Curve’s Martin Krung shared some beautiful charts, which we felt deserved to be repackaged as a case study in bootstrapping the Curve Llama Lend markets.

Data

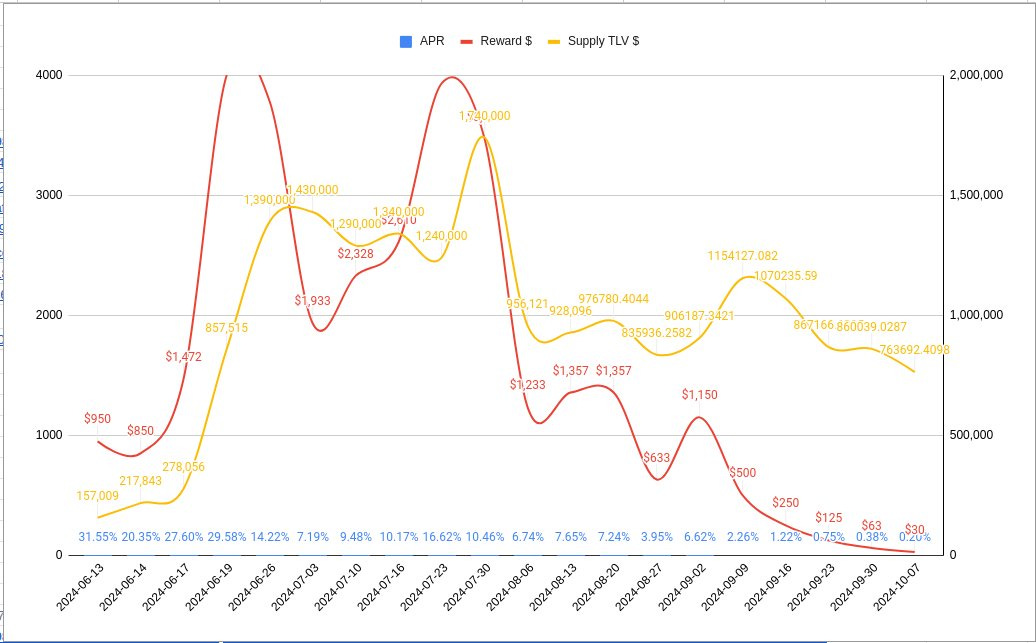

In this case, he examined a few months of supply TVL in $crvUSD to the WETH market on Arbitrum, as a function of rewards supplied and the corresponding rewards APR.

This chart shows off the bootstrapping period of Curve’s Llama Lend WETH market. This market exists on the Arbitrum L2, where gas prices are significantly lower than mainnet, so we may assume that users’ behavior was not constrained by the higher gas costs on Ethereum L1 throughout this period.

Note that the blue values, the Reward APR, only refers to the market value of external rewards streamed to the pool, not the yield generated from borrowing fees in the pool (considered as “natural yield”). With two axes, the blue line ends up the odd man out and is not very visible, so we plot it here separately for your convenience.

The charts tell a story of what we’ll consider as three distinct phases:

Initial Boostrapping (Launch through June 19):

From the market’s launch in June, the rewards were about $1K per week. For this phase TVLs were low (under $500K) so rewards were about 20%-30% for users who supplied to this pool.

Heavy Rewards (June 19 through July 31):

From June 17 through the end of July, these rewards were kicked up to around $3K-$4K. This corresponded with a surge in TVL, which quickly jumped to $1 million and nearly surpassed $2 million at peak. Users chasing this yield diluted the Rewards APR, but rewards were distributed in such a manner to keep the Rewards APR fairly steady, around 10%.

For reference, typical US bank accounts were giving about 5% during this period (reducing to 4.5% after rate cuts), and DeFi stablecoin yields were typically a touch above this value during this period. A 10% yield on stablecoins would likely be considered good, although the greed in space has no upper limit.

