October 24, 2024: Yield of Dreams ⚾🏟️

Are trading volumes shifting to yield-bearing stablecoins?

Curve and Reserve Protocol’s USD3 agree… the next big narrative might well be yield-bearing stablecoins!

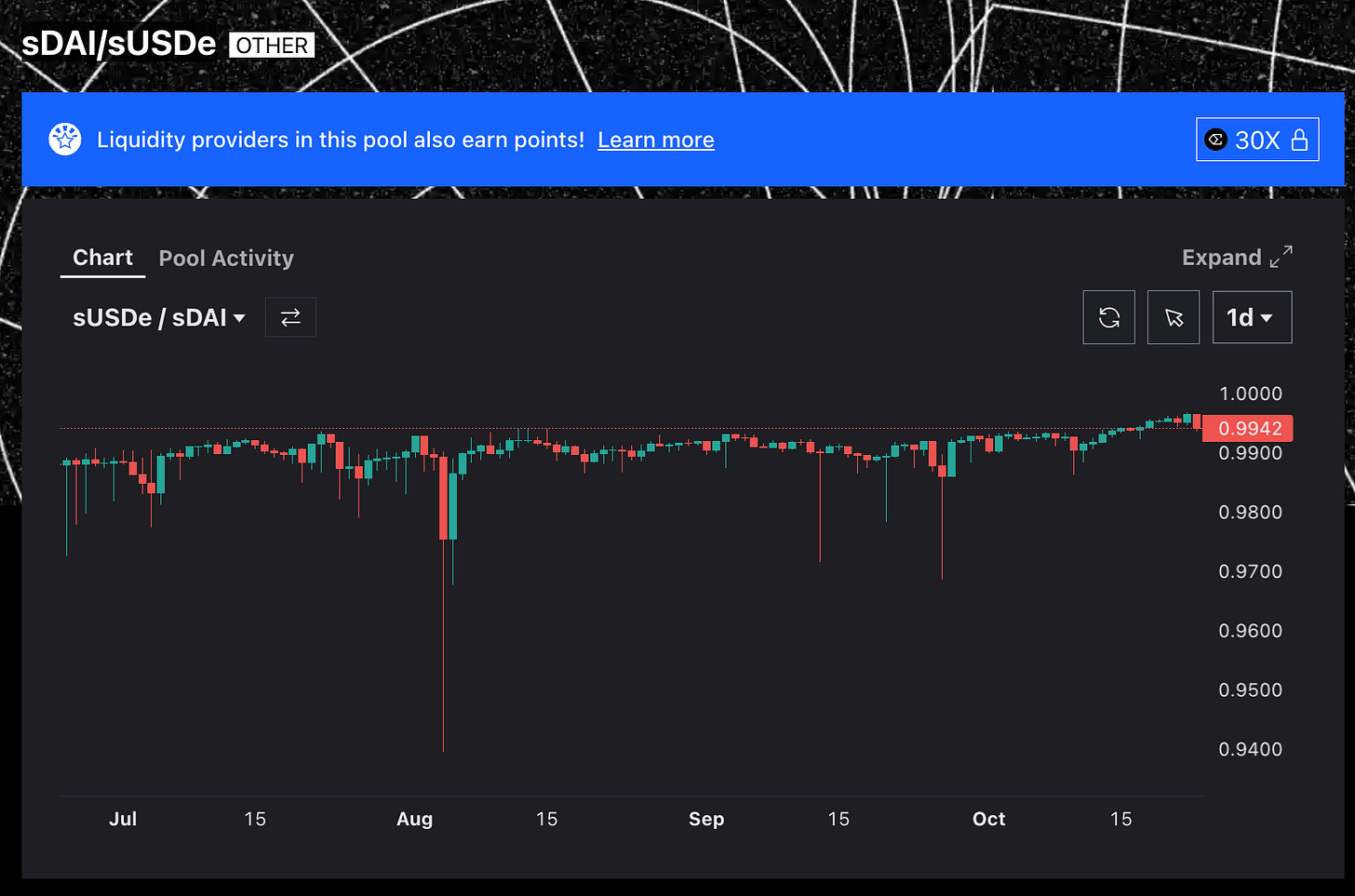

The first pool is a particularly fun case in which both Ethena’s sUSDe and Maker’s sDAI tokens are yield-bearing, and happening to earn yield at roughly the same rate. It’s therefore a StableSwap-NG pool, where the two tokens are effectively pegged as long as they both accrue yield at a steady rate.

