October 1, 2024: $dlcBTC 🎮🕹️

In which DLC stands for Discreet Log Contract, not Downloadable Content

Is BTCFi the hot new narrative? Or is everybody merely front-running another narrative that will never materialize? Too soon to say…

Based on history, we are willing to bet that some of the newer BTC wrappers are low-effort cash grabs that will peter out by next year… if not rug outright. Others will thrive. Impossible to say which is which.

One of the projects we suspect falls into the higher tier of Bitcoin wrappers is dlcBTC, which we review in-depth today.

Discreet Log Contracts

DLC… downloadable content? What on earth is dlcBTC and why is this any different from the hundreds of other Bitcoin wrappers?

In this case the dlcBTC stands for “Discreet Log Contracts”

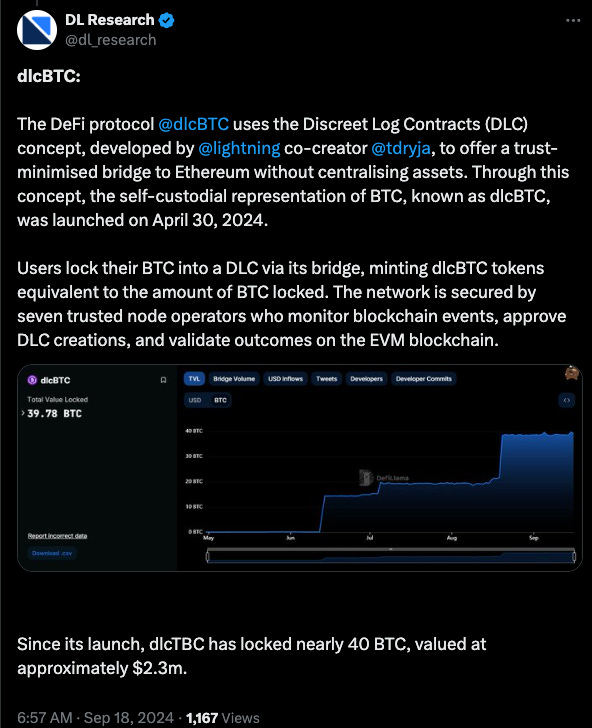

The concept of Discreet Log Contracts goes back to a 2018 White Paper by Thaddeus Dryja, the co-founder of the Bitcoin Lightning Network, and researched via the MIT Digital Currency Initiative. Great pedigree!

If you don’t want to get too down and dirty with the technical details of Discreet Log Contracts, what’s important to note is that Discreet Log Contracts are a breakthrough that allows for two parties to arrive at a trust-minimized agreement in a private and secure manner. This agreement is simple enough to be executed on a chain without advanced smart contract programming capabilities (ie natively on Bitcoin).

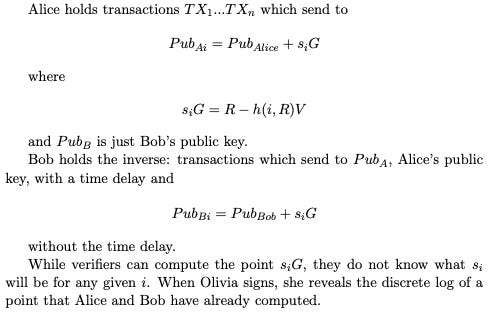

Technical readers should enjoy reading the white paper to understand the precise mechanics, which relies on a unique application of Schnorr Signatures and use discreet logs for verification.

Less technical readers can optionally understand the concept via dlcBTC’s blog post,, or this less technical explainer.

In 2023, the dlcBTC team published their own litepaper detailing how this process could be used to bridge BTC in a theoretically safer fashion. The Bitcoin Taproot upgrade in late 2021 gave Bitcoin sufficient support for Schnorr signatures to allow using this method to create a non-custodial Bitcoin bridge.

