October 15, 2024: $DYAD a Hero 🔥🦸

Throwing $KEROSENE on the so-called "stablecoin trilemma"

If you haven’t yet, please complete our Big Crypto Poll! A bunch of good responses, we’d like to close it out by end of week!

The DYAD website advertises the “highest stable yield on Ethereum mainnet.”

According to their 𝕏 bio, DYAD is “the first capital efficient overcollateralized stablecoin.”

Both are provocative claims, and they surely get the people going. The former gets people excited because everybody wants good yields. They claim about 14% on their website, which is indeed good for stablecoin yields, especially if it doesn’t rug.

The latter claim is more philosophically provocative. It seems tautologically impossible. Capital efficiency is usually calculated as the inverse of collateralization. It should therefore be definitionally impossible to have an overcollateralized stablecoin that’s also capital efficient, right?

Or perhaps we’ve been limiting ourselves by taking these terms at face value. Let’s take a closer look at DYAD and see what’s going on under the hood here….

What is DYAD

The DYAD protocol allows users to mint interest-free stablecoins against collateral types like ETH, and the minimum collateral ratio a user has to maintain can be as low as 100%.

100% would be perfect capital efficiency — what Tether and USDC can get away with because they’re redeemable and completely centralized. Once you move to create a decentralized stablecoin, especially with a volatile asset like Ethereum, nearly every protocol has considered it safer to have a buffer. So how is DYAD getting away with this?

There’s a bit of an accounting trick here. The docs continue…

DYAD starts out similar to other decentralized stablecoins, and requires users to deposit assets that are worth at least 150% of the value of their minted DYAD. Below that value, they risk liquidation, which is a trigger that can be pulled by other ecosystem participants.

The secret sauce of DYAD is that the excess value of all collateral in the system is tokenized, and users who own the token are able to utilize its value as part of their backing.

So, it starts out at 150% collateralization. Quite safe, but not quite the perfect capital efficiency it boasts of? But wait, there's more...

But they take this excess over-collateralization and tokenize it. This token, called $KEROSENE, can be added to their loan as backing. However, the $KEROSENE does not function directly as collateral. Instead, it serves as “a mechanism for allocating the right to mint against existing surplus collateral in the system.” In this way, users can bring down their “theoretical” collateralization ratio down to 100% from 150% while still guaranteeing $DYAD is always backed by a dollar of exogenous collateral. As with any lending protocol, liquidations can occur if the collateralization ratio falls too low.

It’s an interesting system, and thus far the system appears to be working in that the stablecoin has maintained its peg, even as the price of $KEROSENE has fluctuated wildly.

The team goes on to boast…

Via the redirection of idle collateral to active ecosystem participants, DYAD can be Capital Efficient, Stable and Decentralized at the same time. The Stablecoin Trilemma is now solved.

A brief aside..

Try, Trilemma, Again…

Boomers may recall we’ve long considered the “stablecoin trilemma” was little more than a failure of imagination. We poked and prodded and found very little data to support that such a “trilemma” actually exists. At best it represents system of design choices, each with their own pros and cons. At worst, it’s a self-reinforcing mental prison that has convinced builders to give up before they start.

The last time they made the mistake of letting us speak in public, we took a sledge hammer to this false trilemma. No surprise the powers-that-be have kept us under lock and key ever since…

July 12, 2023: Risk Factors in Stablecoin Design 🪙🧑🎨

You may have been wondering why I’ve been harping on this series of posts…

At any rate, we’re encouraged if not surprised to see builders laughing off this so-called “Stablecoin Trilemma,” and we’re pleased to see the thoughtful approach DYAD is taking to architecting a decentralized stablecoin.

FURTHER NOTES

In order to mint DYAD, one must first acquire a Note, a basic NFT. The price of minting a new Note increases linearly by .001 ETH. This mechanic allows them to otherwise charge no fees to create vaults within the system.

At this point it currently costs 0.19 ETH to mint a Note directly on the site. They’re currently at a 0.23 ETH floor price on OpenSea, so it’s probably better to mint directly.

You can find more info about Notes in the DYAD documentation. The advantage to a user for minting a Note is not just that they can mint DYAD, but also engage in a variety of activities around the ecosystem that can earn yield.