With Maker possibly resurrecting sDAI, maybe this will be a fun pool for some time.

The USD3 / sDAI pool is also a StableSwap-NG pool that has been enjoying steady growth since its launch in September (USD3 being a stablecoin from Reserve Protocol that natively earns ~5-8% interest)

Relative to sDAI, it’s also holding its peg:

And both these pools are earning an extremely high native APY, which is sourced from trading fees. Neither need to incentivize their pool (although Ethena is offering points to the sUSDe pool), as the native yields are quite good.

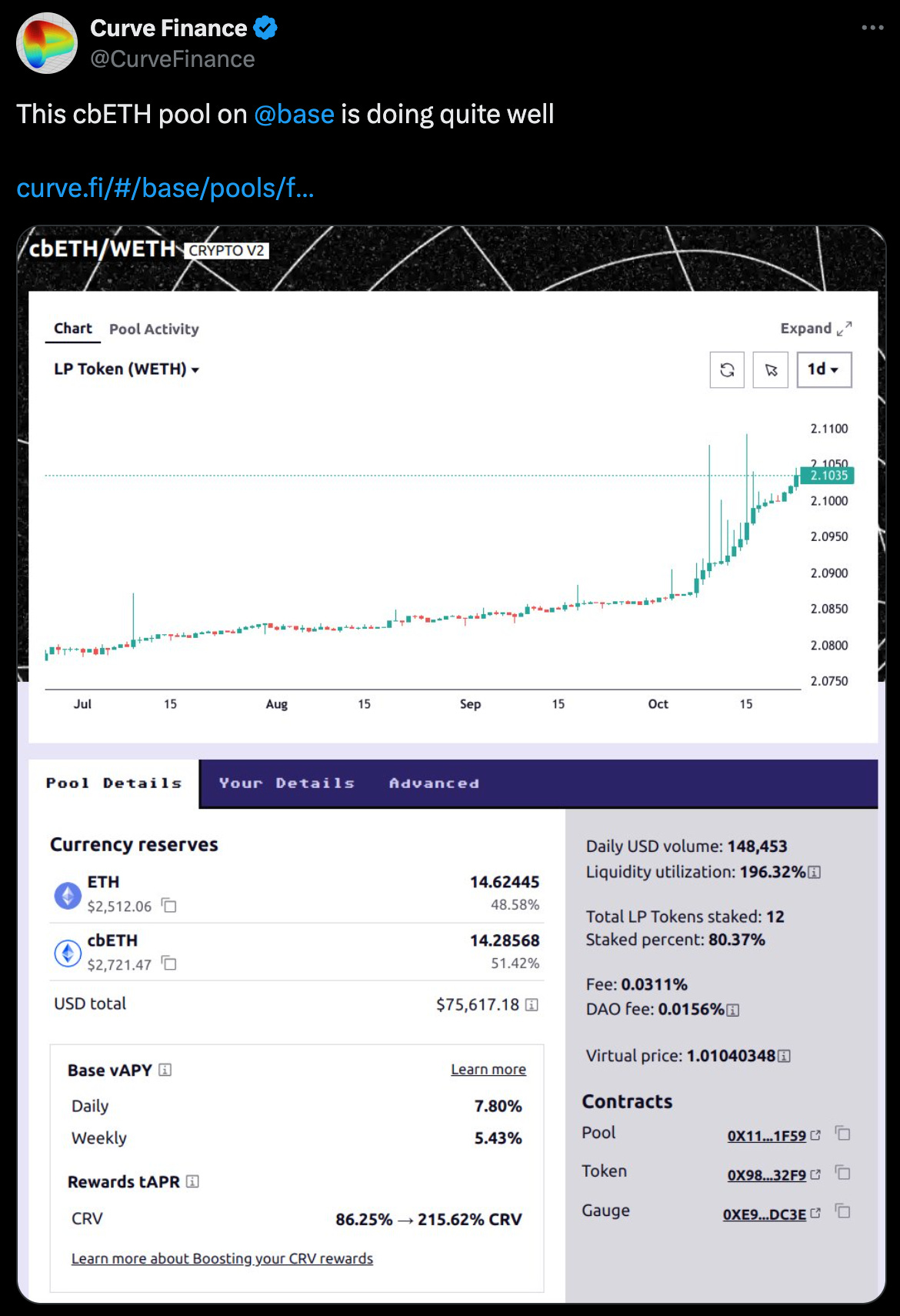

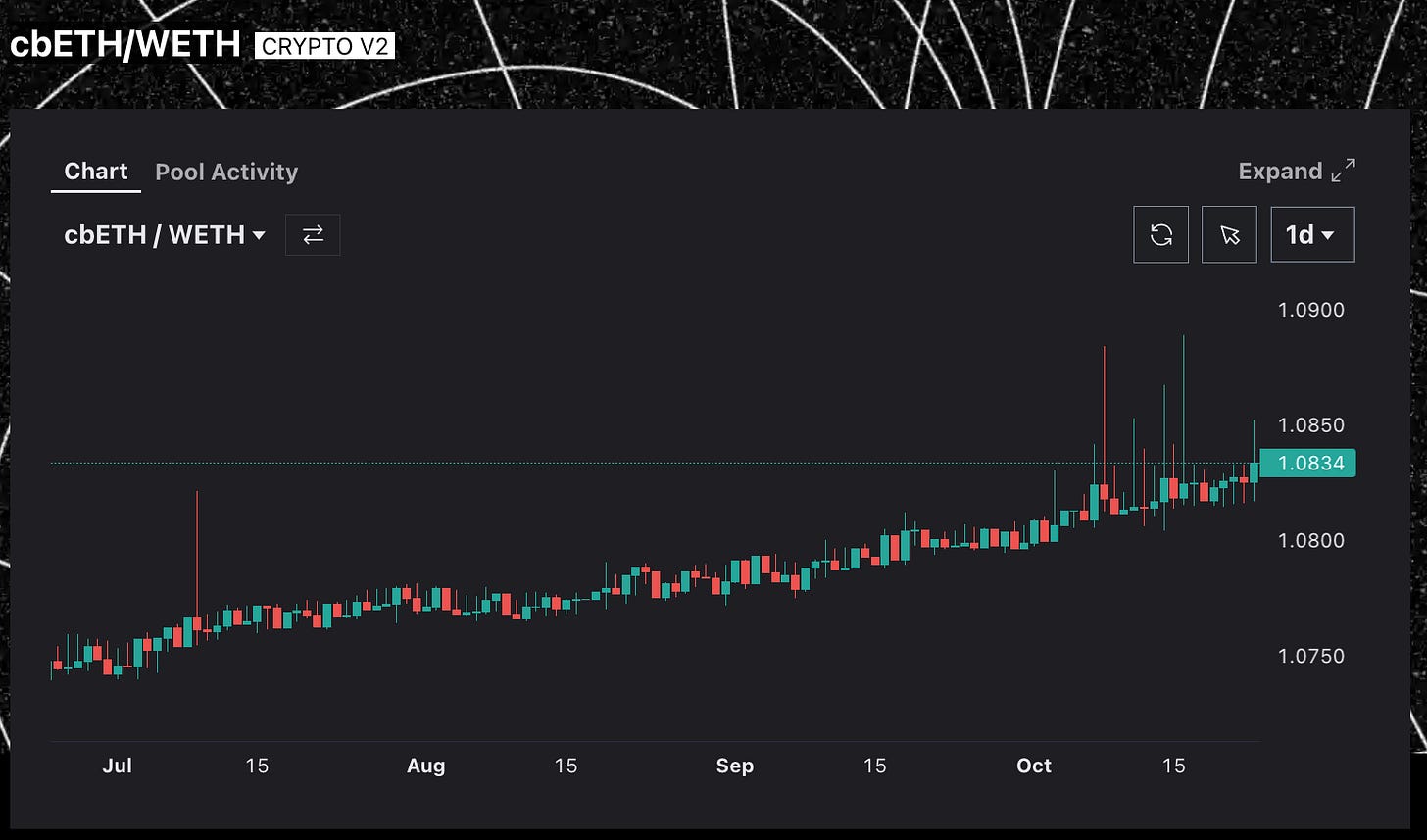

This phenomenon is not simply isolated to dollar stablecoins. On Base, the cbETH / ETH pool is also printing, and it doesn’t precisely fit the pattern.

A few curious differences — this pool only has one yield-bearing token, in the form of cbETH. The pool is therefore a TwoCrypto pool, not a stablecoin pool, since the tokens should not hold peg unless cbETH stops accruing yield.

