Things move fast in crypto. Just a few weeks ago, all the action was at bribe.crv.finance. Suddenly Votium is the new bribeahub.

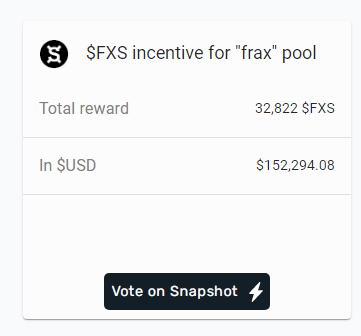

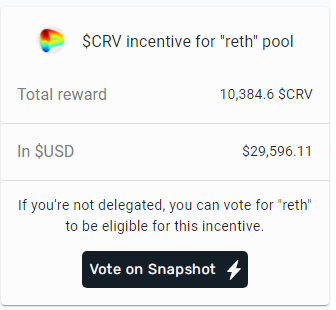

As of this morning, a handful of pools had offered bribes totalling $400K, with no sign the activity will be dissipating anytime soon.

In the future, a strong Curve bribe game may become the difference between GMI and NGMI for DeFi protocols. Would you trust your yield in a protocol that can’t compete in the game?

It’s also a sign of just how quickly things can change. USDN was one of the early pioneers in bribing Curve users. They offered a prize to random users who committed their voting power to USDN on-chain.

Today, such a giveaway has become obsolescent. The USDN pool is at growing risk of drying up.

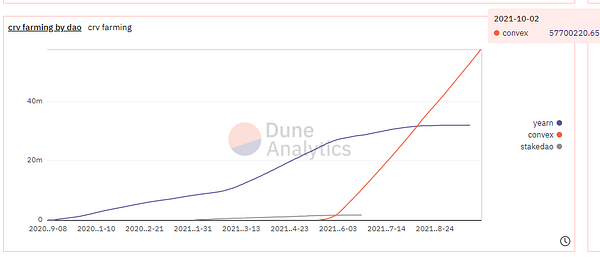

Just a few weeks ago the bribe game was to bribe veCRV holders directly. Yet this has already peaked. The Convex flywheel is spinning inevitably towards its flippening of voting power, and as a result the bribe activity is directed towards incentivizing Convex.

It’s just a few weeks old, but users are already establishing etiquette in the space. $CRV maxis, of course, recommend bribes denominated in $CRV.

For users new to the Rube Goldberg machine that is the Curve/Convex/Votium, it can feel intimidating. Yet it may be worth studying, especially if you like money.

Should any whales in training make their way to the end of the flywheel, they’ll find Votium to be a comfortable landing. Ethereum usage can frighten off smaller fish due to the price of gas. Fortunately, voting on Votium only takes place through signed transactions, not gas-intensive contract executions.

In a test, the approval process cost just 0.0025 ETH at 54 gwei, with all else handled by signing. This makes it one of the few things you can still get on the Ethereum mainnet for under 10 US Tokens.

The complexity of the flywheel appears so frustrating that most users simply give up. Their loss. Anybody dabbling with cryptocurrency for a sufficiently large amount of time is already quite familiar with interacting with the vast swaths of nocoiners who ignore crypto at their own peril. The mindset of the person who runs away from a golden goose is irrational, but all too common.

For this reason, users enjoying the benefits of the flywheel simply cannot believe their good fortunes. Yes, markets are irrational, but at some point you just have to laugh.

Convex valuation is a bit tricky however. The “recursive components” mentioned below do make it almost impossible to approach the problem from a fully theoretical view. Anybody who tries a theoretical approach tends to have a more optimistic view than currently plays out in the markets.

At any rate, if you want to be the sort of person who embraces golden geese instead of fleeing from them, you might this new video tutorial.

Check our disclaimers at https://curve.substack.com/about. Author cast a ballot in the most recent Votium election.