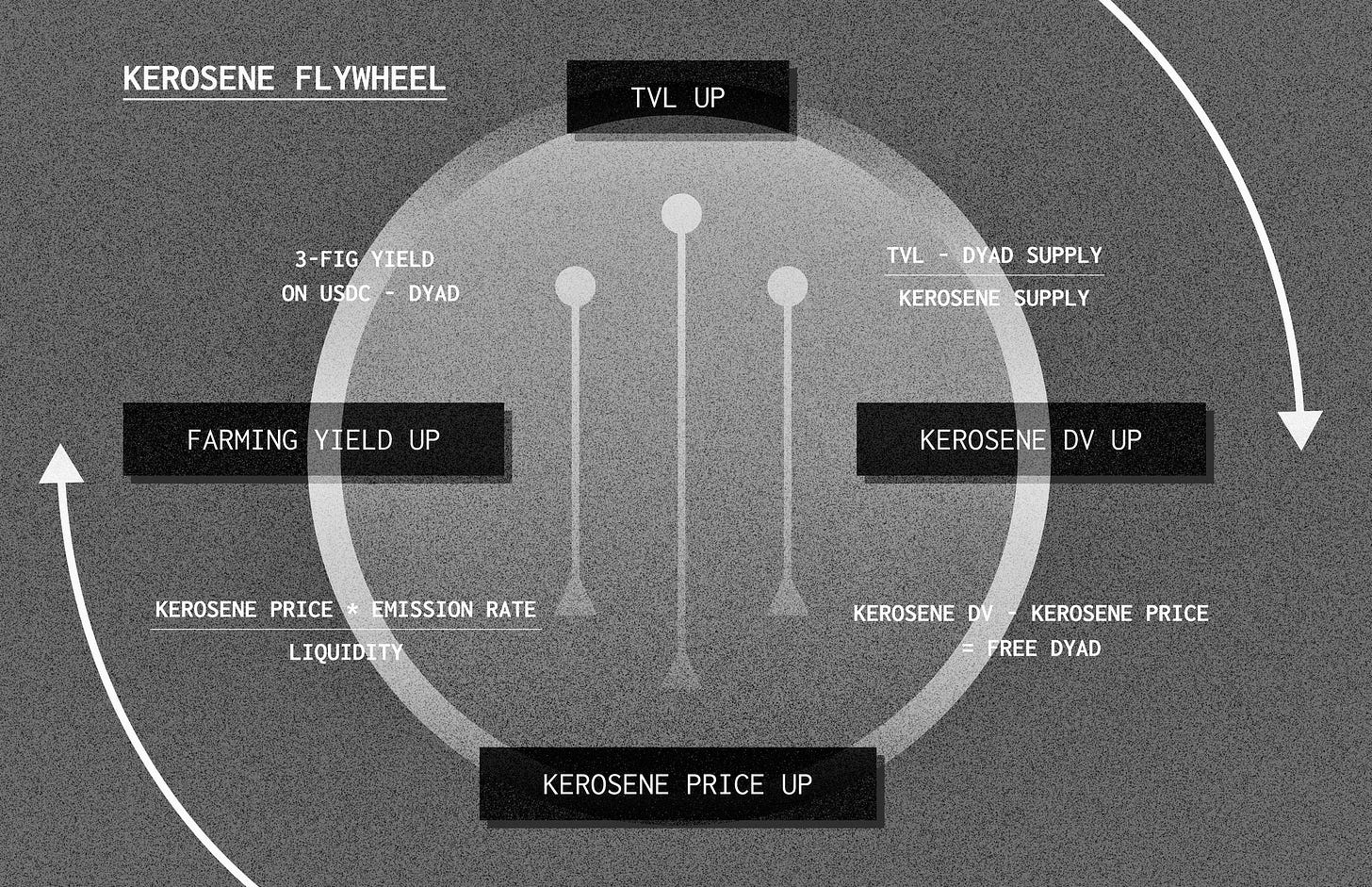

KEROSENE FLYWHEEL

The protocol has a variety of mechanism to spin up a flywheel around $DYAD and $KEROSENE. $KEROSENE is earned by farming it from various pools, with most of the emissions dedicated to liquidity incentives.

They also describe an XP mechanism that allows you to attach $KEROSENE to Notes to boost yield within the ecosystem, for which the leaderboard is shown here:

In total, DYAD describes the fundamental value of a $KEROSENE to be dictated by a formula.

Our mental math puts this at $25MM collateral at present minus $12.6MM DYAD divided by 100MM, or a rough value of 12.4 cents. (Fact checkers want to weigh in here?)

These numbers are mostly corroborated by DefiLlama and CoinGecko, (except the latters lists 167MM as circulating supply, which would put the intrinsic valuation of a $KEROSENE token down to 7.5 cents).

However, CoinGecko sees it trading for just 3 cents.

The documentation describes an arbitrage opportunity being present due to this.

The competition for usage of surplus collateral in the system via the Kerosene token is what drives the flywheel. If Kerosene ever trades below its deterministic value in the market, an arbitrage opportunity opens up.

Why is nobody taking the opportunity? Tough to say… perhaps the arb opportunity is not as clear-cut as the documentation suggests? Or perhaps the Note holders lack the sophistication to execute this opportunity? Or, it may be that the DeFi winter has been brutal for a great many protocols... it’s surprisingly common to see money left on the table in DeFi, especially when the mechanics seem complex.

NEXT STEPS

Of interest to newsletter readers is that the DYAD team is creating a liquidity pool on Curve.

A DYAD-FRAX pool has been created, and FRAX will be using their $CRV power to incentivize the pool.

It appears as if more pools are also being launched with the DYAD stablecoin, so we’ll need to see if the stablecoin gains adoption around the ecosystem.

From Curve socials it appears as if liquidity is coming soon, pending audit results.

Should you ape? We never advise playing with crypto unless you expect to lose it all. It’s a positive sign that the protocol has so many audits, which you can find in their GitHub. We’re always cautious of protocols that use Solidity instead of Vyper, but a quick glance at the contracts suggest it’s mostly straightforward implementations of common standards.

It’s a great sign that the stablecoin has held its peg over the several months DYAD has been in business, despite the fluctuating value of $KEROSENE. That's certainly the most important part of the "stablecoin trilemma" as well as the principal requirement of any stablecoin.

So if you are expecting to lose it all, it’s hard to imagine how you could do much worse playing around the $DYAD ecosystem. You’d have to do worse than losing it all, which would be quite difficult.

More generally though, as DeFi maxis, we’re always thrilled to see innovative new protocols emerging. Kudos to DYAD, and we indeed hope both $DYAD and $KEROSENE both find their way onto Curve soon!

Disclaimers! Author has no affiliation with DYAD, nor any exposure to the DYAD/KEROSENE ecosystem

The issue with DYAD is that they haven't fundamentally solved the trilemma. The so-called DV arbitrage feels like a solution looking for a problem, essentially shooting at an imaginary target. The project's overall game structure suggests that later participants are simply left holding the bag for earlier users. I don't see a foundation for large-scale adoption, as there is no real source of value other than a Ponzi-like scheme of passing the risk from one participant to the next.