Also note the shape of the hockey stick on the graph… it’s not an effect of the price of cbETH suddenly skyrocketed in October due to suddenly earning more yield. Nobody else sees that…

Something happened in the past month (maybe an aggregator or bot picked it up?) and it’s gone haywire.

Note that the $CRV emissions to this pool have come down a bit since the above screenshot, but they’re still delivering 10% to 25% boosted (good luck getting this) as of publication.

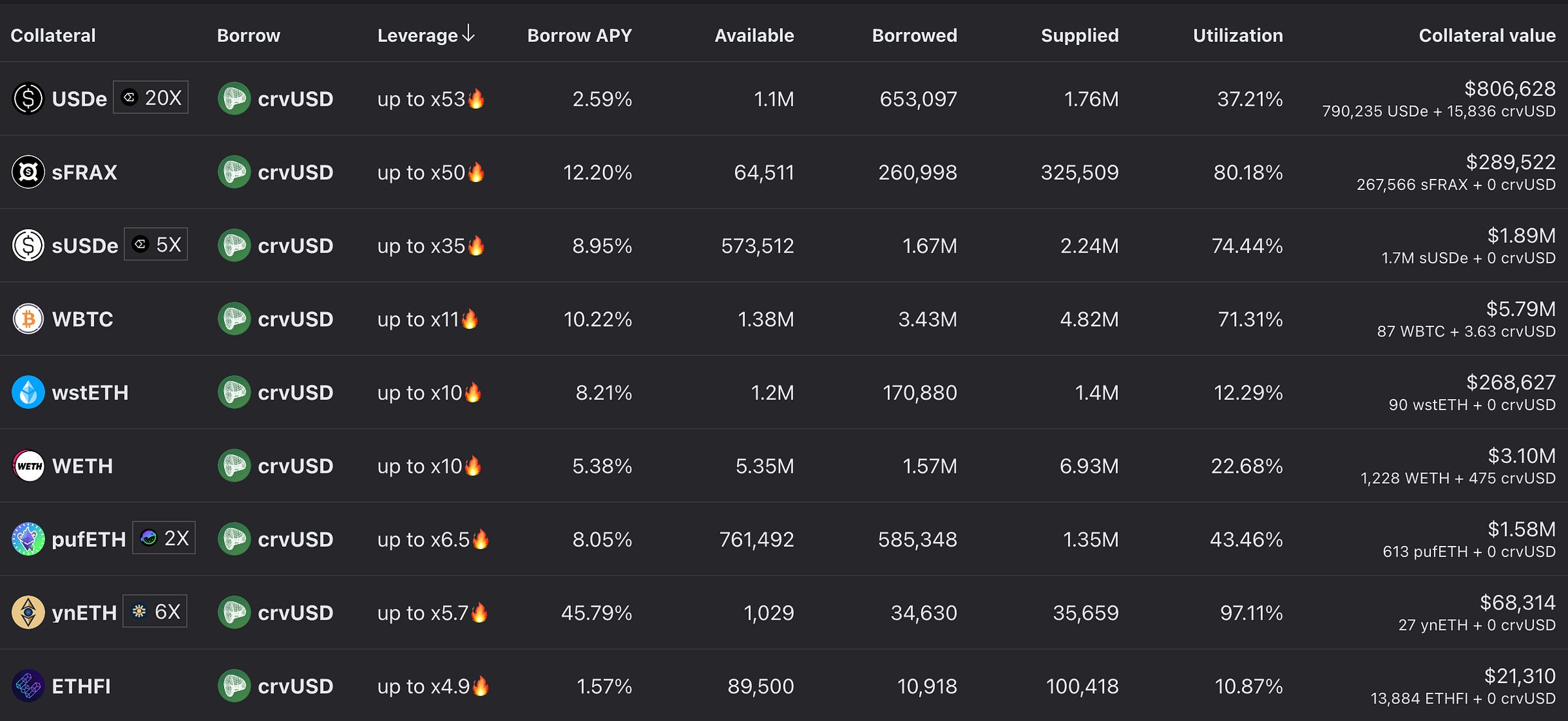

Lending Markets

One of the interesting features to keep an eye on for yield-bearing stablecoins, given this uptick in trading activity, is if they have a corresponding Llama Lend market. If they have leverage, any slight depeg in these token prices can be traded to quite a profit if they repeg. Keep an eye on, say, sFRAX and sUSDe.

