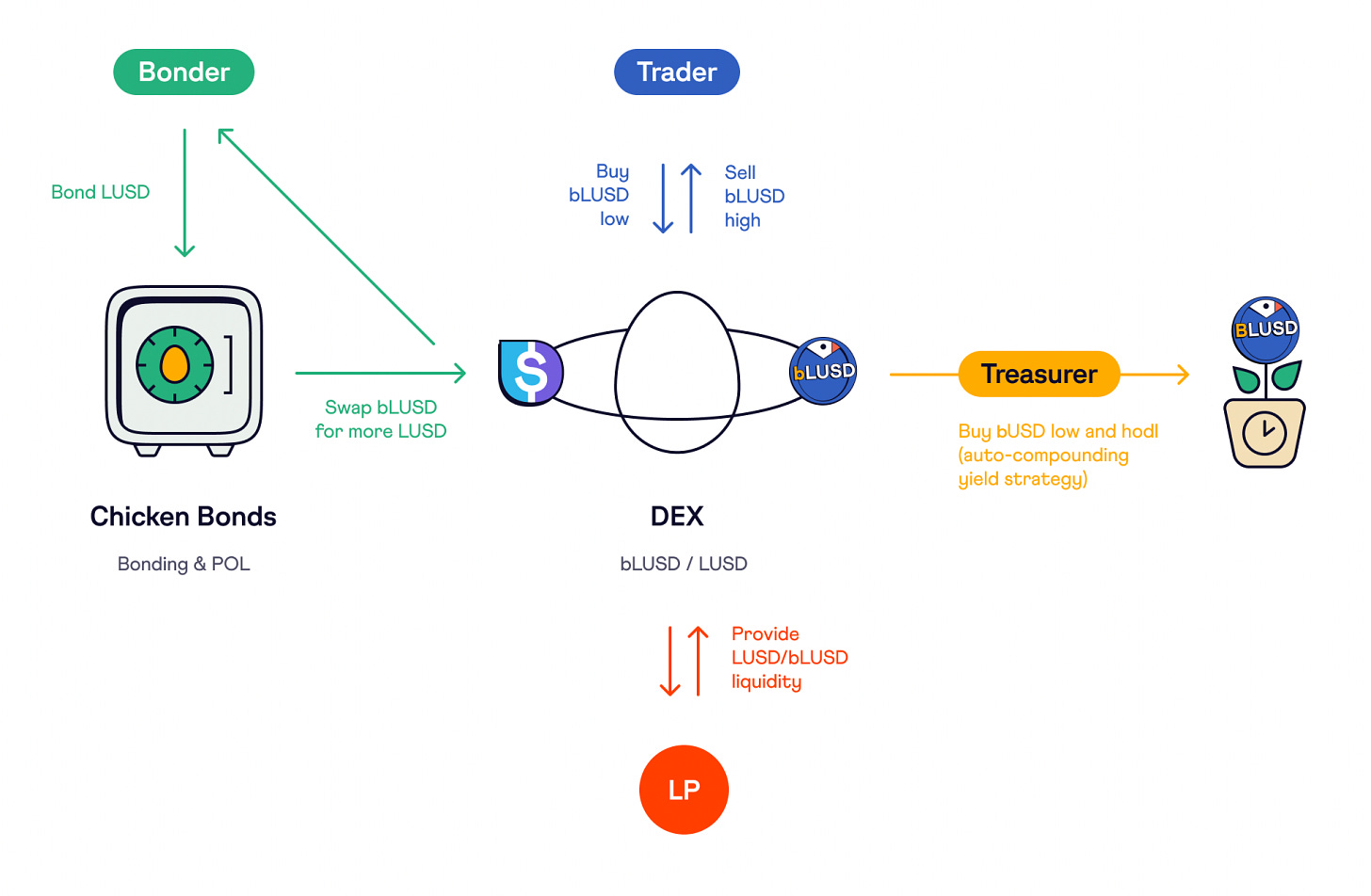

The basic concept offers users some very light game theory, which we’ll grossly oversimplify here.

LUSD

We presume you’re already familiar with the $LUSD dollarcoin. $LUSD features its own native source of yield in its stability pool, which earns depositors a variable yield that tends to spike during major liquidation events.