It still looks complicated, but it all simplifies down to an explanation that could fit onto a bumper sticker:

In other words, $dlcBTC operates a non-custodial Bitcoin bridge where funds are secured on the Bitcoin blockchain itself.

dlcBTC Launches

The dlcBTC team got to work, and in April of this year they successfully launched dlcBTC onto Arbitrum.

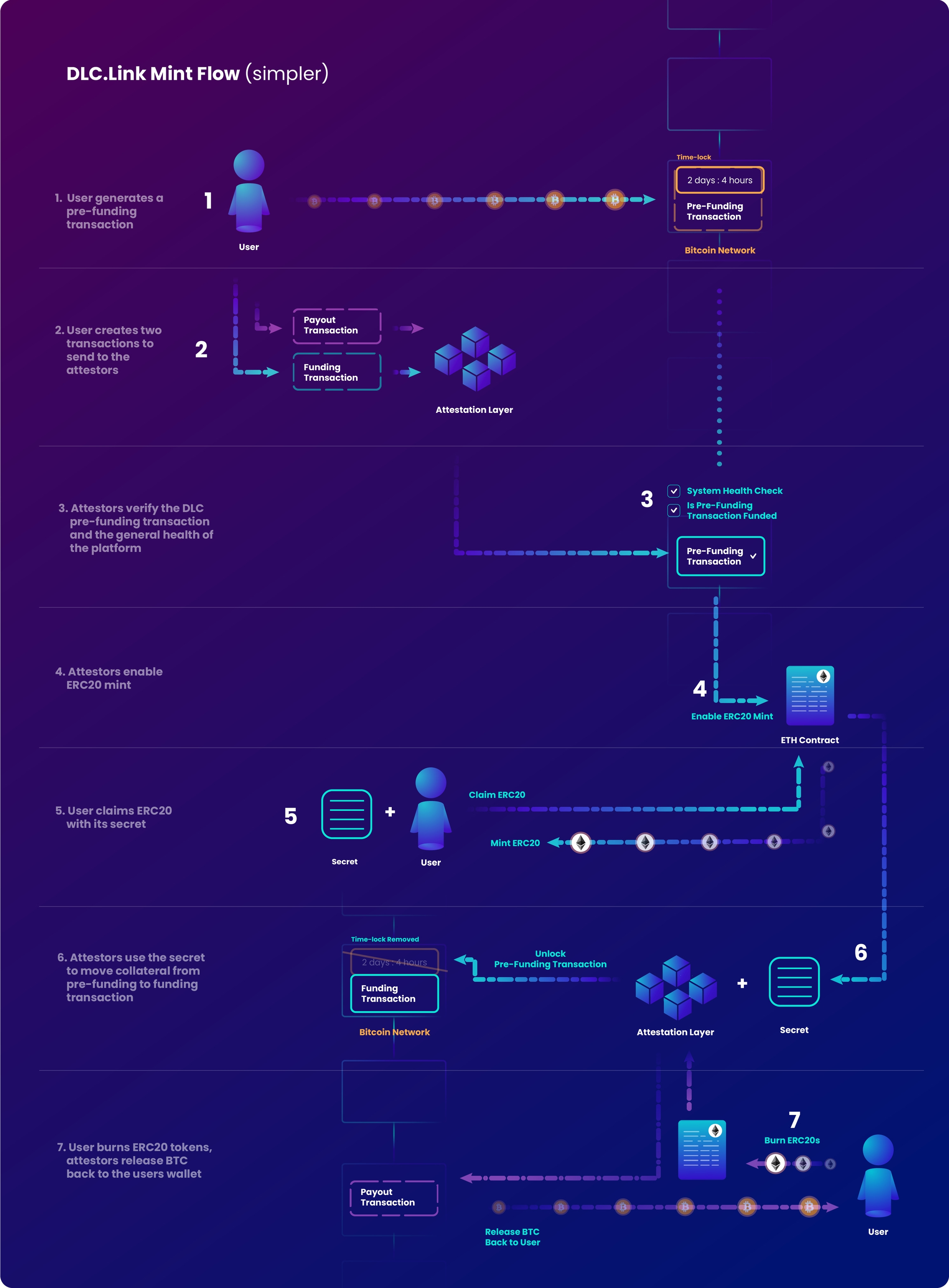

The minting flow, as described by docs:

It again looks complicated, but boils down to a simple marketing pitch:

Unlike custodied or bridged Bitcoins, it is minted by institutions directly from self-custody — a process known as “self-wrapping”.