Maturity (August to present)

By August, the reward incentives began the process tapering off. Despite the fact the Reward APR was reduced, the TVL began to naturally stabilize to a market equilibrium in the $700K - $900K range.

Importantly, the users supplying $crvUSD to these markets did not have the rug pulled out from under them. In fact, the high rewards period had artificially pushed the supply so high that borrow rates in the market were unnaturally low. As borrowers took advantage of these low rates, the market pushed towards an equilibrium.

In effect, as the rewards petered out, the source of supplier yield shifted from rewards (artificial) to yield sourced from borrowers (natural). You can observe the increase in loans tended to occur steadily throughout the period, dipping slightly at the start of phase 3 (when rewards started to phase out,) but continuing to increase steadily as rewards petered out.

The effect can be seen on the “natural” rates, which moved upwards in August in lockstep with rewards petering out.

As of publication, the yield is almost entirely driven by the “natural” lend APY (a bit higher than the risk-free T-Bill rate) with relatively insignificant external rewards.

Discussion

It’s often said that bootstrapping liquidity in DeFi is expensive, but for this Llama Lend case study the process can occur quite inexpensively.

Total expenditure: $25,531

Final TVL: $763.692

Cost per dollar of TVL: $0.03

A two-sided marketplace may often be considered a challenge, but Llama Lend shows how the process can quite easily happen by incentivizing the supply side (lenders) for a short period. As potential borrowers see artificially low borrow rates, they fill out the other side of the market, until a natural equilibrium is established.

We observe that this learning is already being put into effect in launching new markets, most recently to bootstrap a tBTC lending market on Arbitrum.

Martin confirmed in private chat he plans to follow the results of the tBTC rewards and reproduce the charts. His goal is to find a good way to preprogram the bootstrapping process, which is important because some grants could not be centrally managed without a license.

He commented:

“The gold standard would be to pay rewards reflexive to what happens during the market bootstrapping.”

Applications

This particular case study occurred in three distinct phases, but theoretically it could be smoothed significantly so that rewards were distributed according to formulas where operators might control just a few parameters as levers.

