Octover 27, 2023: The Second Quest 🏰🐎

Paladin launches v2, plus more news on governance + the flywheel

A metric ton of activity this past week! Who sez it’s Octover???

Paladin: The Second Quest

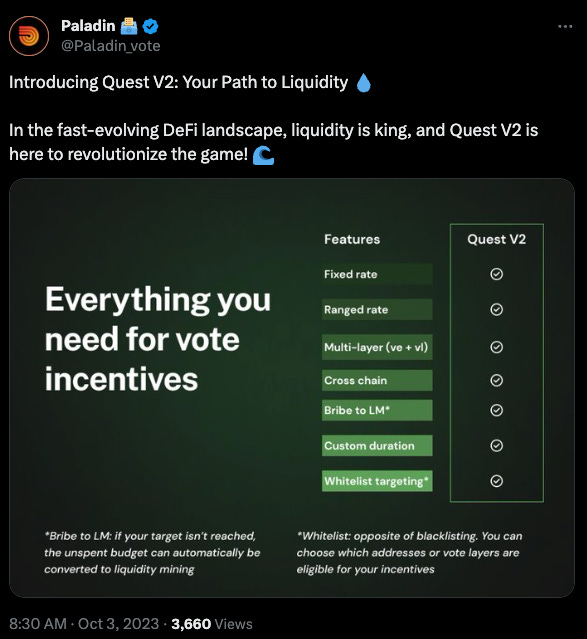

After a long time in dev, Paladin announced the launch of Quest v2, for use atop Curve and other veTokens.

Quest’s launch last year targeted the issue of arbitrary rewards distribution. In other words, quest givers end up overpaying, while quest seekers end up diluted. Quest allowed quest givers to target a specific amount of votes they like, while also allowing voters to know their precise rewards before accepting a quest. The design proved popular, to the tune of $5MM worth of incentives distributed.

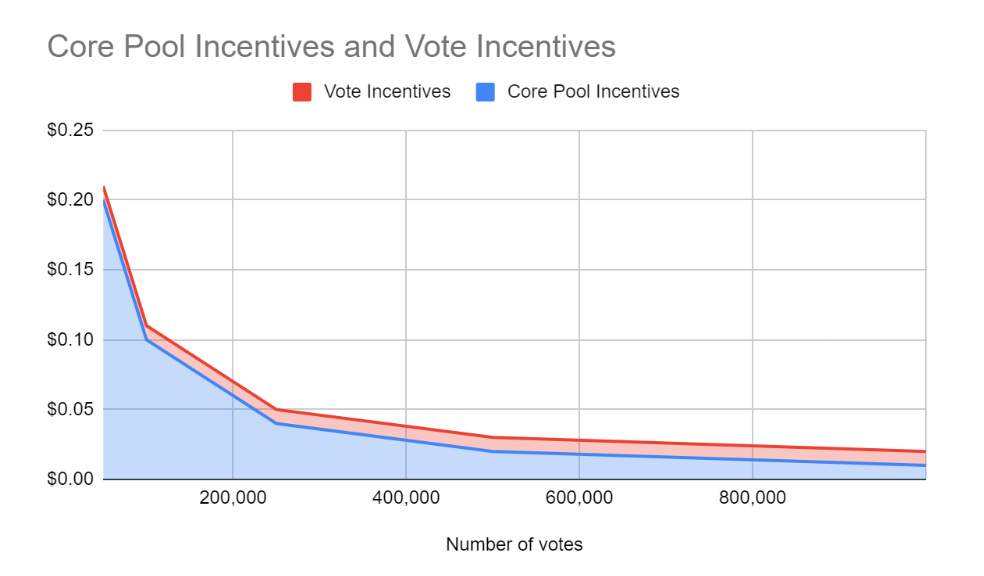

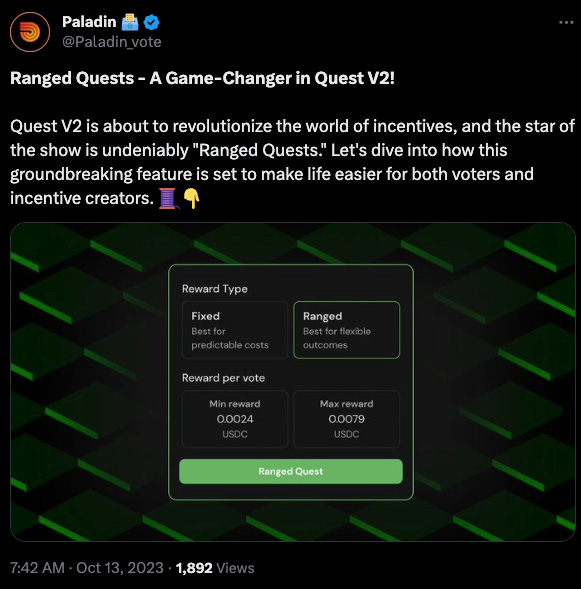

Quest v2 introduces Ranged Quests, or what they dub “geometric bribing”, to allow for shaping liquidity rewards within specific bounds.

More detail on ranged quests in their blog and 𝕏 thread.

The upgrade also introduces roll-over voting to allow for more flexible options that help overcome the problem of mercenary governance.

It’s robust and featureful upgrade that demonstrates they are well-attuned to the issues of onchain governance, congrats!

For more, check out their full blog post and launch thread.

Speaking of governance, the superlative Curve Monitor continues getting quietly upgraded. veCRV voters can now vote directly on the site:

Combined with stealth updates to the revenues, it’s becoming the most important website to bookmark and keep refreshing throughout the day.

Rounding out the topic of governance, a great thread on Convergence, and their “govearn” mechanism.

Prisma

Prisma Finance is making growth look easy. Every few weeks they casually raise the debt ceiling, and it fills up often within minutes. They’ve smashed through $75MM and continue climbing.

Those who are engaging in the Prisma ecosystem for points should note that they’ve tweaked the structure to avoid too many people depositing single-sided to the Curve pool.

Earlier this week we detailed some of the issues besetting its progenitor, Liquity, as redemptions are hammering the protocol.

Uptober 24, 2023: The Whale Playground 🐋🛝

Overheard: “We are so back. I'm not sure of the level of this back. It's a new kind of back. I'm tryna measure it relative to the level of backs we have experienced in this cycle of backs and overs and it seems this is way more back than the other backs but still different than most.”

At the time we’d asked Prisma for comment on whether they may suffer from the same issue, and they’ve since gotten back and informed me they’re working on different modules to improve redemptions better for users and LPs in the stability pool. They informed me that some interesting bits of code are going under audit, so SOON™️

More on their upcoming $PRISMA token.

Odds and Ends

Congrats to Stake DAO! 60MM locked veCRV, just months after notching 50MM

$CRV lock rates have been nothing but up-only. Is this the effect of emissions reductions from August?

Pendle on locking $crvUSD Silo yields.

Protocols strategically acquiring $CVX. Memories of the bull…

Vyper Day at DevConnect looks lit!

Reserve continues their expansion on Base

No idea if this is legit or a scam, but we’re watching!

Finally, if you need something to get you through this weekend, check out this great interview between Flywheel DeFi and Cryptovestor!

Disclaimers! Of mentioned assets, author is invested in Curve, Convex, Prisma, Silo, and Prisma…