— Aki Balogh, dlcBTC

The “self-wrapping” thus far has generated modest yet up-only TVL, recently landing around $3 MM (40 BTC).

Depending on your perspective, $dlcBTC launched at a great or a terrible time. Great because they happened to squeeze in just before the BTCFi narrative exploded. Terrible because they also have the burden of competing amidst a field of low-effort forks.

Earlier marketing for $dlcBTC appeared to focus on the “safety” aspect, leaning into the minting process to emphasize that dlcBTC was a “safer” way to bridge Bitcoin. However, while degens profess to care about safety, their willingness to YOLO their entire net worth into outright scams reveals a different preference.

In what may be a realistic and strategic concession to the reality of the market, nowadays $dlcBTC has picked up a new slogan that focuses more on BTCFi.

Put Your Bitcoin to Work

Or on their website, “Safely earn yield on Bitcoin.”

While safety is a core component of much of their messaging, they’ve been very hard at work creating integrations so users have something to do with dlcBTC. In just the past month, we’ve spotted integrations with Beefy, Aera, Garden, Jasper, Enzyme, Silo, and we surely missed some.

We know we missed at least one, because we haven’t mentioned our focus area of Curve, where $dlcBTC has really shone:

At the moment the majority of dlcBTC liquidity sits in the dlcBTC / WBTC Curve pool on Arbitrum. They also offer a points program to stakers.

Even better, with sufficient liquidity on Arbitrum and a new enough pool with built-in oracle, they have the prerequisites to create a Llama Lend market.