Chicken Bonds introduces a derivative token, $bLUSD (boosted $LUSD), which captures the accumulated yield of the Chicken Bonds system. The $bLUSD being backed by this yield means it tends to accrue value over time. The yield earned by $bLUSD is necessarily superior to the yield one would get from staking $LUSD individually, because it also captures the yields from users who “chicken out” so to speak…

Game of Chicken

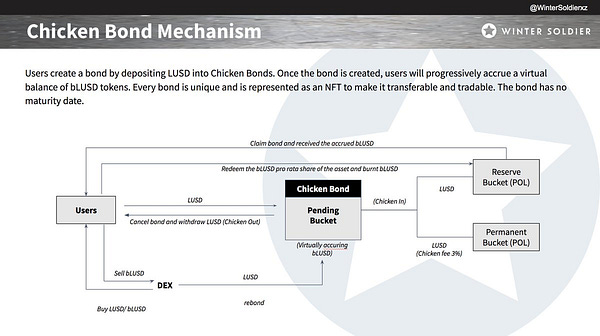

For the user, the basic game theory mechanics are quite simple. You join the game by “bonding,” which is represented graphically in the system as buying an egg with $LUSD. Holding an egg gives the user two options:

Chicken Out: Quit and receive a 100% refund of $LUSD

Chicken In: Forfeit the initial deposit for a claim on $bLUSD

Chicken Out

“Chickening Out” protects users who need to give up for any reason — maybe they need their money back for a sudden emergency expense. They get refunded in whole, and the yield they accrued flows to the benefit of $bLUSD.

They are protected from loss, but may be thought of as the prime “loser” in the system insofar as they forfeit any yield they could have otherwise earned.

Chicken In

“Chickening In” means pulling the trigger to convert your egg into $bLUSD.

This process has a bit of complexity in terms of picking the optimum time to pull the trigger. The balance of $bLUSD one receives for “chickening in” increases over time, although the rate tapers off.

Figuring out the optimum time is a complex math problem (their White Paper is a great read, particularly if you like calculus). With $bLUSD designed to accrue yield over time, we’d assume errors in timing are more of the “less yield than optimal” variety and not so much the “got rekt” variety.

NFTs

A fun feature of the entire system is that a user’s Chicken Bond position is managed by its corresponding NFT. The NFT directly allows the holder to “Chicken In” or “Chicken Out.” Thus, the user can directly trade the NFT separately if they like. This capability allows for far more complex trading strategies at all parts of the ecosystem.

Chicken Bonds also went ahead and supplied gorgeous artwork for the NFT by famed artist Luchador, complete with rare traits driven by factors like the size of the bond and the specific choices taken:

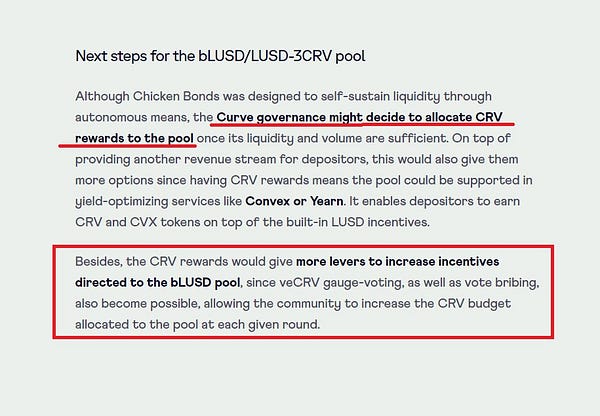

Curve Effects

The entire system is also built atop Curve. One of the sources of yield distributed to $bLUSD, in addition to the $LUSD Stability pool, is the $LUSD Curve pool. The yield in this case is harvested through the corresponding Yearn vault.

Another key piece of the architecture is the $bLUSD / $LUSD Curve pool, which serves as a source of liquidity. Some portion of the $LUSD generated in the system is flowing to incentivize this pool, which is the source of the whopping 65% $LUSD at present. The v2 pool is currently pricing a 30% premium on the value of $bLUSD as well.

The team is presently pursuing a gauge for this pool as well, which would further juice the entire system.

Risks

Naturally, before you ape in you should do a careful parsing of all the risks. Their documentation points to some of these risks. We’ve not yet seen a report from the Crypto Risks team. The sky-high yield may be a further indicator the market is pricing in additional risks, and the yield may drop if the market ultimately judges it to be safe. As always, nothing presented here should be considered as financial advice.

Further Resources

We attempted to further simplify the already accessible reading material for this article. As a result, we don’t pretend this guide was comprehensive, and we purposefully skipped over some concepts.

If you are interested in Chicken Bonds, we highly recommend you familiarize yourself several of the great resources the community has drawn up on this topic.

Reading

Threads

Twitter Space

Disclaimers! We’re smol brain and may have gotten some details wrong, please lambast us in the comments! Author has no position in Chicken Bonds, has only indirect exposure to $LQTY through involvement in PAC DAO.

Yo! I've read your mail for a while now and thus wanted to let ya know that we’re launching our NFT collection's community of the most active web3 contributors, motivated by one vision:

-push web3 education forward

We like to invite you to the society 🥷

We're forming a network of creators & builders for which we deliver a series of mini products, broader vision is to scale a web3 learning platform. DMs are open here or on Twitter :)