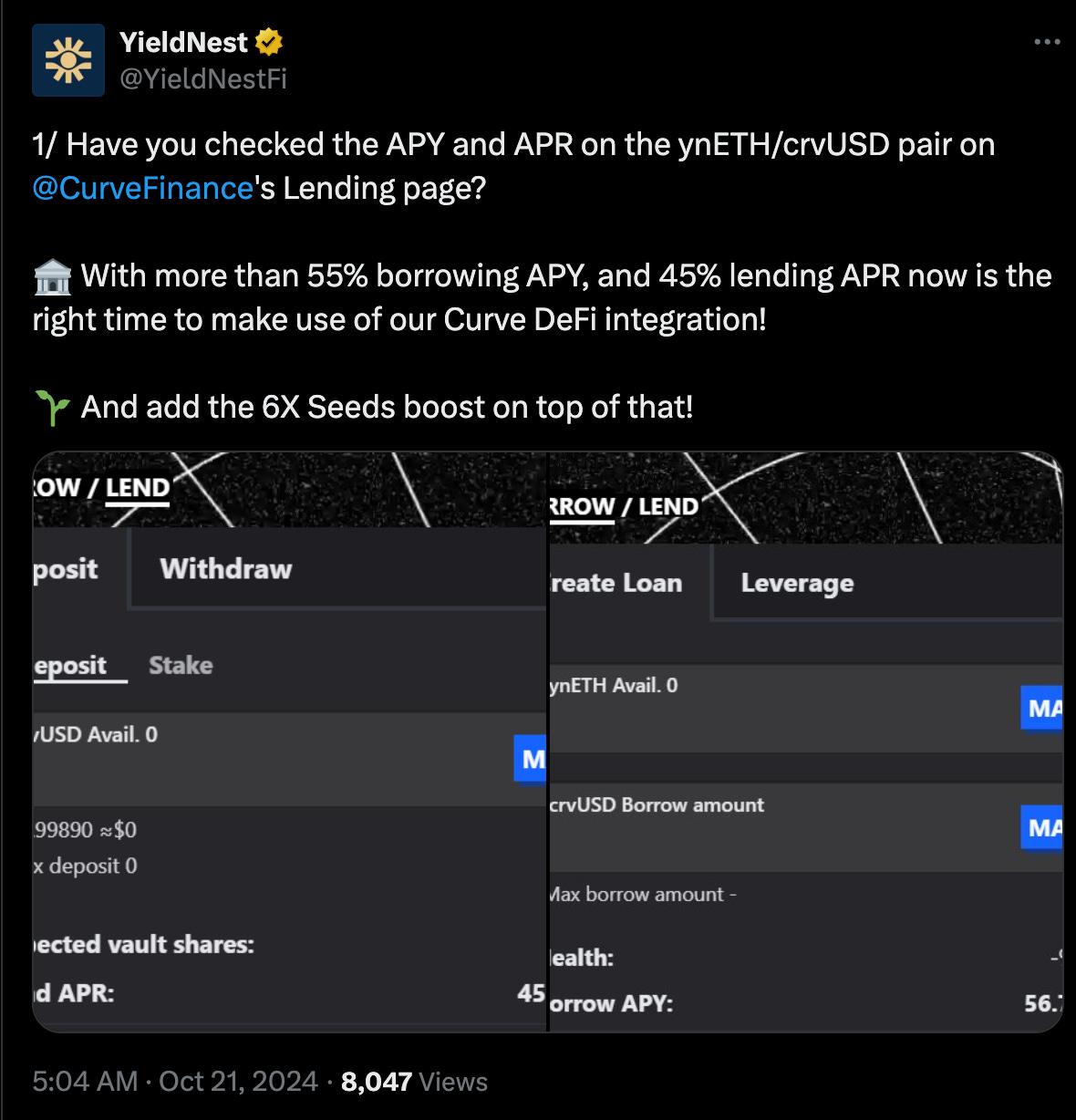

YieldNest’s ynETH, which earns yields from a variety of sources, is pushing their lending market heavily via their points program.

We covered YieldNest’s market in much more detail last week.