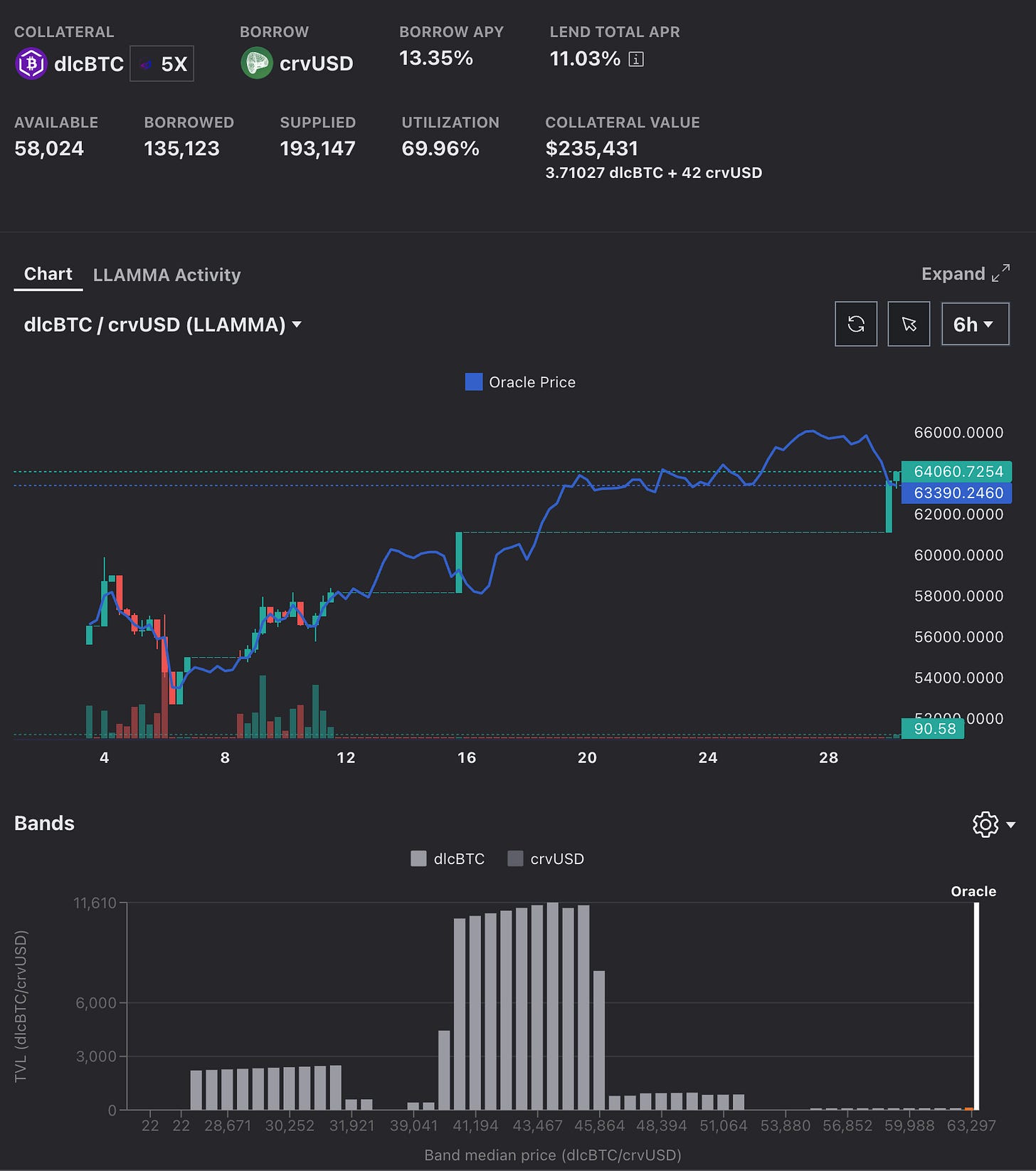

At the moment, about a tenth of the $dlcBTC supply is experimenting with the vault (which also earns 5x points), giving a borrow APY of 13.35% and available leverage up to 10x.

Meanwhile lenders can supply $crvUSD to the vault to earn 11% APR, inclusive of ARB rewards earmarked to the pool.

This puts it right in line with going Llama Lend market rates for supplying, all of which could be interesting given the era of rate cuts.

It’s not clear how much Bitcoiners care about the plethora of BTCfi services being built out on Ethereum, but $dlcBTC is certainly hard at work to capture this market if it exists.

Of course, make sure to research all the risks before serving as either a borrower or lender in any Llama Lend market or third party services!

Which segues nicely into our final topic…

Is dlcBTC Safe?

With the caveat that nothing in crypto is safe, is dlcBTC in fact safer than other forms of wrapped BTC?

The team has published two audits, from MetaTrust and CoinFabrik.

We’re not super familiar with either firm, so we can’t testify to their quality, but it’s always better to receive audits than not.

The most severe issue surfaced in the MetaTrust audit was the centralization risk in the DLCManager contract:

Several functions are subject to a 4/6 multisig.

YMMV, of course, as to the existence of a multisig controlling such admin functionality.

The contracts are also written in Solidity, not Vyper, which consider a risk factor because it signals the devs may not be complete and utter chads.

Fortunately, a cursory look over their Github repo suggests the contracts, at least on the Ethereum side, are plain and straightforward. Somebody may have fat fingered a constant somewhere, but nice to see it doesn’t look overly complex. DYOR though!

The scope of the audits doesn’t appear to cover the Bitcoin side (ie, the DLCs). We can take some comfort from the fact that ~40 BTC has been bridged for six months without hacks. When in doubt, give it time and TVL to see if hackers can crack it, as the protocol builds Lindyness.

The protocol also has a $20K bug bounty program, in case you are able to crack it.

Learn More

The team, and co-founder Aki Balogh in particular, have assembled a lot of video content. We link some here, and urge you to check out their website for more.

DISCLAIMERS! None of this is financial advice! If you ape into dlcBTC and you lose everything, SFYL. Author has no stake in dlcBTC!