Congrats to Asymmetry Finance, which opened its public sale for $ASF and saw quite a response.

In just the first 10 minutes, the team pulled in a quick $1MM.

As of publication, it’s already nearly 3/4 to its cap and continuing to sell quickly. The sale is open for a full week, but we doubt it lasts so long.

One of the interesting features of this raise is the community friendly nature of the token launch. Observe…

What’s that, you might ask? A community raise at a lower FDV? The prior VC round was at $45MM FDV, but the community round is valued at $30MM.

Why on earth did the team make this decision?

In a public 𝕏 space with Mario Nawfal, the team described that they were concerned about the negative feedback loop that comes from “insanely high FDVs.” They decided to sell to the community at a lower FDV, to forestall this negative feedback loop and better decentralize the DAO.

If you’re still interested and it hasn’t filled, you can find the sale on Fjord Foundry. The LBP Overview of what the money is being used for:

USDaf

Timed well to build hype for their token sale, the team recently announced the launch of $USDaf, an inflation-resistant stablecoin built in partnership with Ampleforth.

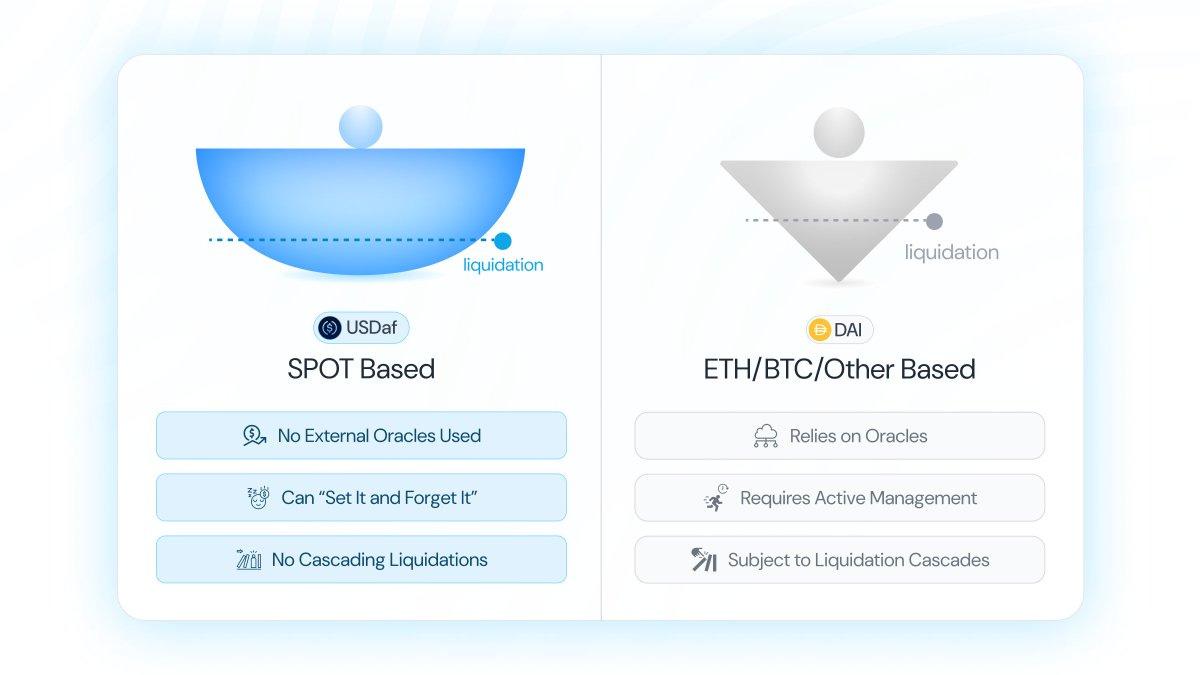

Breaking down the pieces here, $USDaf is the stablecoin operated by Asymmetry. Fewer details have yet been released, but the Asymmetry website describes it works as a CDP, with redemption and liquidation risks. They also declared a staked $USDaf, which will be earning around 14% yield.

$USDaf is minted using $SPOT (developed by Ampleforth) as collateral. $SPOT is described as “low volatility commodity money” and serves as a flatcoin that tracks purchasing power based on a 2019 dollar.

One intriguing aspect of the $SPOT token is that it does not use oracles.

The $SPOT token is well described on their primer, and describes a structure of cleaving AMPL into low and high volatility pairs that may remind you of Protocol f(x)

It’s particularly exciting to see so much activity in DeFi. It’s supposed to be the depths of a DeFi Winter, but innovation and community fundraising suggest hints of spring…

Disclaimers! Author has a stake in $ASF