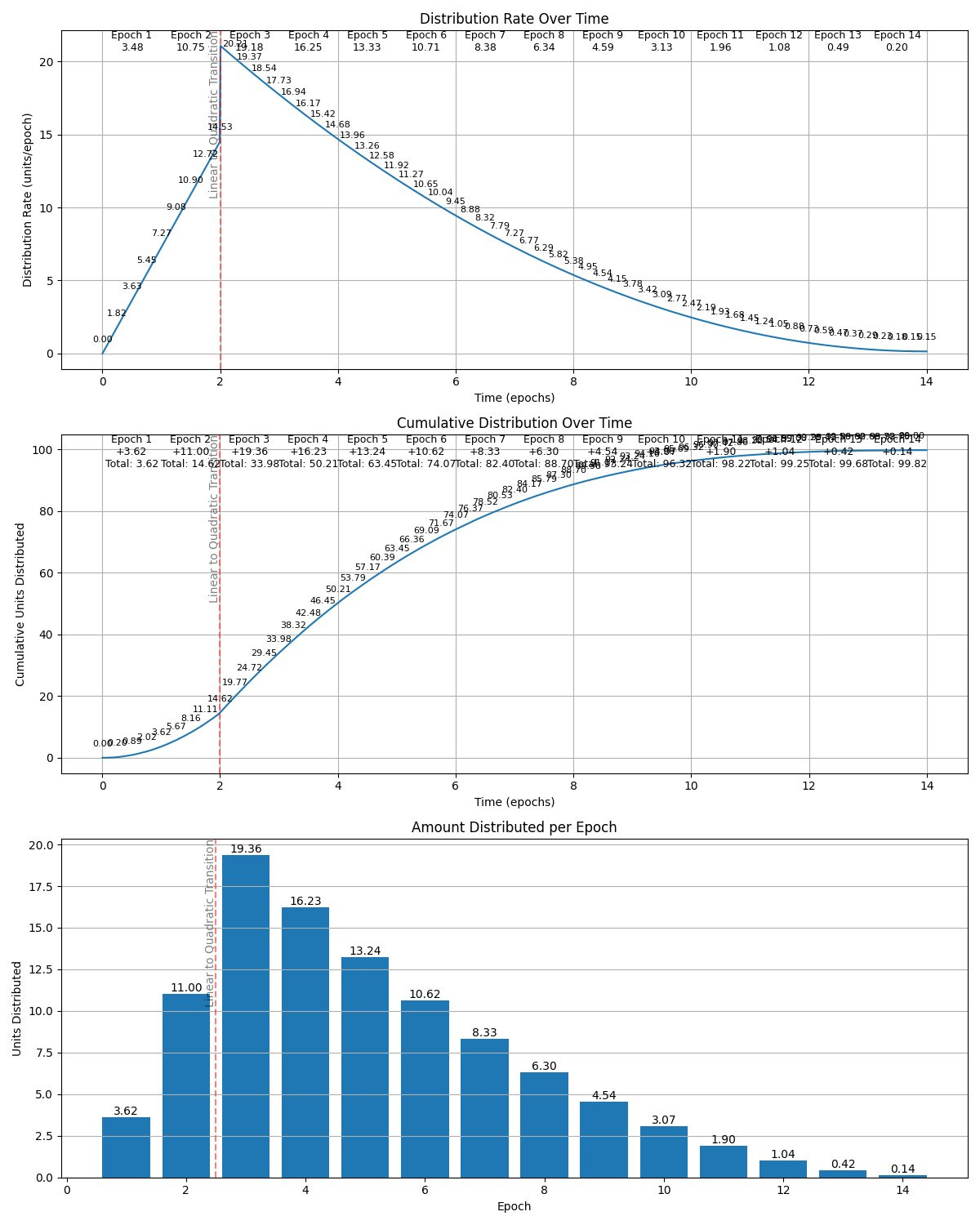

The chart presented below shows a hypothetical example of how the results from above may be smoothed into a more structured approach with an assist from Claude AI and its occasionally overactive imagination.

Note that these are not real data, but attempts Martin made to create ideal bootstrapping scenarios for a fixed amount of rewards.

You can see that rewards were structured to ramp up quickly, then taper off gradually. Among a few epochs, rates were chosen as to smooth the ramp downwards, representing an even distribution of supply.

If you are interested in learning more about applying rewards, recommend to check his Github repository on bootstrapping lending markets:

Conclusion

When reviewing the results, we thought a lot about the phrase “It’s easier to pull on a rope than push on a rope.”

Anybody who’s ever tried to found a startup can probably relate. When you find something like the elusive concept of “product market fit,” users just sort of naturally flow into your product. When you lack “product market fit,” it doesn’t really matter what you try, the users cannot be coaxed.

The Llama Lend results hint at something close to “product market fit” and a natural use of incentives to launch markets. In the supply bootstrapping phase, users are naturally attracted to free money. As rewards are cut off, borrowers are naturally incentivized to borrow more while the market is below some natural borrow rate, which may be considered another form of “product market fit”.

Some markets do not have natural borrow demand, so attempts to create a two-sided marketplace are a bit like pushing on a rope. You can backfill rewards, but TVL will disappear when it is turned off and no borrowers appear. The corollary to this would be looking into the effects of providing additional incentives to markets that did see natural demand, to support further growth.

This case study demonstrates that these questions can be approached in a data-driven fashion, with new Llama Lend markets all adding new data points for such experiments.

We note that Llama Lend automatically calculates borrow rate as a function of utilization. Given the prior results, we believe additional study on the shape of different utilization curves could be done with the intent of:

Accelerating the bootstrapping process

Promoting further growth of markets at equilibrium state

We observe Martin is in fact already experimenting in this direction. Stay tuned…

Disclaimers!