October 17, 2024: Nested Yield 🪆📈

YieldNest’s $ynETH is now available as collateral on Llama Lend!crv.mktcap.eth is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

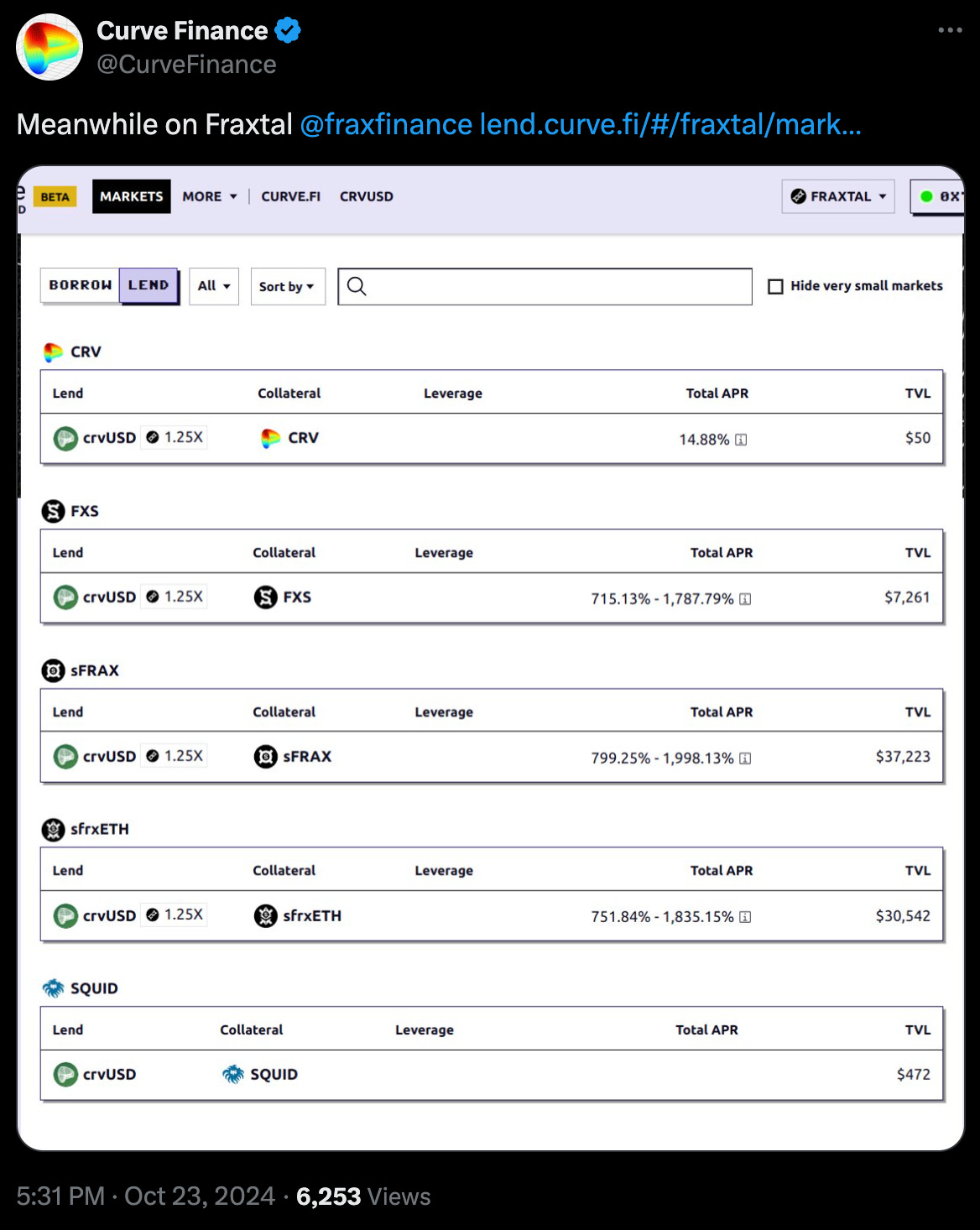

Another place to keep an eye out for this effect is on Fraxtal, where yield bearing tokens like sFRAX and sfrxETH have home field advantage. These pools have scarcely begun to take off…

And a special shout-out to that gorgeous $SQUID pool hiding out at the very bottom…

The Future is Yield-Bearing

It truly seems the next narrative in DeFi may be natively yield-bearing stablecoins. We’ve already highlighted two yield-bearing dollarcoins just this week in USDM and Cap Labs.

October 23, 2024: Move Mountains 🏔️🗻

Last month a conversation started on removing TrueUSD as a peg keeper.crv.mktcap.eth is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Rumor has it another may be joining the fray soon enough…